How to open an arts and crafts shop?

Are you keen to open an arts and crafts shop but don't know where to begin? Then you're in luck because this guide will lead you through all the steps required to check if your business idea can be profitable and, if so, turn it into a reality.

Our guide is for prospective entrepreneurs who are thinking about starting an arts and crafts shop no matter how far they are in their journey - whether you’re just thinking about it or in the middle of market research this guide will be useful to you.

Think of this as your blueprint: we cover everything you need to know about opening an arts and crafts shop and what key decisions you’ll need to make along the way.

Ready? Let’s get started!

Learn how an arts and crafts shop works

Before you can start an arts and crafts shop, you need to have a solid understanding of how the business works and what are its main revenue streams.

This will give you a glimpse into the profitability potential of your venture, whilst allowing you to decide whether or not it is a good fit for your situation (current skill set, savings and capital available to start the business, and family responsibilities).

It may be that creating an arts and crafts shop is an excellent idea, but just not the right one for you.

Before starting their own company, successful entrepreneurs typically:

- Consult with and take advice from experienced arts and crafts shop owners

- Acquire hands-on experience by working in an operational arts and crafts shop

- Take relevant training courses

Let's explore each option in a bit more detail.

Consulting with and taking advice from experienced arts and crafts shop owners

Having "seen it all", established business owners can offer valuable insights and hands-on advice drawn from their own experiences.

This is because, through both successes and failures, they've gained a more informed and practical understanding of what it takes to build and sustain a successful arts and crafts shop over the long term.

Acquiring hands-on experience by working in an operational arts and crafts shop

If you want to open an arts and crafts shop, having industry-specific experience is imperative because it equips you with the knowledge, network, and acumen necessary to navigate challenges and make informed decisions critical to the success of your future business.

You'll also be able to judge whether or not this business idea is suitable for you or if there might be conflicts of interest with your personal life (for example, long working hours could be incompatible with raising young children).

This work experience will also help you to make contacts in the industry and familiarise yourself with customers and their expectations, which will prove invaluable when you set up your arts and crafts shop.

Take relevant training courses

Taking a training course is another way of familiarising yourself with the business model of your future activity before you decide to make the jump.

You may choose to complete a training course to obtain a certificate or degree, or just take online courses to acquire practical skills.

Before going any further in setting up your venture

Before you go any further with your plans to open an arts and crafts shop, make sure you have a clear vision of what it will take in terms of:

- What skills are needed to run the business successfully (do you have some or all of these skills?)

- What a standard working week looks like (does it suit your personal commitments?)

- What sales potential and long-term growth prospects the arts and crafts shop has (compare this with your level of ambition)

- What options you'll have once you decide to retire (or move on and inevitably sell the company)

This analysis of the business model and the constraints of the business should help you to check that your idea of launching an arts and crafts shop fits your entrepreneurial profile.

If there is a match, it will then be time to look at assembling the founding team of your business.

Can your business idea be profitable?

Just enter your data and let The Business Plan Shop crunch the numbers. We will tell if your business idea can generate profits and cash flows, and how much you need to get started.

Assembling your arts and crafts shop's founding team

The next step to opening your arts and crafts shop is to think about the ideal founding team, or to decide to go in alone.

Starting and growing a successful business doesn't have to be a solo journey and setting up an arts and crafts shop with several co-founders is generally easier. The business benefits from a management team with a wider skillset, decisions are made together, and the financial risk is shared among the partners, making the journey more collaborative and less daunting.

But, running a business with several partners brings its own challenges. Disagreements between co-founders are quite common, and these can pose risks to the business. That's why it's crucial to consider all aspects before starting your own business.

We won't go into too much detail here, as this is a complex topic that deserves its own guide, but we do recommend that you ask yourself the following questions:

- What is the ideal number of co-founders for this venture?

- Are you on the same wavelength as your potential partners in terms of vision and ambition?

- How will you deal with potential failure?

Let's look at each of these questions in more detail.

What is the ideal number of co-founders for this venture?

To answer this question you will need to consider the following:

- What skills do you need to run the business? Are you lacking any?

- How much startup capital do you need? How much do you have?

- How are key decisions going to be made? - It is usually advisable to have an odd number of partners (or a majority shareholder) to help break the tie.

Put simply, your co-founders contribute skills, capital, or both. Increasing the number of partners becomes advantageous when there is a deficiency in either of these resources.

Are you on the same wavelength as your potential partners in terms of vision and ambition?

Your business partners should share the same short and long-term vision, be it business expansion or social responsibility, to avoid future frustrations and simplify decision-making. Different views are natural, but alignment is ideal.

In any case, you should think of having an exit mechanism in place in case one of the partners wants to move on.

How will you deal with potential failure?

We wish you nothing but success when starting up and growing your arts and crafts shop, but it's always wise to have a backup in case things don't go as planned.

How you deal with a potential failure can vary significantly based on the relationship you have with your business partner (close friend, spouse, ex-colleague, etc.) and the personal circumstances of each of you.

For instance, starting a business with your spouse might seem appealing, but if it doesn't succeed, you risk losing 100% of the household income at once, which could be stressful.

Similarly, going into a partnership with a friend can put pressure on the friendship in the event of failure or when you need to make difficult decisions.

There is no wrong answer, but it is essential to carefully evaluate your options before starting up to ensure you're well-prepared for any potential outcomes.

Conducting market research for an arts and crafts shop

The next step in launching an arts and crafts shop is to carry out market research. Let's take a look at what this involves.

The objectives of market research

The objective here is very simple: to assess the level of demand for your business and whether there is an opportunity for it to thrive in your chosen location.

The first step will be to check that the market is not saturated with competing offers and that there is room for a new player: your arts and crafts shop.

Your market analysis will also help you identify a concept and market positioning that has every chance of being successful in your target market, thereby helping increase your business's chances of success.

Carrying out market research for your arts and crafts shop will also enable you to better understand the expectations of your future customers and the most effective ways to communicate with them in your marketing plan.

Analyse key trends in the industry

Your market research should start with an industry analysis in order to gain a good understanding of the main players and current trends in your sector.

Once you've delved into the current state of the market, it will be time to assess what proportion of your target market can be seized by your arts and crafts shop. To do this, you will need to consider both the demand and supply side of the market.

Assess the demand

After checking out the industry, let's shift our focus to figuring out what your potential customers want and how they like to buy.

A classic mistake made by first-time entrepreneurs is to assess demand on the global or national market instead of concentrating on their target market. Only the market share that can be captured by your company in the short term matters.

Your demand analysis should seek to find answers to the following questions:

- Who are your target customers?

- How many are there?

- What are their expectations?

- What are their buying habits?

- How much budget do they have?

- What are the different customer segments and their characteristics?

- What are the main distribution channels and means of communication for reaching each segment?

The aim of the demand analysis is to identify the customer segments that could be targeted by your arts and crafts shop and what products and services you need to offer to meet their expectations.

Analyse the supply side

You will also have to familiarize yourself with the competing arts and crafts shops on the market targeted by your future business.

Amongst other things, you’ll need to ask yourself:

- Who are the main competitors?

- How many competitors are already present?

- Where are they located?

- How many people do they employ?

- What is their turnover?

- How do they set their prices?

- Are they small independent businesses or national players?

- Do they seem to be in difficulty or are they flourishing?

- What is their market positioning?

- What types of products and services do they offer?

- What do customers seem to like about them?

The aim of the competitive analysis is to identify who your competitors will be and to gather information that will help you find a differentiating commercial positioning (more on that later in this guide).

Regulations

Conducting market research is also an opportunity to look at the regulations and conditions required to do business.

You should ask yourself the following questions:

- Do you need to have a specific degree to open an arts and crafts shop?

- Do you need specific licences or permits?

- What are the main regulations applicable to your future business?

Given that your project is at an early stage, your focus should be to clear that there are no roadblocks from a regulatory standpoint before you deep dive into the planning process.

Once your project is more advanced, you will have the opportunity to talk about regulation more in-depth with your lawyer.

Concluding your market research

By the time your market research is completed, you should have either:

- Pinpointed an untapped business opportunity

- Or arrived at the realisation that the market is saturated, prompting the search for alternative business ideas or models.

If the conclusion is that there is an opportunity in the market to cater to one or more customer segments currently overlooked by competitors, that's great!

Conversely, if you come to the conclusion that the market is already saturated, don’t panic! The good news is that you won’t spend several years working hard on a project that has little chance of success. There is no shortage of business ideas either - at The Business Plan Shop, we have identified more than 1,300 potential business ideas!

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast and write a business plan to help convince investors that your business idea can be profitable.

How should I position my arts and crafts shop on the market?

The next step to start your arts and crafts shop is to define precisely the market positioning your company will adopt in order to capitalise on the opportunity identified during your market research.

Market positioning refers to the place your product and service offering occupies in customers' minds and how they differ from the competition. Being perceived as a low-cost solution, for example.

To find a concept and a market positioning that will resonate with your customers, you need to address the following issues:

- How can you differentiate yourself from your competitors?

- Do you have the option of joining a franchise to reduce risk?

- Is it better to start or buy an arts and crafts shop already in operation?

- How will you validate your concept and market positioning before investing in the business?

Let's look at these aspects in more detail.

How can you differentiate yourself from your competitors?

Opening an arts and crafts shop means starting with a major disadvantage compared with competitors already active on the market.

While you will have to create everything from scratch, your competitors already have everything in place.

Your competitors' teams know the business well, whereas yours has only just been recruited, their customers are loyal and they benefit from word of mouth that you don't yet have.

So you're going to need a solid plan to succeed in taking market share from your competitors and making your mark.

There are a number of aspects to consider in order to try to avoid direct confrontation if possible:

- Can you target a different customer base than your competitors?

- Can you offer products or services that are different from or complementary to what your competitors already sell?

- How will your competitors react to your arts and crafts shop entering their market?

- Can you build a sustainable competitive advantage that will enable you to compete with your current and future competitors?

Do you have the option of joining a franchise to reduce risk?

A proven way of reducing the risk of your business venture is to join a franchise.

Joining an arts and crafts shop franchise means you don't have to start from scratch. You benefit from the brand recognition of a group and support with operational processes, relations with suppliers, recruitment, etc.

On the flip side, being part of a franchise will restrict your personal freedom, and you'll have to pay an entry fee and an annual royalty (typically a percentage of your sales).

Nevertheless, where possible, starting up as a franchise is generally a good way of reducing risks, especially if you're up against competitors with well-known brands.

Please note, however, that franchising opportunities vary from country to country and region to region, so there is no guarantee that you'll be able to find a franchise.

Is it better to start or buy an arts and crafts shop already in operation?

The other alternative to setting up a new independent business is to buy out and take over an arts and crafts shop already in operation.

Here too, a takeover is a good way of reducing the risk of your project compared with a pure start-up.

Taking over a business has two enormous advantages over setting up a new one: you start out on an equal footing with your competitors since you take over the team and the customer base, and you don't increase the supply on the market enabling you to maintain the existing balance on the market where the business operates.

However, as with franchising, the capital requirements for a takeover are higher because the business will have to be bought from its previous owners.

How will you validate your concept and market positioning before investing in the business?

However you decide to set up your business, you will need to ensure that there is a good fit between what you sell and what customers are looking to buy.

To do this, you'll need to meet your target customers to present your products or services and check that they meet their expectations.

Deciding where to base your arts and crafts shop

The next step to opening an arts and crafts shop is deciding where you want to set up your business.

Choosing the right location for your business is like finding the perfect stage for a play. Without it, your business may lack the spotlight it deserves.

Whilst there is no “perfect” location for your arts and crafts shop, one that meets as many of the following factors as possible could be ideal:

- Visibility and foot traffic

- Parking space, road and public transport accessibility

- Proximity to target customers

- Competitor presence

This list is obviously not exhaustive and will have to be adapted to the particularities of your project.

Once you’ve considered the factors above, it’s important to think about the budget that your startup has at its disposal. You’ll need to find a location that meets your business requirements but is affordable enough, especially short-term.

If you opt for renting instead of buying your premises, make sure to take into account the terms of the lease, including aspects such as the duration, rent increase, renewal, and so on.

The lease contractual terms vary greatly from country to country, so be sure to check the terms applicable to your situation and have your lease reviewed by your lawyer before signing.

Need inspiration for your business plan?

Avoid writer's block and draft your own business plan in no time by drawing inspiration from dozens of business plan templates.

Decide on a legal form for your arts and crafts shop

It's now time to think about the legal structure for your arts and crafts shop.

The legal form of a business simply means the legal structure it operates under. This structure outlines how the business is set up and defines its legal obligations and responsibilities.

What are the most common legal structures?

Naturally, the names and intricacies of business structures differ by country. However, they typically fit into two main categories:

- Individual businesses

- Companies

Individual businesses

Individual businesses are usually a good fit for self-employed individuals and freelancers who want limited administrative work. These types of entrepreneurs are commonly referred to as sole traders or sole proprietorships.

As mentioned above, the main benefit of being a sole trader is that minimal paperwork is required to launch and operate the business. Tax calculations are also relatively simple and annual accounts are not always required (and when they are, usually don't need to be audited) which saves a bit of time and money on bookkeeping and accounting fees.

Decision-making is also easy as the final decision is fully dependent on the sole trader (even if employees are hired).

However, being a sole trader also has drawbacks. The main disadvantage is that there is no separation between the individual running day-to-day operations and the business.

This means that if the business were to file for bankruptcy or legal disputes were to arise, the individual would be liable for any debts and their personal assets subsequently at risk. In essence, sole traders have unlimited liability.

This also means that profits earned by the business are usually taxed under the personal income tax category of the sole trader.

Another drawback is that sole traders might find it harder to finance their business. Debt (bank loan for example) is likely to be the only source of external financing given that the business doesn't have a share capital (effectively preventing equity investors from investing in their business).

Companies

Companies are more flexible and more robust than individual businesses. They are suitable for projects of all sizes and can be formed by one or more individuals, working on their own or with employees.

Unlike individual businesses, companies are recognised as distinct entities that have their own legal personality. Usually, there is also a limited liability which means that founders and investors cannot lose more than the capital they have invested into the business.

This means that there is a clear legal separation between the company and its owners (co-founders and investors), which protects the latter's personal assets in the event of legal disputes or bankruptcy.

Entrepreneurs using companies also gain the advantage of being able to attract equity investment by selling shares in the business.

As you can see companies offer better protection and more financing options, but this comes at a trade-off in terms of red-tape and complexity.

From a taxation perspective, companies are usually liable for corporation tax on their profits, and the income received by the owners running the business is taxed separately (like normal employees).

Normally, companies also have to produce annual accounts, which might have to be audited, and hold general assemblies, among other formalities.

How should I choose my arts and crafts shop's legal setup?

Choosing the right legal setup is often simple once you figure out things like how many partners you'll have, if you hire employees, and how much money you expect to make.

Remember, a great business idea can work well no matter which legal structure you pick. Tax laws change often, so you shouldn't rely too much on getting specific tax benefits from a certain structure when getting started.

You could start by looking at the legal structures most commonly utilised by your competitors. As your idea evolves and you're ready to officially register your business, it's a good idea to confirm your choice using inputs from a lawyer and an accountant.

Can I switch my arts and crafts shop's legal structure if I get it wrong?

Yes, you have the flexibility to change your legal setup later, which might include selling the existing one and adopting a new structure in certain situations. Keep in mind, though, that this restructuring comes with additional expenses, so making the right choice from the start is usually more cost-effective.

Can your business idea be profitable?

Just enter your data and let The Business Plan Shop crunch the numbers. We will tell if your business idea can generate profits and cash flows, and how much you need to get started.

Calculating the budget to open an arts and crafts shop

The next step to opening an arts and crafts shop involves thinking about the equipment and staff needed to launch and run your business on a day-to-day basis.

Each project has its own characteristics, which means that it is not possible to estimate the budget for opening an arts and crafts shop without building a complete financial forecast.

So be careful when you see estimates circulating on the Internet. As with all figures, ask yourself these questions:

- Is my project similar (location, concept, size, etc.)?

- How recent is the information?

- Is it from a trustworthy source?

Startup costs and investments to open an arts and crafts shop

For an arts and crafts shop, the initial working capital requirements and investments may include the following elements:

- Inventory: This includes the cost of purchasing initial inventory for your arts and crafts shop, such as materials, tools, and finished products. It also includes the cost of restocking inventory as it sells out.

- Equipment and machinery: This includes any necessary equipment and machinery for running your arts and crafts shop, such as sewing machines, pottery wheels, and woodworking tools. It also includes the cost of maintenance and repairs for these items.

- Store fixtures and displays: These are the physical elements that help showcase and organize your products in your shop. This can include shelving, display cases, and signage.

- Furniture and decor: This includes any furniture and decor items used for the aesthetic appeal of your shop, such as tables, chairs, and decorations. It also includes the cost of maintaining and replacing these items over time.

- Point-of-sale system: This is the system used for processing sales and managing inventory in your arts and crafts shop. It includes the cost of purchasing the system and any ongoing fees for software updates and technical support.

Of course, you will need to adapt this list to your company's specific needs.

Staffing plan to operate an arts and crafts shop

To establish an accurate financial forecast for your arts and crafts shop, you will also need to assess your staffing requirements.

The extent to which you need to recruit will of course depend on your ambitions for the company's growth, but you might consider recruiting for the following positions:

Once again, this list is only indicative and will need to be adjusted according to the specifics of your arts and crafts shop.

Other operating expenses required to run an arts and crafts shop

You also need to consider operating expenses to run the business:

- Staff costs: This includes salaries, wages, and benefits for your employees, such as sales associates, cashiers, and managers.

- Accountancy fees: You may need to hire an accountant to help you manage your financial records and prepare your taxes.

- Insurance costs: You will need to purchase insurance to protect your business from potential risks, such as property damage or liability claims.

- Software licenses: You may need to purchase software licenses for programs that can help you manage your inventory, sales, and finances.

- Banking fees: As a business owner, you will likely have to pay fees for maintaining a business bank account and making transactions.

- Rent: If you are leasing a space for your shop, you will need to pay rent to your landlord.

- Utilities: You will need to pay for utilities like electricity, water, and internet to keep your shop running.

- Supplies: This includes all the materials and tools you need for creating your arts and crafts, such as paints, brushes, and paper.

- Marketing and advertising: You may need to spend money on marketing and advertising to promote your shop and attract customers.

- Professional fees: If you hire a lawyer or consultant for legal or business advice, you will need to pay for their services.

- Shipping and delivery: If you sell your products online or offer shipping services, you will need to cover the costs of shipping and delivery.

- Repairs and maintenance: You may need to make repairs or perform regular maintenance on your shop or equipment.

- Office supplies: This includes items like paper, pens, and printer ink that you need for running your business.

- Taxes and licenses: You will need to pay taxes on your business income and obtain any necessary licenses or permits.

- Training and development: You may need to invest in training for your employees to improve their skills and knowledge.

This list will need to be adapted to the specifics of your arts and crafts shop but should be a good starting point for your budget.

Create a sales & marketing plan for your arts and crafts shop

The next step to launching your arts and crafts shop is to think about the actions you need to take to promote your products and services and build customer loyalty.

Here, you'll be looking at the following issues:

- What is the best method to attract as many new customers as possible?

- How to build customer loyalty and spread word of mouth?

- What human and financial resources will be required to implement the planned actions?

- What level of sales can I expect to generate in return?

The precise sales and marketing levers to activate will depend on the size of your arts and crafts shop. But you could potentially leverage some of the initiatives below.

Besides your sales and marketing plan, your sales forecast will be affected by seasonal patterns related to the nature of your business, such as fluctuations during the holiday season, and your competitive landscape.

Can your business idea be profitable?

Just enter your data and let The Business Plan Shop crunch the numbers. We will tell if your business idea can generate profits and cash flows, and how much you need to get started.

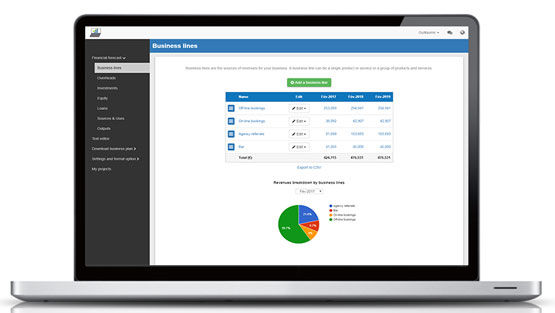

Building your arts and crafts shop's financial forecast

The next step to opening an arts and crafts shop is to create your financial forecast.

What is a arts and crafts shop financial forecast?

A arts and crafts shop financial forecast is a forward-looking tool that projects the financial performance of your business over a specific period (usually 3 years for start-ups).

A forecast looks at your business finances in detail - from income to operating costs and investments - to evaluate its expected profitability and future cash flows.

Building a financial forecast enables you to determine the precise amount of initial financing required to start your arts and crafts shop.

There are many promising business ideas but very few are actually viable and making a financial forecast is the only way to ensure that your project holds up economically and financially.

Your financial forecast will also be part of your overall business plan (which we will detail in a later step), which is the document you will need to secure financing.

Financial forecasts are used to drive your arts and crafts shop and make key decisions, both in the pre and post-launch phases:

- Should we go ahead with the business or scrap the idea?

- Should we hire staff or use an external service provider?

- Which development project offers the best growth prospects?

- Etc.

Creating a financial forecast for starting an arts and crafts shop is an iterative process as you will need to refine your numbers as your business idea matures.

As your arts and crafts shop grows, your forecasts will become more accurate. You will also need to test different scenarios to ensure that your business model holds true even if economic conditions deteriorate (lower sales than expected, difficulties in recruiting, sudden cost increases or equipment failure problems, for example).

Once you’ve launched your business, it will also be important to regularly compare your accounting data to your financial projections in order to keep your forecast up-to-date and maintain visibility on future cash flows.

What does a financial forecast look like?

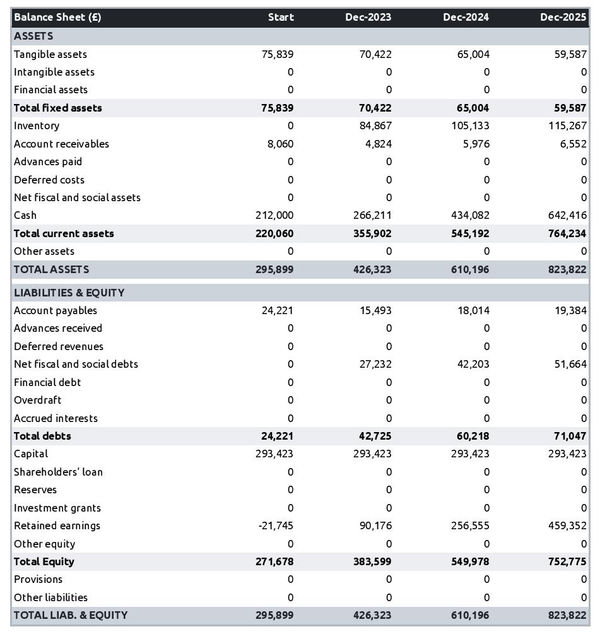

Once ready, your arts and crafts shop forecast will be presented using the financial tables below.

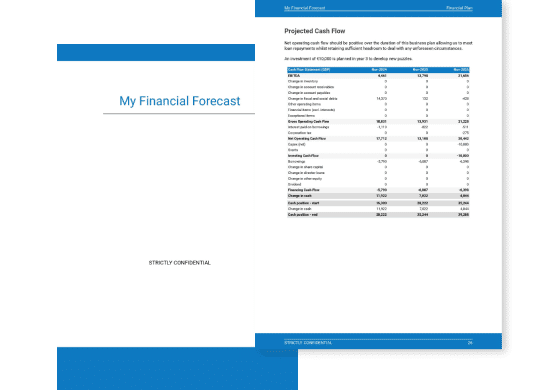

The forecasted profit & loss statement

The profit & loss forecast gives you a clear picture of your business’ expected growth over the first three to five years, and whether it’s likely to be profitable or not.

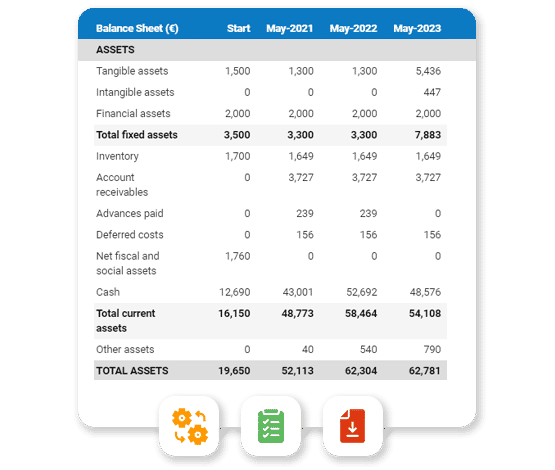

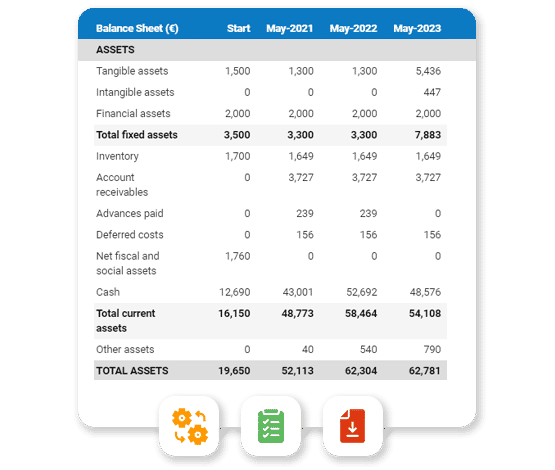

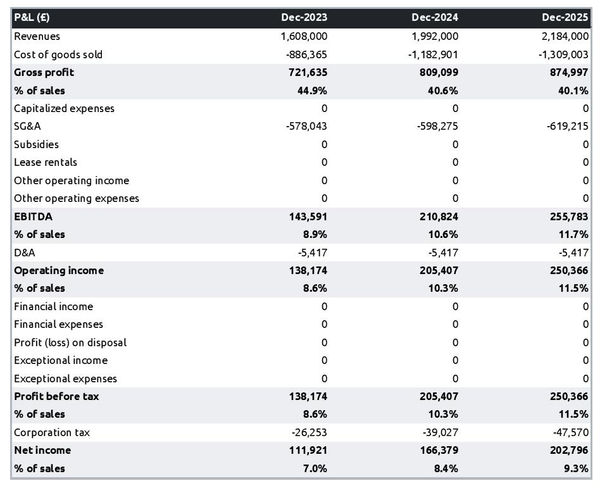

The projected balance sheet

Your arts and crafts shop's forecasted balance sheet enables you to assess your financial structure and working capital requirements.

The projected cash flow statement

A projected cash flow statement to start an arts and crafts shop is used to show how much cash the business is expected to generate or consume over the first three years.

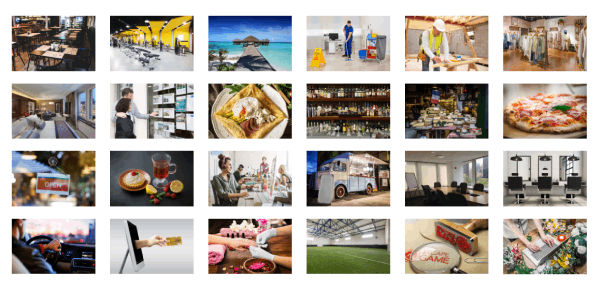

Which solution should you use to make a financial forecast for your arts and crafts shop?

The easiest and safest way to create your arts and crafts shop forecasts is to use an online financial forecasting software, like the one we offer at The Business Plan Shop.

There are several advantages to using professional software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You have access to complete financial forecast templates

- You get a complete financial forecast ready to be sent to your bank or investors

- The software helps you identify and correct any inconsistencies in your figures

- You can create scenarios to stress-test your forecast's main assumptions to stress-test the robustness of your business model

- After you start trading, you can easily track your actual financial performance against your financial forecast, and recalibrate your forecast to maintain visibility on your future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you are interested in this type of solution, you can try our forecasting software for free by signing up here.

How do I choose a name and register my arts and crafts shop?

Now that your project of launching an arts and crafts shop is starting to take shape, it's time to look at the name of your business.

Finding the name itself is generally fairly easy. The difficulty lies in registering it.

To prevent this guide from being too long, we won't go into all the criteria you need to take into account when choosing a striking name for your arts and crafts shop. However, try to choose a name that is short and distinctive.

Once you have a name that you like, you need to check that it is available, because you cannot use a name that is identical or similar to that of a competitor: this type of parasitic behaviour is an act of unfair competition for which you risk being taken to court by your competitors.

To avoid any problems, you will need to check the availability of the name:

- Your country's company register

- With the trademark register

- With a domain name reservation company such as GoDaddy

- On an Internet search engine

If the desired name is available, you can start the registration process.

It is common to want to use the trading name as the name of the company, and to have a domain name and a registered trademark that also correspond to this name: Example ® (trading name protected by a registered trademark), Example LTD (legal name of the company), example.com (domain name used by the company).

The problem is that each of these names has to be registered with a different entity, and each entity has its own deadlines:

- Registering a domain name is immediate

- Registering a trademark usually takes at least 3 months (if your application is accepted)

- The time taken to register a new business depends on the country, but it's generally quite fast

How do I go about it?

Well, you have two choices:

- Complete all registrations at the same time and cross your fingers for a smooth process.

- Make sure to secure the domain names and trademarks. Once that's done, wait for confirmation of a successful trademark registration before moving on to register the company.

At The Business Plan Shop, we believe it's essential to prioritize securing your domain names and trademarks over the business name. This is because you have the flexibility to use a different trading name than your legal business name if needed.

Regardless, we suggest discussing this matter with your lawyer (see below in this guide) before making any decisions.

Need inspiration for your business plan?

Avoid writer's block and draft your own business plan in no time by drawing inspiration from dozens of business plan templates.

What corporate identity do I want for my arts and crafts shop?

The following step to start an arts and crafts shop is to define your company's visual identity.

Visual identity is part of the DNA of your arts and crafts shop: it makes you recognizable and recognized by your customers, and helps you stand out from the competition. It also helps convey your values, notably through the choice of colors that identify the company.

Creating your business's visual identity yourself is entirely possible: there are several online tools that let you generate color palettes, choose typography and even generate logos.

However, we advise you to delegate this task to a designer or a communications agency for a professional result.

Your corporate identity will include the following elements:

- Your business logo

- Your brand guidelines

- Your business cards

- Design and theme of your website

Logo

Your arts and crafts shop's logo serves as a quick identifier for your company. It will be featured on all your communication platforms (website, social networks, business cards, etc.) and official documents (invoices, contracts, etc.).

Beyond its appearance, your logo should be easy to use on any type of support and background (white, black, gray, colored, etc.). Ideally, it should be easy to use in a variety of colors.

Brand guidelines

One of the challenges when starting an arts and crafts shop is to ensure a consistent brand image wherever your company is visible.

This is the role of your company's brand guidelines, which defines the typography and colors used by your brand and thus acts as the protector of your brand image.

Typography refers to the fonts used (family and size). For example, Trebuchet in size 22 for your titles and Times New Roman in size 13 for your texts.

The colors chosen to represent your brand should typically be limited to five (or fewer):

- The main colour,

- A secondary colour (the accent),

- A dark background colour (blue or black),

- A grey background colour (to vary from white),

- Possibly another secondary colour.

Business cards

Classic but a must-have, your business cards will be at your side to help you easily communicate your contact details to your founders, customers, suppliers, recruitment candidates, etc.

In essence, they should feature your logo and adhere to the brand guidelines mentioned earlier.

Website theme

Likewise, the theme of your arts and crafts shop website will integrate your logo and follow the brand guidelines we talked about earlier.

This will also define the look and feel of all your site's graphic elements:

- Buttons

- Menus

- Forms

- Banners

- Etc.

What legal steps are needed to start an arts and crafts shop?

The next step in opening an arts and crafts shop is to look in detail at the legal and regulatory formalities.

Although it is possible to do the formalities yourself and draft some of the documents detailed here, The Business Plan Shop recommends that you seek advice on these aspects from a law firm.

Registering a trademark and protecting the intellectual property of your arts and crafts shop

One of the first things you need to do here is to protect your company's current and future intellectual property.

One way of doing this is to register a trade mark, as mentioned earlier in this guide. Your lawyer will be in a position to do the formalities for you and to help you select the classes (economic activities) and jurisdictions in which you have an interest in obtaining protection.

Your law firm can also advise you on other ways of protecting your company's intellectual property.

Preparing the legal documents for your arts and crafts shop

Your arts and crafts shop will need a set of legal and contractual documents to operate on a daily basis.

Your exact needs in this respect will depend on the country in which you are launching your arts and crafts shop and the size and legal form envisaged for the company. Once again, we highly recommend having these documents prepared by your lawyer.

As a minimum, we recommend that you have the following documents prepared:

- Employment contracts

- General terms and conditions of sale

- General terms and conditions of use for your website

- Privacy Policy for your website

- Cookie Policy for your website

- Invoices

- Etc.

Applying for licences and permits and registering for various taxes

Here too, the list of licences and business permits required for your business to operate legally will depend on the country in which you have decided to start your arts and crafts shop.

Your law firm will be able to advise you on all the regulations applicable to your business.

Likewise, your accountant will be able to assist you and take care of the formalities involved in complying with the tax authorities.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast and write a business plan to help convince investors that your business idea can be profitable.

Create a business plan for your arts and crafts shop

The next step to open an arts and crafts shop: put together your business plan.

What is a business plan?

To keep it simple, a business plan comprises two crucial components:

- Firstly, a numerical part, the financial forecast (which we mentioned earlier), which highlights the initial financing requirements and profitability potential of the arts and crafts shop,

- And a written, well-argued section that presents your project in detail, aims to convince the reader of its chances of success, and provides the context needed to assess whether the forecast is realistic or not.

The business plan will enable you to verify the coherence of your project, and ensure that the company can be profitable before incurring further costs. It will also help you convince business and financial partners.

As you can see, your business plan must be convincing and error-free.

How to write a business plan for an arts and crafts shop?

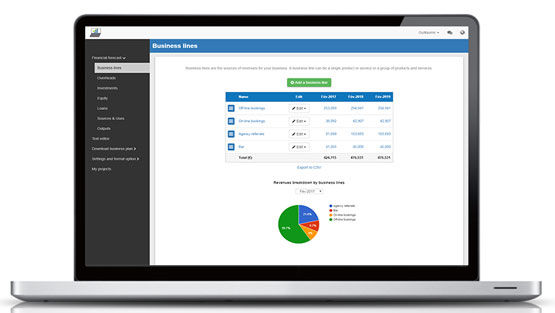

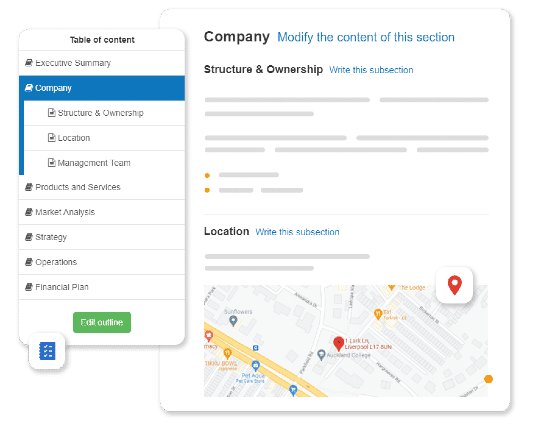

Nowadays, the modern and most efficient way to write an arts and crafts shop business plan is to use startup business plan software like the one we offer at The Business Plan Shop.

Using The Business Plan Shop to create a business plan for anarts and crafts shop has several advantages :

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can access a library of dozens of complete startup business plan samples and templates for inspiration

- You get a professional business plan, formatted and ready to be sent to your bank or investors

- You can create scenarios to stress test your forecast's main assumptions

- You can easily track your actual financial performance against your financial forecast by importing accounting data

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you're interested in using this type of solution, you can try The Business Plan Shop for free by signing up here.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast and write a business plan to help convince investors that your business idea can be profitable.

Financing the launch of your arts and crafts shop

Once your business plan has been written, you’ll need to think about how you might secure the funding required to open your arts and crafts shop.

The amount of initial financing required will of course depend on the size of your arts and crafts shop and the country in which you wish to set up.

Financing your startup will probably require you to obtain a combination of equity and debt, which are the primary financial resources available to businesses.

Equity funding

Equity refers to the amount of money invested in your arts and crafts shop by founders and investors and is key to starting a business.

Equity provides your company with stable, long-term (often permanent) capital. It also demonstrates the commitment of the company's owners to the project, since these sums can be lost in the event of bankruptcy.

Because the equity invested by the founders may be lost if the project doesn't succeed, it signals to investors and other financial institutions the founders' strong belief in the business's chances of success and might improve the likelihood of obtaining further funding as a result.

In terms of return on investment, equity investors receive dividends paid by the company (provided it is profitable) or realise capital gains by reselling their shares (provided they find a buyer interested in the company).

Equity investors are, therefore, in a very risky position. They stand to lose their initial investment in the case of bankruptcy and will only obtain a return on investment if the business manages to be profitable or sold. On the other hand, they could generate a very high return if the venture is a financial success.

Given their position, equity investors are usually looking to invest in business ventures with sufficient growth and profitability potential to offset their risk.

From the point of view of the company and its creditors, equity reduces risk, since equity providers finance the company and are only remunerated in the event of success.

From a technical standpoint, equity consists of:

- Share capital and premiums: which represent the amount invested by the shareholders. This capital is considered permanent as it is non-refundable. In return for their investment, shareholders receive shares that entitle them to information, decision-making power (voting in general assembly), and the potential to receive a portion of any dividends distributed by the company.

- Director loans: these are examples of non-permanent capital advanced to the company by the shareholders. This is a more flexible way of injecting some liquidity into your company than doing so as you can repay director loans at any time.

- Reserves: these represent the share of profits set aside to strengthen the company's equity. Allocating a percentage of your profits to the reserves can be mandatory in certain cases (legal or statutory requirement depending on the legal form of your company). Once allocated in reserves, these profits can no longer be distributed as dividends.

- Investment grants: these represent any non-refundable amounts received by the company to help it invest in long-term assets.

- Other equity: which includes the equity items which don't fit in the other categories. Mostly convertible or derivative instruments. For a small business, it is likely that you won't have any other equity items.

The main sources of equity are as follows:

- Personal contribution from the founders' savings.

- Private investors: business angels, friends and family.

- Crowdfunding campaigns to find investors or collect donations (usually in exchange for a gift).

- Government initiatives such as loans on favourable terms to help partners build up their start-up capital.

Debt funding

Another option for partially funding your arts and crafts shop is to borrow.

By definition, debt works in the opposite way to equity:

- Debt needs to be repaid, whereas equity is permanent.

- Lenders get a contractually guaranteed return, whereas equity investors only generate a return if the company is a success.

When a company borrows money, it agrees to pay interest and repay the borrowed principal according to a pre-established schedule. Therefore, lenders make money regardless of whether the company is profitable and their main risk is if the company goes bankrupt.

To limit their risk, lenders are usually conservative and cautious in their approach. They only finance projects where they are confident that they will be repaid in full.

Companies borrow in two ways:

- Against their assets: this is the most common way of borrowing. The bank finances a percentage of the price of an asset (a vehicle or a building, for example) and takes the asset as collateral. If the company cannot repay, the bank seizes the asset and sells it to limit its losses.

- Against their future cash flows: the bank evaluates the company's financial forecast to estimate its borrowing capacity and assesses the conditions (amount, interest rate, term, etc.) on which it is prepared to lend, taking into account the credit risk posed by the company.

It's difficult to borrow against future cash flow when setting up an arts and crafts shop, because the business doesn't yet have historical data to reassure lenders about the credibility of the forecasted cash flows.

Borrowing against assets is, therefore, often the only option available to entrepreneurs. What's more, the assets that can be financed with this option must be easy to resell, in the unfortunate event that the bank is forced to seize them, which may limit your options even further.

In terms of possible sources of borrowing, the main sources here are banks and credit institutions. Bear in mind, however, that each institution is different, both in terms of the risk it is prepared to accept and in terms of how the risk of your project will be perceived and what items it will agree to finance.

In some countries, it is also possible to borrow from private investors (directly or via crowdlending platforms) or other companies, but not everywhere.

Things to remember about financing an arts and crafts shop

There are various ways you can raise the initial financing you need to open your arts and crafts shop. A minimum amount of equity will be needed to give the project credibility, and bank financing can be sought to complete the package.

What to do after launching my arts and crafts shop?

Launching your arts and crafts shop is the beginning of an exciting entrepreneurial adventure, and the culmination of your efforts to turn your idea into a reality. But this is also when the real work begins.

As you know, nearly half of all new businesses fail, so you'll need to do everything you can to make your business sustainable right from the start.

Estimating the future financial performance of an arts and crafts shop inevitably involves a degree of uncertainty. That's why we recommend simulating several scenarios: a central case with the most likely scenario, an optimistic case, and a pessimistic case designed to test the limits of your business model.

Normally, your company's actual financial performance, observed after you start trading, should fall somewhere between your pessimistic and optimistic cases.

The important thing will be to quickly measure and compare this actual performance with the figures in your forecast to see where you stand, then update the forecast to re-estimate the future cash flows and cash position of your arts and crafts shop.

This forward-looking financial management exercise is the only way to know where you stand and where you're going. And, when your figures fall short of expectations, to quickly implement actions to turn things around before the company runs out of cash.

There's nothing more dangerous than waiting until you have your accounts, which takes up to nine months after the end of your financial year (if you are in the UK, abroad your mileage will vary), to then realize that you're not on the right track and that your arts and crafts shop won't have enough cash to operate over the next twelve months.

This is where using a forecasting solution that integrates actuals vs. forecast tracking, like The Business Plan Shop's financial dashboards do, can simplify the financial management of your business and help reduce the risk associated with your start-up project.

Need inspiration for your business plan?

Avoid writer's block and draft your own business plan in no time by drawing inspiration from dozens of business plan templates.

Key takeaways

- There are 15 key steps to opening an arts and crafts shop.

- Your financial forecast will enable you to accurately assess your initial financing requirements and the potential profitability of your project.

- Your business plan will give your financial partners the context they need to be able to judge the consistency and relevance of your forecast before deciding whether or not to finance the creation of your arts and crafts shop.

- Post-launch, it's essential to have an up-to-date forecast to maintain visibility of your business's future cash flows.

- Using a financial planning and analysis platform that integrates forecasts, business plans and actual performance monitoring, such as The Business Plan Shop, makes the process easier and reduces the risks involved in starting a business.

We hope this guide has helped you understand how to open an arts and crafts shop. Please don't hesitate to contact us if you have any questions or want to share your experience as an entrepreneur.

Also on The Business Plan Shop

Know someone who wants to start an arts and crafts shop? Share this guide with them!