In this how to start a business guide:

1. Tools for starting a business

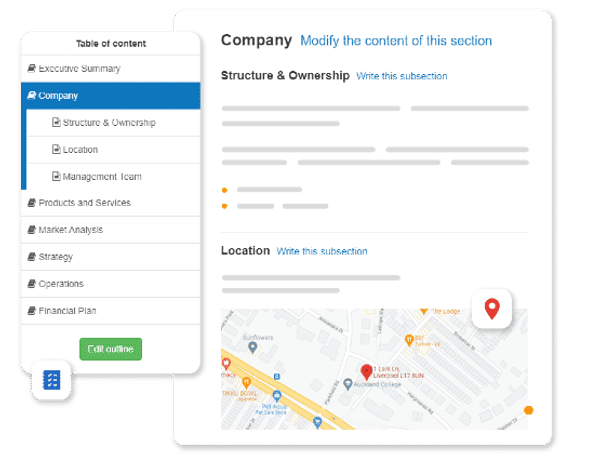

How The Business Plan Shop's platform helps you start a business

Knowing whether or not your business idea can be profitable and what level of capital is needed to launch are two key questions that every startup entrepreneur asks themselves.

Luckily for you, The Business Plan Shop helps you answer both questions by allowing you to build a complete, three-way financial forecast (containing a profit and loss statement, balance sheet and cash flow forecast).

Forecasting lets you anticipate future income and expenses which helps you determine the profitability of your business model. The cash flow statement, in particular, provides insights into cash movements, enabling you to estimate the initial capital required to navigate potential challenges effectively.

Our online software also lets you showcase the credibility of your business concept by helping you write a startup business plan. This can then be presented to lenders and investors when seeking funding.

Helping you find out whether or not your business model is viable and guiding you through every stage of writing a business plan to obtain financing are just two ways that The Business Plan Shop helps startups.

If you'd like to learn more, check out our financial tools for startups page.

2. Tips for starting up a business

Conduct thorough market research to understand your ideal customer profile, competition, and industry trends. This will help you refine your business concept and make informed decisions.

Evaluate your business model by considering both best and worst case scenarios to understand the potential outcomes of different levels of performance.

Assess different legal structures (e.g., sole proprietorship, partnership, LLC, or corporation), understand their unique legal and tax consequences and opt for the one that best fits your startup.

Create a business plan to assess the financial viability of your business idea before committing your money, time, and energy to it.

3. Our guides to starting a business by sector

Frequently Asked Questions About Starting A Business

Starting a successful business requires framework and organisation, especially in the early stages. Having both of these helps individuals avoid confusion and ensures that all of the necessary components of launching a business are considered.

A simple way to achieve this is to follow a step-by-step framework when starting a business.

Here are some of the main steps that you should consider:

- Market research: identify your business idea, research the market, competition and potential customers.

- Location: decide where you are going to set up your business (physical or digital presence or both).

- Concept: decide what products and services you will offer and how they will set you apart from your competition.

- Branding: develop your brand identity, including a business name and logo.

- Go to market: develop your sales and marketing plan.

- Legal structure: choose a legal form that best fits your startup.

- Business plan: create a detailed business plan outlining your goals and strategies.

- Financing: secure startup funding.

A business plan is a written document that sets out the commercial, operational and financial objectives of the company over the next 3 to 5 years.

It consists of two main parts:

- A written part that presents, in detail, your business, the team, your strategy, and your medium-term objectives.

- A financial forecast that highlights the expected profitability of the business and the initial funding requirements.

The lack of business planning is one of the main reasons why more than 50% of startups fail within 5 years. If you're starting a business, writing a business plan is a must-have in order to reduce the risk of failure of your project.

Business plans are also required by most lenders and investors in order to secure financing, therefore a business plan is also highly recommended if you're seeking a loan or equity investment for your business.

This depends where you start and in which industry you operate.

The cost of starting the business itself (company formation, legal expenses, etc.) is usually quite modest though it varies significantly country by country.

The investments and initial working capital requirements (such as buying inventories) will mainly vary based on the industry you operate on. For example, a service company where all you need to get started is a computer and a desk will be much cheaper to start than an industrial business for which you need to invest in heavy machinery.

You should create a financial forecast in order to assess the exact budget needed to start your own business.

The Business Plan Shop's online forecasting software can help crunching the numbers.

Yes, it is possible to start a business with limited or no money, but it depends on the type of business and your approach.

Here are some ways to start a business with little to no money or capital:

- Service-based business: consider offering a service that requires minimal upfront costs, such as consulting, freelance writing, graphic design, or social media management. You can start by leveraging your skills and offering your services to clients.

- Online business: if you decide to start an online business such as an e-commerce store, you'll probably have low startup costs as a result of saving on rental and other expenses associated with high-street businesses.

- Crowdfunding: you could raise funds from a "crowd of backers" who believe in your business idea. This can help you secure the initial capital you need and you won't need to invest much of your money to do so.

Starting a business with limited funds is doable, but some industries, like manufacturing or physical stores, need substantial investments. Operating on a tight budget can hinder growth, so a robust business plan and resourcefulness are vital for securing funding.

Try The Business Plan Shop for free!

Our online software guides you through the process of starting a business by enabling you to check the financial viability of your business model and the level of capital and funding required.

Free 7-day trial. No credit card required.