1. Tools for building a financial forecast

Online financial forecasting software

Using financial forecasting software is the modern way to create robust forecasts for businesses of all sizes.

Good forecasting software solutions offer the flexibility to quickly model any business model, to assess the impact of scenarios (or stress tests), and to compare and track the business's actuals against what was planned in the financial forecast.

Simply input your revenues, alongside your company’s operating expenses, long-term assets and financial resources - and let the software crunch all of the financial data for you without errors.

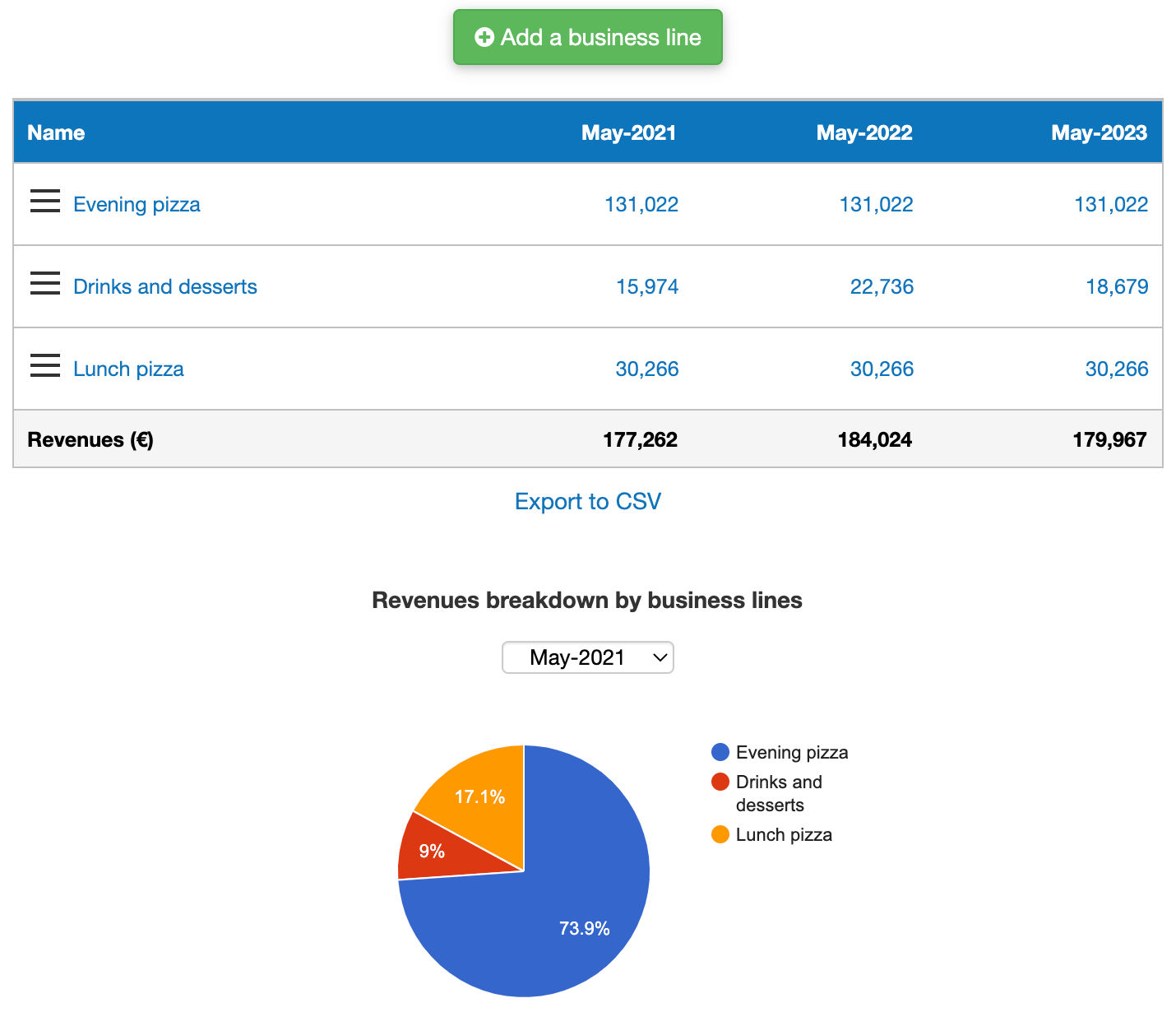

The Business Plan Shop's solution

The Business Plan Shop has created a simple and efficient online business planning and financial forecasting software that you can try for free by signing up here.

With The Business Plan Shop’s forecasting software, you’ll get a complete three-way financial forecast over 3 or 5 years, including a profit and loss statement, cash flow statement and projected balance sheet.

Suitable for every type of business across all sectors, our software also handles all currencies and multiple financial statement formats.

Answer simple questions and let our business plan software crunch the numbers for you

No accounting or financial expertise needed

Get a complete, three-way financial forecast that’ll immediately attract lenders and investors’ attention

Easily track your actual financial performance against your forecast, and keep your forecast up to date as time goes by

Stuck? Our support team will be happy to answer your questions

Free 7-day trial.

Sample financial forecasts to get inspiration from

Not sure how to organize your sales forecast or how to model your cost structure? Get a bit of inspiration from our financial forecast templates.

Each one comes with a full set of projected financial statements and a complete written business plan example so that you can get a better idea of what banks and investors expect to see.

Our financial forecast templates can be used directly inside our software, or downloaded as a separate document.

Why not use Excel to create a financial forecast?

Excel is a great tool for building forecasts as it gives you maximum flexibility, but you have to know what you are doing and be prepared to spend a lot more time creating a forecast than with specialized software.

Using spreadsheets may be a viable option for creating a financial forecast for some entrepreneurs, but it is by far not the best or most efficient solution for most, because:

- It's risky: you need to be an expert in financial modeling and accounting if you want to avoid calculation errors (and your numbers to be taken seriously by financiers).

- It's long and your time is better spent elsewhere: using Excel is much slower than using software that does the calculations and formatting for you.

- It's hard to maintain: a financial forecast created using Excel doesn't automatically update and there's no easy way to compare your actuals against your forecast.

- It's tedious: even modelling a basic fixed cost with simple payment terms and VAT or GST can span across dozens of lines.

2. Key components of a financial forecast

A financial forecast is a projection or estimation of a company's future financial performance. It typically includes anticipated revenues, expenses, profits, and cash flows over a specific period, such as a month, quarter, or year.

Financial forecasts are essential tools used by businesses for various purposes, including:

- Assess the expected growth and profitability for the next three or five years

- Keep an eye on your future cash flows (both short-term and long-term)

- Assess how much financing your business requires (for startup, growth, etc.)

- Compare scenarios and make data-driven decisions: should we invest in project A or project B? Should we hire or outsource? Etc.

Forecasts are usually presented using 4-5 financial tables: a profit and loss statement (or P&L), a balance sheet, a cash flow statement, a sources and uses table, and sometimes a break-even calculation.

Below we explore each of these tables in a bit more detail.

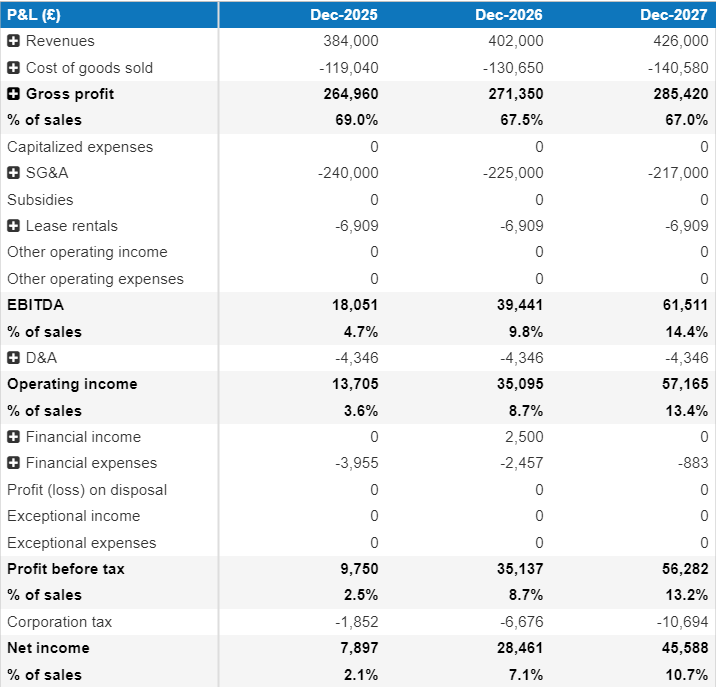

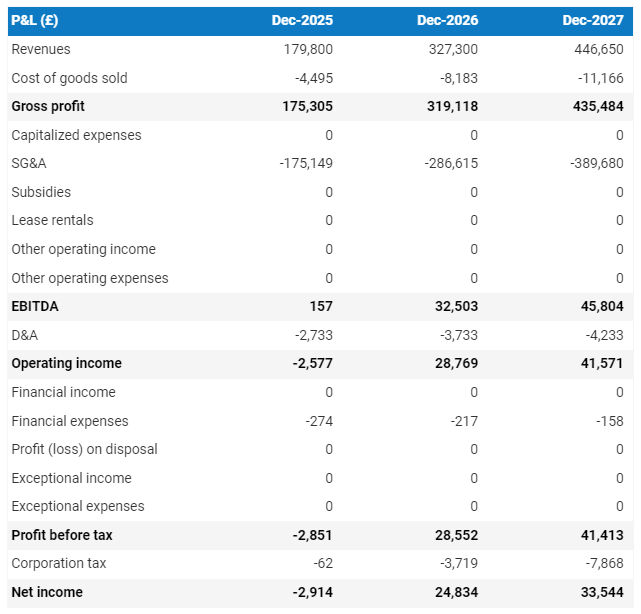

The projected profit and loss statement

The profit and loss forecast enables you to assess your business's expected turnover and growth over the next 3 or 5 years.

It also allows you to view the expected profitability of the company both at the operational level (EBITDA or Earnings Before Interest Tax Depreciations & Amortization, which measures the company's cashable profits from operations) and at the global level (net profit or loss).

Finally, the P&L enables you to compare how revenues and costs are expected to evolve in order to ensure the company's margins are maintained or improved throughout the financial forecast.

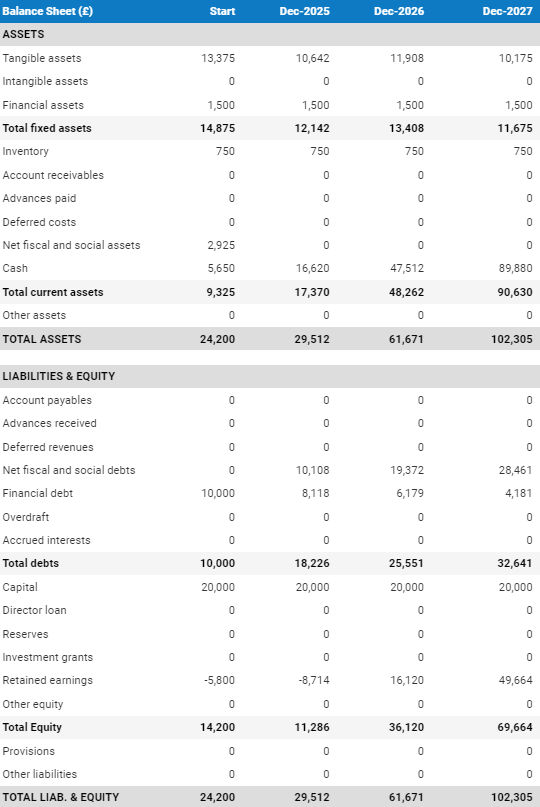

The projected balance sheet

A projected balance sheet includes three key elements:

- Assets, i.e. what the company owns (stocks, equipment, etc.)

- Liabilities, what the company owes (to suppliers, loans, etc.)

- Equity (money invested by the shareholders)

The balance sheet makes it possible to observe the financial structure of the business (weight of debt in relation to equity), as well as the working capital requirement (WCR - i.e. money immobilised by the business activity: inventory, invoices pending payment, etc.), and the evolution of the value of the productive assets (vehicles, buildings, equipment, etc.).

By cross-referencing the balance sheet and the income statement, we can analyse the company's:

- Liquidity (ability to repay its short-term debts) and solvency (ability to repay its medium to long-term debts)

- Procurement policy (number of days of sales in stock) and the commercial policy (payment terms with customers and suppliers)

- Investment policy (increase or decrease in the value of productive assets, rate of depreciation, etc.)

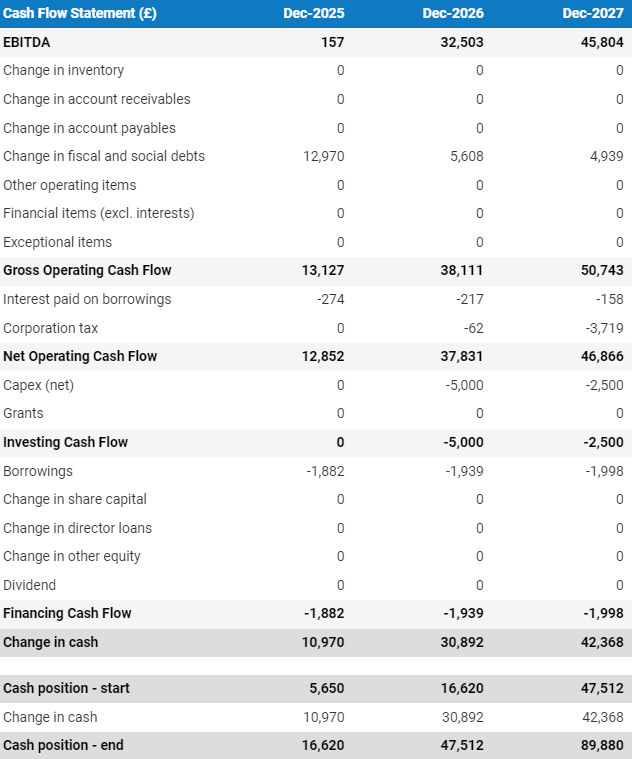

The cash flow forecast

The cash flow forecast provides a complete view of how much cash is generated or consumed by the business.

By looking at this table, you can check that the business is generating enough cash to meet your loan repayments, renew your equipment, and invest to grow.

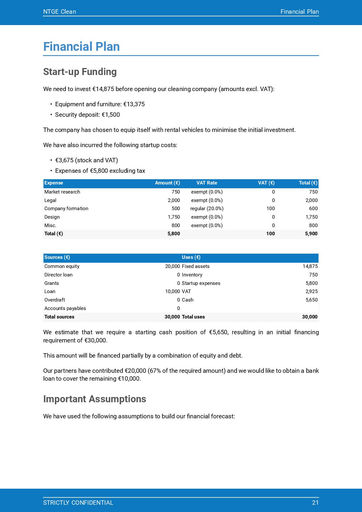

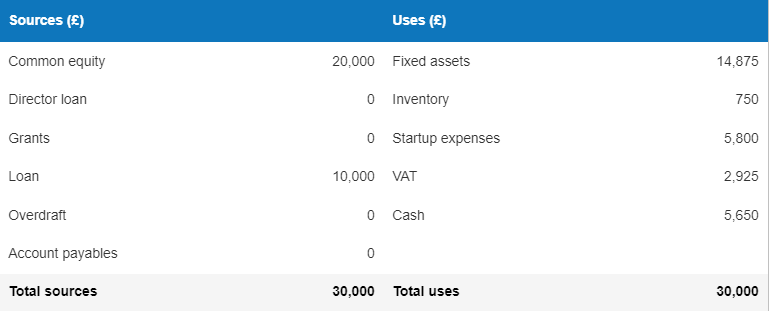

The sources and uses table

The sources and uses table, also called initial financing plan, shows how the financing of a startup is distributed at launch, and how the risks are distributed between the founders and the external capital providers.

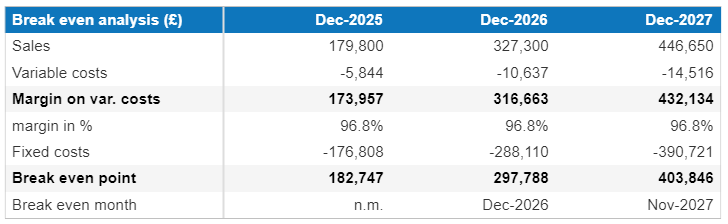

The breakeven point table

The breakeven point is the minimum volume of sales required for the business to be profitable.

It can be expressed in volume (number of sales), in value (amount of revenues), or in days of revenues.

3. Tips for creating a robust financial forecast

Mistakes to avoid in your financial forecast

It's easy to get carried away and be too optimistic in a forecast. Below are a couple of tips to help make yours as accurate as possible:

- Consider seasonality and cyclical trends - most businesses experience peaks and troughs of activity at some point during the year, make sure this is reflected in your forecast and that your business has enough cash on the balance sheet throughout.

- Growth doesn't happen in a vacuum - make sure your forecast includes adequate financial and human resources to generate the growth you anticipate.

- Revisit your financial forecast regularly - continuously monitor actual performance against projected figures and revise your forecast periodically to reflect the evolving nature of your business and maintain visibility on future cash flows.

Financial forecasting links and resources

Want to dig deeper into the ins and outs of the subtle art of financial forecasting? Then look no further than in the guides below:

- Financial forecast example - just starting your business? we guide you through each section of the financial forecast with an example

- How to forecast sales - discover the different methods of forecasting sales for a business plan

- Financial forecast for a business idea - three ways to create a financial forecast for a startup.

Frequently Asked Questions About Financial Forecasting

A financial forecast is an estimation of the future financial performance of a business.

Why would you need a financial forecast?

- Planning: building a financial forecasting helps you set realistic financial goals and objectives, and develop strategies to achieve them.

- Investment and financing - a financial forecast form part of an overall business plan which you can use to help obtain funding from lenders or investors.

- Performance evaluation - creating a financial forecast lets you compare actual performance against what was predicted meaning you can understand how well your business is performing in relation to your expectations and can help you adjust future budgets accordingly.

The key components of a financial forecast include:

- A profit and loss forecast: this is used to project your business's income, expenses and profitability over a given period (usually 3 or 5 years).

- A balance sheet forecast: this statement estimates the financial position of your business at a specific point in the future. The balance sheet helps in assessing your company's financial health, liquidity, and solvency.

- A cash flow forecast: this financial statement focuses on the timing and amount of cash inflows and outflows. It helps determine whether your business will have sufficient cash to meet its obligations and fund its operations. The cash flow is derived from the other 2 statements above.

As you can see a financial forecast has 3 elements at its core, which is why we often talk of 3-way forecasts.

Try The Business Plan Shop for free!

Our financial forecasting software guides you through each step of creating a financial forecast, making it quick and easy to produce a set of projections that are accurate, professional and can be presented to your financial partners.

Free 7-day trial. No credit card required.