How to create a financial forecast for a waterpark?

Creating a financial forecast for your waterpark, and ensuring it stays up to date, is the only way to maintain visibility on future cash flows.

This might sound complex, but with the right guidance and tools, creating an accurate financial forecast for your waterpark is not that hard.

In this guide, we'll cover everything from the main goal of a financial projection, the data you need as input, to the tables that compose it, and the tools that can help you build a forecast efficiently.

Without further ado, let us begin!

Why create and maintain a financial forecast for a waterpark?

The financial projections for your waterpark act as a financial blueprint to guide its growth with confidence and ensure its long-term financial viability.

To create them, you will need to look at your business in detail - from sales to operating costs and investments - to assess how much profit it can generate in the years to come and what will be the associated cash flows.

During challenging market conditions, maintaining an up-to-date financial forecast enables early detection of potential financial shortfalls, allowing for timely adjustments or securing financing before facing a cash crisis.

Your waterpark's financial forecast will also prove invaluable when seeking financing. Banks and investors will undoubtedly request a thorough examination of your financial figures, making precision and presentation essential.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

What information is needed to build a waterpark financial forecast?

The quality of your inputs is key when it comes to financial modelling: no matter how good the model is, if your inputs are off, so will the forecast.

If you are building a financial plan to start a waterpark, you will need to have done your market research and have a clear picture of your sales and marketing strategies so that you can project revenues with confidence.

You will also need to have a clear idea of what resources will be required to operate the waterpark on a daily basis, and to have done your research with regard to the equipment needed to launch your venture (see further down this guide).

If you are creating a financial forecast of an existing waterpark, things are usually simpler as you will be able to use your historical accounting data as a budgeting base, and complement that with your team’s view on what lies ahead for the years to come.

Let's now zoom in on what will go in your waterpark's financial forecast.

The sales forecast for a waterpark

The sales forecast, also called topline projection, is normally where you will start when building your waterpark financial forecast.

Creating a coherent sales projection boils down to estimating two key drivers:

- The average price

- The number of monthly transactions

To do this, you will need to rely on historical data (for an existing business), market research data (for both new and existing waterparks), and consider the elements below:

- Weather Conditions: The weather can have a significant impact on the number of visitors to your waterpark. Hot and sunny days will likely result in higher attendance, while rainy or cooler days may lead to a decrease in visitors.

- Local Events: Large events, such as concerts or festivals, in your area can also impact your waterpark's sales. These events may draw potential customers away from your park or attract more visitors looking for additional activities.

- Competition: The presence of other waterparks in your area can also affect your sales. If there are multiple options for visitors, they may choose to go to a different park with lower prices or better attractions.

- Economic Conditions: The overall state of the economy can also play a role in your waterpark's sales. During times of economic downturn, families may be less likely to spend money on leisure activities, leading to a decrease in attendance.

- Seasonal Trends: The time of year can also impact your sales forecast. Summer months tend to be the busiest for waterparks, while colder months may see a decrease in visitors. Planning for these seasonal trends is crucial in creating an accurate sales forecast.

After the sales forecast comes the operating expenses budget, which we will now look into in more detail.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The operating expenses for a waterpark

The next step is to estimate the expenses needed to run your waterpark on a day-to-day basis.

These will vary based on the level of sales expected, and the location and size of your business.

But your waterpark's operating expenses should include the following items at a minimum:

- Staff Costs: This includes the salaries, wages, benefits, and training expenses for all employees, including lifeguards, maintenance workers, and customer service staff.

- Accountancy Fees: These are the fees paid to a professional accountant or bookkeeper to manage the financial records and tax filings for the waterpark.

- Insurance Costs: As a waterpark, you are responsible for ensuring the safety of your guests and employees. This includes liability insurance, property insurance, and worker's compensation insurance.

- Software Licences: To efficiently manage your operations, you will need to invest in software licenses for ticketing, scheduling, and other management systems.

- Banking Fees: Every time you process a payment or make a transaction, your bank charges fees. These can add up quickly, especially during peak season.

- Utilities: Running a waterpark requires a lot of water and electricity, which can be significant expenses. You will also need to account for other utilities such as gas and internet.

- Maintenance and Repairs: With constant use and exposure to the elements, your waterpark will require regular maintenance and repairs to keep everything in working order.

- Supplies: This includes all the necessary supplies to keep your park running smoothly, such as cleaning products, office supplies, and first aid kits.

- Marketing and Advertising: To attract visitors to your waterpark, you will need to invest in marketing and advertising efforts, such as social media ads, print ads, and promotional materials.

- Security: Ensuring the safety and security of your guests is crucial. This may include hiring security personnel, installing surveillance cameras, or investing in other security measures.

- Landscaping and Groundskeeping: A well-maintained and attractive park can enhance the overall experience for your guests. This includes regular landscaping and groundskeeping services.

- Professional Services: You may need to hire outside professionals for services such as legal advice, human resources consulting, or marketing strategy development.

- Concessions: If your waterpark offers food and beverage options, you will need to consider the cost of supplies, inventory, and staffing for your concessions area.

- Entertainment: To keep guests entertained, you may want to invest in live entertainment, such as musicians or performers, or activities such as water slides or games.

- Janitorial Services: With a large number of visitors, your waterpark will require regular cleaning to maintain a safe and hygienic environment. This may include hiring janitorial services or purchasing cleaning supplies.

This list is, of course, not exhaustive, and you'll have to adapt it according to your precise business model and size. A small waterpark might not have the same level of expenditure as a larger one, for example.

What investments are needed to start or grow a waterpark?

Creating and expanding a waterpark also requires investments which you need to factor into your financial forecast.

Capital expenditures and initial working capital items for a waterpark could include elements such as:

- Water Slides: These are the main attractions at a waterpark and can range from simple tube slides to complex multi-level slides with twists and turns. You will need to purchase these slides and install them in your park.

- Wave Pool: This is a popular feature in waterparks where artificial waves are generated for visitors to enjoy. This requires the installation of specialized equipment and construction of a pool large enough to accommodate the waves.

- Lazy River: A lazy river is a slow-moving water ride that allows visitors to relax and float along on tubes. This feature requires the construction of a pool and the installation of pumps and filters to keep the water flowing.

- Children's Play Area: A designated area for younger visitors to play and splash around is a must-have in a waterpark. This area may include small slides, fountains, and interactive water features. You will need to purchase and install these play structures.

- Pump and Filtration Systems: These are essential for maintaining clean and safe water in your park. You will need to invest in pumps, filters, and other equipment to keep the water circulating and filtered.

Again, this list is not exhaustive and will need to be adjusted according to the circumstances of your waterpark.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The financing plan of your waterpark

The next step in the creation of your financial forecast for your waterpark is to think about how you might finance your business.

You will have to assess how much capital will come from shareholders (equity) and how much can be secured through banks.

Bank loans will have to be modelled so that you can separate the interest expenses from the repayments of principal, and include all this data in your forecast.

Issuing share capital and obtaining a bank loan are two of the most common ways that entrepreneurs finance their businesses.

What tables compose the financial plan for a waterpark?

Now let's have a look at the main output tables of your waterpark's financial forecast.

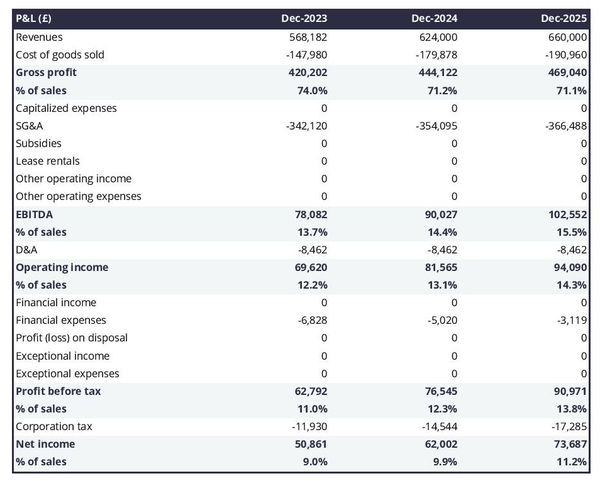

The profit & loss forecast

The forecasted profit & loss statement will enable you to visualise your waterpark's expected growth and profitability over the next three to five years.

A financially viable P&L statement for a waterpark should normally show:

- Sales growing above inflation

- Stable or expanding (ideally) profit margins

- A net profit

This will of course depend on the stage of your business: a new venture might be loss-making until it reaches its breakeven point in year 2 or 3, for example.

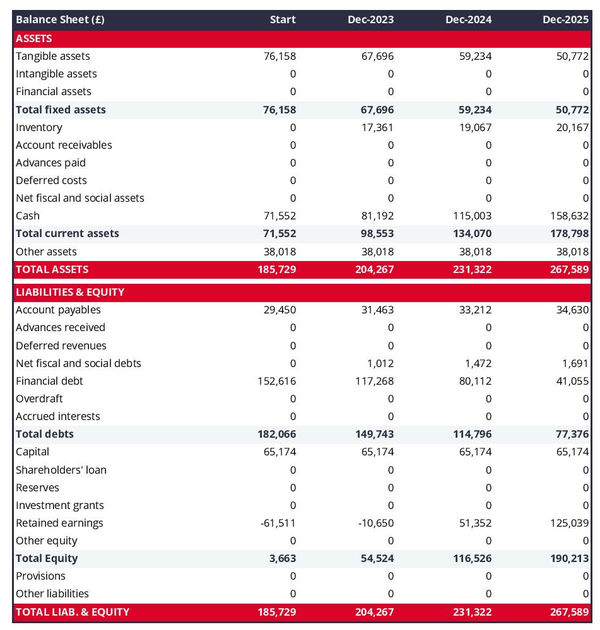

The projected balance sheet

The projected balance sheet gives an overview of your waterpark's financial structure at the end of the financial year.

It is composed of three categories of items: assets, liabilities and equity:

- Assets: are what the business possesses and uses to produce cash flows. It includes resources such as cash, buildings, equipment, and accounts receivable (money owed by clients).

- Liabilities: are the debts of your waterpark. They include accounts payable (money owed to suppliers), taxes due and bank loans.

- Equity: is the combination of what has been invested by the business owners and the cumulative profits to date (which are called retained earnings). Equity is a proxy for the value of the owner's stake in the business.

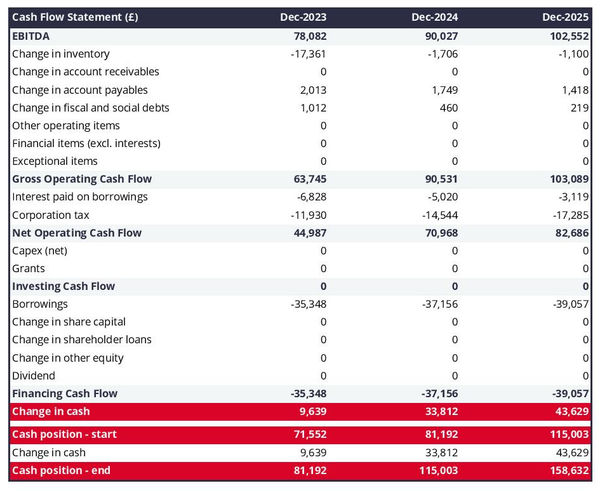

The cash flow projection

The cash flow forecast of your waterpark will show how much cash the business is expected to generate or consume over the next three to five years.

There are multiple ways of presenting a cash flow forecast but from experience, it is better to organise it by nature in order to clearly show these elements:

- Operating cash flow: how much cash is generated by the waterpark's operations

- Investing cash flow: what is the business investing to expand or maintain its equipment

- Financing cash flow: is the business raising additional funds or repaying financiers (debt repayment, dividends)

Your cash flow forecast is the most important element of your overall financial projection and that’s where you should focus your attention to ensure that your waterpark is adequately funded.

Note: if you are preparing a financial forecast in order to try to secure funding, you will need to include both a yearly and monthly cash flow forecast in your waterpark's financial plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Which tool should you use to create your waterpark's financial projections?

Building a waterpark financial forecast is not difficult provided that you use the right tool for the job. Let’s see what options are available below.

Using online financial projection software to build your waterpark's forecast

The modern and easiest way to build a forecast is to use professional financial projection software such as the one we offer at The Business Plan Shop.

There are several advantages to using specialised software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You have access to complete financial forecast templates

- You get a complete financial forecast ready to be sent to your bank or investors

- You can easily track your actual financial performance against your financial forecast, and recalibrate your forecast as the year goes by

- You can create scenarios to stress test your forecast's main assumptions

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

- It’s cost-efficient and much cheaper than using an accountant or consultant (see below)

If you are interested in this type of solution, you can try our forecasting software for free by signing up here.

Hiring a financial consultant or chartered accountant

Hiring a consultant or chartered accountant is also an efficient way to get a professional waterpark financial projection.

As you can imagine, this solution is much more expensive than using software. From experience, the creation of a simple financial forecast over three years (including a balance sheet, income statement, and cash flow statement) is likely to start around £700 or $1,000 excluding taxes.

The indicative estimate above, is for a small business, and a forecast done as a one-off. Using a financial consultant or accountant to track your actuals vs. forecast and to keep your financial forecast up to date on a monthly or quarterly basis will naturally cost a lot more.

If you choose this solution, make sure your service provider has first-hand experience in your industry, so that they may challenge your assumptions and offer insights (as opposed to just taking your figures at face value to create the forecast’s financial statements).

Why not use a spreadsheet such as Excel or Google Sheets to build your waterpark's financial forecast?

You and your financial partners need numbers you can trust. Unless you have studied finance or accounting, creating a trustworthy and error-free waterpark financial forecast on a spreadsheet is likely to prove challenging.

Financial modelling is very technical by nature and requires a solid grasp of accounting principles to be done without errors. This means that using spreadsheet software like Excel or Google Sheets to create accurate financial forecasts is out of reach for most business owners.

Creating forecasts in Excel is also inefficient nowadays:

- Software has advanced to the point where forecasting can be done much faster and more accurately than manually on a spreadsheet.

- With artificial intelligence, the software is capable of detecting mistakes and helping decision-making.

Spreadsheets are versatile tools but they are not tailor-made for reporting. Importing your waterpark's accounting data in Excel to track actual vs. forecast is incredibly manual and tedious (and so is keeping forecasts up to date). It is much faster to use dedicated financial planning tools like The Business Plan Shop which are built specially for this.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Use our financial projection templates for inspiration

The Business Plan Shop has dozens of financial forecasting templates available.

Our examples contain both the financial forecast, and a written business plan which presents, in detail, the company, the team, the strategy, and the medium-term objectives.

Whether you are just starting out or already have your own waterpark, looking at our template is always a good way to get ideas on how to model financial items and what to write when creating a business plan to secure funding.

Takeaways

- A financial forecast shows expected growth, profitability, and cash generation metrics for your waterpark.

- Tracking actuals vs. forecast and having an up-to-date financial forecast is key to maintaining visibility on your future cash flows.

- Using financial forecasting software is the modern way of creating and maintaining financial projections.

We hope that this guide helped you gain a clearer perspective on the steps needed to create the financial forecast for a waterpark. Don't hesitate to contact us if you have any questions!

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Also on The Business Plan Shop

- Financial forecast example

- How to project sales for a business?

- Sample financial forecast for business idea

Know someone who runs a waterpark? Share our business guide with them!