How to create a financial forecast for a logging company?

If you are serious about keeping visibility on your future cash flows, then you need to build and maintain a financial forecast for your logging company.

Putting together a logging company financial forecast may sound complex, but don’t worry, with the right tool, it’s easier than it looks, and The Business Plan Shop is here to guide you.

In this practical guide, we'll cover everything you need to know about building financial projections for your logging company.

We will start by looking at why they are key, what information is needed, what a forecast looks like once completed, and what solutions you can use to create yours.

Let's dive in!

Why create and maintain a financial forecast for a logging company?

In order to prosper, your business needs to have visibility on what lies ahead and the right financial resources to grow. This is where having a financial forecast for your logging company becomes handy.

Creating a logging company financial forecast forces you to take stock of where your business stands and where you want it to go.

Once you have clarity on the destination, you will need to draw up a plan to get there and assess what it means in terms of future profitability and cash flows for your logging company.

Having this clear plan in place will give you the confidence needed to move forward with your business’s development.

Having an up-to-date financial forecast for a logging company is also useful if your trading environment worsens, as the forecast enables you to adjust to your new market conditions and anticipate any potential cash shortfall.

Finally, your logging company's financial projections will also help you secure financing, as banks and investors alike will want to see accurate projections before agreeing to finance your business.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

What information is used as input to build a logging company financial forecast?

A logging company's financial forecast is only as good as the inputs used to build it.

If you are creating (or updating) the forecast of an existing logging company, then you mostly need your accounting information, key historical operating non-financial data, and your team’s input on what to expect for the coming years.

If you are building financial projections for a logging company startup, you will need to have done your research and have a clear picture of your competitive environment and go-to-market strategy so that you can forecast sales accurately.

For a new venture, you will also need a precise list of the resources needed to keep the logging company running on a day-to-day basis and a list of the equipment and expenditures required to start the business (more on that later).

Let's now take a closer look at the elements that make up your logging company's financial forecast.

The sales forecast for a logging company

The sales forecast, also called topline projection, is normally where you will start when building your logging company financial forecast.

Creating a coherent sales projection boils down to estimating two key drivers:

- The average price

- The number of monthly transactions

To do this, you will need to rely on historical data (for an existing business), market research data (for both new and existing logging companies), and consider the elements below:

- Weather patterns: Adverse weather conditions such as heavy rainfall or snowfall can affect the accessibility and productivity of logging operations. This can lead to a decrease in the volume of timber harvested and potentially drive up the average price due to limited supply.

- Demand for timber products: Fluctuations in the demand for timber products, such as lumber and paper, can impact the average price of timber. During periods of high demand, prices may increase while during periods of low demand, prices may decrease.

- Government regulations: Changes in government regulations, such as restrictions on logging in certain areas or increased regulations on harvesting methods, can affect the cost of production and potentially drive up the average price of timber.

- Competition: The presence of other logging companies in the same region can impact the average price of timber. Increased competition may lead to lower prices as companies try to attract more customers, while less competition may lead to higher prices.

- Natural disasters: Unforeseen events such as wildfires or disease outbreaks in forests can greatly impact the supply of timber and drive up the average price. This can also lead to disruptions in the monthly transactions as the company may need to pause operations in affected areas.

After the sales forecast comes the operating expenses budget, which we will now look into in more detail.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The operating expenses for a logging company

The next step is to estimate the costs you’ll have to incur to operate your logging company.

These will vary based on where your business is located, and its overall size (level of sales, personnel, etc.).

But your logging company's operating expenses should normally include the following items:

- Staff costs: This includes salaries, wages, and benefits for your logging crew, office staff, and management team.

- Equipment maintenance: Regular maintenance and repairs for your logging equipment, such as chainsaws, trucks, and skidders.

- Fuel: The cost of fuel for your logging equipment and company vehicles.

- Insurance: Insurance premiums to protect your business and employees from potential risks and accidents.

- Accountancy fees: Fees for hiring an accountant to manage your financial records and taxes.

- Permits and licenses: The cost of obtaining necessary permits and licenses for logging operations.

- Office supplies: The cost of necessary office supplies, such as paper, printer ink, and pens.

- Software licenses: Fees for using software programs that help manage your business, such as accounting or inventory software.

- Safety equipment: The cost of safety gear for your logging crew, such as hard hats, safety glasses, and gloves.

- Training and education: Expenses related to training and educating your employees, such as safety training or professional development courses.

- Rent: If you rent office space or a warehouse for storing equipment, this would be an operating expense.

- Utilities: The cost of electricity, water, and other utilities for your office and equipment.

- Marketing and advertising: Expenses for promoting your logging business, such as website development, print ads, or attending trade shows.

- Banking fees: Fees associated with your business bank account, such as transaction fees or monthly account fees.

- Vehicle maintenance: Regular maintenance and repairs for your company vehicles, such as trucks and trailers used for hauling logs.

This list is not exhaustive by any means, and will need to be tailored to your logging company's specific circumstances.

What investments are needed to start or grow a logging company?

Once you have an idea of how much sales you could achieve and what it will cost to run your logging company, it is time to look into the equipment required to launch or expand the activity.

For a logging company, capital expenditures and initial working capital items could include:

- Logging equipment: This includes items such as chainsaws, skidders, and log loaders. These are essential tools for a logging company as they are used to cut, move, and load logs onto trucks for transport.

- Trucks and trailers: Logging companies require heavy-duty trucks and trailers to transport logs from the forest to the mill. These vehicles are crucial for the smooth operation of a logging company.

- Log processing equipment: Once logs have been transported to the mill, they need to be processed into lumber or other wood products. This requires specialized equipment such as sawmills, chippers, and debarkers.

- Land and forestry rights: In order to operate a logging company, you will need to secure land and forestry rights. This can include purchasing or leasing land for logging purposes, as well as obtaining permits and licenses from government agencies.

- Maintenance and repairs: As with any heavy machinery, logging equipment and vehicles require regular maintenance and occasional repairs. This should be factored into your expenditure forecast to ensure that your equipment remains in good working condition.

Again, this list will need to be adjusted according to the specificities of your logging company.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The financing plan of your logging company

The next step in the creation of your financial forecast for your logging company is to think about how you might finance your business.

You will have to assess how much capital will come from shareholders (equity) and how much can be secured through banks.

Bank loans will have to be modelled so that you can separate the interest expenses from the repayments of principal, and include all this data in your forecast.

Issuing share capital and obtaining a bank loan are two of the most common ways that entrepreneurs finance their businesses.

What tables compose the financial plan for a logging company?

Now let's have a look at the main output tables of your logging company's financial forecast.

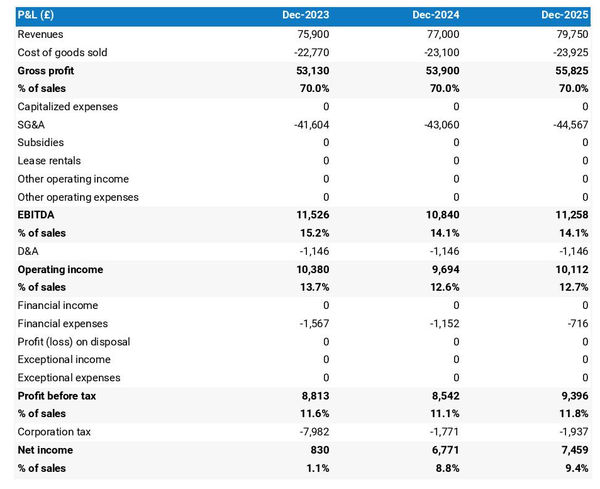

The profit & loss forecast

The forecasted profit & loss statement will enable you to visualise your logging company's expected growth and profitability over the next three to five years.

A financially viable P&L statement for a logging company should normally show:

- Sales growing above inflation

- Stable or expanding (ideally) profit margins

- A net profit

This will of course depend on the stage of your business: a new venture might be loss-making until it reaches its breakeven point in year 2 or 3, for example.

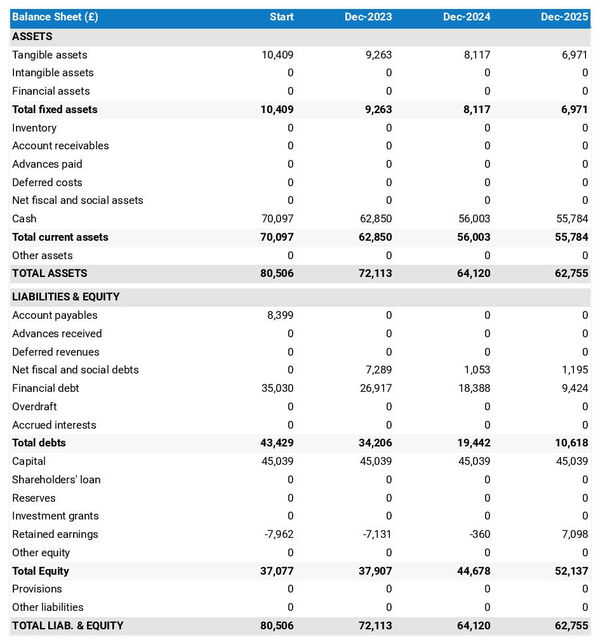

The projected balance sheet

Your logging company's projected balance sheet provides a snapshot of your business’s financial position at year-end.

It is composed of three types of elements: assets, liabilities and equity:

- Assets: represent what the business possesses including cash, equipment, and accounts receivable (money owed by clients).

- Liabilities: represent funds advanced to the business by lenders and other creditors. They include accounts payable (money owed to suppliers), taxes payable and loans from banks and financial institutions.

- Equity: is the combination of what has been invested by the business owners and the cumulative profits and losses generated by the business to date (which are called retained earnings). Equity is a proxy for the value of the owner's stake in the business.

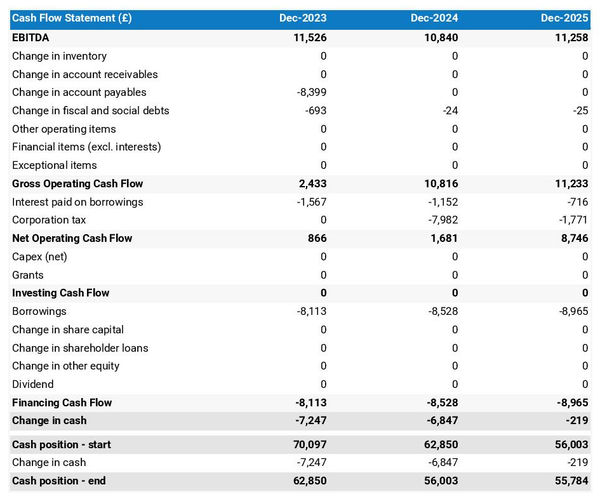

The cash flow forecast

Your logging company's cash flow forecast shows how much cash your business is expected to consume or generate in the years to come.

It is best practice to organise the cash flow forecast by nature to better explain where cash is used or generated by the logging company:

- Operating cash flow: shows how much cash is generated by the operating activities

- Investing cash flow: shows how much will be invested in capital expenditure to maintain or expand the business

- Financing cash flow: shows if the business is raising new capital or repaying financiers (debt repayment, dividends)

Keeping an eye on (and regularly updating) your logging company's cash flow forecast is key to ensuring that your business has sufficient liquidity to operate normally and to detect financing requirements as early as possible.

If you are trying to raise capital, you will normally be asked to provide a monthly cash flow forecast in your logging company's financial plan - so that banks or investors can assess seasonal variation and ensure your business is appropriately capitalised.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Which tool should you use to create your logging company's financial forecast?

Creating your logging company's financial forecast may sound fairly daunting, but the good news is that there are several ways to go about it.

Using online financial projection software to build your logging company's forecast

The modern and easiest way to build a forecast is to use professional financial projection software such as the one we offer at The Business Plan Shop.

There are several advantages to using specialised software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You have access to complete financial forecast templates

- You get a complete financial forecast ready to be sent to your bank or investors

- You can easily track your actual financial performance against your financial forecast, and recalibrate your forecast as the year goes by

- You can create scenarios to stress test your forecast's main assumptions

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

- It’s cost-efficient and much cheaper than using an accountant or consultant (see below)

If you are interested in this type of solution, you can try our forecasting software for free by signing up here.

Calling in a financial consultant or chartered accountant

Outsourcing the creation of your logging company financial forecast is another possible solution.

This will cost more than using software as you can expect as your price will have to cover the accountant’s time, software cost, and profit margin.

Price can vary greatly based on the complexity of your business. For a small business, from experience, a simple three-year financial forecast (including a balance sheet, income statement, and cash flow statement) will start at around £700 or $1,000.

Bear in mind that this is for forecasts produced at a single point in time, updating or tracking your forecast against actuals will cost extra.

If you decide to outsource your forecasting:

- Make sure the professional has direct experience in your industry and is able to challenge your assumptions constructively.

- Steer away from consultants using sectorial ratios to build their client’s financial forecasts (these projections are worthless for a small business).

Why not use a spreadsheet such as Excel or Google Sheets to build your logging company's financial forecast?

You and your financial partners need numbers you can trust. Unless you have studied finance or accounting, creating a trustworthy and error-free logging company financial forecast on a spreadsheet is likely to prove challenging.

Financial modelling is very technical by nature and requires a solid grasp of accounting principles to be done without errors. This means that using spreadsheet software like Excel or Google Sheets to create accurate financial forecasts is out of reach for most business owners.

Creating forecasts in Excel is also inefficient nowadays:

- Software has advanced to the point where forecasting can be done much faster and more accurately than manually on a spreadsheet.

- With artificial intelligence, the software is capable of detecting mistakes and helping decision-making.

Spreadsheets are versatile tools but they are not tailor-made for reporting. Importing your logging company's accounting data in Excel to track actual vs. forecast is incredibly manual and tedious (and so is keeping forecasts up to date). It is much faster to use dedicated financial planning tools like The Business Plan Shop which are built specially for this.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Use our financial projection templates for inspiration

The Business Plan Shop has dozens of financial forecasting templates available.

Our examples contain both the financial forecast, and a written business plan which presents, in detail, the company, the team, the strategy, and the medium-term objectives.

Whether you are just starting out or already have your own logging company, looking at our template is always a good way to get ideas on how to model financial items and what to write when creating a business plan to secure funding.

Takeaways

- A financial projection shows expected growth, profitability, and cash generation for your business over the next three to five years.

- Tracking actuals vs. forecast and keeping your financial forecast up-to-date is the only way to maintain visibility on future cash flows.

- Using financial forecasting software makes it easy to create and maintain up-to-date projections for your logging company.

You have reached the end of our guide. We hope you now have a better understanding of how to create a financial forecast for a logging company. Don't hesitate to contact our team if you have any questions or want to share your experience building forecasts!

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Also on The Business Plan Shop

- Example of financial projections

- How to project sales for a business?

- Example of financial forecast for business idea

Know someone who runs or wants to start a logging company? Share our financial projection guide with them!