How to write a 3 year business plan?

It's common knowledge that a well-written 3-year business plan brings clarity to the decision-making process as it helps you identify key goals, possible shortfalls and lets you track milestones as you grow.

Plus, banks and investors expect to see a professional business plan - meaning its unlikely that you will obtain sizeable funding without one.

However, most entrepreneurs, struggle to write a business plan. For some, it can be difficult to know where to start, whilst others don't have the expertise to project financials on their own.

Luckily for you, our guide will turn writing a 3-year business plan into a breeze by giving you a standard outline, tips, and tools to speed up the process and avoid mistakes.

Ready? Let's get started!

What is a 3-year business plan?

A 3-year business plan is a document providing detailed information about your business and its objectives for the three years to come.

To keep it short and simple, a business plan consists of two parts:

- A financial forecast which provides information about the expected growth and profitability of your business, your potential funding requirements, and cash flow projections.

- A written presentation which provides the context and details needed to assess the relevance of the forecast: company overview, description of products and services, market analysis, strategy, operations, etc.

How does a 3-year business plan differ from a 5-year business plan?

Whilst the two plans may sound similar, there are distinct differences in terms of the content and their likely reliability.

Let's explore this in more detail:

- The main difference between a 3-year business plan and a 5-year business plan is the timespan of the financial projections. 5-year plans are usually less accurate as they predict further into the future where uncertainty is greater.

- 3-year plans are the most commonly used type of business plan as it is hard to estimate what the business environment will look like beyond this horizon, especially for startups or small businesses who lack experience in financial predictions.

- 5-year business plans often appear abstract, with guesstimates for years 4 and 5. In contrast, three-year plans provide a balanced perspective on the business's future without projecting too far ahead.

- Since 3-year plans cover a short(er) timeframe, they allow for greater accountability. It might be ok not to implement something planned in a 5-year plan, but in a 3-year plan the management team is committed to what it says it will execute.

- 3-year plans are also easier to revise and maintain as there is less detail to update (both in the editorial and financial sections). This allows for quicker adjustments in response to changing market conditions.

Now that you understand the difference between 3 vs. 5-year plans, let's take a minute to verify which one you need.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Is a 3-year business plan right for you?

As we said before, 3-years is the gold standard of business planning, and we recommend that you stick to this format (unless you have been specifically asked for a longer time horizon)

One exception is for businesses in transition, for which a longer time horizon might be preferable - you can read more about this in our 5-year business plan guide.

Let's now have a look at the tools you can use to write your 3-year plan, before diving into the actual content of the document.

What tool should I use to write a 3-year business plan efficiently?

Writing a business plan can be both tedious and difficult if you start from scratch. Luckily for you, online business plan software can help you write a professional plan in no time!

There are several advantages to using specialised software like The Business Plan Shop:

- You are guided through the writing process by detailed instructions and examples for each part of the business plan

- You can be inspired by already written business plan templates

- You can easily create your 3-year financial forecast by letting the software take care of the financial calculations for you

- You get a professional document, formatted and ready to be sent to your bank

- You can easily compare your forecast against actuals from your accounting system to ensure you are on track to deliver your plan, and adjust your forecast to keep it up to date as time goes by

If you are interested in this type of solution, you can try our software for free by signing up to The Business Plan Shop today.

3-year business plan templates and examples

At The Business Plan Shop, we have numerous examples of three-year business plan templates which you can use to help structure your own plan (change the numbers and text with your businesses' details to make the plan your own) or simply for inspiration.

Why you shouldn't be using Excel and Word to write a 3-year business plan

Word and Excel used to be popular programs to create three-year business plans.

On the plus side, Word and Excel are easy to use, offer plenty of features and are relatively cost-effective.

However, you'll need to compute formulas yourself, which means that you need to know what you are doing in order to create a financial forecast without errors.

Because of this, and unless you have a degree in finance, it is unlikely that lenders or investors will take your numbers crunched with Excel seriously.

It's also much longer to use Excel and Word than to use business plan software solutions like The Business Plan Shop.

How do I write a 3-year business plan in practice?

Before writing a 3-year business plan, it's important to think about growth objectives, content to include, who you could obtain inputs from and the length of the document.

Let's explore each concept in more detail.

How do you set 3-year business (growth) goals?

It's best to start with what you think you can achieve over the next 12 months, given the human and financial resources at your disposal.

Then, you can use you can use this landing zone as a starting point to repeat the process for the next 12 months. And so on, so forth.

When setting revenue objectives, or planning investments, use both your profit and loss statement and cash flow forecasts as guides to ensure you have the financial means to fund the working capital or capital expenditures needed to achieve your goals (or to adjust the amount of financing you need to secure in your business plan).

The Business Plan Shop's financial forecasting software can help you crunch the numbers and produce a full set of financial statements, which update instantly as you change your assumptions.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

From experience, business growth often takes longer to ramp up than we first imagine. So it's important to leave plenty of headroom in your forecast to account for the unexpected.

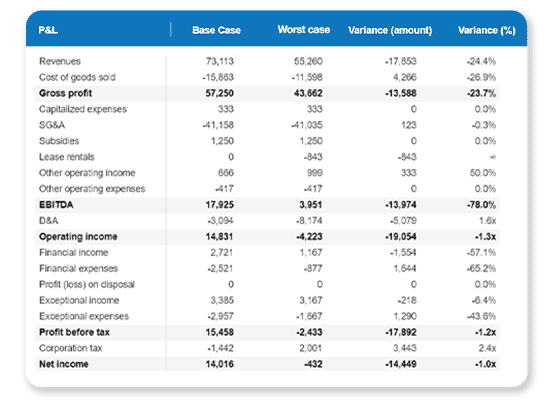

It's also useful to brainstorm different scenarios and stress test your core assumptions, to ensure your forecast is robust enough.

That's where it's handy to use a tool like The Business Plan Shop, which makes it easy to model the impact that financial decisions have on both your income and cash flows.

All you need to do is to duplicate your main forecast, change some of your assumptions, and click compare to view the difference in the financials of both scenarios like in the picture below.

What is the content of a 3-year business plan?

The written part of a 3-year business plan is composed of 7 main sections, let's have a look at each of these and what they include.

Executive Summary

The executive summary of your three-year business plan should include a short, concise overview of the entire plan (state what type of business you are and your ideal customer profile) as well as goals for each year of the plan. It should also include key financials such as projected revenues and expenses.

Be sure to mention major risks or opportunities in the market, and the overall strategy that you believe will help your business achieve success.

Keeping the executive summary short and snappy will allow readers to quickly understand the key points and determine if they want to read further or not.

Company

Then comes the presentation of the company where you will introduce the structure and ownership of your business, its location, and management team.

In the structure and ownership subsection, you will explain the legal structure of the company and who owns or holds shares in the business.

When writing about location, you will show where the business is located and explain why the location is relevant given the nature of your activity and the type of customers targeted by your business.

Finally, you will end the section with a short presentation of the management team stating, who will be responsible for the implementation of the business plan. State each person's qualifications, experience, and responsibilities.

Market analysis

When presenting the conclusion of your market analysis in your three-year business plan, you should include an overview of the demographics and segmentation of the target market for your business.

This would include information about age groups, income levels, location, and other relevant characteristics that are associated with potential customers (for a restaurant this might include how often your clients eat out for example).

You should also provide the reader with an understanding of who your primary target customers are and why you think your products or services are a good fit for that particular group.

In addition, it is also important to examine any competition in the area as well as any barriers to entry that might exist, such as regulation or other factors.

Understanding these elements will help better position yourself within the marketplace and ensure you can compete effectively.

Providing a detailed market analysis in your three-year business plan will enable you to effectively demonstrate an in-depth understanding of current market conditions when pitching investors or banks for funding opportunities.

Products and services

After the market analysis comes the products and services section of your three-year business plan.

Here, you will describe the main categories of products or services offered by your business.

For example, if you run an ice cream parlour, you could state the different flavours that are available for customers to choose from (mint, vanilla, etc.) but also mention that they can add additional toppings (strawberry and chocolate sauces, etc.).

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Strategy section

The strategy section of your three-year business plan should start by explaining how your business might gain a competitive advantage by differentiating itself from competitors.

For example, for a construction company, this could be achieved through developing relationships with architects, providing superior customer service, or leveraging technology in operations to improve efficiency.

Next, you should explain what prices you will charge for your products and services and why you chose this level of pricing.

Then you should follow with your sales and marketing plan, in which you should explain how you plan to attract and retain customers. For example, you might partner with complementary businesses or offer loyalty cards to encourage repeat purchases.

After the sales and marketing plan comes the milestones section. Milestones summarise what your goals are and where you plan to be in three years. For a startup, they may look like this:

- Within 1 month: obtain financing

- Within 2 months and one week: startup

- Within 12 months: reaching your break-even point

- Within 24 months: generate £50,000 in annual profit

- Within 36 months: move into bigger premises

Finally, talk about the risks which could affect your business within the next three years and how you intend to mitigate them.

Operations section

Recruiting and procuring the right personnel are essential components of any three-year business plan.

To effectively present a recruitment plan and procurement strategy in a business plan, there should be an organized overview of: the opening hours, the type of personnel needed, the number of employees that need to be recruited, and the budget available (this might be affected by your cash flow position).

You should also outline any staff that you've already have, any qualifications that they hold and what experience they have.

Talk about the suppliers you've chosen to work with and the reason for picking them over others.

Finally, you should state any key assets that you plan to hold, such as IP, vehicles or equipment.

Financials

For any business plan, the financial section is crucial. It translates your plan into numbers and provides investors an in-depth glance at what they can expect if they decide to invest in your business.

Your three-year business plan should contain a full set of financial statements: balance sheet, profit & loss statement and a cash flow statement.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Obtaining inputs from key stakeholders before writing your 3-year business plan

To help ensure that your business plan is accurate, it should ideally be written by your management team (one or more managers who are responsible for overall strategy and the day-to-day running of the business).

It's also important to obtain input from key staff members. For example, the head of sales should help build the sales forecast because they are the one responsible for executing the sales strategy.

How many pages does a 3-year business plan need?

Like most business plans, there's no specific number of pages that yours must have. A good rule of thumb, however, is to keep it between 15 and 35 pages.

As long as you've covered all the key sections, ranging from the executive summary to the financial projections, your three-year business plan should be good to go!

Remember, quality is more valuable than quantity.

How to make sure your 3-year business plan stays relevant?

Writing a comprehensive business plan takes time, to get a return on investment on this time you need to actually use and maintain your plan.

To do so, you will want to regularly compare your actuals (actual data from your accounting software) with your financial projections to check you are on track to deliver the plan.

Then you will want to adjust your forecast and plan as time goes by so that your plan stays current and your business can maintain clear visibility of its future cash flows.

If you used The Business Plan Shop to create your forecast, this is easy to do as actuals vs. forecast tracking is built in our solution:

That's it for now, we hope this guide helped you better understand how to write a 3-year business plan.

Please do not hesitate to contact us if you have any questions related to business planning or our solution.

Also on The Business Plan Shop

- How to write the business plan for a grant application?

- Business plan vs business case: what's the difference?

- Business plan personnel plan template

- Guide to write the competition section of a business plan

- What is a one-page business plan

Know someone running a business? Share our guide with them!