How to write a business plan for a sugar manufacturer?

Writing a business plan for a sugar manufacturer can be an intimidating task, especially for those just starting.

This in-depth guide is designed to help entrepreneurs like you understand how to create a comprehensive business plan so that you can approach the exercise with method and confidence.

We'll cover: why writing a sugar manufacturer business plan is so important - both when starting up, and when running and growing the business - what information you need to include in your plan, how it should be structured, and what tools you can use to get the job done efficiently.

Let's get started!

Why write a business plan for a sugar manufacturer?

Understanding the document's scope and goals will help you easily grasp its structure and content. Before diving into the specifics of the plan, let's take a moment to explore the key reasons why having a sugar manufacturer business plan is so crucial.

To have a clear roadmap to grow the business

It's rarely business as usual for small businesses. The economy follows cycles where years of growth are followed by recessions, and the business environment is always changing with new technologies, new regulations, new competitors, and new consumer behaviours appearing all the time...

In this context, running a business without a clear roadmap is like driving blindfolded: it's dangerous at best. That's why writing a business plan for a sugar manufacturer is essential to create successful and sustainable businesses.

To write an effective business plan, you will need to take stock of where you are (if you are already in business) and where you want the business to go in the next three to five years.

Once you know where you want your sugar manufacturer to be, you'll have to identify:

- what resources (human, equipment, and capital) are needed to get there,

- at what pace the business needs to progress to get there in time,

- and what risks you'll face along the way.

Going through this process regularly is beneficial, both for startups and existing companies, as it helps make informed decisions about how best to allocate resources to ensure the long-term success of the business.

To maintain visibility on future cash flows

Businesses can go for years without making a profit, but they go bust as soon as they run out of cash. That's why "cash is king", and maintaining visibility on your sugar manufacturer's future cash flows is critical.

How do I do that? That's simple: you need an up-to-date financial forecast.

The good news is that your sugar manufacturer business plan already contains a financial forecast (more on that later in this guide), so all you have to do is to keep it up-to-date.

To do this, you need to regularly compare the actual financial performance of your business to what was planned in your financial forecast, and adjust the forecast based on the current trajectory of your business.

Monitoring your sugar manufacturer's financial health will enable you to identify potential financial problems (such as an unexpected cash shortfall) early and to put in place corrective measures. It will also allow you to detect and capitalize on potential growth opportunities (higher demand from a given segment of customers for example).

To secure financing

Crafting a comprehensive business plan for your sugar manufacturer, whether you're starting up or already established, is paramount when you're seeking financing from banks or investors.

Given how fragile small businesses are, financiers will want to ensure that you have a clear roadmap in place as well as command and control of your future cash flows before entertaining the idea of funding you.

For banks, the information in your business plan will be used to assess your borrowing capacity - which is defined as the maximum amount of debt your business can afford alongside your ability to repay the loan. This evaluation helps them decide whether to extend credit to your business and under what terms (interest rate, duration, repayment options, collateral, etc.).

Similarly, investors will thoroughly review your plan to determine if their investment can yield an attractive return. They'll be looking for evidence that your sugar manufacturer has the potential for healthy growth, profitability, and consistent cash flow generation over time.

Now that you understand the importance of creating a business plan for your sugar manufacturer, let's delve into the necessary information needed to craft an effective plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Information needed to create a business plan for a sugar manufacturer

Drafting a sugar manufacturer business plan requires research so that you can project sales, investments and cost accurately in your financial forecast, and convince the reader that there is a viable commercial opportunity to be seized.

Below, we'll focus on three critical pieces of information you should gather before starting to write your plan.

Carrying out market research for a sugar manufacturer

Carrying out market research before writing a business plan for a sugar manufacturer is essential to ensure that the financial projections are accurate and realistic.

Market research helps you gain insight into your target customer base, competitors, pricing strategies and other key factors which can have an impact on the commercial success of your business.

In particular, it is useful in forecasting revenue as it provides valuable data regarding potential customers’ spending habits and preferences.

Your sugar manufacturer might discover that consumers increasingly prefer organic ingredients, and that they may be willing to pay a premium for products with natural sweeteners. Additionally, market research could reveal that consumers may be looking for sugar products that contain fewer calories, as health consciousness continues to grow.

This information can then be used to create more accurate financial projections which will help investors make informed decisions about investing in your sugar manufacturer.

Developing the sales and marketing plan for a sugar manufacturer

Budgeting sales and marketing expenses is essential before creating a sugar manufacturer business plan.

A comprehensive sales and marketing plan should provide an accurate projection of what actions need to be implemented to acquire and retain customers, how many people are needed to carry out these initiatives, and how much needs to be spent on promotions, advertising, and other aspects.

This helps ensure that the right amount of resources is allocated to these activities in order to hit the sales and growth objectives forecasted in your business plan.

The staffing and capital expenditure requirements of a sugar manufacturer

Whether you are starting or expanding a sugar manufacturer, it is important to have a clear plan for recruitment and capital expenditures (investment in equipment and real estate) in order to ensure the success of the business.

Both the recruitment and investment plans need to be coherent with the timing and level of growth planned in your forecast, and require appropriate funding.

Staffing costs the sugar manufacturer might incur include wages for employees, payroll taxes, and employee benefits such as health insurance. Equipment costs might include items such as conveyor belts, sugar processing machines, and other machinery used to produce the sugar. Additionally, the manufacturer might have to pay for the maintenance and repair of the equipment.

In order to create a realistic financial forecast, you will also need to consider the other operating expenses associated with running the business on a day-to-day basis (insurance, bookkeeping, etc.).

Once you have all the necessary information to create a business plan for your sugar manufacturer, it is time to start creating your financial forecast.

What goes into your sugar manufacturer's financial forecast?

The financial forecast of your sugar manufacturer will enable you to assess the profitability potential of your business in the coming years and how much capital is required to fund the actions planned in the business plan.

The four key outputs of a financial forecast for a sugar manufacturer are:

- The profit and loss (P&L) statement,

- The projected balance sheet,

- The cash flow forecast,

- And the sources and uses table.

Let's take a closer look at each of these.

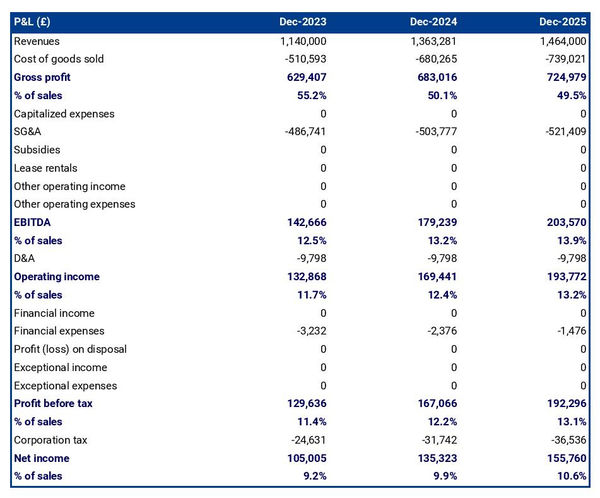

The projected P&L statement

The projected P&L statement for a sugar manufacturer shows how much revenue and profits your business is expected to generate in the future.

Ideally, your sugar manufacturer's P&L statement should show:

- Healthy growth - above inflation level

- Improving or stable profit margins

- Positive net profit

Expectations will vary based on the stage of your business. A startup will be expected to grow faster than an established sugar manufacturer. And similarly, an established company should showcase a higher level of profitability than a new venture.

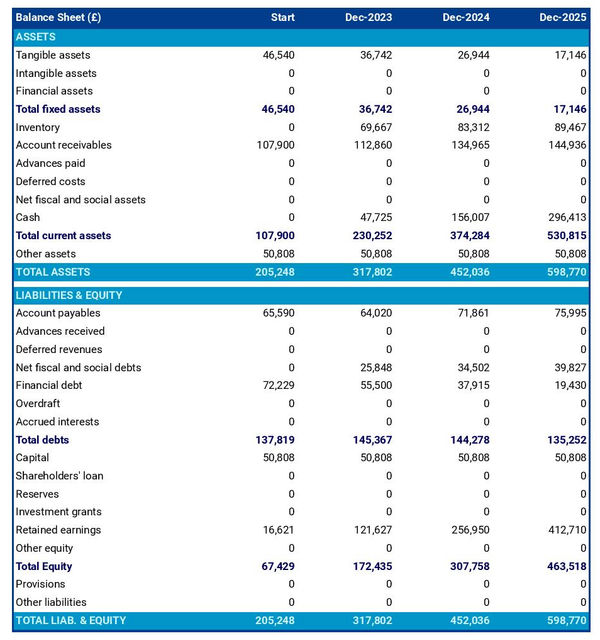

The projected balance sheet of your sugar manufacturer

The balance sheet for a sugar manufacturer is a financial document that provides a snapshot of your business’s financial health at a given point in time.

It shows three main components: assets, liabilities and equity:

- Assets: are resources owned by the business, such as cash, equipment, and accounts receivable (money owed by clients).

- Liabilities: are debts owed to creditors and other entities, such as accounts payable (money owed to suppliers) and loans.

- Equity: includes the sums invested by the shareholders or business owners and the cumulative profits and losses of the business to date (called retained earnings). It is a proxy for the value of the owner's stake in the business.

Examining the balance sheet is important for lenders, investors, or other stakeholders who are interested in assessing your sugar manufacturer's liquidity and solvency:

- Liquidity: assesses whether or not your business has sufficient cash and short-term assets to honour its liabilities due over the next 12 months. It is a short-term focus.

- Solvency: assesses whether or not your business has the capacity to repay its debt over the medium-term.

Looking at the balance sheet can also provide insights into your sugar manufacturer's investment and financing policies.

In particular, stakeholders can compare the value of equity to the value of the outstanding financial debt to assess how the business is funded and what level of financial risk has been taken by the owners (financial debt is riskier because it has to be repaid, while equity doesn't need to be repaid).

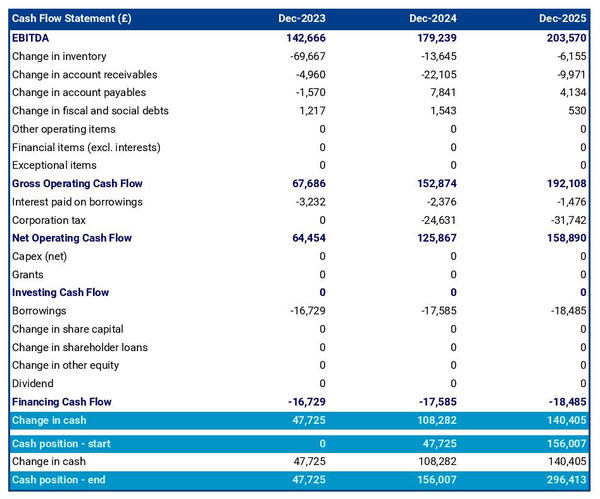

The cash flow forecast

As we've seen earlier in this guide, monitoring future cash flows is the key to success and the only way of ensuring that your sugar manufacturer has enough cash to operate.

As you can expect showing future cash flows is the main role of the cash flow forecast in your sugar manufacturer business plan.

It is best practice to organise the cash flow statement by nature in order to show the cash impact of the following areas:

- Cash flow generated from operations: the operating cash flow shows how much cash is generated or consumed by the business's commercial activities

- Cash flow from investing activities: the investing cash flow shows how much cash is being invested in capital expenditure (equipment, real estate, etc.) either to maintain the business's equipment or to expand its capabilities

- Cash flow from financing activities: the financing cash flow shows how much cash is raised or distributed to financiers

Looking at the cash flow forecast helps you to make sure that your business has enough cash to keep running, and can help you anticipate potential cash shortfalls.

Your sugar manufacturer business plan will normally include both yearly and monthly cash flow forecasts so that the readers can view the impact of seasonality on your business cash position and generation.

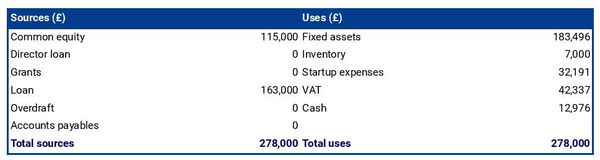

The initial financing plan

The initial financing plan, also known as a sources and uses table, is a valuable resource to have in your business plan when starting your sugar manufacturer as it reveals the origins of the money needed to establish the business (sources) and how it will be allocated (uses).

Having this table helps show what costs are involved in setting up your sugar manufacturer, how risks are shared between founders, investors and lenders, and what the starting cash position will be. This cash position needs to be sufficient to sustain operations until the business reaches a break-even point.

Now that you have a clear understanding of what goes into the financial forecast of your sugar manufacturer business plan, let's shift our focus to the written part of the plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The written part of a sugar manufacturer business plan

The written part of a sugar manufacturer business plan is composed of 7 main sections:

- The executive summary

- The presentation of the company

- The products and services

- The market analysis

- The strategy

- The operations

- The financial plan

Throughout these sections, you will seek to provide the reader with the details and context needed for them to form a view on whether or not your business plan is achievable and your forecast a realistic possibility.

Let's go through the content of each section in more detail!

1. The executive summary

The executive summary, the first section of your sugar manufacturer's business plan, serves as an inviting snapshot of your entire plan, leaving readers eager to know more about your business.

To compose an effective executive summary, start with a concise introduction of your business, covering its name, concept, location, history, and unique aspects. Share insights about the services or products you intend to offer and your target customer base.

Subsequently, provide an overview of your sugar manufacturer's addressable market, highlighting current trends and potential growth opportunities.

Then, present a summary of critical financial figures, such as projected revenues, profits, and cash flows.

You should then include a summary of your key financial figures such as projected revenues, profits, and cash flows.

Lastly, address any funding needs in the "ask" section of your executive summary.

2. The presentation of the company

As you build your sugar manufacturer business plan, the second section deserves attention as it delves into the structure and ownership, location, and management team of your company.

In the structure and ownership part, you'll provide valuable insights into the legal structure of the business, the identities of the owners, and their respective investments and ownership stakes. This level of transparency is vital, particularly if you're seeking financing, as it clarifies which legal entity will receive the funds and who holds the reins of the business.

Moving to the location part, you'll offer a comprehensive view of the company's premises and articulate why this specific location is strategic for the business, emphasizing factors like catchment area, accessibility, and nearby amenities.

When describing the location of your sugar manufacturer, you could highlight its proximity to a major international airport, allowing for easy access to the global market. Additionally, the area may have access to important resources, such as water, rail, and road transportation, that could facilitate the manufacturing process. The region could also have a highly educated and skilled workforce, which could enable you to find the best talent for your business. Finally, the local government might offer incentives to businesses in the area, making it easier to operate and grow.

Lastly, you should introduce your esteemed management team. Provide a thorough explanation of each member's role, background, and extensive experience.

It's equally important to highlight any past successes the management team has achieved and underscore the duration they've been working together. This information will instil trust in potential lenders or investors, showcasing the strength and expertise of your leadership team and their ability to deliver the business plan.

3. The products and services section

The products and services section of your business plan should include a detailed description of the offerings that your company provides to its customers.

For example, your sugar manufacturer might offer a variety of white and brown sugars, sugary syrups, and flavored sugars to meet customers' needs. Additionally, it could offer tailored services such as custom packaging and labeling options, as well as recipe assistance and technical advice to ensure customers are getting the best possible product for their needs. Finally, it could offer specialized services such as organic certification and sugar-related research and development to support customers in their specific areas.

When drafting this section, you should be precise about the categories of products or services you sell, the types of customers you are targeting and how customers can buy them.

4. The market analysis

When outlining your market analysis in the sugar manufacturer business plan, it's essential to include comprehensive details about customers' demographics and segmentation, target market, competition, barriers to entry, and relevant regulations.

The primary aim of this section is to give the reader an understanding of the market size and appeal while demonstrating your expertise in the industry.

To begin, delve into the demographics and segmentation subsection, providing an overview of the addressable market for your sugar manufacturer, key marketplace trends, and introducing various customer segments and their preferences in terms of purchasing habits and budgets.

Next, shift your focus to the target market subsection, where you can zoom in on the specific customer segments your sugar manufacturer targets. Explain how your products and services are tailored to meet the unique needs of these customers.

For example, your target market might include people who bake for a living. This could include cake decorators, pastry chefs, or bakers who make treats to sell at a bakery or to order. Additionally, those who enjoy baking for fun at home would be a great customer segment to target. You could create special products and marketing campaigns to engage them.

In the competition subsection, introduce your main competitors and explain what sets your sugar manufacturer apart from them.

Finally, round off your market analysis by providing an overview of the main regulations that apply to your sugar manufacturer.

5. The strategy section

When writing the strategy section of a business plan for your sugar manufacturer, it is essential to include information about your competitive edge, pricing strategy, sales & marketing plan, milestones, and risks and mitigants.

The competitive edge subsection should explain what sets your company apart from its competitors. This part is especially key if you are writing the business plan of a startup, as you have to make a name for yourself in the marketplace against established players.

The pricing strategy subsection should demonstrate how you intend to remain profitable while still offering competitive prices to your customers.

The sales & marketing plan should outline how you intend to reach out and acquire new customers, as well as retain existing ones with loyalty programs or special offers.

The milestones subsection should outline what your company has achieved to date, and its main objectives for the years to come - along with dates so that everyone involved has clear expectations of when progress can be expected.

The risks and mitigants subsection should list the main risks that jeopardize the execution of your plan and explain what measures you have taken to minimize these. This is essential in order for investors or lenders to feel secure in investing in your venture.

Your sugar manufacturer may face two major risks: supply chain disruptions and price fluctuations. Supply chain disruptions could occur if any of the suppliers of raw materials, such as sugar cane, experience a disruption in their production processes. This could lead to a shortage of raw materials, which could ultimately affect your manufacturer's ability to produce sugar. Additionally, your manufacturer may also face price fluctuations due to external factors such as weather conditions and market demand. This could lead to increased costs of raw materials or decreased profit margins, both of which could affect your manufacturer's bottom line.

6. The operations section

The operations of your sugar manufacturer must be presented in detail in your business plan.

The first thing you should cover in this section is your staffing team, the main roles, and the overall recruitment plan to support the growth expected in your business plan. You should also outline the qualifications and experience necessary to fulfil each role, and how you intend to recruit (using job boards, referrals, or headhunters).

You should then state the operating hours of your sugar manufacturer - so that the reader can check the adequacy of your staffing levels - and any plans for varying opening times during peak season. Additionally, the plan should include details on how you will handle customer queries outside of normal operating hours.

The next part of this section should focus on the key assets and IP required to operate your business. If you depend on any licenses or trademarks, physical structures (equipment or property) or lease agreements, these should all go in there.

You may have key assets such as the recipes for the products you manufacture, and the machinery you use to produce them. These could be key IP (intellectual property) that you might want to protect. Additionally, you could have trademarks and logos associated with your sugar products that could be very valuable to your business.

Finally, you should include a list of suppliers that you plan to work with and a breakdown of their services and main commercial terms (price, payment terms, contract duration, etc.). Investors are always keen to know if there is a particular reason why you have chosen to work with a specific supplier (higher-quality products or past relationships for example).

7. The presentation of the financial plan

The financial plan section is where we will include the financial forecast we talked about earlier in this guide.

Now that you have a clear idea of the content of a sugar manufacturer business plan, let's look at some of the tools you can use to create yours.

What tool should I use to write my sugar manufacturer's business plan?

There are two main ways of creating your sugar manufacturer business plan:

- Using specialized business planning software,

- Hiring a business plan writer.

Using an online business plan software for your sugar manufacturer's business plan

Using online business planning software is the most efficient and modern way to create a sugar manufacturer business plan.

There are several advantages to using specialized software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can access a library of dozens of complete business plan samples and templates for inspiration

- You get a professional business plan, formatted and ready to be sent to your bank or investors

- You can easily track your actual financial performance against your financial forecast

- You can create scenarios to stress test your forecast's main assumptions

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you're interested in using this type of solution, you can try The Business Plan Shop for free by signing up here.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Hiring a business plan writer to write your sugar manufacturer's business plan

Outsourcing your sugar manufacturer business plan to a business plan writer can also be a viable option.

Business plan writers are skilled in creating error-free business plans and accurate financial forecasts. Moreover, hiring a consultant can save you valuable time, allowing you to focus on day-to-day business operations.

However, it's essential to be aware that hiring business plan writers will be expensive, as you're not only paying for their time but also the software they use and their profit margin.

Based on experience, you should budget at least £1.5k ($2.0k) excluding tax for a comprehensive business plan, and more if you require changes after initial discussions with lenders or investors.

Also, exercise caution when seeking investment. Investors prefer their funds to be directed towards business growth rather than spent on consulting fees. Therefore, the amount you spend on business plan writing services and other consulting services should be insignificant compared to the amount raised.

Keep in mind that one drawback is that you usually don't own the business plan itself; you only receive the output, while the actual document is saved in the consultant's business planning software. This can make it challenging to update the document without retaining the consultant's services.

For these reasons, carefully consider outsourcing your sugar manufacturer business plan to a business plan writer, weighing the advantages and disadvantages of seeking outside assistance.

Why not create your sugar manufacturer's business plan using Word or Excel?

Using Microsoft Excel and Word (or their Google, Apple, or open-source equivalents) to write a sugar manufacturer business plan is a terrible idea.

Why?

For starters, creating an accurate and error-free financial forecast on Excel (or any spreadsheet) is very technical and requires both a strong grasp of accounting principles and solid skills in financial modelling.

As a result, it is unlikely anyone will trust your numbers unless - like us at The Business Plan Shop - you hold a degree in finance and accounting and have significant financial modelling experience in your past.

The second reason is that it is inefficient. Building forecasts on spreadsheets was the only option in the 1990s and early 2000s, nowadays technology has advanced and software can do it much faster and much more accurately.

And with the rise of AI, software is also becoming smarter at helping us detect mistakes in our forecasts and helping us analyse the numbers to make better decisions.

Also, using software makes it easy to compare actuals vs. forecasts and maintain our forecasts up to date to maintain visibility on future cash flows - as we discussed earlier in this guide - whereas this is a pain to do with a spreadsheet.

That's for the forecast, but what about the written part of my sugar manufacturer business plan?

This part is less error-prone, but here also software brings tremendous gains in productivity:

- Word processors don't include instructions and examples for each part of your business plan

- Word processors don't update your numbers automatically when they change in your forecast

- Word processors don't handle the formatting for you

- ...

Overall, while Word or Excel may be viable options for creating a sugar manufacturer business plan for some entrepreneurs, it is by far not the best or most efficient solution.

Takeaways

- Using business plan software is a modern and cost-effective way of writing and maintaining business plans.

- A business plan is not a one-shot exercise as maintaining it current is the only way to keep visibility on your future cash flows.

- A business plan has 2 main parts: a financial forecast outlining the funding requirements of your sugar manufacturer and the expected growth, profits and cash flows for the next 3 to 5 years; and a written part which gives the reader the information needed to decide if they believe the forecast is achievable.

We hope that this in-depth guide met your expectations and that you now have a clear understanding of how to write your sugar manufacturer business plan. Do not hesitate to contact our friendly team if you have questions additional questions we haven't addressed here.

Also on The Business Plan Shop

- How to write a business plan to secure a bank loan?

- Business plan tips

- Why do you need a business plan?

- Business plan vs business model

- Key steps to write a business plan?

- Top mistakes to avoid in your business plan

Do you know entrepreneurs interested in starting or growing a sugar manufacturer? Share this article with them!