How to write a business plan for a bank loan?

Whether you need a bank loan to start up a new business, grow an existing business or anything in between, writing a business plan can help make it a reality!

It involves outlining your goals and explaining how you plan to achieve them. A professional business plan is crucial to obtaining a bank loan and planning your outlook for both the short and long-term future.

Yet, most entrepreneurs view writing a business plan as a daunting task. But, it doesn't have to be!

In this guide, we explain what writing a business plan for a bank loan entails, why you need one, what tool you should use, and what content should be included.

Ready? Let's get started!

What is a business plan?

A business plan is a written document that contains two key parts:

- A written presentation that outlines what the company does, its medium term objectives and explains how it plans to achieve them.

- A financial plan that includes a cash flow statement, profit and loss statement and a balance sheet.

Do I need a business plan to secure a business loan?

To get a business loan approved you need to convince the lender that your business will be able to repay it.

Regulated lenders also have legal obligations to demonstrate to their regulators that they are lending responsibly, meaning that your business can afford the loan.

Therefore, whilst a business plan is not strictly necessary to obtain a business loan, most banks will likely ask you to provide one, as it provides an objective way of assessing your borrowing capacity and to demonstrate affordability.

Imagine the following situation, a business borrows £100k from a regulated bank, and then goes bust. The regulator decides to investigate the bank. The bank can then provide the business plan to help demonstrate that the loan was affordable and that it behaved responsibly.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Do banks actually look at business plans or is it just a box-ticking exercise?

Most banks will look at your business plan when you hand in a loan application. How in-depth the bank looks at it though will depend on whether you are borrowing against assets or cash flow.

Asset-based lending

Borrowing against assets involves lending money to businesses whilst using their assets as collateral. These loans are also called secured loans.

Secured loans help reduce risks for lenders, they can seize the collateral if the borrower is unable to repay and sell the asset to recoup part of their losses. That's what happens with mortgages, for example.

Banks usually have pre-set loan-to-value ratios (LTVs) for the most common types of assets (property, equipment, vehicles etc.).

A loan-to-value assessment simply compares the appraised value of your asset against the value of the business loan.

For example, if you're buying a car worth £10,000 and the LTV ratio used by the bank is 70%, they can lend you up to £7,000 and will take the car as collateral.

The bank still needs to assess that you can afford the £7,000 business loan. They might ask you for a business plan, but might decide not to do so given that it's a small amount. They might simply look at your trading history or ask for a personal guarantee from the business owner instead.

BDC Bank - a Canadian bank - says that "financial institutions don’t use the same loan-to-value ratio for all asset types because of different asset liquidity levels".

In layman's terms, liquidity means how easy it is to sell the asset. If it's a delivery van, it's very easy as there is an established secondhand market (high liquidity), if it's a chemical plant it might take up to a year (low liquidity).

In a nutshell, the easier it is to sell the asset (if it needs to be seized), the higher the loan amount.

According to BDC Bank, likely LTV ratios for common asset types are:

- Marketable securities (high in liquidity): 90%

- Accounts receivables: 75%

- Commercial and industrial real estate: 65% to 100%

- Inventory (low in liquidity): 50%.

Capital Source Group - an alternate lender - says that some banks require a down payment of up to 20% of the market value of the equipment, referring to firms seeking finance to purchase key equipment, and mentions an indicative baseline LTV ratio of 50%.

Cash-flow-based lending

As we've seen above, asset-based lending is relatively straightforward, and lower risk as the asset is used as collateral. The decision making is more complicated if your business borrows against cash flows (for e.g. working capital purposes).

Cash-flow-based borrowing involves lending money to businesses based on their predicted cash flows. The bank has to assess how much you can borrow based on historical and projected financials.

Doing so requires to have a clear understanding of the future cash flows of the business, which can only be obtained through a business plan.

What do banks look for in a business plan?

Most banks ask for business plans when you apply for a business loan because they need it to understand:

- Who the borrower is

- Whether or not there is collateral

- If there is a trading history that supports the cash flow forecast

- What borrowing capacity and affordability can be inferred from the forecast

Who the borrower is

Firstly, the bank has to understand what entity or person it is lending money to. For example, if you take over a business, you could buy either its assets or shares.

If you were to buy their assets, a new company would likely be created but if you were to purchase their shares, you could do it directly or via a holding company (likelier option).

Depending on which option you choose, the bank has to decide whether it's lending to your current business, yourself or the holding company. The answer to this question then determines the level of risk the bank is undertaking.

Whether or not there is collateral

Next, the bank has to decide whether or not there is sufficient collateral. Can it secure the loan against the business assets or does it need to request a personal warranty from the business owner(s)?

It will assess:

- Whether or not your current business has any assets that can be used as collateral

- If you, the business owner, have a house or cash in the bank or can offer a credible personal guarantee

- Whether or not the holding company will provide its shares as collateral or if it needs to ask its shareholders for a personal guarantee (or both)

Once the bank understands the value of the security, it can better estimate the borrowing capacity of the entity.

Does the trading history support the cash flow forecast

The bank will want to know if there is any trading history to support your cash flow forecast.

If there isn't, it becomes harder to judge and riskier from a lender's viewpoint.

Borrowing capacity and affordability: total indebtedness and credit metrics

Lastly, the bank will estimate your business credit score by taking into consideration: whether or not you have any outstanding debt, what your past repayments were like, and credit metrics such as fixed charge coverage ratio, net debt-to-equity ratio, and interest coverage ratio (we'll detail these 3 ratios later in this guide).

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

What tool should I use to write a business plan for a bank loan?

Writing a business plan can be both tedious and difficult if you start from scratch. Luckily for you, online business plan software can help you write a professional plan in no time.

There are several advantages to using specialised software like The Business Plan Shop:

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can be inspired by already written business plan templates

- You can easily make your financial forecast by letting the software take care of the financial calculations for you

- You get a professional document, formatted and ready to be sent to your bank

- You can easily compare your forecast against actuals from your accounting system to ensure you are on track to deliver your plan, and adjust your forecast to keep it up to date as time goes by

If you are interested in this type of solution, you can try our software for free by signing up to The Business Plan Shop today.

What does a business plan for a bank loan look like?

There are seven key sections that any business plan for a bank loan must include:

- Executive summary

- Company Overview

- Products and services

- Market analysis

- Strategy

- Operations

- Financial projections

Let's have a look at each one in more detail.

1. Executive summary

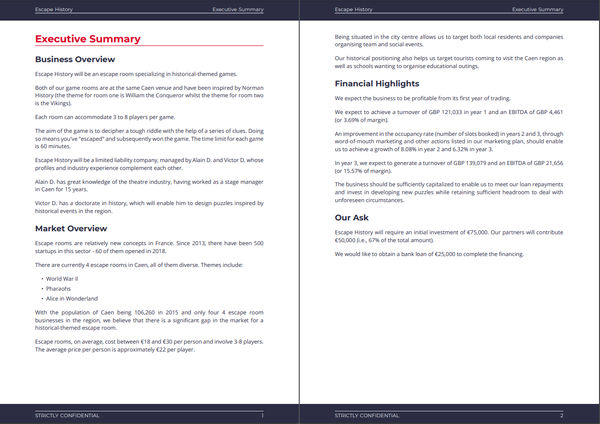

Your executive summary should provide the bank with a quick snapshot of your business (who you are, what you sell, and what your financial projections look like). Remember that this is the first section of your business plan that they will look at - you need to keep them interested and do not need to go into depth.

You should also include details such as the loan amount sought and its purpose, providing the bank with a clear understanding of how the funds will be utilized to support your business's growth and operations.

For example, if you're a small manufacturing company seeking a loan to purchase new equipment, your executive summary would outline the specific amount needed for equipment acquisition and how it will contribute to increasing production capacity and efficiency.

Above is an example of how the "Our Ask" section which details the funding requirements might look like. This image was taken from one of our business plan templates.

Additionally, the executive summary may highlight any collateral or security offered to mitigate the lender's risk.

This could include assets such as real estate, equipment, inventory, or accounts receivable that you're willing to pledge as security for the loan.

By clearly outlining the collateral available to secure the loan, you demonstrate your commitment to fulfilling your financial obligations and provide assurance to the bank regarding the loan's repayment.

Moreover, the executive summary may touch upon the key terms and conditions your business is willing to accept, such as interest rates, repayment schedules, and loan covenants, to ensure the loan aligns with your business's financial objectives and capabilities.

For instance, if you're a small retail store seeking a loan to open a second store, you may try to negotiate a loan repayment holiday to defer the principal repayments until after the second store has started trading in order to improve cash flow.

2. Company overview

In this section, you should explain what structure your business takes up (sole trader, partnership or limited liability company). This way, the bank understands whether or not you are liable if your business defaults on its loan. If you are not they might ask you for a personal guarantee.

If you are a partnership or limited liability company, state who your partners are and what percentage of the business they own. Also, outline any skills and experience they have that make them suitable for their role.

Finally, you should state where your business(es) are located and why that particular location was chosen (for example, it could be because of the parking slots available or transport links, making it very accessible for potential customers).

3. Products and services

You should include a detailed list of the products or services that you sell. Whilst you don't have to specify every single item or service, you should aim to include all of the key ones.

For example, for a hair salon, this might be hair care, washing, stylish haircuts, combing, hair colouring, waving, and hair straightening.

4. Market analysis

The market analysis section of your business plan for a bank loan is where you bring together your local and national market research. Using charts and graphs along with text makes it easier to illustrate your points clearly.

You should also state who you plan to target and the competitors in your local market. For example, if you were a coffee shop business, you could target people seeking a takeaway coffee, those looking for a lunch or snack or people looking for a place to work.

Finally, you should state the regulation in effect in the local market and whether there are any plans to make changes in the future (by the council for example).

5. Strategy

Your strategy section helps explain how you plan to make your business a success. Both marketing and pricing strategies feature in this section.

Explain how you've determined your prices and whether or not they differ from your competitors. Remember that this will depend on your overall pricing strategy (cost-plus pricing, competitive, price skimming, etc.).

Your marketing plan should explain how you plan to attract and retain customers. For example, you could have an attractive storefront with your logo to encourage potential customers to visit inside. You might also offer loyalty cards (for example, buy 3 burgers, get the fourth one free).

Finally, key milestones must also be outlined so that both parties are aware of what needs to be achieved within an agreed-upon timeframe along with measures taken against any foreseeable risks and mitigants related thereto.

6. Operations

The operations section of your business plan for a bank loan should include information about your staffing team. List any current and future recruitment plans, employee skills, experience and what roles they are going to take up.

Plus, you should state what suppliers you chose and why. For example, you might have chosen a particular supplier thanks to their eco-friendly stance or brand reputation.

7. Financial projections

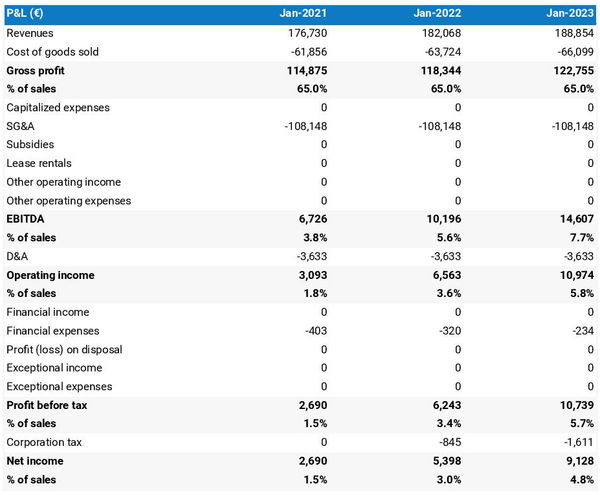

Arguably the most important section in your business plan for a bank, your financial projections help the bank decide whether or not they should lend to your company.

This section includes your balance sheet, profit and loss statement and cash flow forecast. Figures from these three statements are used to compute key ratios (see the section below).

Profit and loss statement

A projected P&L statement shows how much money the company might make and how much it will grow in the future.

It helps stakeholders understand how successful the company could be.

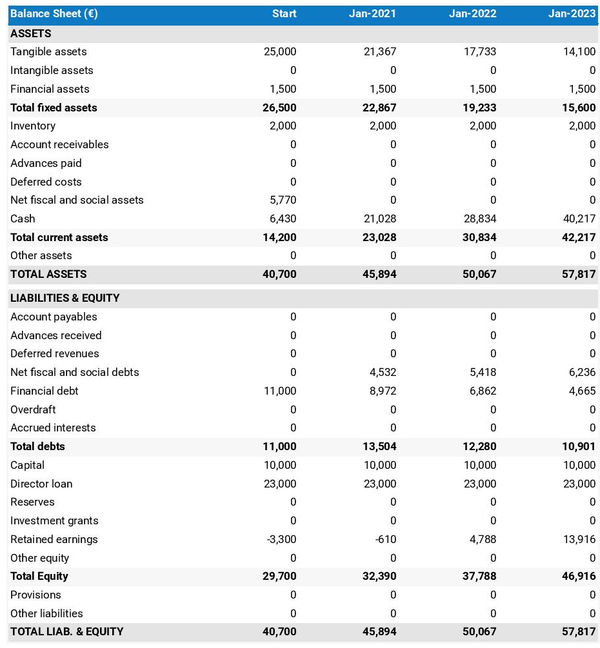

Balance sheet

A balance sheet shows what your business owns (assets), what it owes (liabilities), and what has been invested by the owners (equity).

Looking at a balance sheet enables investors, lenders, and business owners to assess the capital structure of the business.

One key aspect of this analysis is achieved by calculating key liquidity (short-term) and solvability (long-term) ratios to understand if the company can pay its debts as they fall due.

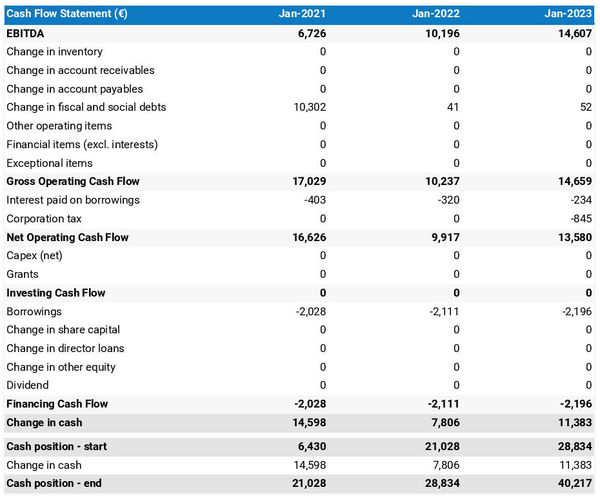

Cash flow statement

A projected cash flow statement is a document used to plan out how much cash your business will generate (inflows) and spend over a certain period (outflows).

This document shows the expected cash flows from the operations, investments and other financial activities.

Having this information can help you decide how much money your business needs to save for future expenses or investments, as well as anticipate potential cash shortfalls.

Do I need a 3 or 5 year business plan for a bank?

When seeking a bank loan, one common question that arises is the duration of the business plan required.

Understanding whether you need a 3-year plan or a more detailed 5-year money lending business plan can impact your credit application process.

For startups, and most small businesses, a 3-year business plan strikes the right balance between providing a clear vision of the future and not overwhelming with excessive detail.

This shorter timeframe is also often preferred by banks as it allows for a focused projection of your business's trajectory without straying too far into the unknown.

For these reasons, three-years is the de facto standard business plan duration for a loan application.

That being said, it might make sense for businesses to use a 5-year business plan in certain situations. For example when there are delayed cash flows because of a longer development or sales cycle or when the loan is used to fund significant capital investments.

Consider a manufacturing company investing in a new factory to increase production capacity. A 5-year plan would detail the initial investment and leave enough time to show the expected returns and the long-term impact on revenue, costs, and market position.

This longer-term view offers a more comprehensive picture of your business's growth potential and can demonstrate to the bank that you have a clear strategy for sustained success.

In summary, whether you opt for a 3 or 5-year business plan depends on the nature of your business, its growth trajectory, and the level of detail required to support your loan application.

How long does a business plan for a bank loan need to be?

Like most business plans, there's no specific number of pages that yours must have. A good rule of thumb, however, is to keep it between 15 and 35 pages.

As long as you've covered all of the key sections, ranging from the executive summary to the financial projections, your business plan for a bank loan should be good to go.

Remember, quality is more important than quantity.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Key financial metrics and ratios banks look at when deciding on a loan application

It's worth noting that ratio targets set by lenders are industry dependent.

There are usually three key financial ratios that banks calculate before lending money:

1. Fixed charged coverage ratio

This solvency ratio assesses how much headroom a business has over its upcoming debt repayments.

It is calculated by dividing the Cash flow available for debt service (or CFADS), which measures how much cash flow is available to pay off debt obligations, by the amount to be paid to service the debt (interest plus principal repayments).

It is one of the main ratios used by lenders to assess the borrowing capacity and the financial risk of a given business.

For businesses utilising bank debt, lenders usually expect the fixed charge coverage ratio to be above 2.0x, which implies that the business is expected to generate twice as much cash as is needed to service the debt, leaving a healthy buffer.

In any case, the ratio should be above 1.0x, below 1.0x the business is not generating enough cash to service its debt which puts lenders at risk.

For example, if your business records a CFADS of £500,000 and total debt service amounting to £250,000 (£50,000 of interest payments, and £200,000 of principal repayments), it will have a fixed charge coverage ratio of 2.0x.

2. Debt-to-EBITDA

This solvency ratio is used to assess the level of debt and borrowing capacity of the business. It compares the level of debt to the firm’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), used as a proxy for the operating cash flow.

For example, if your company has debt worth £20m and an EBITDA of £5M, your debt to EBITDA ratio would be £20m/£5m = 4.0x.

In simple terms, a company with a debt-to-EBITDA ratio of 4.0x would need at least 4 years to repay its debt. Whether or not this is too high will depend on the sector and the risk appetite of the lender.

3. Interest coverage ratio

This solvency ratio is commonly used by lenders to measure a business's ability to pay interest on its debt. It compares the firm’s EBITDA, used as a proxy for the operating cash flow, with the amount of interest expense due in a financial year.

Let's assume that you are writing a restaurant business plan for bank loan. Your business has an EBITDA of £500,000 and interest expenses amounting to £50,000, meaning it will have an interest coverage ratio of 10.0x.

The rationale behind this ratio is that, if the company was to default on its debt, lenders could potentially agree to delay the principal repayments as long as the company remains able to at least pay the interest. In that scenario, their capital would remain at risk but lenders would still be able to earn a return.

The higher the interest coverage ratio the better. Targets set by lenders are industry dependent. An interest coverage ratio higher than 4.0x is generally a good starting point.

Examples and templates of business plans for a bank loan

Most of the business plan templates offered by The Business Plan Shop are examples of companies seeking bank loans and so can be used to structure your own plan.

We have templates to fit various industries including hospitality, retail, services, construction, industrials and more.

PDF vs. PowerPoint pitch: what format should you use to present your business plan to the bank?

When preparing to present your business plan to a bank, one crucial decision is choosing the right format.

Should you go with a traditional PDF document or opt for a more dynamic PowerPoint pitch?

Using a PDF format is usually recommended to present a money-lending business plan. What matters to the bank is the content of your document, and the PDF format offers a comprehensive and structured way to present your business's details, financial projections, and strategies.

This format allows you to include detailed written explanations, charts, and graphs, providing a thorough overview of your business to the bank.

PDFs are particularly suitable for conveying complex information in a clear and organized manner, making it easier for bank officials to review and assess your loan application.

Does it mean that PowerPoint should be avoided at all costs?

Not necessarily, a PowerPoint pitch offers a visual and concise way to present the main takeaways from your business plan to the bank, and could therefore be used to complement your PDF document.

This format allows you to highlight key points, trends, and projections using engaging visuals, bullet points, and diagrams.

PowerPoint presentations could be effective for capturing the attention of bank officials during meetings or presentations, enabling you to convey your business's essence and potential compellingly.

In conclusion, a business plan in PDF is expected when presenting a business plan to the bank, but a PowerPoint can also be provided alongside.

Can I apply for multiple loans at the same time?

As a small business owner seeking financing, you may wonder if it's possible to cast a wider net by applying for multiple loans simultaneously.

While it may seem like a strategic approach to increase your chances of securing funding, there are important factors to consider before pursuing this avenue.

Impact on your credit score

The first factor you need to consider is the potential implications for your credit score, financial stability, and relationship with lenders.

Applying for multiple loans within a short timeframe can result in multiple hard inquiries on your credit report, which may lower your credit score and raise red flags for lenders.

What happens if your business loan request is denied?

The second factor you need to consider is what happens if your initial business loan requests are denied.

Despite your best efforts, there's always the possibility that your business plan for a bank loan may not be enticing enough.

If your business plan fails to meet the lender's requirements or to convince them, it could be worth revisiting and refining your business plan, addressing any weaknesses or gaps highlighted by the lender, before submitting another application to another bank.

For these reasons, it is usually more prudent to approach lenders one by one, to take on board their feedback and wait for a successful offer before playing the market to find the best offer.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Is it worth using a credit broker?

Navigating the loan application process can be daunting, especially when considering multiple lenders.

One option to streamline this process is to enlist the services of a credit broker.

However, it's essential to weigh the benefits and drawbacks of using a credit broker compared to applying to banks independently.

Let's delve into what a credit broker is and whether it's worth utilizing their services for your financing needs.

What is a credit broker?

A credit broker is a professional intermediary who assists individuals and businesses in finding suitable loan options from multiple lenders.

These brokers have extensive knowledge of the lending market and can help match borrowers with lenders that align with their financial needs and preferences.

Credit brokers typically charge a fee for their services, either upfront or upon successful loan approval.

For example, if you're a small business owner in the construction industry seeking financing for a new project.

Instead of approaching individual banks on your own, you'd engage a credit broker to help you navigate the lending landscape.

The broker evaluates your business's financial situation, objectives, and borrowing requirements, then identifies and presents you with tailored loan options from various lenders, saving you time and effort in the process.

Benefits and drawbacks of using a credit broker vs applying to banks independently

Using a credit broker offers several potential benefits, such as access to a wider network of lenders, personalized loan recommendations, and assistance throughout the application process.

Brokers can also negotiate on behalf of borrowers to secure favorable loan terms and conditions.

However, it's essential to consider the drawbacks as well, including the cost of using a broker, the potential for conflicts of interest, and the risk of relying solely on the broker's advice without conducting independent research.

For example, if you were a small business owner in construction, using a credit broker may provide access to specialized lenders familiar with the construction industry's unique financing needs.

The broker can negotiate competitive interest rates and favorable repayment terms, ultimately saving the business owner money and time.

But, you must carefully weigh the broker's fee against the potential savings and ensure transparency in the broker's recommendations to make an informed decision.

In summary, whether it's worth using a credit broker to apply to multiple lenders depends on your specific financial situation, borrowing needs, and preferences.

While brokers offer valuable expertise and assistance, it's essential to evaluate the costs and benefits carefully and consider alternative approaches before making a decision.

How long does the loan approval process usually take?

Understanding the timeline for the loan approval process is crucial for effectively managing your business's financial needs and expectations.

While the duration can vary depending on various factors, having a general understanding of the typical timeline can help you plan accordingly and avoid unnecessary delays.

Let's explore what factors may influence the timeline for the loan approval process.

The loan approval process typically involves several stages, including application submission, review and assessment by the lender, underwriting, and final approval.

The duration of each stage can vary depending on factors such as the complexity of the loan application, the lender's internal processes, and external factors such as market conditions or regulatory requirements.

While some loans may be approved relatively quickly, others may require more time for thorough evaluation and due diligence.

For example, suppose you're a small business owner in the manufacturing sector seeking a term loan to expand your production facility.

After submitting your loan application to a bank, the initial review and assessment may take anywhere from a few days to several weeks, depending on the lender's workload and responsiveness.

Once the application passes the initial review stage, it undergoes underwriting, where the lender evaluates your business's creditworthiness, financial stability, and repayment ability.

This stage can also vary in duration, ranging from a few days to several weeks, depending on the complexity of the loan and the thoroughness of the underwriting process.

Banks know how long their processes usually take so they will be able to give you a clear timeline when you apply. They also appreciate that you may take your business elsewhere if they are too slow to respond, so they usually try to be as fast as possible to be competitive.

On your side, you can speed up the timeline by making sure you have all the documents ready beforehand (including the various documents needed to clear anti-money-laundering checks), and by staying proactive and engaged throughout the process and working closely with your lender.

Key takeaways

Now that we've covered various aspects of crafting a business plan for bank financing, let's summarize the key points to remember:.

- A business plan is mandatory in order to secure a bank loan.

- Use a business plan software (such as The Business Plan Shop) to ensure you write a professional business plan with all the information that banks expect to see.

- Choose a 3-year plan presented in PDF, unless advised otherwise by the bank.

- Take time to understand the loan application process before submitting your application.

- Be prepared for the possibility of your initial loan request being denied, and know how to address and improve your business plan if it fails to secure funding the first time.

- Remember that banks look at credit metrics in different ways, a rejection by one lender doesn't mean you won't get approved by another.

- Consider using a credit broker to apply to multiple lenders if their services align with your financing goals.

We hope that this guide has helped you to better understand how to write a business plan for a bank loan. Do not hesitate to contact us if you still have questions.

Also on The Business Plan Shop

- How investors analyse business plans

- Business plan vs budget: what's the difference?

- Business plan for grant application

Know someone looking to take out a bank loan for their business? Share this article with them!