How to write a business plan for a gastroenterology practice?

Writing a business plan for a gastroenterology practice can be an intimidating task, especially for those just starting.

This in-depth guide is designed to help entrepreneurs like you understand how to create a comprehensive business plan so that you can approach the exercise with method and confidence.

We'll cover: why writing a gastroenterology practice business plan is so important - both when starting up, and when running and growing the business - what information you need to include in your plan, how it should be structured, and what tools you can use to get the job done efficiently.

Let's get started!

Why write a business plan for a gastroenterology practice?

Understanding the document's scope and goals will help you easily grasp its structure and content. Before diving into the specifics of the plan, let's take a moment to explore the key reasons why having a gastroenterology practice business plan is so crucial.

To have a clear roadmap to grow the business

Running a small business is tough! Economic cycles bring growth and recessions, while the business landscape is ever-changing with new technologies, regulations, competitors, and consumer behaviours emerging constantly.

In such a dynamic context, operating a business without a clear roadmap is akin to driving blindfolded: it's risky, to say the least. That's why crafting a business plan for your gastroenterology practice is vital to establish a successful and sustainable venture.

To create an effective business plan, you'll need to assess your current position (if you're already in business) and define where you want the business to be in the next three to five years.

Once you have a clear destination for your gastroenterology practice, you'll have to:

- Identify the necessary resources (human, equipment, and capital) needed to reach your goals,

- Determine the pace at which the business needs to progress to meet its objectives as scheduled,

- Recognize and address the potential risks you may encounter along the way.

Engaging in this process regularly proves advantageous for both startups and established companies. It empowers you to make informed decisions about resource allocation, ensuring the long-term success of your business.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

To get visibility on future cash flows

If your small gastroenterology practice runs out of cash: it's game over. That's why we often say "cash is king", and it's crucial to have a clear view of your gastroenterology practice's future cash flows.

So, how can you achieve this? It's simple - you need to have an up-to-date financial forecast.

The good news is that your gastroenterology practice business plan already includes a financial forecast (which we'll discuss further in this guide). Your task is to ensure it stays current.

To accomplish this, it's essential to regularly compare your actual financial performance with what was planned in your financial forecast. Based on your business's current trajectory, you can make adjustments to the forecast.

By diligently monitoring your gastroenterology practice's financial health, you'll be able to spot potential financial issues, like unexpected cash shortfalls, early on and take corrective actions. Moreover, this practice will enable you to recognize and capitalize on growth opportunities, such as excess cash flow enabling you to expand to new locations.

To secure financing

A detailed business plan becomes a crucial tool when seeking financing from banks or investors for your gastroenterology practice.

Investing and lending to small businesses are very risky activities given how fragile they are. Therefore, financiers have to take extra precautions before putting their capital at risk.

At a minimum, financiers will want to ensure that you have a clear roadmap and a solid understanding of your future cash flows (like we just explained above). But they will also want to ensure that your business plan fits the risk/reward profile they seek.

This will off-course vary from bank to bank and investor to investor, but as a rule of thumb. Banks will want to see a conservative financial management style (low risk), and they will use the information in your business plan to assess your borrowing capacity — the level of debt they think your business can comfortably handle — and your ability to repay the loan. This evaluation will determine whether they'll provide credit to your gastroenterology practice and the terms of the agreement.

Whereas investors will carefully analyze your business plan to gauge the potential return on their investment. Their focus lies on evidence indicating your gastroenterology practice's potential for high growth, profitability, and consistent cash flow generation over time.

Now that you recognize the importance of creating a business plan for your gastroenterology practice, let's explore what information is required to create a compelling plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Information needed to create a business plan for a gastroenterology practice

You need the right data in order to project sales, investments and costs accurately in the financial forecast of your gastroenterology practice business plan.

Below, we'll cover three key pieces of information you should gather before drafting your business plan.

Carrying out market research for a gastroenterology practice

Before you begin writing your business plan for a gastroenterology practice, conducting market research is a critical step in ensuring precise and realistic financial projections.

Market research grants you valuable insights into your target customer base, competitors, pricing strategies, and other crucial factors that can impact the success of your business.

In the course of this research, you may stumble upon trends that could impact your gastroenterology practice.

1. Your gastroenterology practice may see an increase in the demand for minimally invasive treatments as people become more aware of the benefits of these procedures. 2. Your practice might also see an increase in demand for preventative treatments, as people become more interested in maintaining their health and avoiding serious conditions.

Such market trends play a pivotal role in revenue forecasting, as they provide essential data regarding potential customers' spending habits and preferences.

By integrating these findings into your financial projections, you can provide investors with more accurate information, enabling them to make well-informed decisions about investing in your gastroenterology practice.

Developing the sales and marketing plan for a gastroenterology practice

As you embark on creating your gastroenterology practice business plan, it is crucial to budget sales and marketing expenses beforehand.

A well-defined sales and marketing plan should include precise projections of the actions required to acquire and retain customers. It will also outline the necessary workforce to execute these initiatives and the budget required for promotions, advertising, and other marketing efforts.

This approach ensures that the appropriate amount of resources is allocated to these activities, aligning with the sales and growth objectives outlined in your business plan.

The staffing and equipment needs of a gastroenterology practice

Whether you are at the beginning stages of your gastroenterology practice or expanding its horizons, having a clear plan for recruitment and capital expenditures (investment in equipment and real estate) is vital to ensure your business's success.

To achieve this, both the recruitment and investment plans must align coherently with the projected timing and level of growth in your forecast. It is essential to secure appropriate funding for these plans.

A gastroenterology practice might incur costs for staffing, such as hiring a registered nurse and medical assistant to assist with patient care, as well as a receptionist to greet patients and handle administrative tasks. Additionally, the practice would need to invest in equipment such as endoscopy machines, infusion pumps, and other medical supplies.

To create a financial forecast that accurately represents your business's outlook, remember to factor in other day-to-day operating expenses.

Now that you have all the necessary information, it's time to dive in and start creating your business plan and developing the financial forecast for your gastroenterology practice.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

What goes into your gastroenterology practice's financial forecast?

The financial forecast of your gastroenterology practice's business plan will enable you to assess the growth, profitability, funding requirements, and cash generation potential of your business in the coming years.

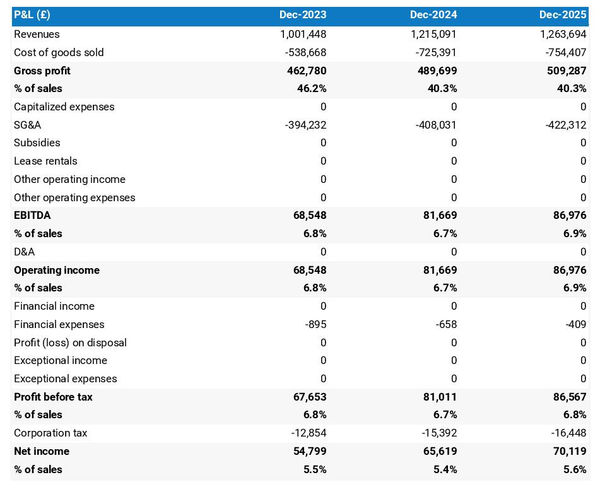

The four key outputs of a financial forecast for a gastroenterology practice are:

- The profit and loss (P&L) statement,

- The projected balance sheet,

- The cash flow forecast,

- And the sources and uses table.

Let's look at each of these in a bit more detail.

The projected P&L statement

Your gastroenterology practice forecasted P&L statement enables the reader of your business plan to get an idea of how much revenue and profits your business is expected to make in the near future.

Ideally, your reader will want to see:

- Growth above the inflation level

- Expanding profit margins

- Positive net profit throughout the plan

Expectations for an established gastroenterology practice will of course be different than for a startup. Existing businesses which have reached their cruising altitude might have slower growth and higher margins than ventures just being started.

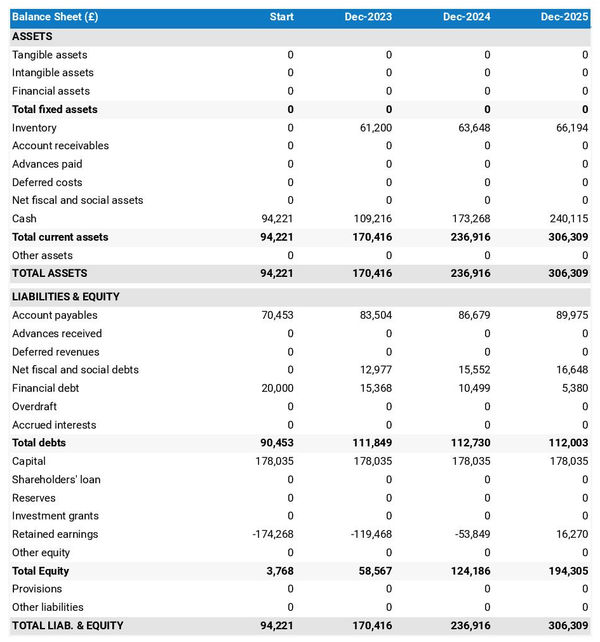

The projected balance sheet of your gastroenterology practice

The balance sheet for a gastroenterology practice is a financial document that provides a snapshot of your business’s financial health at a given point in time.

It shows three main components: assets, liabilities and equity:

- Assets: are resources owned by the business, such as cash, equipment, and accounts receivable (money owed by clients).

- Liabilities: are debts owed to creditors and other entities, such as accounts payable (money owed to suppliers) and loans.

- Equity: includes the sums invested by the shareholders or business owners and the cumulative profits and losses of the business to date (called retained earnings). It is a proxy for the value of the owner's stake in the business.

Examining the balance sheet is important for lenders, investors, or other stakeholders who are interested in assessing your gastroenterology practice's liquidity and solvency:

- Liquidity: assesses whether or not your business has sufficient cash and short-term assets to honour its liabilities due over the next 12 months. It is a short-term focus.

- Solvency: assesses whether or not your business has the capacity to repay its debt over the medium-term.

Looking at the balance sheet can also provide insights into your gastroenterology practice's investment and financing policies.

In particular, stakeholders can compare the value of equity to the value of the outstanding financial debt to assess how the business is funded and what level of financial risk has been taken by the owners (financial debt is riskier because it has to be repaid, while equity doesn't need to be repaid).

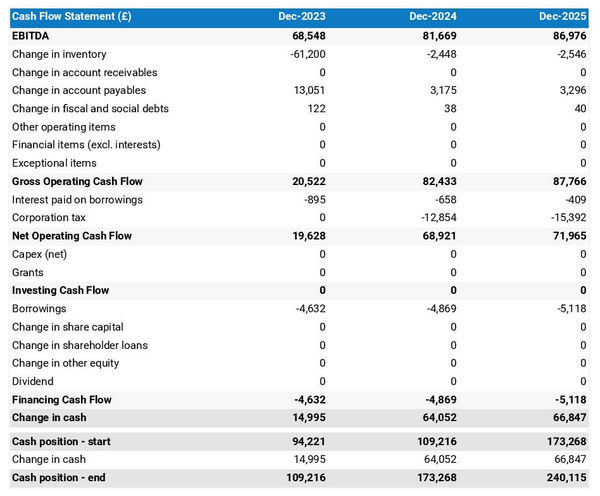

The cash flow forecast

A projected cash flow statement for a gastroenterology practice is used to show how much cash the business is generating or consuming.

The cash flow forecast is usually organized by nature to show three key metrics:

- The operating cash flow: do the core business activities generate or consume cash?

- The investing cash flow: how much is the business investing in long-term assets (this is usually compared to the level of fixed assets on the balance sheet to assess whether the business is regularly maintaining and renewing its equipment)?

- The financing cash flow: is the business raising new financing or repaying financiers (debt repayment, dividends)?

As we discussed earlier, cash is king and keeping an eye on future cash flows an imperative for running a successful business. Therefore, you can expect the reader of your gastroenterology practice business plan to pay close attention to your cash flow forecast.

Also, note that it is customary to provide both yearly and monthly cash flow forecasts in a business plan - so that the reader can analyze seasonal variation and ensure the gastroenterology practice is appropriately funded.

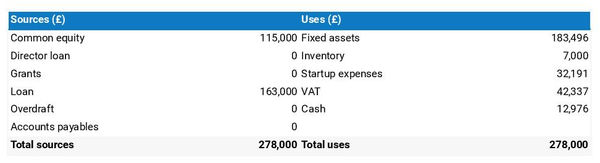

The initial financing plan

The initial financing plan - also called a sources and uses table - is an important tool when starting a gastroenterology practice.

It shows where the money needed to set up the business will come from (sources) and how it will be allocated (uses).

Having this table helps understand what costs are involved in setting up the gastroenterology practice, how the risks are distributed between the shareholders and the lenders, and what will be the starting cash position (which needs to be sufficient to sustain operations until the business breaks even).

Now that the financial forecast of a gastroenterology practice business plan is understood, let's focus on what goes into the written part of the plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The written part of a gastroenterology practice business plan

The written part of a gastroenterology practice business plan is composed of 7 main sections:

- The executive summary

- The presentation of the company

- The products and services

- The market analysis

- The strategy

- The operations

- The financial plan

Throughout these sections, you will seek to provide the reader with the details and context needed for them to form a view on whether or not your business plan is achievable and your forecast a realistic possibility.

Let's go through the content of each section in more detail!

1. The executive summary

The first section of your gastroenterology practice's business plan is the executive summary which provides, as its name suggests, an enticing summary of your plan which should hook the reader and make them want to know more about your business.

When writing the executive summary, it is important to provide an overview of the business, the market, the key financials, and what you are asking from the reader.

Start with a brief introduction of the business, its name, concept, location, how long it has been in operation, and what makes it unique. Mention any services or products you plan to offer and who you sell to.

Then you should follow with an overview of the addressable market for your gastroenterology practice, current trends, and potential growth opportunities.

You should then include a summary of your key financial figures such as projected revenues, profits, and cash flows.

Finally, you should detail any funding requirements in the ask section.

2. The presentation of the company

In your gastroenterology practice business plan, the second section should focus on the structure and ownership, location, and management team of your company.

In the structure and ownership part, you'll provide an overview of the business's legal structure, details about the owners, and their respective investments and ownership shares. This clarity is crucial, especially if you're seeking financing, as it helps the reader understand which legal entity will receive the funds and who controls the business.

Moving on to the location part, you'll offer an overview of the company's premises and their surroundings. Explain why this particular location is of interest, highlighting factors like catchment area, accessibility, and nearby amenities.

When describing the location of your gastroenterology practice, you could emphasize its potential for growth. You might mention the area's potential for increased population density, accessibility to public transportation, and the presence of other medical and health-related facilities nearby. Additionally, you could point out the potential for local businesses to support the practice, such as restaurants and other healthcare providers. These qualities may appeal to potential investors due to their potential for increased revenue.

Finally, you should introduce your management team. Describe each member's role, background, and experience.

Don't forget to emphasize any past successes achieved by the management team and how long they've been working together. Demonstrating their track record and teamwork will help potential lenders or investors gain confidence in their leadership and ability to execute the business plan.

3. The products and services section

The products and services section of your business plan should include a detailed description of what your company offers, who are the target customers, and what distribution channels are part of your go-to-market.

For example, your gastroenterology practice could offer diagnostic services such as endoscopies and colonoscopies, as well as treatments for diseases such as irritable bowel syndrome and gastroesophageal reflux disease (GERD). Your practice could also offer nutritional counseling and lifestyle advice to help patients manage their digestive health. All of these services can help patients identify and address any issues they may be having with their digestive system and maintain their overall health and wellness.

4. The market analysis

When outlining your market analysis in the gastroenterology practice business plan, it's essential to include comprehensive details about customers' demographics and segmentation, target market, competition, barriers to entry, and relevant regulations.

The primary aim of this section is to give the reader an understanding of the market size and appeal while demonstrating your expertise in the industry.

To begin, delve into the demographics and segmentation subsection, providing an overview of the addressable market for your gastroenterology practice, key marketplace trends, and introducing various customer segments and their preferences in terms of purchasing habits and budgets.

Next, shift your focus to the target market subsection, where you can zoom in on the specific customer segments your gastroenterology practice targets. Explain how your products and services are tailored to meet the unique needs of these customers.

For example, your target market might include people with persistent digestive issues. These individuals may be suffering from symptoms such as abdominal pain, constipation, or diarrhea, and are looking for a long-term solution. Additionally, your target market may include individuals with a family history of digestive issues, who are looking for preventative care.

In the competition subsection, introduce your main competitors and explain what sets your gastroenterology practice apart from them.

Finally, round off your market analysis by providing an overview of the main regulations that apply to your gastroenterology practice.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

5. The strategy section

When writing the strategy section of a business plan for your gastroenterology practice, it is essential to include information about your competitive edge, pricing strategy, sales & marketing plan, milestones, and risks and mitigants.

The competitive edge subsection should explain what sets your company apart from its competitors. This part is especially key if you are writing the business plan of a startup, as you have to make a name for yourself in the marketplace against established players.

The pricing strategy subsection should demonstrate how you intend to remain profitable while still offering competitive prices to your customers.

The sales & marketing plan should outline how you intend to reach out and acquire new customers, as well as retain existing ones with loyalty programs or special offers.

The milestones subsection should outline what your company has achieved to date, and its main objectives for the years to come - along with dates so that everyone involved has clear expectations of when progress can be expected.

The risks and mitigants subsection should list the main risks that jeopardize the execution of your plan and explain what measures you have taken to minimize these. This is essential in order for investors or lenders to feel secure in investing in your venture.

Your gastroenterology practice may face the risk of potential lawsuits from patients or their families. For example, a patient may feel that they were misdiagnosed or their procedure was improperly performed. Furthermore, your practice may be vulnerable to data breaches. A malicious third party could gain access to sensitive patient data, leading to financial losses and reputation damage.

6. The operations section

In your business plan, it's also essential to provide a detailed overview of the operations of your gastroenterology practice.

Start by covering your team, highlighting key roles and your recruitment plan to support the expected growth. Outline the qualifications and experience required for each role and your intended recruitment methods, whether through job boards, referrals, or headhunters.

Next, clearly state your gastroenterology practice's operating hours, allowing the reader to assess staffing levels adequately. Additionally, mention any plans for varying opening times during peak seasons and how you'll handle customer queries outside normal operating hours.

Then, shift your focus to the key assets and intellectual property (IP) necessary for your business. If you rely on licenses, trademarks, physical structures like equipment or property, or lease agreements, make sure to include them in this section.

You may have valuable key assets and intellectual property as a gastroenterology practice. For example, you could have proprietary software and systems that track patient information or support billing and patient scheduling. You might also have valuable patents or trademarks associated with your practice's brand or specific treatments. Protecting your key assets and intellectual property is an important part of ensuring the success of your practice.

Lastly, include a list of suppliers you plan to work with, detailing their services and main commercial terms, such as price, payment terms, and contract duration. Investors are interested in understanding why you've chosen specific suppliers, which may be due to higher-quality products or established relationships from previous ventures.

7. The presentation of the financial plan

The financial plan section is where we will include the financial forecast we talked about earlier in this guide.

Now that you have a clear idea of the content of a gastroenterology practice business plan, let's look at some of the tools you can use to create yours.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

What tool should I use to write my gastroenterology practice's business plan?

In this section, we will be reviewing the two main options for writing a gastroenterology practice business plan efficiently:

- Using specialized software,

- Outsourcing the drafting to the business plan writer.

Using an online business plan software for your gastroenterology practice's business plan

Using online business planning software is the most efficient and modern way to create a gastroenterology practice business plan.

There are several advantages to using specialized software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can access a library of dozens of complete business plan samples and templates for inspiration

- You get a professional business plan, formatted and ready to be sent to your bank or investors

- You can easily track your actual financial performance against your financial forecast

- You can create scenarios to stress test your forecast's main assumptions

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you're interested in using this type of solution, you can try The Business Plan Shop for free by signing up here.

Hiring a business plan writer to write your gastroenterology practice's business plan

Outsourcing your gastroenterology practice business plan to a business plan writer can also be a viable option.

These writers possess valuable experience in crafting business plans and creating accurate financial forecasts. Additionally, enlisting their services can save you precious time, enabling you to concentrate on the day-to-day operations of your business.

It's important to be mindful, though, that hiring business plan writers comes with a cost. You'll be paying not just for their time but also for the software they use, and their profit margin.

Based on experience, a complete business plan usually requires a budget of at least £1.5k ($2.0k) excluding tax, and more if revisions are needed after initial meetings with lenders or investors - changes often arise following these discussions.

When seeking investment, be cautious about spending too much on consulting fees. Investors prefer their funds to contribute directly to business growth. Thus, the amount you spend on business plan writing services and other consulting services should be negligible compared to the amount you raise.

Another aspect to consider is that while you'll receive the output of the business plan, you usually won't own the actual document. It will be saved in the consultant's business plan software, which will make updating the plan challenging without retaining the consultant on a retainer.

Given these factors, it's essential to carefully weigh the pros and cons of outsourcing your gastroenterology practice business plan to a business plan writer and decide what best suits your business's unique needs.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Why not create your gastroenterology practice's business plan using Word or Excel?

Using Microsoft Excel and Word (or their Google, Apple, or open-source equivalents) to write a gastroenterology practice business plan is a terrible idea.

Why?

For starters, creating an accurate and error-free financial forecast on Excel (or any spreadsheet) is very technical and requires both a strong grasp of accounting principles and solid skills in financial modelling.

As a result, it is unlikely anyone will trust your numbers unless - like us at The Business Plan Shop - you hold a degree in finance and accounting and have significant financial modelling experience in your past.

The second reason is that it is inefficient. Building forecasts on spreadsheets was the only option in the 1990s and early 2000s, nowadays technology has advanced and software can do it much faster and much more accurately.

And with the rise of AI, software is also becoming smarter at helping us detect mistakes in our forecasts and helping us analyse the numbers to make better decisions.

Also, using software makes it easy to compare actuals vs. forecasts and maintain our forecasts up to date to maintain visibility on future cash flows - as we discussed earlier in this guide - whereas this is a pain to do with a spreadsheet.

That's for the forecast, but what about the written part of my gastroenterology practice business plan?

This part is less error-prone, but here also software brings tremendous gains in productivity:

- Word processors don't include instructions and examples for each part of your business plan

- Word processors don't update your numbers automatically when they change in your forecast

- Word processors don't handle the formatting for you

- ...

Overall, while Word or Excel may be viable options for creating a gastroenterology practice business plan for some entrepreneurs, it is by far not the best or most efficient solution.

Takeaways

- Using business plan software is a modern and cost-effective way of writing and maintaining business plans.

- A business plan is not a one-shot exercise as maintaining it current is the only way to keep visibility on your future cash flows.

- A business plan has 2 main parts: a financial forecast outlining the funding requirements of your gastroenterology practice and the expected growth, profits and cash flows for the next 3 to 5 years; and a written part which gives the reader the information needed to decide if they believe the forecast is achievable.

We hope that this in-depth guide met your expectations and that you now have a clear understanding of how to write your gastroenterology practice business plan. Do not hesitate to contact our friendly team if you have questions additional questions we haven't addressed here.

Also on The Business Plan Shop

- How to write a business plan to secure a bank loan?

- Business plan vs pitch deck

- Supplier business plan

- How to write an internal business plan

- Key steps to write a business plan?

- Top mistakes to avoid in your business plan

Do you know entrepreneurs interested in starting or growing a gastroenterology practice? Share this article with them!