How to write a business plan for a doughnut shop?

Creating a business plan for a doughnut shop is an essential process for any entrepreneur. It serves as a roadmap that outlines the necessary steps to be taken to start or grow the business, the resources required, and the anticipated financial outcomes. It should be crafted with method and confidence.

This guide is designed to provide you with the tools and knowledge necessary for creating a doughnut shop business plan, covering why it is so important both when starting up and running an established business, what should be included in your plan, how it should be structured, what tools should be used to save time and avoid errors, and other helpful tips.

We have a lot to cover, so let's get to it!

Why write a business plan for a doughnut shop?

Having a clear understanding of why you want to write a business plan for your doughnut shop will make it simpler for you to grasp the rationale behind its structure and content. So before delving into the plan's actual details, let's take a moment to remind ourselves of the primary reasons why you'd want to create a doughnut shop business plan.

To have a clear roadmap to grow the business

Small businesses rarely experience a constant and predictable environment. Economic cycles go up and down, while the business landscape is mutating constantly with new regulations, technologies, competitors, and consumer behaviours emerging when we least expect it.

In this dynamic context, it's essential to have a clear roadmap for your doughnut shop. Otherwise, you are navigating in the dark which is dangerous given that - as a business owner - your capital is at risk.

That's why crafting a well-thought-out business plan is crucial to ensure the long-term success and sustainability of your venture.

To create an effective business plan, you'll need to take a step-by-step approach. First, you'll have to assess your current position (if you're already in business), and then identify where you'd like your doughnut shop to be in the next three to five years.

Once you have a clear destination for your doughnut shop, you'll focus on three key areas:

- Resources: you'll determine the human, equipment, and capital resources needed to reach your goals successfully.

- Speed: you'll establish the optimal pace at which your business needs to grow if it is to meet its objectives within the desired timeframe.

- Risks: you'll identify and address potential risks you might encounter along the way.

By going through this process regularly, you'll be able to make informed decisions about resource allocation, paving the way for the long-term success of your business.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

To get visibility on future cash flows

If your small doughnut shop runs out of cash: it's game over. That's why we often say "cash is king", and it's crucial to have a clear view of your doughnut shop's future cash flows.

So, how can you achieve this? It's simple - you need to have an up-to-date financial forecast.

The good news is that your doughnut shop business plan already includes a financial forecast (which we'll discuss further in this guide). Your task is to ensure it stays current.

To accomplish this, it's essential to regularly compare your actual financial performance with what was planned in your financial forecast. Based on your business's current trajectory, you can make adjustments to the forecast.

By diligently monitoring your doughnut shop's financial health, you'll be able to spot potential financial issues, like unexpected cash shortfalls, early on and take corrective actions. Moreover, this practice will enable you to recognize and capitalize on growth opportunities, such as excess cash flow enabling you to expand to new locations.

To secure financing

A detailed business plan becomes a crucial tool when seeking financing from banks or investors for your doughnut shop.

Investing and lending to small businesses are very risky activities given how fragile they are. Therefore, financiers have to take extra precautions before putting their capital at risk.

At a minimum, financiers will want to ensure that you have a clear roadmap and a solid understanding of your future cash flows (like we just explained above). But they will also want to ensure that your business plan fits the risk/reward profile they seek.

This will off-course vary from bank to bank and investor to investor, but as a rule of thumb. Banks will want to see a conservative financial management style (low risk), and they will use the information in your business plan to assess your borrowing capacity — the level of debt they think your business can comfortably handle — and your ability to repay the loan. This evaluation will determine whether they'll provide credit to your doughnut shop and the terms of the agreement.

Whereas investors will carefully analyze your business plan to gauge the potential return on their investment. Their focus lies on evidence indicating your doughnut shop's potential for high growth, profitability, and consistent cash flow generation over time.

Now that you recognize the importance of creating a business plan for your doughnut shop, let's explore what information is required to create a compelling plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Information needed to create a business plan for a doughnut shop

You need the right data in order to project sales, investments and costs accurately in the financial forecast of your doughnut shop business plan.

Below, we'll cover three key pieces of information you should gather before drafting your business plan.

Carrying out market research for a doughnut shop

Before you begin writing your business plan for a doughnut shop, conducting market research is a critical step in ensuring precise and realistic financial projections.

Market research grants you valuable insights into your target customer base, competitors, pricing strategies, and other crucial factors that can impact the success of your business.

In the course of this research, you may stumble upon trends that could impact your doughnut shop.

You may find that customers prefer doughnuts with unique flavors, such as maple bacon or birthday cake. You might also discover that customers are increasingly interested in healthier options, like vegan or gluten-free doughnuts.

Such market trends play a pivotal role in revenue forecasting, as they provide essential data regarding potential customers' spending habits and preferences.

By integrating these findings into your financial projections, you can provide investors with more accurate information, enabling them to make well-informed decisions about investing in your doughnut shop.

Developing the sales and marketing plan for a doughnut shop

Budgeting sales and marketing expenses is essential before creating a doughnut shop business plan.

A comprehensive sales and marketing plan should provide an accurate projection of what actions need to be implemented to acquire and retain customers, how many people are needed to carry out these initiatives, and how much needs to be spent on promotions, advertising, and other aspects.

This helps ensure that the right amount of resources is allocated to these activities in order to hit the sales and growth objectives forecasted in your business plan.

The staffing and capital expenditure requirements of a doughnut shop

Whether you are starting or expanding a doughnut shop, it is important to have a clear plan for recruitment and capital expenditures (investment in equipment and real estate) in order to ensure the success of the business.

Both the recruitment and investment plans need to be coherent with the timing and level of growth planned in your forecast, and require appropriate funding.

A doughnut shop might incur staffing costs such as wages for employees, benefits, and taxes. They may also need to pay for uniforms and other equipment for employees. Additionally, the shop may need to purchase equipment such as mixers, fryers, ovens, and other kitchen tools. They may also need to pay for ingredients and other supplies, such as packaging materials.

In order to create a realistic financial forecast, you will also need to consider the other operating expenses associated with running the business on a day-to-day basis (insurance, bookkeeping, etc.).

Once you have all the necessary information to create a business plan for your doughnut shop, it is time to start creating your financial forecast.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

What goes into your doughnut shop's financial forecast?

The financial forecast of your doughnut shop will enable you to assess the profitability potential of your business in the coming years and how much capital is required to fund the actions planned in the business plan.

The four key outputs of a financial forecast for a doughnut shop are:

- The profit and loss (P&L) statement,

- The projected balance sheet,

- The cash flow forecast,

- And the sources and uses table.

Let's take a closer look at each of these.

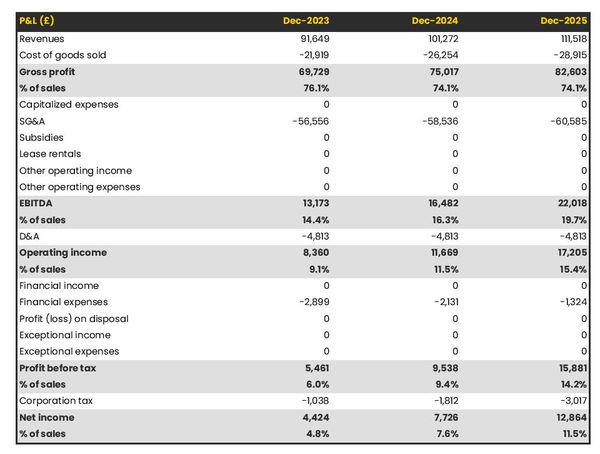

The projected P&L statement

The projected P&L statement for a doughnut shop shows how much revenue and profits your business is expected to generate in the future.

Ideally, your doughnut shop's P&L statement should show:

- Healthy growth - above inflation level

- Improving or stable profit margins

- Positive net profit

Expectations will vary based on the stage of your business. A startup will be expected to grow faster than an established doughnut shop. And similarly, an established company should showcase a higher level of profitability than a new venture.

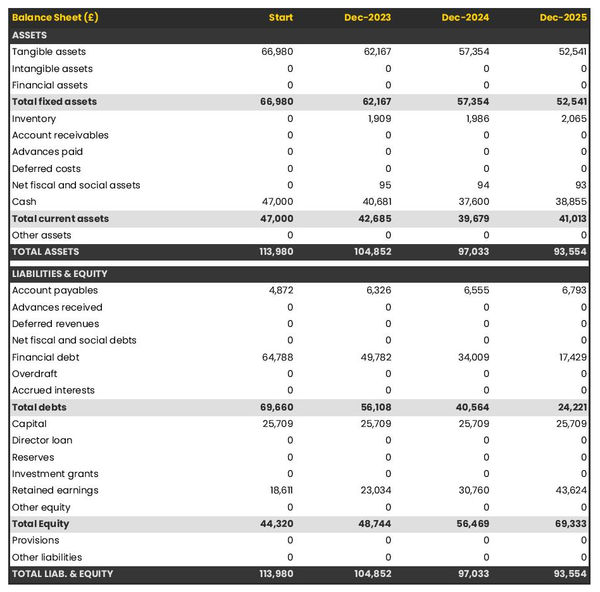

The projected balance sheet of your doughnut shop

Your doughnut shop's forecasted balance sheet enables the reader of your plan to assess your financial structure, working capital, and investment policy.

It is composed of three types of elements: assets, liabilities and equity:

- Assets: represent what the business owns and uses to produce cash flows. It includes resources such as cash, equipment, and accounts receivable (money owed by clients).

- Liabilities: represent funds advanced to the business by lenders and other creditors. It includes items such as accounts payable (money owed to suppliers), taxes due and loans.

- Equity: is the combination of what has been invested by the business owners and the cumulative profits and losses generated by the business to date (which are called retained earnings). Equity is a proxy for the value of the owner's stake in the business.

Your doughnut shop's balance sheet will usually be analyzed in conjunction with the other financial statements included in your forecast.

Two key points of focus will be:

- Your doughnut shop's liquidity: does your business have sufficient cash and short-term assets to pay what it owes over the next 12 months?

- And its solvency: does your business have the capacity to repay its debt over the medium-term?

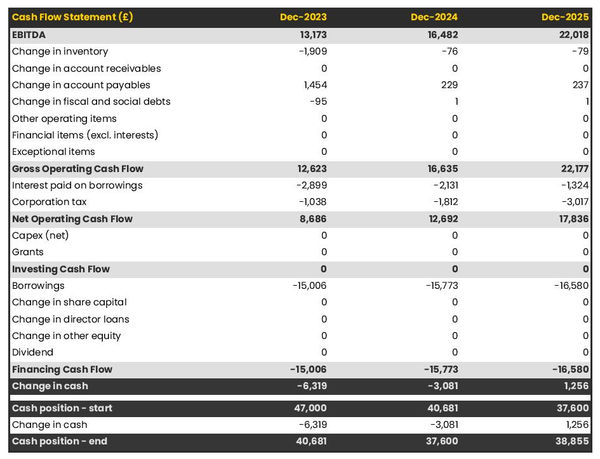

The projected cash flow statement

A cash flow forecast for a doughnut shop shows how much cash the business is projected to generate or consume.

The cash flow statement is divided into 3 main areas:

- The operating cash flow shows how much cash is generated or consumed by the operations (running the business)

- The investing cash flow shows how much cash is being invested in capital expenditure (equipment, real estate, etc.)

- The financing cash flow shows how much cash is raised or distributed to investors and lenders

Looking at the cash flow forecast helps you to ensure that your business has enough cash to keep running, and can help you anticipate potential cash shortfalls.

It is also a best practice to include a monthly cash flow statement in the appendices of your doughnut shop business plan so that the readers can view the impact of seasonality on your business cash position and generation.

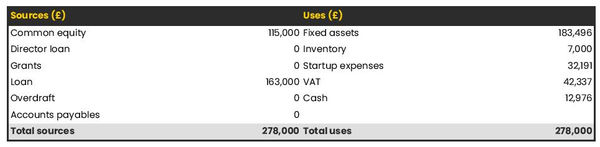

The initial financing plan

The initial financing plan, also known as a sources and uses table, is a valuable resource to have in your business plan when starting your doughnut shop as it reveals the origins of the money needed to establish the business (sources) and how it will be allocated (uses).

Having this table helps show what costs are involved in setting up your doughnut shop, how risks are shared between founders, investors and lenders, and what the starting cash position will be. This cash position needs to be sufficient to sustain operations until the business reaches a break-even point.

Now that you have a clear understanding of what goes into the financial forecast of your doughnut shop business plan, let's shift our focus to the written part of the plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The written part of a doughnut shop business plan

The written part of a doughnut shop business plan is composed of 7 main sections:

- The executive summary

- The presentation of the company

- The products and services

- The market analysis

- The strategy

- The operations

- The financial plan

Throughout these sections, you will seek to provide the reader with the details and context needed for them to form a view on whether or not your business plan is achievable and your forecast a realistic possibility.

Let's go through the content of each section in more detail!

1. The executive summary

In your doughnut shop's business plan, the first section is the executive summary — a captivating overview of your plan that aims to pique the reader's interest and leave them eager to learn more about your business.

When crafting the executive summary, start with an introduction to your business, including its name, concept, location, how long it has been running, and what sets it apart. Briefly mention the products and services you plan to offer and your target customer profile.

Following that, provide an overview of the addressable market for your doughnut shop, current trends, and potential growth opportunities.

Next, include a summary of key financial figures like projected revenues, profits, and cash flows.

Finally, in the "ask" section, detail any funding requirements you may have.

2. The presentation of the company

In your doughnut shop business plan, the second section should focus on the structure and ownership, location, and management team of your company.

In the structure and ownership part, you'll provide an overview of the business's legal structure, details about the owners, and their respective investments and ownership shares. This clarity is crucial, especially if you're seeking financing, as it helps the reader understand which legal entity will receive the funds and who controls the business.

Moving on to the location part, you'll offer an overview of the company's premises and their surroundings. Explain why this particular location is of interest, highlighting factors like catchment area, accessibility, and nearby amenities.

When describing the location of your doughnut shop, you could emphasize its potential for success due to the area's population density and economic stability. You may also highlight the convenience of the shop's location with its proximity to major transportation hubs, making it easily accessible to customers. Additionally, you could point out the area's diverse demographic, which could mean a larger customer base for the shop. Lastly, you might mention the potential for growth in the surrounding area, as new developments could bring more customers.

Finally, you should introduce your management team. Describe each member's role, background, and experience.

Don't forget to emphasize any past successes achieved by the management team and how long they've been working together. Demonstrating their track record and teamwork will help potential lenders or investors gain confidence in their leadership and ability to execute the business plan.

3. The products and services section

The products and services section of your doughnut shop business plan should include a detailed description of what your company sells to its customers.

For example, your doughnut shop could offer freshly made doughnuts, a variety of coffee and tea drinks, and seasonal specialties like pumpkin spice doughnuts. Customers could enjoy these treats in the store or take them to go. The freshly made doughnuts could be customized for special occasions such as birthdays or weddings, while the coffee and tea drinks could be a great accompaniment to a sweet snack. The seasonal specialties would offer customers something new to look forward to each season.

The reader will want to understand what makes your doughnut shop unique from other businesses in this competitive market.

When drafting this section, you should be precise about the categories of products or services you sell, the clients you are targeting and the channels that you are targeting them through.

4. The market analysis

When outlining your market analysis in the doughnut shop business plan, it's essential to include comprehensive details about customers' demographics and segmentation, target market, competition, barriers to entry, and relevant regulations.

The primary aim of this section is to give the reader an understanding of the market size and appeal while demonstrating your expertise in the industry.

To begin, delve into the demographics and segmentation subsection, providing an overview of the addressable market for your doughnut shop, key marketplace trends, and introducing various customer segments and their preferences in terms of purchasing habits and budgets.

Next, shift your focus to the target market subsection, where you can zoom in on the specific customer segments your doughnut shop targets. Explain how your products and services are tailored to meet the unique needs of these customers.

For example, your target market might include urban professionals who are in their 20s - 40s. This segment is likely to be relatively busy and have a higher disposable income, making buying doughnuts a convenient and affordable indulgence. They also tend to be more health-conscious than older generations, so you'd want to emphasize the quality ingredients and craftsmanship of your product.

In the competition subsection, introduce your main competitors and explain what sets your doughnut shop apart from them.

Finally, round off your market analysis by providing an overview of the main regulations that apply to your doughnut shop.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

5. The strategy section

When writing the strategy section of a business plan for your doughnut shop, it is essential to include information about your competitive edge, pricing strategy, sales & marketing plan, milestones, and risks and mitigants.

The competitive edge subsection should explain what sets your company apart from its competitors. This part is especially key if you are writing the business plan of a startup, as you have to make a name for yourself in the marketplace against established players.

The pricing strategy subsection should demonstrate how you intend to remain profitable while still offering competitive prices to your customers.

The sales & marketing plan should outline how you intend to reach out and acquire new customers, as well as retain existing ones with loyalty programs or special offers.

The milestones subsection should outline what your company has achieved to date, and its main objectives for the years to come - along with dates so that everyone involved has clear expectations of when progress can be expected.

The risks and mitigants subsection should list the main risks that jeopardize the execution of your plan and explain what measures you have taken to minimize these. This is essential in order for investors or lenders to feel secure in investing in your venture.

Your doughnut shop could face risks related to its ingredients. For example, the price of flour or sugar might spike unexpectedly, which could drastically increase the cost of doing business. Additionally, the shop could face risks related to food safety. If the shop is not careful to properly store and handle ingredients, they could risk a health-related incident that could damage their reputation.

6. The operations section

The operations of your doughnut shop must be presented in detail in your business plan.

Begin by addressing your staff, specifying the main roles and your recruitment plan to support the anticipated growth. Outline the qualifications and experience needed for each role and discuss your recruitment strategies, which may involve using job boards, referrals, or headhunters.

Next, clearly state your doughnut shop's operating hours, allowing the reader to gauge the adequacy of your staffing levels. Additionally, mention any considerations for varying opening times during peak seasons and your approach to handling customer queries outside regular operating hours.

The key assets and intellectual property (IP) required to run your business should also be highlighted. If you rely on licenses, trademarks, physical structures like equipment or property, or lease agreements, ensure they are well-documented in this section.

You may have key assets in the form of recipes and flavors of doughnuts that you have created, and these could be intellectual property. You might also have a logo, a trademark, or a slogan that are all considered IP and are key assets to your business.

Finally, provide a comprehensive list of suppliers you intend to collaborate with, along with a breakdown of their services and main commercial terms, such as price, payment terms, break clauses and contract duration. Investors often seek insight into the reasons behind your supplier choices, which may include a preference for higher-quality products or established relationships from past ventures.

7. The presentation of the financial plan

The financial plan section is where we will include the financial forecast we talked about earlier in this guide.

Now that you have a clear idea of the content of a doughnut shop business plan, let's look at some of the tools you can use to create yours.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

What tool should I use to write my doughnut shop's business plan?

In this section, we will be reviewing the two main solutions for creating a doughnut shop business plan:

- Using specialized online business plan software,

- Outsourcing the plan to the business plan writer.

Using an online business plan software for your doughnut shop's business plan

Using online business planning software is the most efficient and modern way to create a doughnut shop business plan.

There are several advantages to using specialized software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can access a library of dozens of complete business plan samples and templates for inspiration

- You get a professional business plan, formatted and ready to be sent to your bank or investors

- You can easily track your actual financial performance against your financial forecast

- You can create scenarios to stress test your forecast's main assumptions

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you're interested in using this type of solution, you can try The Business Plan Shop for free by signing up here.

Hiring a business plan writer to write your doughnut shop's business plan

Outsourcing your doughnut shop business plan to a business plan writer can also be a viable option.

Business plan writers are skilled in creating error-free business plans and accurate financial forecasts. Moreover, hiring a consultant can save you valuable time, allowing you to focus on day-to-day business operations.

However, it's essential to be aware that hiring business plan writers will be expensive, as you're not only paying for their time but also the software they use and their profit margin.

Based on experience, you should budget at least £1.5k ($2.0k) excluding tax for a comprehensive business plan, and more if you require changes after initial discussions with lenders or investors.

Also, exercise caution when seeking investment. Investors prefer their funds to be directed towards business growth rather than spent on consulting fees. Therefore, the amount you spend on business plan writing services and other consulting services should be insignificant compared to the amount raised.

Keep in mind that one drawback is that you usually don't own the business plan itself; you only receive the output, while the actual document is saved in the consultant's business planning software. This can make it challenging to update the document without retaining the consultant's services.

For these reasons, carefully consider outsourcing your doughnut shop business plan to a business plan writer, weighing the advantages and disadvantages of seeking outside assistance.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Why not create your doughnut shop's business plan using Word or Excel?

Using Microsoft Excel and Word (or their Google, Apple, or open-source equivalents) to write a doughnut shop business plan is a terrible idea.

Why?

For starters, creating an accurate and error-free financial forecast on Excel (or any spreadsheet) is very technical and requires both a strong grasp of accounting principles and solid skills in financial modelling.

As a result, it is unlikely anyone will trust your numbers unless - like us at The Business Plan Shop - you hold a degree in finance and accounting and have significant financial modelling experience in your past.

The second reason is that it is inefficient. Building forecasts on spreadsheets was the only option in the 1990s and early 2000s, nowadays technology has advanced and software can do it much faster and much more accurately.

And with the rise of AI, software is also becoming smarter at helping us detect mistakes in our forecasts and helping us analyse the numbers to make better decisions.

Also, using software makes it easy to compare actuals vs. forecasts and maintain our forecasts up to date to maintain visibility on future cash flows - as we discussed earlier in this guide - whereas this is a pain to do with a spreadsheet.

That's for the forecast, but what about the written part of my doughnut shop business plan?

This part is less error-prone, but here also software brings tremendous gains in productivity:

- Word processors don't include instructions and examples for each part of your business plan

- Word processors don't update your numbers automatically when they change in your forecast

- Word processors don't handle the formatting for you

- ...

Overall, while Word or Excel may be viable options for creating a doughnut shop business plan for some entrepreneurs, it is by far not the best or most efficient solution.

Takeaways

- Using business plan software is a modern and cost-effective way of writing and maintaining business plans.

- A business plan is not a one-shot exercise as maintaining it current is the only way to keep visibility on your future cash flows.

- A business plan has 2 main parts: a financial forecast outlining the funding requirements of your doughnut shop and the expected growth, profits and cash flows for the next 3 to 5 years; and a written part which gives the reader the information needed to decide if they believe the forecast is achievable.

We hope that this in-depth guide met your expectations and that you now have a clear understanding of how to write your doughnut shop business plan. Do not hesitate to contact our friendly team if you have questions additional questions we haven't addressed here.

Also on The Business Plan Shop

- How to write a business plan to secure a bank loan?

- How long should your business plan be?

- Business plan formatting guide

- Strategic plan vs business plan

- Key steps to write a business plan?

- Top mistakes to avoid in your business plan

Do you know entrepreneurs interested in starting or growing a doughnut shop? Share this article with them!