How to write a business plan for a distribution company?

Writing a business plan for a distribution company is essential in order to get your business off the ground, improve profitability or raise financing.

Whether you are starting up a new distribution company or looking to grow an existing one, having an effective and comprehensive business plan is key.

This guide will provide detailed information on why writing a business plan for your distribution company is important, what information it should contain, and what tools can be used to write your own.

With this guide as your reference, you will have all the knowledge needed to create an effective and successful business plan for your distribution company.

Why write a business plan for a distribution company?

There are several reasons to write a distribution business plan. Below, we cover some of the most important ones!

To set a clear roadmap

Writing a business plan for a distribution company is an important step for entrepreneurs to ensure the long-term success of their venture.

It requires you to think strategically and set objectives that will guide your decisions over the next 3-5 years.

This is especially critical for startups who need to consider all aspects of their business idea and ensure it can be viable before investing time and money, but also beneficial for established distribution companies looking to expand or improve operations in the coming years.

By having a clear roadmap laid out before them, you can have a better understanding of what needs to be done in order to reach your business objectives.

Planning ahead also helps you anticipate any potential obstacles that may stand in the way of success, allowing you to take proactive measures and adjust your plans accordingly.

To get clarity on your cash flow

One of the most important benefits of having a business plan is that it allows you to regularly compare your financial performance against what was planned and make necessary adjustments in order to keep your forecast accurate.

By doing this regularly, you can identify potential financial issues (such as an unexpected cash shortfall) early on and take corrective action before they become serious problems. This also enables you to seize opportunities that may arise along the way in order to maximise profits or grow faster.

To secure financing

Having a comprehensive distribution company business plan is also essential for getting financing from banks or investors.

Banks use the business plan to assess your borrowing capacity, identify potential collateral, and decide whether they think you will be able to repay the funds they lend your company.

Similarly, creating a business plan for your distribution company is also an essential step when looking to secure financing from equity investors.

Investors will carefully review the business plan to ensure that their investment in your distribution company can generate good returns. As such, they will want to see evidence of healthy growth and profitability as well as strong cash flows in your business plan.

With a comprehensive and well-thought-out business plan, you can be confident that you are presenting potential lenders or investors with all the information they need to make an informed decision about financing your company.

Now that we understand why it is important to write a business plan for your distribution company, let's look into what information is needed in order to create one.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

What information is needed to create a business plan for a distribution company?

Writing a distribution business plan requires research so that you can project sales, investments and cost accurately in your financial forecast.

In this section, we cover three key pieces of information you should gather before drafting your plan!

Carrying out market research for a distribution company

Carrying out market research prior to writing a business plan for your distribution company is essential in order to get an accurate understanding of your target market and competitive landscape

This information is invaluable when it comes to forecasting revenues and creating realistic projections in the business plan. But also in order to convince and demonstrate to the reader that there is a real opportunity to be seized on the target market.

Developing the marketing plan for a distribution company

Getting a clear picture of the road to market for your distribution company is also a prerequisite for writing the actual business plan itself.

This will be key when it comes to both forecasting sales and marketing expenditures in the financial forecast, and communicating your strategy effectively in your business plan.

The staffing and equipment needs of a distribution company

Distribution companies require serious capital expenditures - from fleets of trucks and warehouses to highly specialised packing equipment - and a significant workforce.

It is essential to think through the recruitment plan, financial investments, and any other costs (and associated timings) that may be associated with the business before you start drafting the document.

Once you've gathered the information mentioned above, it will be time to start working on the financial forecast for your distribution company. Let’s see what this entails

How do I build a financial forecast for a distribution company?

The objective of the financial forecast for a distribution company is to obtain 4 key financial tables: the Profit & Loss (P&L) statement, the balance sheet, cash flow forecast and a sources and uses table.

Let’s have a look at each of these in a bit more detail.

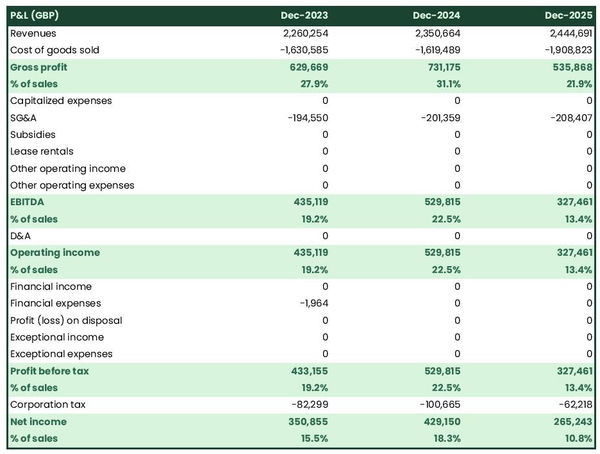

The projected P&L statement

The projected P&L statement of a distribution company shows us how much money the company will make and how much it is expected to grow in the future.

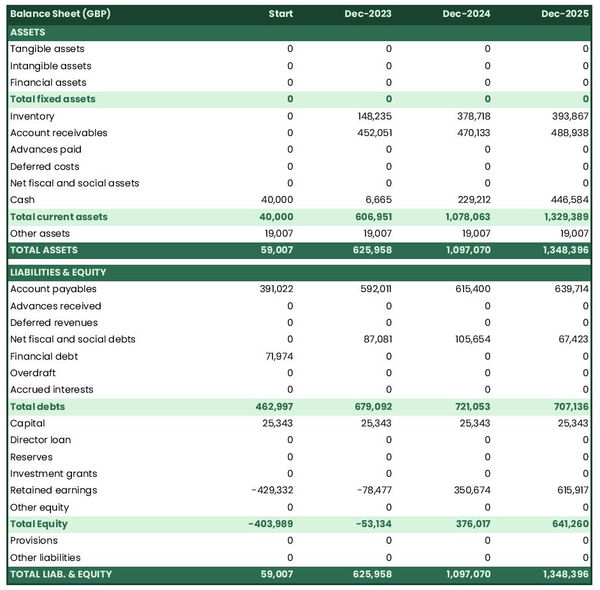

The projected balance sheet of your distribution company

The balance sheet for a distribution company is a financial document that provides an overview of the company’s assets, liabilities, and equity at a specific point in time.

This statement serves as a snapshot of the business's financial health and can be used to determine the company’s ability to repay its debt in the short term (liquidity) and medium term (solvency).

Assets are items of value that your company holds, such as cash, inventory, accounts receivable and property; liabilities are the money owed to creditors or other businesses; and equity is what remains after liabilities have been subtracted from assets (and can be used as a proxy for shareholder value).

By looking at a company’s balance sheet, lenders, investors, and the business owner can gain insight into the financial health of the company.

A balance sheet is a valuable tool for assessing how the company is doing financially, and ultimately its ability to remain sustainable and profitable over time.

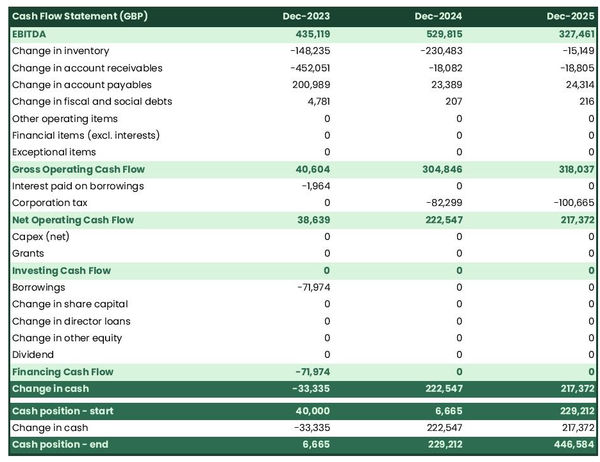

The projected cash flow statement

A projected cash flow statement is a helpful tool for a distribution company. It shows how much money the company will have coming in and going out over a certain period of time.

This helps you plan and ensure the business has enough capital for growth and investments.

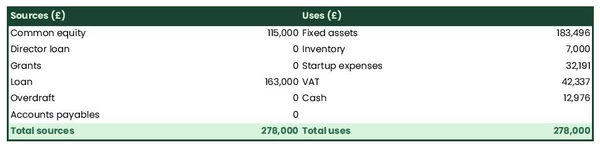

The initial financing plan

The initial financing plan (also called the sources and uses table) shows the sums that the company needs to start and how they will be used.

It is important to have this so that you know how much capital is needed to deliver the business plan and what it will be used for.

The sources show where the money comes from, such as investors or loans. The uses show what the money will be used for, like buying equipment or working capital. By having a source and use table, you can make sure that your business has enough money to get started!

Now that you understand what the financial forecast is made of, it's time to move on to another key part of the business plan - the written section.

The written section is an important component, as it provides the context needed to understand and interpret financial figures.

Let's dive in and take a closer look at this essential piece of your distribution company’s business plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The written part of a distribution business plan

A comprehensive business plan for your distribution company contains seven key sections: executive summary, presentation of the company, products and services section, market analysis, strategy section, operations section and financial plan.

1. The executive summary

The executive summary of a distribution company plan should start with a concise overview of your business.

This section should then include an overview of the market, highlighting any competitive advantages that your company has.

You should also include key financials such as expected revenues, costs, and profit margins.

Finally, this section should include a clear and concise explanation of the ask that your company is making to potential investors or lenders. This could include an overview of the funding required, and what it will be used for.

The executive summary should succinctly capture all of these important details in order to convince stakeholders to read the rest of your business plan.

2. The presentation of the company

When writing the presentation of a distribution company for a business plan, it is important to focus on three key elements: structure and ownership, location and management team.

Starting with the structure and ownership, it is important to provide an accurate description of the legal framework of the company. This includes information about the type of business entity the company is operating under, the ownership structure and whether any external investors are involved.

Additionally, investors may be interested in understanding any equity or debt held by the company and how the capital has been allocated.

The location of a distribution business is also critical for success. Any information about where the warehouse facilities are located as well as how many and what size they are should be included in the business plan.

This information should also include geographic reach and any serviceable areas where the company has a particularly strong presence.

Finally, a complete description of the management team is essential for investors. The management team’s expertise and experience in the industry must be highlighted, including information about their roles and qualifications.

3. The products and services section

When writing the products and services section of a business plan for a distribution company, it’s important to include detailed information about what your company actually does.

You should start with an overview of the types of services offered - such as transportation, storage, packaging, click and collect, etc. - and then move on to specifics like which modes of transport are used (airfreight, sea-freight) or what type of packaging is available (pharmaceutical goods, food and beverage, standard good parcels, etc.).

It’s also important to provide details on any additional value-added services provided by the company; these could include things like custom labelling and product assembly.

Additionally, mention if there are any special certifications or accreditations that make your business stand out from competitors in terms of quality control and safety standards. Ultimately these factors will be key in convincing potential investors that this is a viable business opportunity worth investing in.

4. The market analysis

When presenting the conclusion of your market analysis in your distribution company's business plan, it is important to include information about demographics and segmentation, target market, competition, barriers at entry, and regulation.

This will ensure that the reader of the business plan - whether they be a bank or an investor - has all the necessary information to make an informed decision with regard to the size of the opportunity in the target market.

Demographics and segmentation should cover the target market size as well as any other pertinent data points such as verticals served. Understanding these details will help provide insight into which segments are viable targets for the company’s products and services.

Additionally, understanding who your competitors are within those segments is key to assessing whether the company is well-positioned to capture the opportunity

It is also important for the reader to understand any potential barriers at entry that could limit your ability to enter certain market segments; this could include regulations from governmental agencies or clients being locked in existing long-term contracts with other distributors.

5. The strategy section

When writing the strategy section of a business plan for your distribution company, it is essential to include information about your competitive edge, pricing strategy, marketing plan, milestones and risks and mitigants.

The competitive edge should be outlined in detail; this includes any unique features or services that set your company apart from competitors.

Additionally, the pricing strategy must be included to demonstrate how you intend to remain profitable while still offering competitive prices in order to attract customers.

A comprehensive sales & marketing plan should also be included, this outlines how you intend to reach out and acquire new customers as well as retain existing ones with loyalty programs or special offers.

It’s also important to include specific milestones along with dates so that everyone involved has clear expectations of progress being made over time and what the next sets of goals are.

Finally, identifying potential risks early on and providing mitigating factors is essential in order for investors or lenders to feel secure in investing their money into your venture.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

6. The operations section

In order to present the operations of your distribution company in a business plan, it is important to provide detailed information about the staffing team, roles of staff members, and recruitment plan.

This should include job descriptions for each role, details on how they will be compensated, and an outline of the recruitment and training processes.

Other key elements of a distribution company’s operations that need to be addressed in the business plan include any assets and intellectual property owned by the business.

This includes physical items such as warehouses (whether owned or leased), trucks, and equipment needed for daily operations.

Additionally, any relevant intellectual property such as brand names, logos and copyrights should be clearly stated in the plan.

Finally, it is important to outline the suppliers that a distribution company plans to work with. This should include information about contractual arrangements and payment terms for each supplier.

With this information included in the business plan, potential investors or lenders will have a better understanding of the operations that are required to run a successful distribution business.

7. The presentation of the financial plan

The financial plan section is where we will include the financial forecast we talked about earlier in this guide.

Now that we have discussed the content of a distribution company business plan, let us look at some of the tools available to help you create one.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

What tool should I use to write my distribution business plan?

In this section, we will review the three main solutions for creating a business plan for your distribution company: using Word and Excel, hiring a consultant, and using online business plan software.

Create your distribution company's business plan using Word and Excel

Using Microsoft Office’s Word and Excel applications for writing a business plan for a distribution company may seem like a cost-effective solution for business owners.

While this is true in terms of cost, there are also some drawbacks to this approach that should be considered when making the decision to use Word and Excel.

Creating an accurate financial forecast for a distribution company in Excel can be extremely challenging and time-consuming unless one is an expert accountant and financial modeller. Additionally, financiers may not view such an analysis as reliable since it was created by someone other than a professional.

Furthermore, once created it can be difficult to keep a financial forecast up-to-date.

Writing the actual business plan in Word is also inefficient as it requires the business owner to start from scratch and spend hours formatting the document afterwards.

Hire a consultant to write your distribution company's business plan

Outsourcing a distribution company plan to a consultant or accountant can be a viable solution for business owners looking to present their plan to investors or banks.

Consultants and accountants are both well-equipped to write business plans and create financial forecasts.

However, there are some drawbacks to outsourcing a business plan. For one, accountants may lack the industry expertise to accurately forecast sales.

Additionally, hiring consultants or accountants will be costly and there is potential for unexpected extra costs if modifications or updates need to be made to the plan.

Furthermore, entrepreneurs who outsource their distribution company's plan have less control over the outcome of the project than if they had written it themselves.

Finally, not all consultants have experience with business planning related to distribution companies and may not possess the same level of expertise as an entrepreneur who is very familiar with their industry.

Use an online business plan software for your distribution company's business plan

Another alternative is to use online business plan software. There are several advantages to using specialised software:

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can be inspired by already written business plan templates

- You can easily make your financial forecast by letting the software take care of the financial calculations for you, without error

- You get a professional document, formatted and ready to be sent to your bank

- You can easily update your financial forecast and track it against actual financial performance to see where the business stands

If you're interested in using this type of solution, you can try our software for free by signing up here.

We hope that this article has helped you to better understand how to write the business plan for a distribution company. Do not hesitate to contact us if you still have questions!

Also on The Business Plan Shop

- Do I need a business plan? Your questions answered

- Business Model vs. Business Plan

- How to write the business plan for a grant application?

Know someone in the distribution industry? Share this article with them!