How do I change my financial forecast settings?

This article explains how to change your financial forecast settings in The Business Plan Shop's financial forecasting software.

Your financial forecast settings can be updated at anytime.

How does the module work?

Settings tab

The settings tab allows you to change key information about your financial forecast.

You can alter your: plan type, plan start date, plan duration, currency used, unit used for exports and outputs, format of outputs and the employees social costs payment frequency.

VAT/GST tab

This tab is only relevant if your business is eligible for VAT or sales taxes.

Corporation tax tab

This tab allows you to choose the corporation tax model that your business follows.

The four options are: France, UK, standard or custom.

Comments & notes tab

The comments & notes tab lets you write important notes on each page that may prove useful at a later point.

These notes can be kept private or shared with other users that you have invited on your account.

Frequently Asked Questions

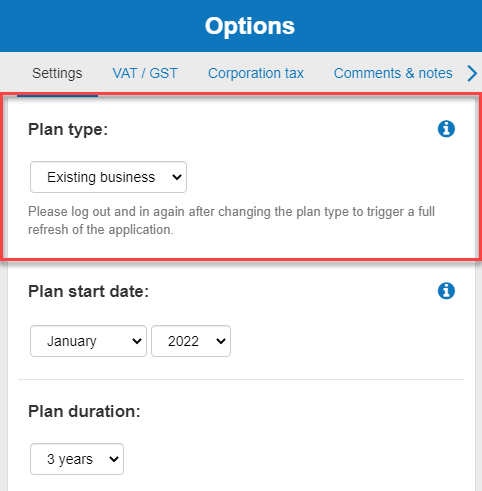

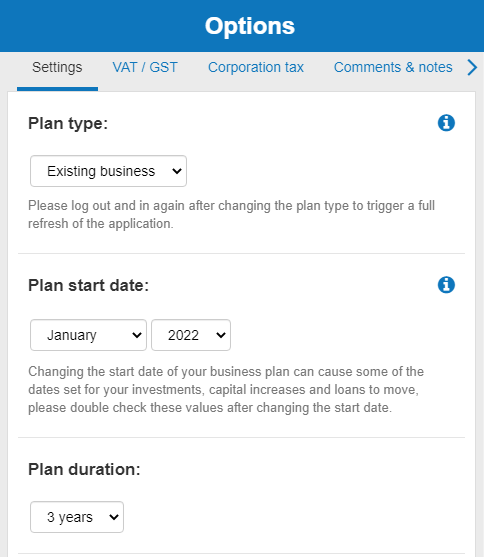

- Firstly, click on the settings tab at the top of this page

- Next, you'll see a dropdown menu with the heading "Plan type"

![changing my plan type in the business plan shop's financial forecasting software]()

Notes:

This option should be used if you're looking to change the type of business plan that you want to create. You can either create a start-up plan or a plan for an existing business.

The difference between the two types of business plan is the opening balance sheet:

- With a start-up plan: fixed assets, inventories, loans, start-up costs, and capital contributions at the beginning of the plan are used to draw up the Sources & Uses table and calculate the starting cash position of the company

- With an existing business plan: you can enter the opening balance sheet

It is recommended to log out and log back in after changing the plan type to trigger a full refresh of the application.

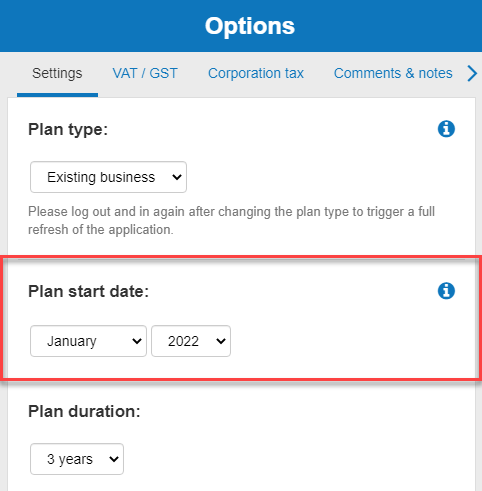

- Firstly, click on the settings tab at the top of this page

- Next, you'll see a dropdown menu with the heading "Plan start date"

![changing the business plan start date]()

Notes:

This option should be used if you want to change your business plan start date.

Note that changing the start date of your business plan can cause some of the dates set for your investments, capital increases and loans to move, please double check these values after changing the start date.

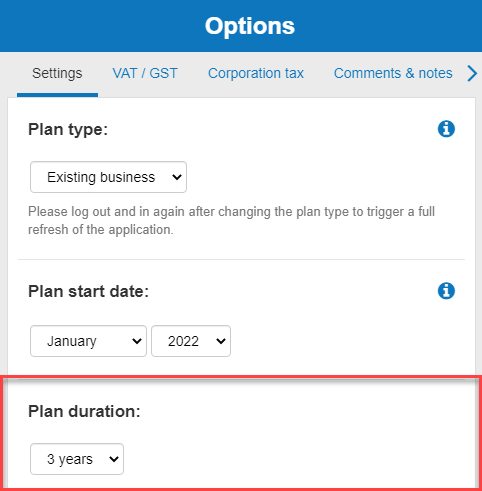

- Firstly, click on the settings tab at the top of this page

- Next, you'll see a dropdown menu with the heading "Plan duration:"

![changing my business plan duration from three years to five years]()

Notes:

You can choose to build a three-year or five-year business plan.

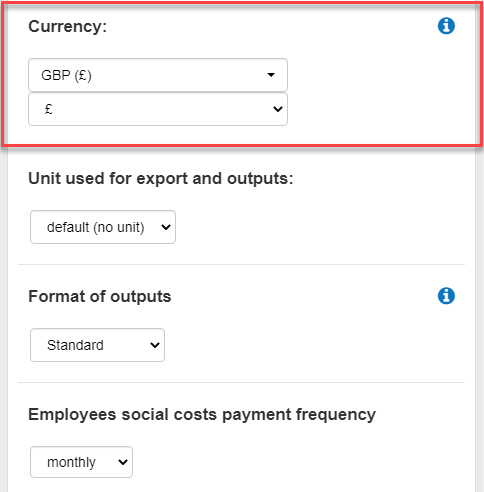

- Firstly, click on the settings tab at the top of this page

- Next, you'll see a dropdown menu with the heading "Currency"

![changing the currency used in the business plan shop's financial forecasting software]()

Notes:

You can change the currency that your business plan uses and the corresponding symbol that you want to display in the software.

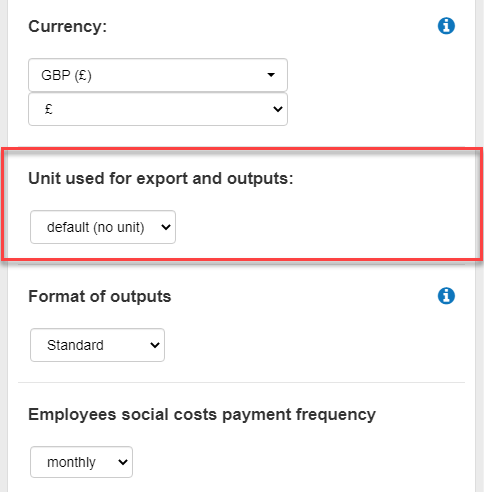

- Firstly, click on the settings tab at the top of this page

- Next, you'll see a dropdown menu with the heading "Unit used for exports and outputs"

![changing the unit used for exports and outputs]()

Notes:

There are three types of units that can be used in your financial statements:

- Default (no unit): this will show the entire figure in full (for example, $635,542)

- Thousands: this will show your figure in thousands (for example, $635,542 would show as $635.5k)

- Millions: this will show your figure in millions (for example, $635,542 would show as $0.6m)

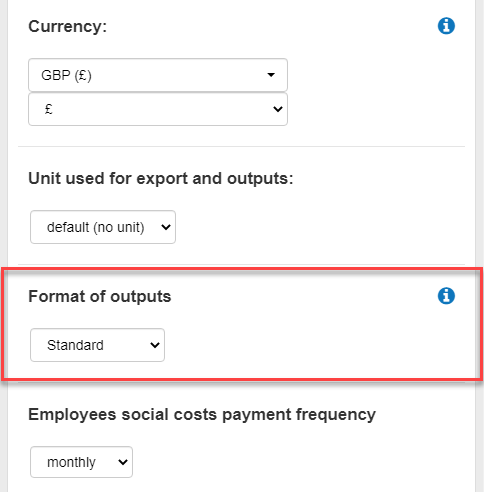

- Firstly, click on the settings tab at the top of this page

- Next, you'll see a dropdown menu with the heading "Format of outputs"

![changing my format of outputs in the software]()

Notes:

Currently, The Business Plan Shop supports two formats for financial statements:

- The standard format: which is the recommended format for most companies

- The French GAAP format which follows the French Plan Comptable Général

The main differences between the two formats are:

- The presentation of the P&L above the EBIT (or operating income)

- The order in which items appear on the balance sheet

- The chart of accounts generated when you add CSV as a financial data source depends on the format selected.

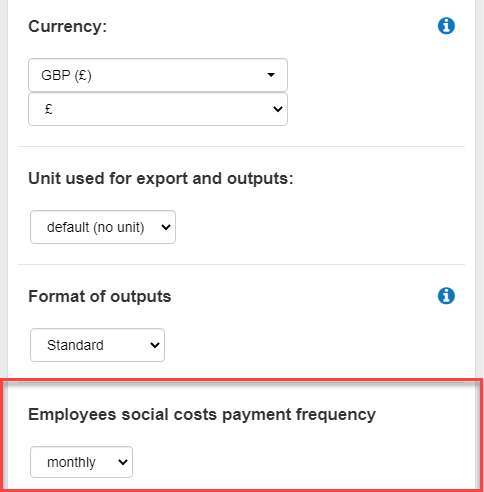

- Firstly, click on the settings tab at the top of this page

- Next, you'll see a dropdown menu with the heading "Employees social costs payment frequency"

![changing my employee social costs payment frequency in the software]()

Notes:

You can change the payment frequency for your employees' social contributions (such as National Insurance and Income Tax if you are in the UK).

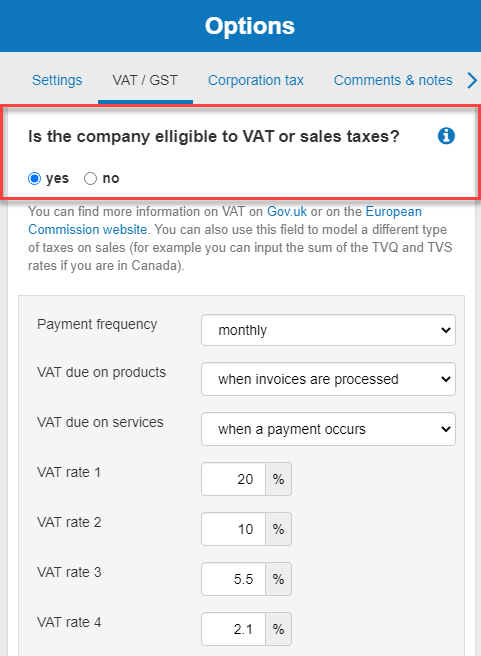

- Firstly, click on the VAT/GST tab at the top of this page

- Next, you'll see a heading named "Is the company elligible to VAT or sales taxes?"

![accounting for VAT/GST in the software]()

Notes

What is VAT used for?

Value Added Tax (VAT) is a consumption tax for which collection is the responsibility of companies.

Businesses charge VAT to their customers and then periodically remit it to the government.

When the customer is not a consumer, the latter may, if he himself is subject to VAT, deduct the VAT he has paid on his purchases from the amount of VAT to be paid to the government.

VAT rate and eligibility

VAT applies to most products and services. However, certain categories of goods and services are exempt or at a reduced rate.

You can find more information on this subject on the UK's government website, or an equivalent website if you are based in another country.

How does VAT work in The Business Plan Shop?

In The Business Plan Shop, the software calculates the VAT balance for each period by adding the VAT collected on sales and subtracting the deductible VAT on purchases.

VAT on services is taken into account at the time of payment while VAT on goods is taken into account at the time of invoicing.

The VAT balance is then paid to the government on a monthly or quarterly basis.

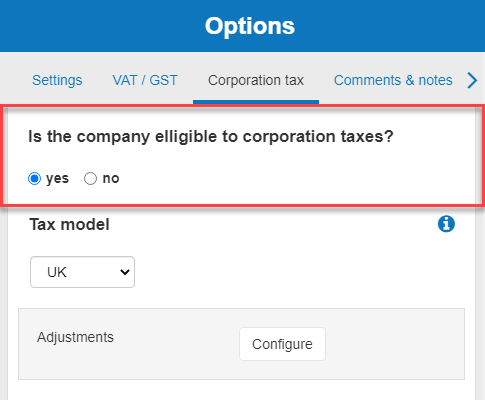

- Firstly, click on the corporation tax tab at the top of this page

- Next, you'll see a heading named "Is the company elligible to corporation taxes?"

![setting my corporation tax model in the software]()

- Select yes

Notes:

This tab allows you to choose the corporation tax model that your business follows. The four options are: France, UK, standard or custom.

The France model

This model simulates the French corporation tax system, it uses the following assumptions:

- The fiscal year is the same as the company's financial year (12 months from the beginning of the plan)

- 4 advances, each of 25% of the tax amount for the previous year, are paid in March, June, September, and December. No advances are paid by start-ups in their first financial year, nor when the tax amount was less than €3k in the previous year

- The balance is paid 4 months after the end of the financial year

- The model uses the level of earnings before tax and revenues to compute the applicable rate

- The model carries losses forward but doesn't factor special rules regarding deficits greater than 1 million

- The tax amount is computed yearly and then converted to a monthly amount to give an indication of the cost in the monthly P&L

The UK model

This model simulates the UK corporation tax system, it uses the following assumptions:

- The fiscal year starts in April and ends in March

- The company's financial year ends 12 months from the beginning of the plan

- When the tax amount is less than £1.5m: it is paid in full 9 months after the financial year-end

- When the tax amount is greater than £1.5m: 4 advances of the estimated current liability are paid in the 7th and 10th month of the current financial year, and the 1st and 4th month of the next financial year. The balance is paid 9 months after the end of the financial year

- The model carries losses forward

- The tax amount is computed yearly and then converted to a monthly amount to give an indication of the cost in the monthly P&L

- If you use a different tax year-end and financial year-end, and switch from a 5 years plan to a 3 years plan: data previously entered in year 4 of your plan can impact the calculation as it won't be reset automatically by the software

The standard model

This model uses the following assumptions:

- The fiscal year is the same as the company's financial year (12 months from the beginning of the plan)

- The corporation tax is computed monthly using the rate you entered and the payment is instantaneous

- The model carries losses forward

The custom model

This model enables you to create a custom tax model using your own set of assumptions.

Things to note about this model:

- Advance and balance payment dates are relative to the tax year

- If you use a different tax year-end and financial year-end, and switch from a 5 years plan to a 3 years plan: data previously entered in year 4 of your plan can impact the calculation as it won't be reset automatically by the software

Note that your chosen model will apply throughout your financial forecast.

In The Business Plan Shop the financial years are necessarily 12 months long.

If you start trading during the year, the software will establish your financial statements over 12 months from the date of beginning of your business plan (for example from September to August).

The best practice in business planning is to always make financial forecasts for a full 12 months. Otherwise the financial years are not comparable and it is not possible to perform a financial analysis of the company.

However, if you wish to use the calendar year end as your financial or fiscal year end, you can do so as follows:

- Choose January as the start month of the plan

- Enter the first year's data in monthly, starting with the fiscal year start month

- Note that if you choose this approach: you will not be able to use the sources and uses table.

Other taxes, for example local taxes such as business rates in the UK, or company car tax, must be entered in the overheads module.

Corporation tax is a tax on the profits of companies. The applicable rate and the methods of calculating the tax base vary slightly from one country to another.

If you are a sole trader, corporation tax might not apply to you: you will be subject to income tax instead.

To know the VAT rate applicable to your products or services, you need to refer to the government website of your country.

If you sell online, you may also be subject to the VAT and equivalent taxes of other countries (for example in the EU you must apply the VAT of the customer's country as soon as you generate more than €1,000 in sales across all countries). For an exhaustive list of applicable regulations, please consult this article.

Most countries have a system of reduced corporation tax rates for small businesses.

The eligibility criteria generally depend on the level of turnover or profit achieved by the company, as well as the composition of its capital.

You can find more information on how the reduced tax rate works on your country's tax website.

We can easily add your currency symbol if it is not in our list, just contact us at support.

If you are in Canada

QST, GST and HST work in a similar way to VAT, so you can simply change the applicable rates and use the VAT function as if it were QST, HST or GST.

Go further with The Business Plan Shop

Was this page helpful?