How does the forecasted financial statements module work?

This article explains how the forecasted financial statements work in The Business Plan Shop's financial forecasting software.

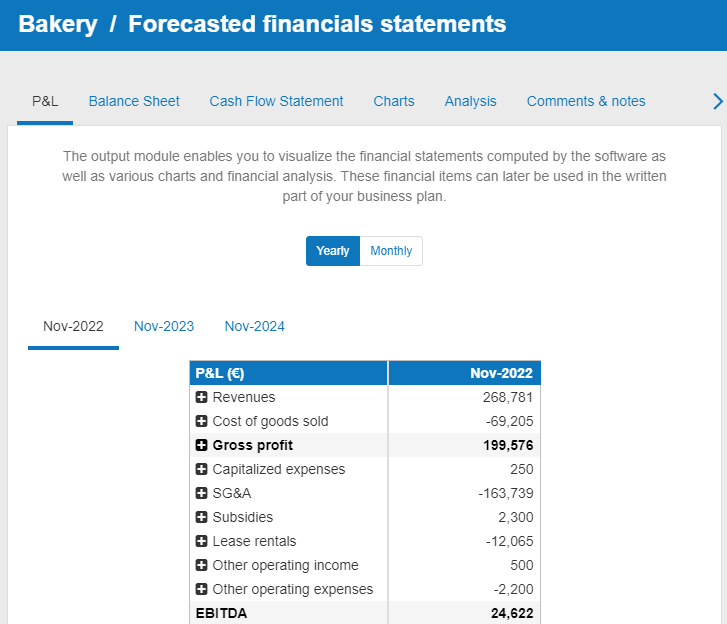

Your forecasted financial statements (P&L, balance sheet, cash flow statement) are built automatically using the data that you input into the software about your business.

How does the module work?

P&L tab

The P&L (Profit and Loss statement) presents an overview of the company’s losses and profits during a financial period.

It enables you to analyse the company's growth and profitability, but doesn’t take working capital movements into account.

Balance sheet tab

The balance sheet gives an overview of the company’s assets (what it possesses or is owned) and liabilities (what it owes to its creditors) at the end of a period.

Cash flow statement tab

The cash flow statement shows how much cash has been generated or consumed by the company over a given period.

The cash flows are broken down by category: operating, investing and financing.

Charts tab

The charts tab allows you to visualize how your financial data would look like in graphic form.

Analysis tab

The analysis tab is comprised of six key parts: financials analysis, credit analysis, break-even analysis, employee report, VAT report and your corporation tax report.

These analysis can be inserted in your business plan, except the VAT report and corporation tax report.

Financial analysis

The financials analysis uses ratios and key performance indicators to summarise how your business is performing in terms of efficiency, growth and profitability.

Credit analysis

The credit analysis uses ratios and key performance indicators to summarise your business's short term liquidity and long-term solvency.

Break-even analysis

The break-even analysis calculates the volume of sales required for the company to reach profitability.

Employee report

The employee report enables you to visualize key statistics on your personnel plan.

VAT report

The VAT report summarises your business's VAT position. It is mainly meant to be used as an audit tool.

Corporation tax report

The corporation tax report details how we compute the corporation tax liability for your business. It is mainly meant to be used as an audit tool.

Comments & notes tab

The comments & notes tab lets you write important notes on each page that may prove useful at a later point.

These notes can be kept private or shared with other users that you have invited on your account.

Frequently Asked Questions

The cash flows linked to the sources and uses are recorded by the software in the opening balance sheet in order to isolate the impact of exceptional elements linked to the creation of the company, and thus to make the financial statements comparable throughout the business plan.

If you prefer to see them appear in period 1, simply change the mapping of your elements from the "start of plan" date to the first month of your forecast. However, if you do this, you will not be able to use the sources and uses table.

If your cash position is at zero and your bank overdraft is increasing in the balance sheet prepared by The Business Plan Shop, your business is not profitable or not sufficiently capitalized.

When your cash flow is negative, the software adds the cash outflow to the existing cash, or, when the cash reaches zero, to the overdraft in the financial debts.

In the software, the numbers in parentheses, such as (5,000), represent negative numbers.

Go further with The Business Plan Shop

Was this page helpful?