How do I use the loans module?

This article explains how you can use the loans module to model loans from financial institutions.

This data enables our software to build your financial statements (balance sheet, P&L, cash flow statement), which can then be downloaded along with your business plan.

It’s fast and easy to do.

What loans are handled by our software?

We handle four types of loans:

- The constant annuity loan

- The constant amortization loan

- The bullet loan

- The custom term loan

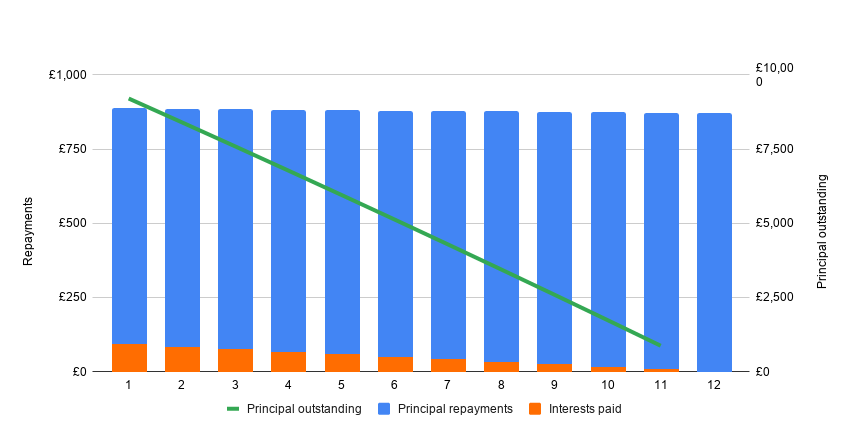

The constant annuity loan

The constant annuity loan is the most common type of loan. Its principle is very simple: you pay a fixed amount at each period (the annuity - note that this is called an annuity even when the payment frequency is not annual), and this amount is divided between the payment of interest and repayment of the principal.

As you repay the loan, the portion of the annuity allocated to interest payments decreases in favour of principal repayments.

Here is an example for a loan of £10,000 over 12 months with a monthly interest rate of 10%:

The constant amortisation loan

The principle of the constant amortisation loan is quite simple: you repay a fixed capital amount at each period and pay in addition the interest on the calculated outstanding capital.

As the repayments are made, the amount of the annuity decreases as the principal is repaid (less interest to be paid).

Here is an example for a loan of £10,000 over 12 months with a monthly interest rate of 10%:

Bullet loan

The bullet loan is very simple: you only pay the interest and repay the entire principal at the end of the borrowing period.

This type of loan is more expensive than other types of loans because, since you do not repay the principal, you have to pay interest on the full amount borrowed each period.

It is also riskier because it requires the company to have a sufficient cash reserve to be able to repay the capital in full at the end. In practice, this type of loan is generally reserved for companies of a certain size, or requires serious guarantees to be given to the bank.

Here is an example for a loan of £10,000 over 12 months with a monthly interest rate of 10%:

Custom term loan

A custom term loan allows you to choose a custom amortization schedule. This is achieved by entering the percentage of principal repaid in each period into our software.

Here is an example of a custom term loan with increasing quarterly repayments between January 2022 and January 2023:

How does the loans module work?

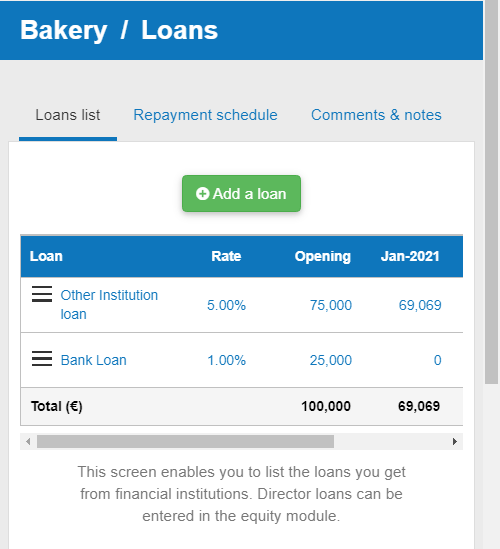

At the centre of the module, you will find a table which details the principal outstanding of each loan.

You can view loan data for up to 5 years from when you started the business plan.

You can edit, copy and delete loans by using the buttons in the table.

You can reorganise loans in the table using drag and drop.

How does the loans module impact my financial forecast?

The Business Plan Shop's Our software will use your loan data to create your forecasted financial statements (P&L, balance sheet and cash flow statement).

These statements also form part of the financial plan section of your business plan.

As soon as you save a new loan amount, the software will automatically recalculate everything to ensure that your financial forecast is up to date. It’s fast and simple, meaning that your plan will always be ready to export.

When building your forecasted financial statements:

- We’ll use the data entered to compute your repayment schedule.

- We’ll then use that data to include the interest charge in your P&L, the principal repayments and interests paid in your cash flow forecast, and the outstanding principal and accrued interests in your balance sheet.

What advice can you give me relating to the module?

You should list any loans that you receive from financial institutions. Director loans can be entered in the equity module.

Frequently Asked Questions

- Simply, click on the add a/an "loans" button above the table

![adding a new loan to the table]()

Notes:

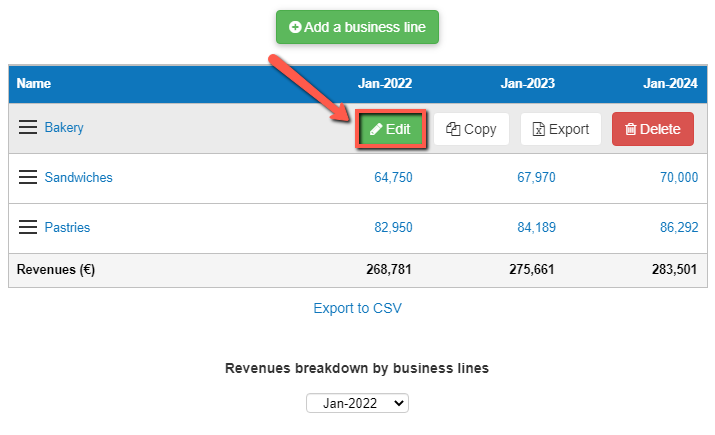

- In this example, we have used a screenshot from the business lines module which works in a similar way as this module

If you are on desktop:

- Choose the row that you want to edit

- Hover your cursor over that row. An edit button will now appear.

![editing loans on desktop in the business plan shop's business planning software]()

- Click on the button

- You should now be able to edit the loans

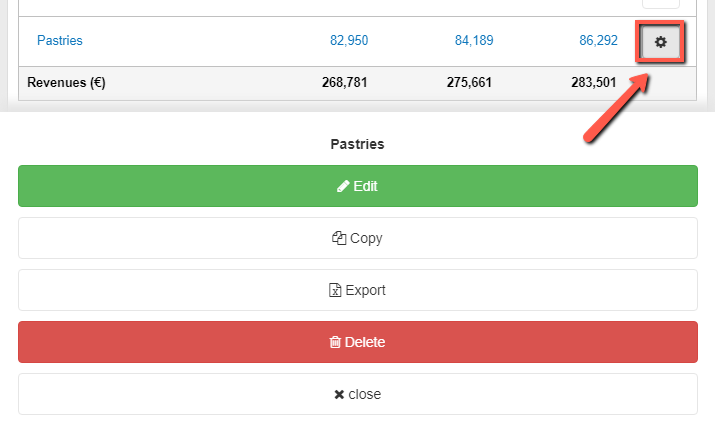

If you are on mobile:

- Choose the row that you want to edit

- Click on the settings button at the end of the row. An edit button will now appear.

![editing loans on mobile]()

- Click on the edit button

- You should now be able to edit the loan

Notes:

- In this example, we have used a screenshot from the business lines module which works in a similar way as this module

- You can also click on the name of the loans in the table to edit it for both desktop and mobile

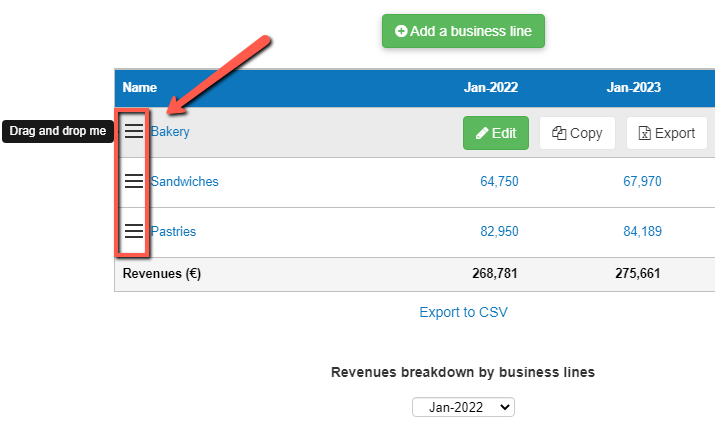

Notes:

- You can re-order loans by dragging and dropping them inside the table

- In this example, we have used a screenshot from the business lines module which works in a similar way as this module

If you are on desktop:

- Click on the drag handle at the beginning of the row

![reordering loans by dragging and dropping them in the table]()

- Click and hold on the icon simultaneously, while dragging it to your chosen location in the table.

- The loans should now be placed in your desired position in the table

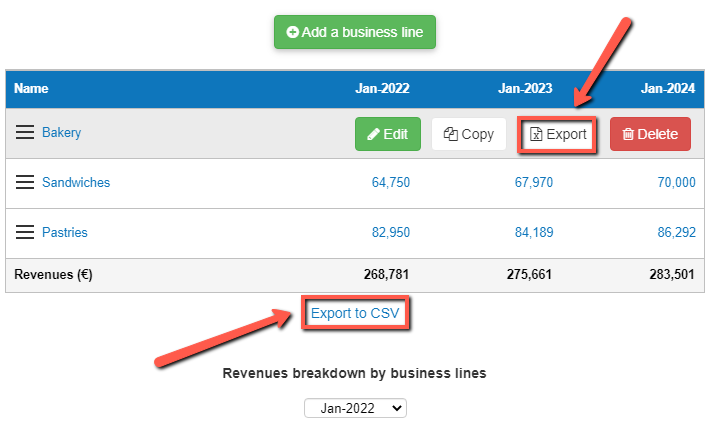

If you are on desktop:

- Choose the row that you want to export

- Hover your cursor over that row. An export button will now appear.

![exporting either a single loan or the entire table of loans on desktop]()

- Click on the export button

- The file will automatically download as a CSV

If you are on mobile:

- Choose the row that you want to export

- Click on the more options icon at the end of the row. An export button will now appear.

![exporting a single loan on mobile]()

- Click on the export button

- The file will automatically download as a CSV

Notes:

- In this example, we have used a screenshot from the business lines module which works in a similar way as this module

- If you are on desktop, you can also click on the "export to CSV" button beneath the table. This exports the entire table, rather than a single loan. In this case, you'll also be given the choice to export either monthly or yearly data.

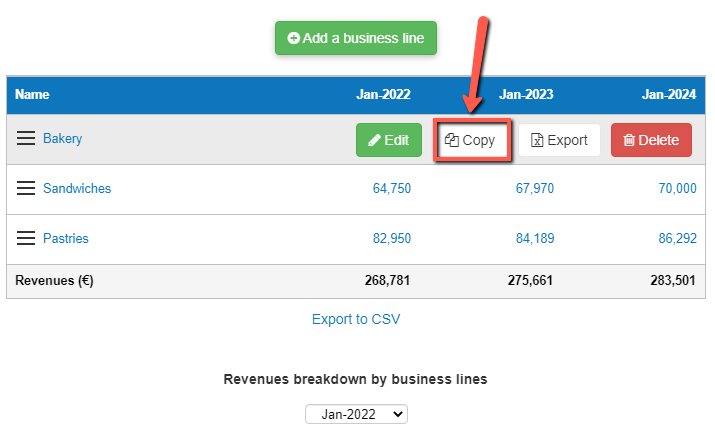

If you are on desktop:

- Choose the row that you want to duplicate

- Hover your cursor over that row. A copy button will now appear.

![producing duplicates of specific loans on desktop]()

- Click on the copy button

- You’ll now have two rows that have the same settings and data

If you are on mobile:

- Choose the row that you want to duplicate

- Click on the more options icon at the end of the row. A copy button will now appear.

![producing duplicates of specific loans on mobile]()

- Click on the copy button

- You’ll now have two rows that have the same settings and data

Notes:

- In this example, we have used a screenshot from the business lines module which works in a similar way as this module

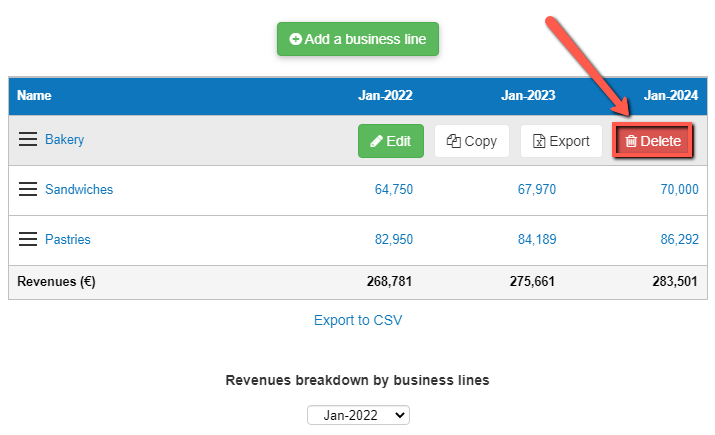

If you are on desktop:

- Choose the row that you want to delete from the table

- Hover your cursor over that row. A delete button will now appear.

![removing outdated loans on desktop]()

- Click on the delete button

- That row will now be deleted from the table

If you are on mobile:

- Choose the row that you want to delete from the table

- Click on the more options icon at the end of the row. A delete button will now appear.

![removing outdated loans on mobile]()

- Click on the delete button

- That row will now be deleted from the table

Notes:

- In this example, we have used a screenshot from the business lines module which works in a similar way as this module

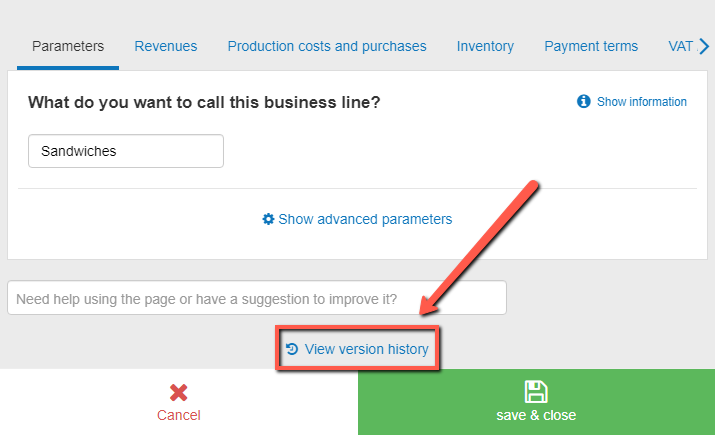

- Click on the name of any loans in the table

- For other ways to edit an loans, check out our FAQ above

- You'll now be taken to the edit view page

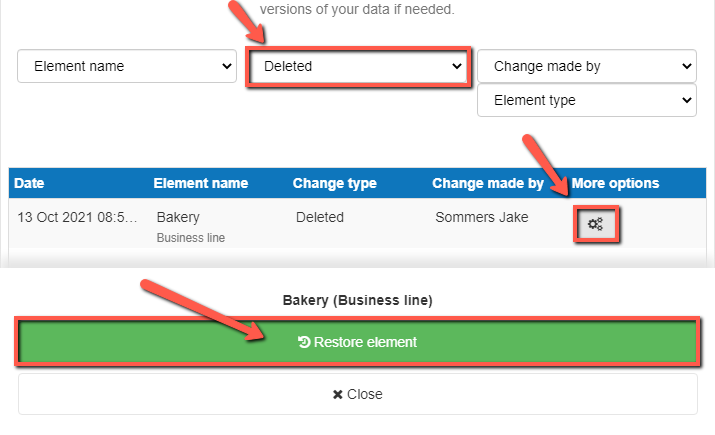

- Scroll down and click on view version history, just beneath the table

![viewing previous versions of the loan table]()

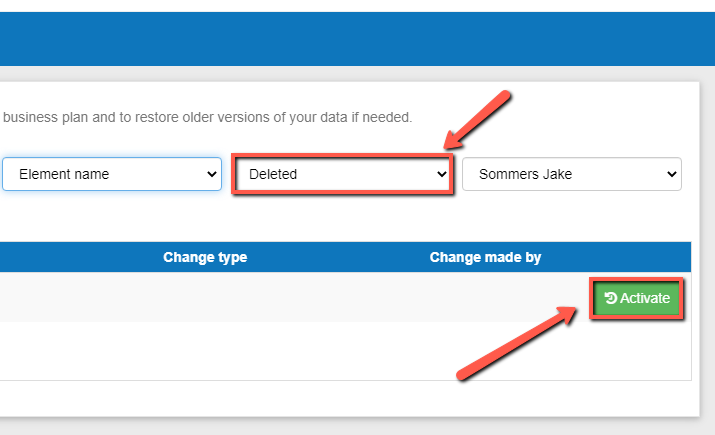

- Use the filters located above the table to find your deleted loans

The final step will depend on whether your on desktop or mobile:

If you are on desktop:

- Click on the "activate" button in the table to restore the loans

![restoring accidently deleted loans on desktop]()

If you are on mobile:

- Click on the "more" button at the end of the row

- Click on the "restore loans" button that appears

![restoring accidently deleted loans on mobile]()

- Click on the "restore loans" button that appears

Go further with The Business Plan Shop

Was this page helpful?