How can I enter loans?

This article explains how to enter loans in The Business Plan Shop's our financial forecasting software.

This data enables our software to build your financial statements (balance sheet, P&L, cash flow statement), which can then be downloaded along with your business plan.

It’s fast and easy to do.

How can I add or edit loans in The Business Plan Shopour software?

Firstly, follow this link to access the loans module.

Once you are on the module, you can either click the add button at the top of the list to add a new loan or edit an existing one.

If you are on desktop, to edit an existing loan:

- Hover your mouse over the row containing the loan in the list

- Click the edit button that appears

If you are on mobile, to edit an existing loan:

- Click on the settings icon at the end of the row containing the loan in the list

- Click on the edit button that appears

How does the edit loan module work?

The module contains tabs that enable you to enter the financial data required to model the loan.

Settings tab

The settings tab allows you to enter the name and the amount for the loan. This is also where you will select the start date, tenor, rate, payment frequency and repayment type.

Grace period tab

The grace period tab is where you can configure potential repayment or interest holidays from which you might benefit.

At a minimum lenders would expect you to pay interests, therefore you cannot have a deferred interest period that is greater than the deferred repayments.

Note that our software will treat deferred interests as new borrowings (they will be capitalized and added to the principal outstanding).

Early Repayments tab

The early repayments tab is only applicable to businesses who wish to repay part of their loan in advance. It lets you enter the amount of principal that you wish to repay early, that amount cannot be greater than the outstanding principal at the time of payment.

Note that the software doesn’t automatically factor any early prepayment fees that might apply.

Repayments schedule tab

The repayments schedule tab allows you to view both the debt service (how much interest and principal you will repay) and the principal outstanding for your loan. It updates everytime you change your settings, even if you haven’t yet saved the changes so that you can view in real time how much you will repay and when.

How does the edit loans module impact my financial forecast?

The Business Plan Shop's Our software will use your loan amount data to create your forecasted financial statements (P&L, balance sheet and cash flow statement).

These statements also form part of the financial plan section of your business plan.

As soon as you save a new loan amount, the software will automatically recalculate everything to ensure that your financial forecast is up to date. It’s fast and simple, meaning that your plan will always be ready to export.

When building your forecasted financial statements:

- We’ll use the data entered to compute your repayment schedule.

- We’ll then use that data to include the interest charge in your P&L, the principal repayments and interests paid in your cash flow forecast, and the outstanding principal and accrued interests in your balance sheet.

What advice can you give me before I begin editing my loans?

You should list any loans that you receive from financial institutions. Director loans can be entered in the equity module.

Frequently Asked Questions

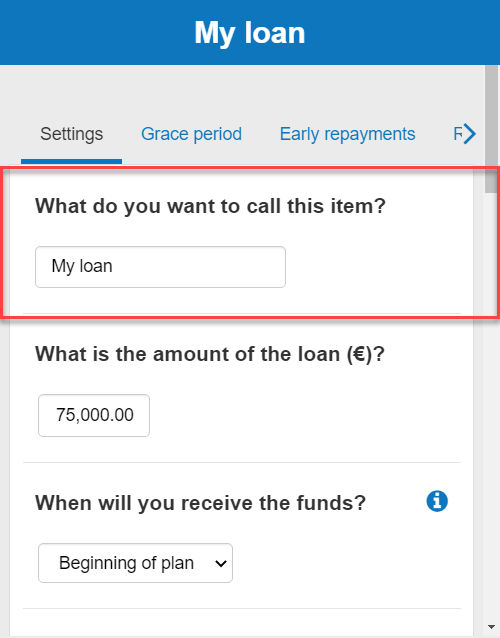

- Firstly, click on the settings tab at the top of this page

- Next, you’ll see a text box with the heading “What do you want to call this item?

![entering investment loan 1A as the loan name into the business plan software]()

- Enter your chosen name into the text box given (In this example, we’ve chosen My Loan as the name of the loan).

- Finally, press the “save and close” button.

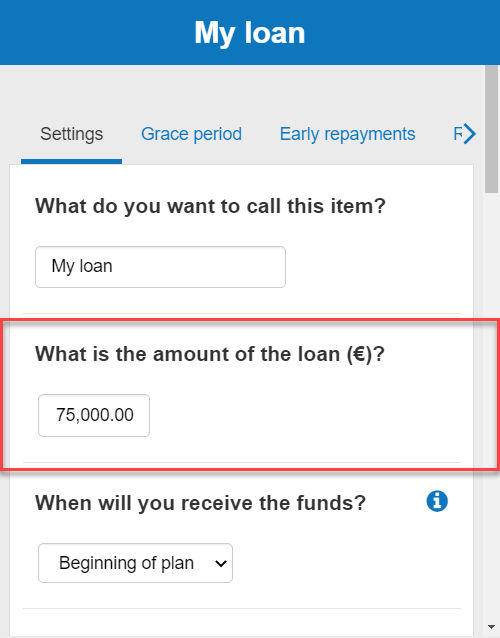

- Firstly, click on the "settings tab" at the top of the page:

- Next, you’ll see a table with the heading "What is the amount of the loan?"

![entering the value of the investment loan amount]()

- Enter the investment loan amount into the software

- Press save & close

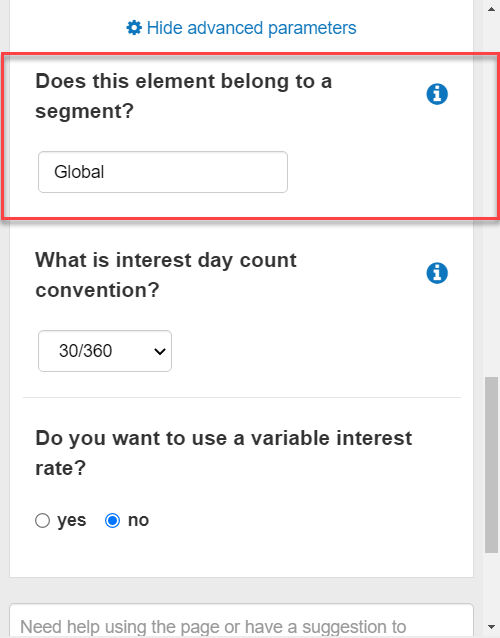

Classifying your loan by segment allows you to group expenses in your forecasted financial statements.

This means that you can breakdown and adjust the level of details when you export your business plan.

To classify your loan by segment:

- Firstly, click on the settings tab at the top of this page

- Next, scroll down to the bottom of the page and click on “show advanced parameters”

- You’ll see a text box with the heading “does this element belong to a segment?

Enter your chosen segment name into the text box given

- If you don't want to use a segment leave the field empty or on “Global”

Finally, press the “save and close” button

There are four types of loans:

- The constant annuity loan

- The constant amortization loan

- The bullet loan

- The custom term loan

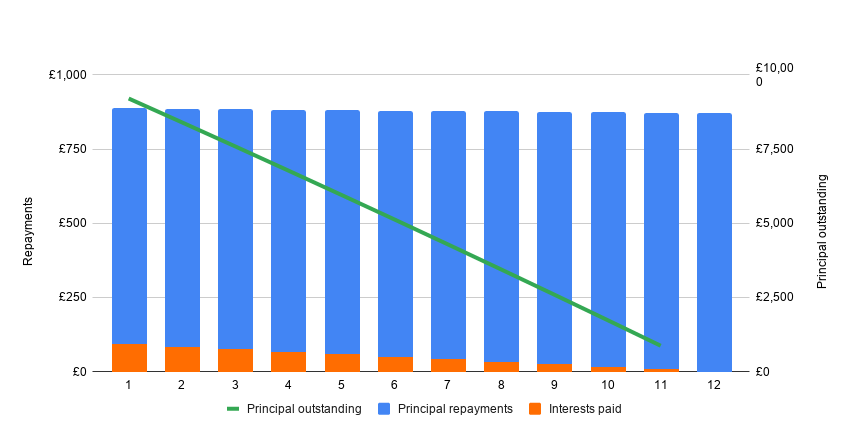

The constant annuity loan

The constant annuity loan is the most common type of loan. Its principle is very simple: you pay a fixed amount at each period (the annuity), and this amount is divided between the payment of interest and repayment of the principal.

As you repay the loan, the portion of the annuity allocated to interest payments decreases in favour of principal repayments.

Here is an example for a loan of £10,000 over 12 months with a monthly interest rate of 10%:

The constant amortisation loan

The principle of the constant amortisation loan is quite simple: you repay a fixed capital amount at each period and pay in addition the interest on the calculated outstanding capital.

As the repayments are made, the amount of the annuity decreases as the principal is repaid (less interest to be paid).

Here is an example for a loan of £10,000 over 12 months with a monthly interest rate of 10%:

Bullet loan

The operation of the bullet loan is very simple: you only pay the interest and repay the entire principal at the end of the borrowing period.

This type of loan is more expensive than other types of loans because, since you do not repay the principal, you have to pay interest on the full amount borrowed each period.

It is also riskier because it requires the company to have a sufficient cash reserve to be able to repay the capital in full at the end. In practice, this type of loan is generally reserved for companies of a certain size, or requires serious guarantees to be given to the bank.

Here is an example for a loan of £10,000 over 12 months with a monthly interest rate of 10%:

Custom term loan

A custom term loan allows you to choose a custom amortization schedule. This is achieved by entering the percentage of principal repaid in each period into our software.

Here is an example of a custom term loan with increasing quarterly repayments between January 2022 and January 2023:

Go further with The Business Plan Shop

Was this page helpful?