How to create a financial forecast for a fruit processing firm?

Creating a financial forecast for your fruit processing firm, and ensuring it stays up to date, is the only way to maintain visibility on future cash flows.

This might sound complex, but with the right guidance and tools, creating an accurate financial forecast for your fruit processing firm is not that hard.

In this guide, we'll cover everything from the main goal of a financial projection, the data you need as input, to the tables that compose it, and the tools that can help you build a forecast efficiently.

Without further ado, let us begin!

Why create and maintain a financial forecast for a fruit processing firm?

The financial projections for your fruit processing firm act as a financial blueprint to guide its growth with confidence and ensure its long-term financial viability.

To create them, you will need to look at your business in detail - from sales to operating costs and investments - to assess how much profit it can generate in the years to come and what will be the associated cash flows.

During challenging market conditions, maintaining an up-to-date financial forecast enables early detection of potential financial shortfalls, allowing for timely adjustments or securing financing before facing a cash crisis.

Your fruit processing firm's financial forecast will also prove invaluable when seeking financing. Banks and investors will undoubtedly request a thorough examination of your financial figures, making precision and presentation essential.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

What information is used as input to build a fruit processing firm financial forecast?

A fruit processing firm's financial forecast is only as good as the inputs used to build it.

If you are creating (or updating) the forecast of an existing fruit processing firm, then you mostly need your accounting information, key historical operating non-financial data, and your team’s input on what to expect for the coming years.

If you are building financial projections for a fruit processing firm startup, you will need to have done your research and have a clear picture of your competitive environment and go-to-market strategy so that you can forecast sales accurately.

For a new venture, you will also need a precise list of the resources needed to keep the fruit processing firm running on a day-to-day basis and a list of the equipment and expenditures required to start the business (more on that later).

Let's now take a closer look at the elements that make up your fruit processing firm's financial forecast.

The sales forecast for a fruit processing firm

From experience, it is usually best to start creating your fruit processing firm financial forecast by your sales forecast.

To create an accurate sales forecast for your fruit processing firm, you will have to rely on the data collected in your market research, or if you're running an existing fruit processing firm, the historical data of the business, to estimate two key variables:

- The average price

- The number of monthly transactions

To get there, you will need to consider the following factors:

- Seasonal Variations: As a fruit processing firm, you are aware that certain fruits are only available during specific seasons. This can affect your average price and number of monthly transactions as the availability of these fruits may cause fluctuations in demand and supply.

- Weather Conditions: Weather plays a crucial role in the growth and quality of fruits. Adverse weather conditions such as drought, floods, or extreme temperatures can impact the supply of fruits, which may lead to an increase in prices and affect the number of monthly transactions.

- Competition: The fruit processing industry is becoming increasingly competitive, and new players are constantly entering the market. This can affect your average price and number of monthly transactions as competitors may offer similar products at lower prices, leading to a decrease in demand for your products.

- Consumer Trends: Consumer preferences and trends can also influence the average price and number of monthly transactions for your fruit processing firm. For example, a growing trend towards healthy eating may increase the demand for your products, leading to higher prices and more transactions.

- Economic Conditions: The overall economic conditions of a country or region can have a significant impact on your business. In times of economic downturn, consumers may be more price-sensitive, leading to a decrease in your average price and number of monthly transactions.

Once you have an idea of what your future sales will look like, it will be time to work on your overhead budget. Let’s see what this entails.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The operating expenses for a fruit processing firm

Once you know what level of sales you can expect, you can start budgeting the expenses required to operate your fruit processing firm on a daily basis.

Expenses normally vary based on how much revenue you anticipate (which is why, from experience, it is always better to start your forecast with the topline projection), and where your business is based.

Operating expenses for a fruit processing firm will include some of the following items:

- Staff costs: This includes salaries, benefits, and training expenses for your employees who will be involved in the fruit processing operations.

- Accountancy fees: You will likely need to hire an accountant or accounting firm to help you manage your financial records and file taxes accurately.

- Insurance costs: It is important to have insurance coverage for your fruit processing firm to protect against potential risks such as product recalls or equipment damage.

- Software licenses: Depending on the specific processes and systems you use, you may need to pay for software licenses to manage inventory, track sales, or perform other essential tasks.

- Banking fees: You will likely have to pay fees for maintaining a business bank account, wire transfers, and other banking services.

- Raw materials: This includes the cost of purchasing fruits from suppliers to be used in the processing of your products.

- Packaging materials: You will need to purchase packaging materials, such as boxes and labels, to package and label your fruit products.

- Utilities: This includes the cost of electricity, water, and gas used in your fruit processing operations.

- Rent or mortgage: If you do not own the building where your fruit processing firm is located, you will need to budget for rent or mortgage payments.

- Marketing and advertising: You will need to promote your fruit products through various marketing and advertising channels to reach potential customers.

- Transportation costs: This includes the cost of transporting raw materials to your facility and delivering finished products to customers.

- Maintenance and repairs: You will need to budget for regular maintenance and repairs of equipment and facilities used in your fruit processing operations.

- Taxes and licenses: As a business, you will be responsible for paying taxes and obtaining necessary licenses to operate legally.

- Consulting fees: You may need to hire consultants or experts to help you with specific aspects of your fruit processing operations, such as food safety regulations or product development.

- Waste disposal: There will likely be costs associated with proper disposal of waste generated during the fruit processing process.

This list will need to be tailored to the specificities of your fruit processing firm, but should offer a good starting point for your budget.

What investments are needed to start or grow a fruit processing firm?

Once you have an idea of how much sales you could achieve and what it will cost to run your fruit processing firm, it is time to look into the equipment required to launch or expand the activity.

For a fruit processing firm, capital expenditures and initial working capital items could include:

- Equipment: This includes machinery and tools used in the processing of fruits, such as peelers, slicers, and blenders.

- Furniture and Fixtures: This category includes items like tables, chairs, and display cases for retail areas or office furniture.

- Vehicles: Depending on the size of your fruit processing firm, you may need to invest in delivery trucks or vans to transport your products to retailers or wholesalers.

- Buildings: If you are looking to expand your operations, you may need to purchase or lease additional buildings to house your processing equipment and storage areas.

- Technology: This could include purchasing software or hardware for inventory management, accounting, or quality control processes.

Again, this list will need to be adjusted according to the specificities of your fruit processing firm.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The financing plan of your fruit processing firm

The next step in the creation of your financial forecast for your fruit processing firm is to think about how you might finance your business.

You will have to assess how much capital will come from shareholders (equity) and how much can be secured through banks.

Bank loans will have to be modelled so that you can separate the interest expenses from the repayments of principal, and include all this data in your forecast.

Issuing share capital and obtaining a bank loan are two of the most common ways that entrepreneurs finance their businesses.

What tables compose the financial plan for a fruit processing firm?

Now let's have a look at the main output tables of your fruit processing firm's financial forecast.

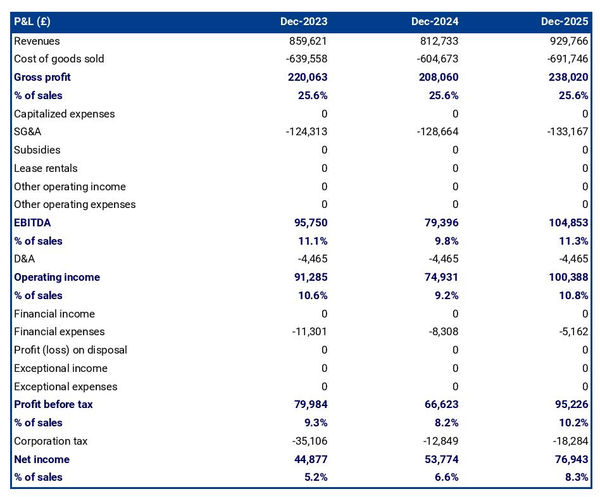

The forecasted profit & loss statement

The profit & loss forecast gives you a clear picture of your business’ expected growth over the first three to five years, and whether it’s likely to be profitable or not.

A healthy fruit processing firm's P&L statement should show:

- Sales growing at (minimum) or above (better) inflation

- Stable (minimum) or expanding (better) profit margins

- A healthy level of net profitability

This will of course depend on the stage of your business: numbers for an established fruit processing firm will look different than for a startup.

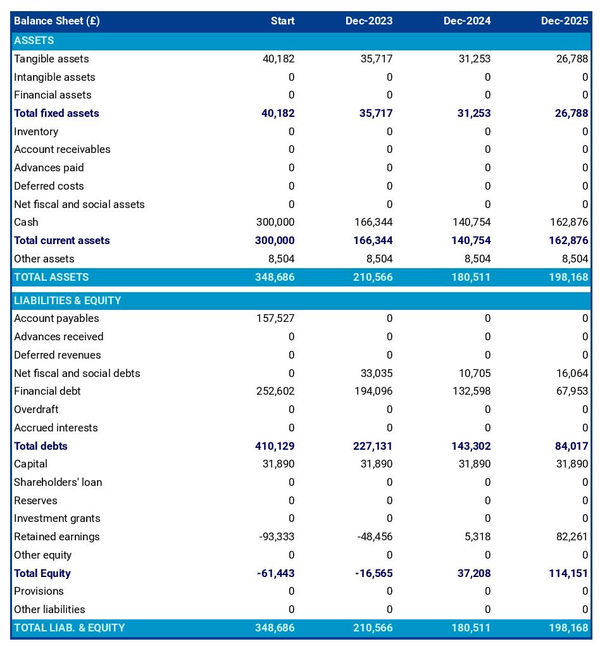

The projected balance sheet

The projected balance sheet gives an overview of your fruit processing firm's financial structure at the end of the financial year.

It is composed of three categories of items: assets, liabilities and equity:

- Assets: are what the business possesses and uses to produce cash flows. It includes resources such as cash, buildings, equipment, and accounts receivable (money owed by clients).

- Liabilities: are the debts of your fruit processing firm. They include accounts payable (money owed to suppliers), taxes due and bank loans.

- Equity: is the combination of what has been invested by the business owners and the cumulative profits to date (which are called retained earnings). Equity is a proxy for the value of the owner's stake in the business.

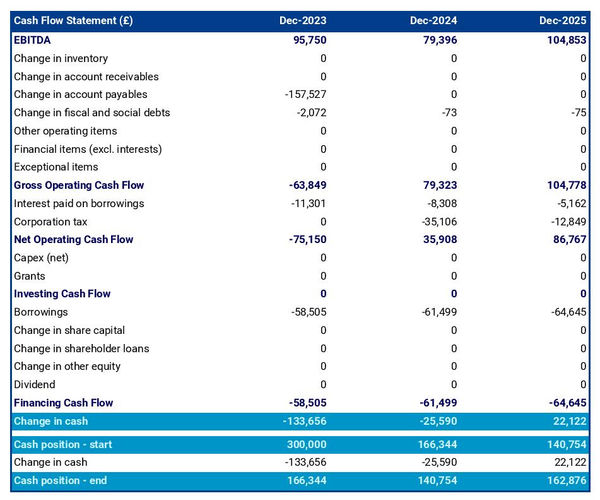

The cash flow forecast

Your fruit processing firm's cash flow forecast shows how much cash your business is expected to consume or generate in the years to come.

It is best practice to organise the cash flow forecast by nature to better explain where cash is used or generated by the fruit processing firm:

- Operating cash flow: shows how much cash is generated by the operating activities

- Investing cash flow: shows how much will be invested in capital expenditure to maintain or expand the business

- Financing cash flow: shows if the business is raising new capital or repaying financiers (debt repayment, dividends)

Keeping an eye on (and regularly updating) your fruit processing firm's cash flow forecast is key to ensuring that your business has sufficient liquidity to operate normally and to detect financing requirements as early as possible.

If you are trying to raise capital, you will normally be asked to provide a monthly cash flow forecast in your fruit processing firm's financial plan - so that banks or investors can assess seasonal variation and ensure your business is appropriately capitalised.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Which tool should you use to create your fruit processing firm's financial projections?

Building a fruit processing firm financial forecast is not difficult provided that you use the right tool for the job. Let’s see what options are available below.

Using online financial forecasting software to build your fruit processing firm's projections

The modern and easiest way is to use an online financial forecasting tool such as the one we offer at The Business Plan Shop.

There are several advantages to using specialised software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You have access to complete financial forecast templates

- You get a complete financial forecast ready to be sent to your bank or investors

- You can easily track your actual financial performance against your financial forecast, and recalibrate your forecast as the year goes by

- You can create scenarios to stress test your forecast's main assumptions

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

- It’s cost-efficient and much cheaper than using an accountant or consultant (see below)

If you are interested in this type of solution, you can try our projection software for free by signing up here.

Hiring a financial consultant or chartered accountant

Hiring a consultant or chartered accountant is also an efficient way to get a professional fruit processing firm financial projection.

As you can imagine, this solution is much more expensive than using software. From experience, the creation of a simple financial forecast over three years (including a balance sheet, income statement, and cash flow statement) is likely to start around £700 or $1,000 excluding taxes.

The indicative estimate above, is for a small business, and a forecast done as a one-off. Using a financial consultant or accountant to track your actuals vs. forecast and to keep your financial forecast up to date on a monthly or quarterly basis will naturally cost a lot more.

If you choose this solution, make sure your service provider has first-hand experience in your industry, so that they may challenge your assumptions and offer insights (as opposed to just taking your figures at face value to create the forecast’s financial statements).

Why not use a spreadsheet such as Excel or Google Sheets to build your fruit processing firm's financial forecast?

Creating an accurate and error-free fruit processing firm financial forecast with a spreadsheet is very technical and requires a deep knowledge of accounting and an understanding of financial modelling.

Very few business owners are financially savvy enough to be able to build a forecast themselves on Excel without making mistakes.

Lenders and investors know this, which is why forecasts created on Excel by the business owner are often frowned upon.

Having numbers one can trust is key when it comes to financial forecasting and to that end using software is much safer.

Using financial forecasting software is also faster than using a spreadsheet, and, with the rise of artificial intelligence, software is also becoming smarter at helping us analyse the numbers to make smarter decisions.

Finally, like everything with spreadsheets, tracking actuals vs. forecasts and keeping your projections up to date as the year progresses is manual, tedious, and error-prone. Whereas financial projection software like The Business Plan Shop is built for this.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Use our financial projection templates for inspiration

The Business Plan Shop has dozens of financial forecasting templates available.

Our examples contain both the financial forecast, and a written business plan which presents, in detail, the company, the team, the strategy, and the medium-term objectives.

Whether you are just starting out or already have your own fruit processing firm, looking at our template is always a good way to get ideas on how to model financial items and what to write when creating a business plan to secure funding.

Takeaways

- A financial forecast shows expected growth, profitability, and cash generation metrics for your fruit processing firm.

- Tracking actuals vs. forecast and having an up-to-date financial forecast is key to maintaining visibility on your future cash flows.

- Using financial forecasting software is the modern way of creating and maintaining financial projections.

We hope that this guide helped you gain a clearer perspective on the steps needed to create the financial forecast for a fruit processing firm. Don't hesitate to contact us if you have any questions!

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Also on The Business Plan Shop

- Financial forecast example

- How to create a turnover forecast for a business?

- Example of financial forecast for business idea

Know someone who runs a fruit processing firm? Share our business guide with them!