How to prepare financial projections for a business plan?

In this guide, we explain what business plan financial projections look like, what tools can be used to create them accurately, and where to find examples.

Ready? Let's get started!

What are financial projections in a business plan?

In a business plan, financial projections show the expected business performance over the next three or five years in numerical terms.

They help translate the actions planned in your business plan into tangible levels of profitability and cash flows.

This is achieved by building a financial forecast containing a balance sheet, profit and loss statement, and cash flow statement (each of which we will talk about in detail later in the guide).

Why do we need financial projections in a business plan?

There are four key reasons why every business plan should have a set of financial projections spanning either three or five years. Let's explore them!

To demonstrate that the business is financially viable

The definition of a business that is financially viable, is one that has the ability to pay off both short and long-term obligations as they fall due. This is measured by the cash flows generated and/or the liquidity of the business' assets.

Financial ratios are often used to calculate viability metrics and these involve figures found in the balance sheet, income statement, and cash flow statement (all of which are part of a business plan's financial projections).

To assess the funding requirements

Projecting and calculating cash flow helps you understand how much cash your business will generate or consume over the next three to five years.

You can then compare this with your current and projected cash position to decide whether or not you require additional funding to negate any shortfalls in cash.

To assess the business' borrowing capacity

Banks or investors will look at your financial statements when your business applies for a loan and use the financial projections to compute key metrics such as coverage ratios (interest coverage ratio for e.g.) and liquidity ratios (current ratio for e.g.).

Calculating such ratios helps banks or investors understand how much borrowing capacity your business has (i.e. how much they would be willing to lend to you given your business's financials, their risk appetite and the overall economic state).

To assess the value of the business and potential return on investment

Your financial projections allow key stakeholders to value your business using various methodologies such as a discounted cash flow valuation or by applying a multiple to key metrics such as your revenues or EBITDA.

This valuation can then be used by investor to estimate their return on investment by comparing the value of your business today with the expected value at exit.

Doing so helps them understand their likely return and whether or not they should be investing in your business (because there is an opportunity cost - they may receive a better rate of return on another project).

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

What do financial projections include in a business plan?

Let's now have a look at the different elements which compose a financial projection.

Projected sales

The sales forecast shows the business's main activities and how much revenues each of them is expected to generate.

In this travel agency example, the business' three main activities are local tours, business tours and international tours:

Projected expenditures

The projected expenditures or overheads show all the day-to-day costs of running the business.

These normally include common expenses such as marketing, rent, or insurance:

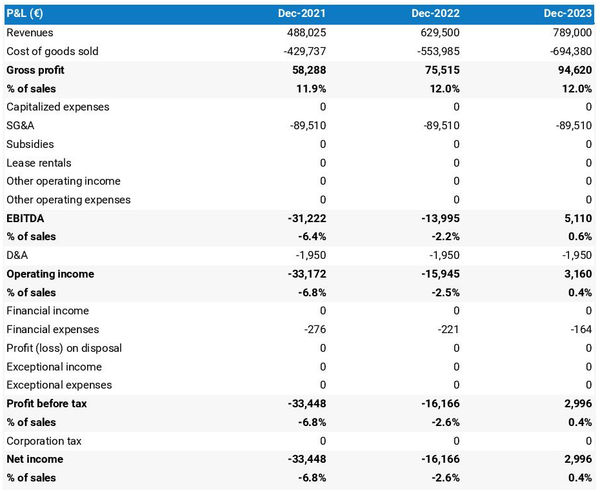

Projected profit and loss statement

A projected P&L statement shows how much profit the company might make and how much it is likely to grow in the future.

It helps stakeholders understand how successful the company could be and if it is profitable or loss-making.

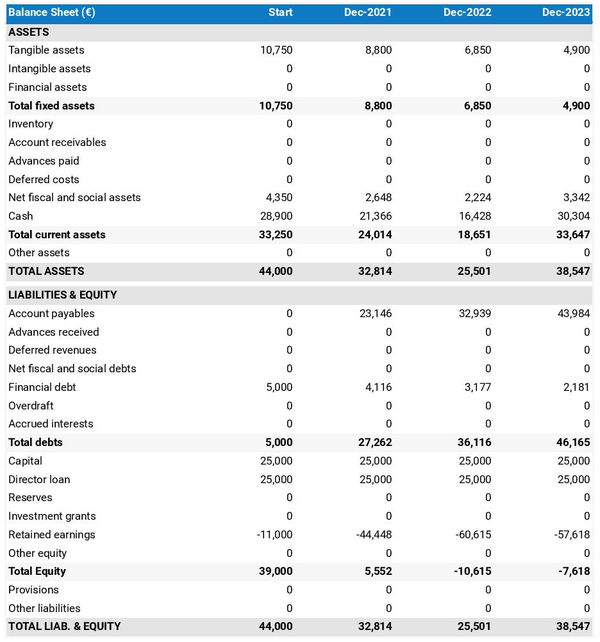

Projected balance sheet

A balance sheet is an essential tool for managing the finances of your business, as it helps you to track what your assets are worth and how much debt you owe.

It provides valuable insight into the solvability and liquidity of your business, allowing you to assess whether it can pay its debts as they become due.

By regularly monitoring your balance sheet, you can better manage risks and make sure that your business is sufficiently capitalised.

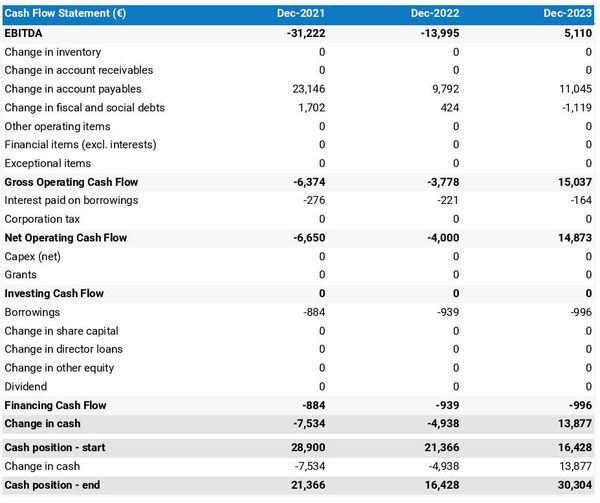

Projected cash flow forecast

A projected cash flow statement (or cash flow forecast) is a document that shows how much cash a business expects to generate and spend in the future.

It helps you check if your business will have a strong enough cash position to cover current and upcoming expenses, or if you need additional capital from outside sources.

It also explains how cash is used inside the business.

Sources & Uses

An initial financing plan, also known as a sources and uses table, is a helpful tool which shows how you will finance the creation (or expansion) of your business and what the initial financing will be used for.

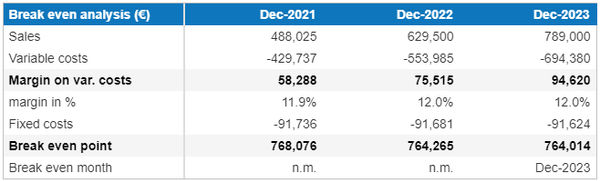

Break-even point analysis

The break-even analysis shows how many units of a good or service your business needs to sell to break-even (the point where your total costs are equal to your revenue).

Any sales made after the break-even point is achieved is profit.

What tools can I use to create financial projections for a business plan?

There are three main solutions that you can use to build your business plan financial projections:

- Use Word or Excel

- Hire an accountant to help you

- Use an online business plan software

Build your business plan financial projections using Word or Excel

One of the main advantages of using Excel to create financial projections for your business plan is the cost - the program is relatively cheap and widely available.

However, creating financial projections in Excel requires expert knowledge in accounting and financial modelling. This is mandatory both to create the projections without errors and for the numbers to be taken seriously by financiers.

Hire an accountant to help you build your business plan's financial projections

Outsourcing your financial projections to a consultant or accountant is an attractive option for many business owners.

On the plus side, both consultants and accountants have a knack for creating accurate financial forecasts.

On the other hand, these services are expensive with a simple financial forecast starting at around £700 ($1,000), from experience.

Use an online business plan software to help you build your business plan financial projections

These days, the market practice and most popular alternative is to use online business plan software to crunch the numbers for you.

There are several advantages to doing so, as with software you can:

- Create a forecast faster than with Excel, without errors, and for much cheaper than by outsourcing this to a consultant

- Easily make your financial forecast by letting the software take care of the financial calculations for you

- Easily incorporate even the most complex of costs into your financial projections

- Get a professional document, formatted and ready to be sent to your bank or investors

- Easily keep your forecast up to date, and compare it against your accounting data to make sure you are on track to deliver your plan, or make adjustments if needed

If you're interested in using this type of solution, you can try our software for free by signing up here.

What are the steps to create financial projections for a business plan?

In this section, we take a look at the steps needed to create financial projections for both startups and existing businesses.

Startups

1/ Assess your potential sales volume

The first step to create financial projections for a startup is to estimate how many units you think you will sell each month.

The exact definition of a unit will vary based on your type of business, it could be a product for a store, a number of billable hours for a lawyer, etc.

To assess how many units you can sell each month, you will need to have done your market research and put in place a go-to-market strategy.

You will also need to take into account, your products or services mix (what items are more popular or frequently bought together), the length of your sales cycle, your capacity (how many customers can you serve at most), and seasonality (when are you most busy during the year).

2/ Derive your sales forecast

Once you know how many units you will sell, multiply the number of units by the average price for your products or services.

This will give you the total sales value (price multiplied by volume).

3/ Assess inventory levels and procurement

Once you have a sales forecasts in place, the next step is to look at the inventory needed, and the purchase costs (retail) or production costs (manufacturing, service, or agriculture) in order to estimate your gross profit.

Your inventory levels will be derived from your sales forecast. For example, if you want to sell 100 widgets per week, you require at least that amount in inventory, so you need to purchase {x} widgets every month.

Similarly, for both services and manufacturing, you will need to assess how much production capacity you have and the associated production costs.

Once you have this information, you can assess your cost of goods sold and derive your gross profit (sales minus cost of goods sold).

4/ Assess sales and marketing expenses

The next step for your forecast is to ensure you have the resources required to achieve your sales targets.

Your sales and marketing expenses might include a mix of people, ad spend, communication expenses, distribution costs, etc.

The exact level of resources required will depend on your business model and location.

For example, a store located in a shopping mall with a high footfall should naturally attract a large number of potential customers in-store. And might, therefore, want to focus its sales and marketing spend on attractive discounts and loyalty schemes.

A manufacturer might have to put in place a sales team that can negotiate effectively with retailers and other potential distributors.

A web agency might need to deploy a mix of effective cold calling and online advertising campaigns to reach small businesses.

Once you've assessed the sales and marketing expenses, you can move on to the general and administrative expenses.

5/ Assess general and administrative costs

You now need to assess the level of general and administrative expenses which will include all other operating expenditures: rent, staff, accountant, insurance, utilities, etc.

Again, this will depend on your business model and location.

An e-commerce business that does not have a physical venue would not have to pay for expenses such as rent or building insurance. They, will, however, still incur staffing costs.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

6/ Assess the capital expenditures required

The next step to create the financial projections of your business plan is to look at the investments required. This will apply more to some business models than others.

If you run a manufacturing business, for example, you'll likely have a high level of capital expenditure, such as machinery and equipment required to mass produce goods.

Therefore, you'll need to assess how much these will cost you to both purchase and run (including maintenance costs).

7/ Assess other startup costs

Startup costs are the costs associated with creating a new business, such as licencing, the cost of registering the business, lawyer fees for producing the paperwork such as contracts and terms of business, etc.

Here also, the exact costs will depend on your type of business.

8/ Model payment terms and tax

Payment terms might vary (especially if you are a startup). Whilst you may have to pay suppliers upfront right now, you'll likely build up trust with them and be offered more favourable payment terms in the future.

This means that it's important to ensure that your projections reflect this and that your payment terms are easy to adjust (if you don't know how future payment terms will look already).

You'll also need to take into account corporation or income tax in your financial projections.

If you sell goods or services, there will be a sales tax (also called VAT or GST) applied to what your business sells and buys. This will need to be modelled as well.

9/ Balance your cash position

At this stage, you will need to check your sources and uses table to understand whether you have enough cash at the beginning of your business plan.

Then you will need to repeat the operation on the cash flow statement to ensure your business has enough cash throughout your business plan.

If your business shows a cash shortfall, then you will need to add equity or debt to balance things out.

10/ Model borrowings

If you've taken out a bank loan to fund your startup, you'll need to compute interests and include monthly repayments as part of your financial projections.

11/ Check projected cash flows

At this stage your financial projections shoudl be complete, it's now a good idea to check your cash flow forecast.

Doing so allows you to verify whether or not your business will have a positive cash balance (presuming that your projections are accurate) so that you can afford to repay your debt with comfortable headroom.

Existing business

For existing businesses, the steps are similar to those that are listed above for startups. There are, however, two key differences:

- Existing businesses start with an opening balance which is not at zero.

- Existing businesses can use historical data as a starting point for their financial projections. This means that they are much more likely to be accurate as they are based on real-life figures, rather than pure estimates.

With The Business Plan Shop, it's easy to import your historical data into our software and use it as a budgeting base to create your financial forecast or projections. All you need to do is adjust the numbers for growth in years two and three inside our software.

You can also import your existing balance sheet so that you don't have to input your assets, equity, or liabilities from scratch.

Sanity checking and stress testing the financial projections in your business plan

Once you've done your financial projections, you need to ensure that they are realistic by checking that you've taken into account the following elements.

Seasonality

The overall effect that seasonality will have on your financial projections depends on your business type.

For example, if you own an ice cream parlour, the figures in your sales forecast should reflect the difference between the summer and winter months.

Capacity

Capacity refers to the volume of sales which your business can handle.

If you're a small coffee shop for example, it's unlikely that you'll be able to sell 50,000 cups of coffee every day.

Even if you believe that there is sufficient demand to meet this target, your business probably doesn't have the capacity (staff and equipment) to serve that many customers.

Expected growth is reasonable given your level of notoriety / past performance

If you're an existing business that's been operating for a number of years, it's unlikely that your sales will suddenly increase rise by 200% in any given year (unless something dramatic happens).

It's more likely that your expected growth will be in line with growth from previous years.

Similarly, as an unknown startup, it is unlikely that your sales will immediately skyrocket. You will need time to make a name for yourself and for word of mouth to kick in.

Costs evolve in line with sales

If your business' sales increase, it's likely that your total costs will also increase (but not necessarily by the same percentage).

For example, if you are a coffee shop, and you sell more cups of coffee, you'll probably need to use a higher volume of milk and coffee beans.

You may also need more baristas in-house to make those extra cups of coffee, and that could increase wages and/or salary costs.

Make sure this is reflected in your financial projections.

How often do I need to monitor and adjust my financial projections?

Once you've built your financial projections (spanning either three or five years), it's a good idea to update them regularly.

How often you update your projections will depend on a number of factors. If there's a big change in the economic activity (for example, if the economy enters a sudden recession), you would need to act sooner rather than later.

Usually, it's a good idea to go over them at the end of each month or quarters to see how well your business performed compared to the previous period and to what was planned in your business plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Where can I find examples and templates of financial projections for a business plan?

You can read our guide on Financial forecast example for startups.

You can also have a look at our business plan templates - each one comes equipped with an editorial section and a set of financial projections for that business type!

This is the end of our guide, we hope it helped you better understand how to create financial projections for a business plan.

Also on The Business Plan Shop

- Three ways to create a financial forecast for a business idea

- Financial forecast example for new businesses and startups

- How do I write the key assumptions section of my business plan?

- Business plan vs business proposal

- How do I write the research and development section of my business plan?

Know someone looking to make financial projections? Share this article with them!