Our painting company business plan template gives you the structure to write a professional plan

Not accustomed to writing business plans? Our painting company business template will turn a typically challenging process into a total breeze.

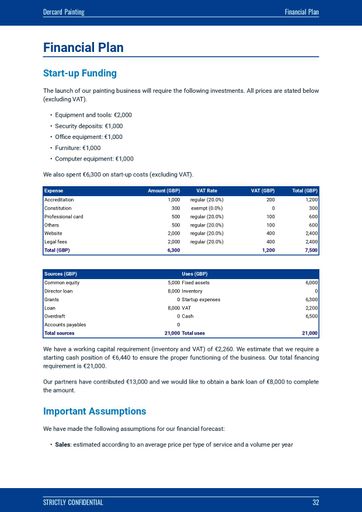

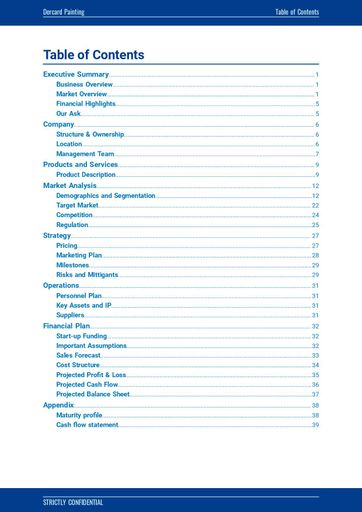

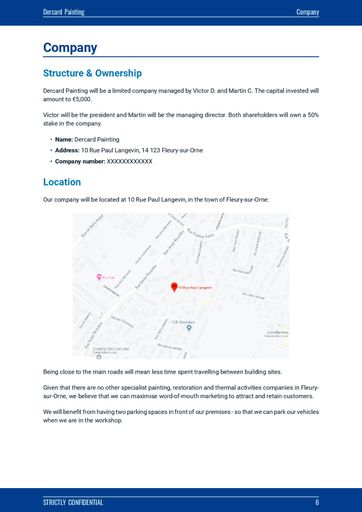

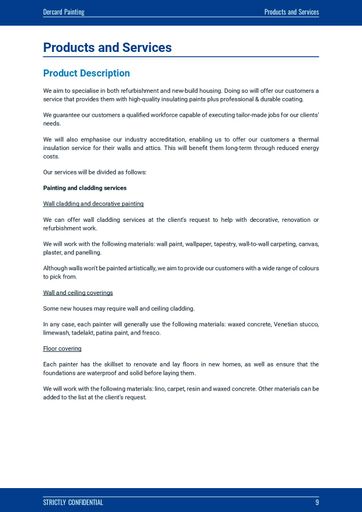

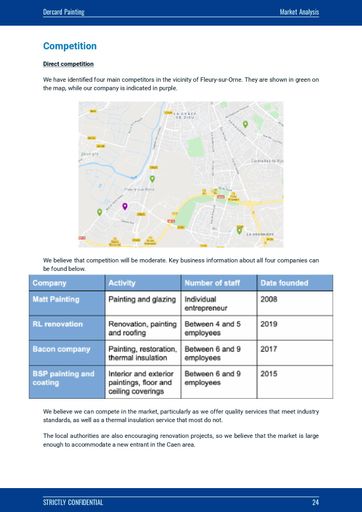

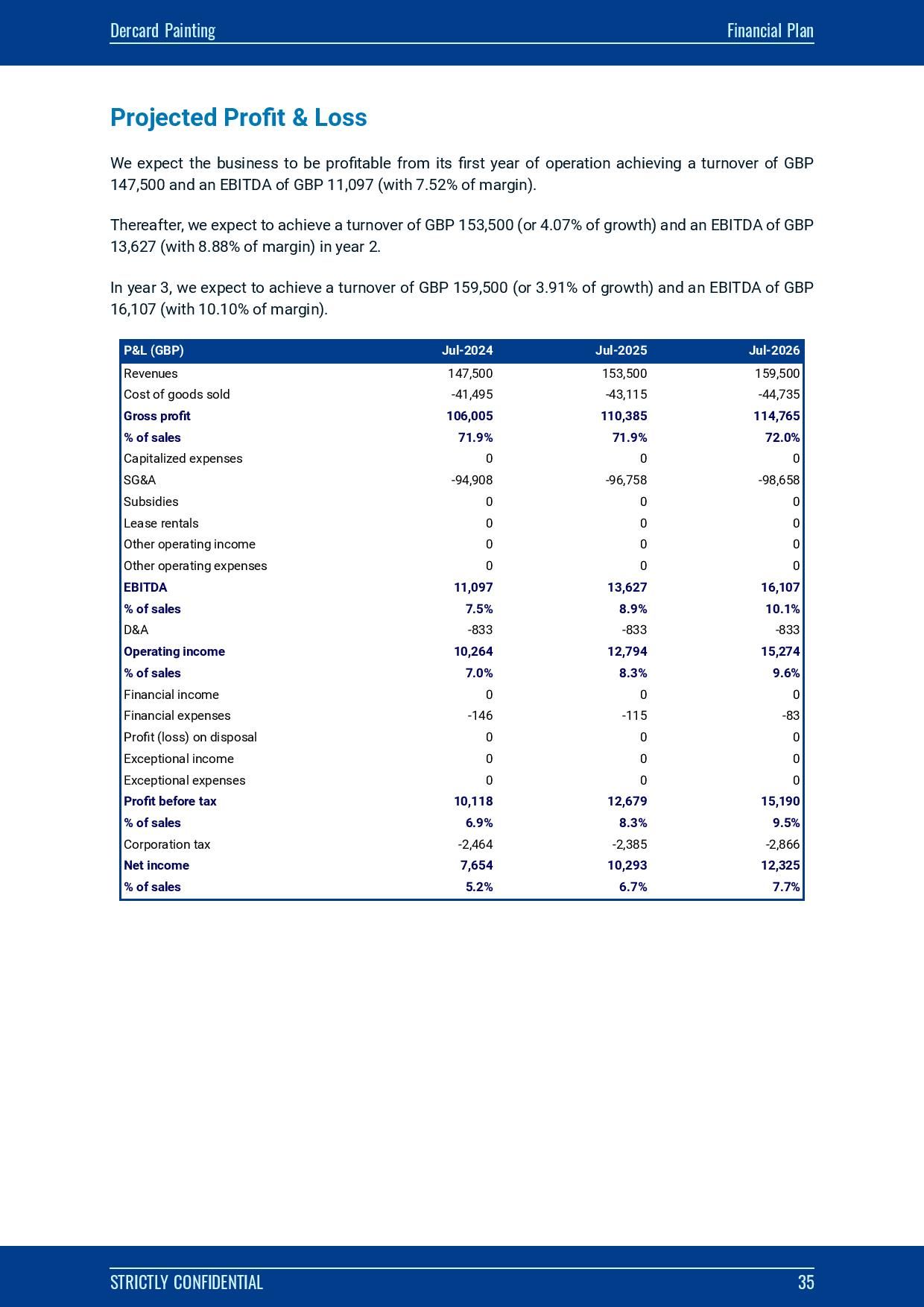

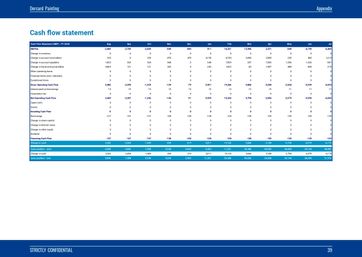

Modelled on a complete business plan of a painting company in France, our template features both the financial forecast and the written part that presents the project, its team, the local market and the business strategy implemented by the management.

Cast your eyes on this template to achieve a better understanding of what your bank and investors would like to see, so that you can create a business plan that meets their expectations.