How to open a gemstone brokerage firm?

Want to start a gemstone brokerage firm but don't know where to begin? Then you've come to the right place!

Our comprehensive guide covers everything related to opening a gemstone brokerage firm - from choosing the right concept to setting out your marketing plan and financing your business.

You'll also learn how to assess the profitability of your business idea and decide whether or not it can be viable from a financial perspective.

Ready to kickstart your entrepreneurial journey? Let's begin!

What is the business model of a gemstone brokerage firm?

Before thinking about starting a gemstone brokerage firm, you'll need to have a solid understanding of its business model (how it generates profits) and how the business operates on a daily basis.

Doing so will help you decide whether or not this is the right business idea for you, given your skillset, personal savings, and lifestyle choices.

Looking at the business model in detail will also enable you to form an initial view of the potential for growth and profitability, and to check that it matches your level of ambition.

The easiest ways to acquire insights into how a gemstone brokerage firm works are to:

- Speak with gemstone brokerage firm owners

- Undertake work experience with a successful gemstone brokerage firm

- Participate in a training course

Speak with gemstone brokerage firm owners

Talking to seasoned entrepreneurs who have also set up a gemstone brokerage firm will enable you to gain practical advice based on their experience and hindsight.

Learning from others' mistakes not only saves you time and money, but also enhances the likelihood of your venture becoming a financial success.

Undertake work experience with a successful gemstone brokerage firm

Gaining hands-on experience in a gemstone brokerage firm provides insights into the day-to-day operations, and challenges specific to the activity.

This firsthand knowledge is crucial for effective planning and management if you decide to start your own gemstone brokerage firm.

You'll also realise if the working hours suit your lifestyle. For many entrepreneurs, this can be a "make or break" situation, especially if they have children to look after.

First-hand experience will not only ensure that this is the right business opportunity for you, but will also enable you to meet valuable contacts and gain a better understanding of customer expectations and key success factors which will likely prove advantageous when launching your own gemstone brokerage firm.

Participate in a training course

Undertaking training within your chosen industry is another way to get a feel for how a gemstone brokerage firm works before deciding to pursue a new venture.

Whichever approach you go for to gain insights before starting your gemstone brokerage firm, make sure you familiarise yourself with:

- The expertise needed to run the business successfully (do you have the skills required?)

- How a week of running a gemstone brokerage firm might look like (does this fit with your personal situation?)

- The potential turnover of your gemstone brokerage firm and long-term growth prospects (does this match your ambition?)

- The likely course of action if you decide to sell the company or retire (it's never too early to consider your exit)

At the end of this stage, you should be able to decide whether opening a gemstone brokerage firm is the right business idea for you given your current personal situation (skills, desires, money, family, etc.).

Can your business idea be profitable?

Just enter your data and let The Business Plan Shop crunch the numbers. We will tell if your business idea can generate profits and cash flows, and how much you need to get started.

Assemble your gemstone brokerage firm's founding team

The next step to start your gemstone brokerage firm is to think about the ideal founding team, or to go in alone (which is always an option).

Setting up a business with several partners is a way of reducing the (high) risk of launching a gemstone brokerage firm since it allows the financial risk of the project to be shared between the co-founders.

This also allows the company to benefit from a greater diversity of profiles in the management team and to spread the burden of decision-making over several shoulders.

But, running a business with multiple co-founders brings its own challenges. Disagreements between co-founders are quite common, and these can pose risks to the business. That's why it's crucial to consider all aspects before starting your business.

To make an informed decision, we suggest asking yourself these questions:

- How many co-founders would increase the project's chances of success?

- Do you and your potential partners share the same aspirations for the project?

- What is your plan B in case of failure?

Let's examine each of these questions in detail.

How many co-founders would increase the project's chances of success?

The answer to this question will depend on a number of factors, including:

- Your savings compared with the amount of initial capital needed to launch the gemstone brokerage firm

- The skills you have compared with those needed to make a success of such a project

- How you want key decisions to be taken in the business (an odd number of partners or a majority partner is generally recommended to avoid deadlock)

Put simply, your partners contribute money and/or skills, and increasing the number of partners is often a good idea when one of these resources is in short supply.

Do you and your potential partners share the same aspirations for the project?

One of the key questions when selecting your potential partners will be their expectations. Do you want to create a small or large business? What are your ambitions for the next 10 or 15 years?

It's better to agree from the outset on what you want to create to avoid disagreements, and to check that you stay on the same wavelength as the project progresses to avoid frustration.

What is your plan B in case of failure?

Of course, we wish you every success, but it's wise to have a plan B when setting up a business.

How you handle the possibility of things not working out can depend a lot on the kind of relationship you have with your co-founders (like being a close friend, spouse, former colleague, etc.) and each person's individual situation.

Take, for instance, launching a business with your spouse. It may seem like a great plan, but if the business doesn't succeed, you could find yourself losing the entire household income at once, and that could be quite a nerve-wracking situation.

Similarly, starting a business partnership with a friend has its challenges. If the business doesn't work out or if tough decisions need to be made, it could strain the friendship.

It's essential to carefully evaluate your options before starting up to ensure you're well-prepared for any potential outcomes.

Is there room for another gemstone brokerage firm on the market?

The next step in starting a gemstone brokerage firm is to undertake market research. Now, let's delve into what this entails.

The objectives of market research

The goal here is straightforward: evaluate the demand for your business and determine if there's an opportunity to be seized.

One of the key points of your market analysis will be to ensure that the market is not saturated by competing offers.

The market research to open your gemstone brokerage firm will also help you to define a concept and market positioning likely to appeal to your target clientele.

Finally, your analysis will provide you with the data you need to assess the revenue potential of your future business.

Let's take a look at how to carry out your market research.

Evaluating key trends in the sector

Market research for a gemstone brokerage firm usually begins with an analysis of the sector in order to develop a solid understanding of its key players, and recent trends.

Assessing the demand

After the sector analysis comes demand analysis. Demand for a gemstone brokerage firm refers to customers likely to consume the products and services offered by your company or its competitors.

Looking at the demand will enable you to gain insights into the desires and needs expressed by your future customers and their observed purchasing habits.

To be relevant, your demand analysis must be targeted to the geographic area(s) served by your company.

Your demand analysis should highlight the following points:

- Who buys the type of products and services you sell?

- How many potential customers are there in the geographical area(s) targeted by your company?

- What are their needs and expectations?

- What are their purchasing habits?

- How much do they spend on average?

- What are the main customer segments and their characteristics?

- How to communicate and promote the company's offer to reach each segment?

Analyzing demand helps pinpoint customer segments your gemstone brokerage firm could target and determines the products or services that will meet their expectations.

Assessing the supply

Once you have a clear vision of who your potential customers are and what they want, the next step is to look at your competitors.

Amongst other things, you’ll need to ask yourself:

- What brands are competing directly/indirectly against your gemstone brokerage firm?

- How many competitors are there in the market?

- Where are they located in relation to your company's location?

- What will be the balance of power between you and your competitors?

- What types of services and products do they offer? At what price?

- Are they targeting the same customers as you?

- How do they promote themselves?

- Which concepts seem to appeal most to customers?

- Which competitors seem to be doing best?

The aim of your competitive analysis will be to identify who is likely to overshadow you, and to find a way to differentiate yourself (more on this see below).

Regulations

Market research is also an opportunity to look at the regulations and conditions required to do business.

Ask yourself the following questions:

- Do you need a special degree to open a gemstone brokerage firm?

- Are there necessary licences or permits?

- What are the main laws applicable to your future business?

At this stage, your analysis of the regulations should be carried out at a high level, to familiarize yourself with any rules and procedures, and above all to ensure that you meet the necessary conditions for carrying out the activity before going any further.

You will have the opportunity to come back to the regulation afterwards with your lawyer when your project is at a more advanced stage.

Take stock of the lessons learned from your market analysis

Market research should give you a definitive idea of your business idea's chances of commercial success.

Ideally, the conclusion is that there is a market opportunity because one or more customer segments are currently underserved by the competition.

On the other hand, the conclusion may be that the market is already taken. In this case, don't panic: the first piece of good news is that you're not going to spend several years working hard on a project that has no chance of succeeding. The second is that there's no shortage of ideas out there: at The Business Plan Shop, we've identified over 1,300 business start-up ideas, so you're bound to find something that will work.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast and write a business plan to help convince investors that your business idea can be profitable.

How should I position my gemstone brokerage firm on the market?

The next step to start your gemstone brokerage firm is to define precisely the market positioning your company will adopt in order to capitalise on the opportunity identified during your market research.

Market positioning refers to the place your product and service offering occupies in customers' minds and how they differ from the competition. Being perceived as a low-cost solution, for example.

To find a concept and a market positioning that will resonate with your customers, you need to address the following issues:

- How can you differentiate yourself from your competitors?

- Is it better to start or buy a gemstone brokerage firm already in operation?

- How will you validate your concept and market positioning before investing in the business?

Let's look at these aspects in more detail.

How can you differentiate yourself from your competitors?

Opening a gemstone brokerage firm means starting with a major disadvantage compared with competitors already active on the market.

While you will have to create everything from scratch, your competitors already have everything in place.

Your competitors' teams know the business well, whereas yours has only just been recruited, their customers are loyal and they benefit from word of mouth that you don't yet have.

So you're going to need a solid plan to succeed in taking market share from your competitors and making your mark.

There are a number of aspects to consider in order to try to avoid direct confrontation if possible:

- Can you target a different customer base than your competitors?

- Can you offer products or services that are different from or complementary to what your competitors already sell?

- How will your competitors react to your gemstone brokerage firm entering their market?

- Can you build a sustainable competitive advantage that will enable you to compete with your current and future competitors?

Is it better to start or buy a gemstone brokerage firm already in operation?

The alternative to setting up a new independent business is to buy out and take over a gemstone brokerage firm already in operation.

A takeover is a good way of reducing the risk of your project compared with a pure start-up.

Taking over a business has two enormous advantages over setting up a new one: you start out on an equal footing with your competitors since you take over the team and the customer base, and you don't increase the supply on the market enabling you to maintain the existing balance on the market where the business operates.

However, the capital requirements for a takeover are higher because the business will have to be bought from its previous owners.

How will you validate your concept and market positioning before investing in the business?

However you decide to set up your business, you will need to ensure that there is a good fit between what you sell and what customers are looking to buy.

To do this, you'll need to meet your target customers to present your products or services and check that they meet their expectations.

Deciding where to base your gemstone brokerage firm

The next step to opening a gemstone brokerage firm is deciding where you want to set up your business.

Choosing the right location for your business is like finding the perfect stage for a play. Without it, your business may lack the spotlight it deserves.

Whilst there is no “perfect” location for your gemstone brokerage firm, one that meets as many of the following factors as possible could be ideal:

- Visibility and foot traffic - A gemstone brokerage firm would benefit from being in a location with high visibility and foot traffic, as it would increase the chances of attracting potential customers and creating brand awareness.

- Parking space, road and public transport accessibility - Having ample parking space and easy access to main roads and public transport would make it convenient for customers to visit the brokerage firm and also make it easier for suppliers to deliver gemstones.

- Proximity to target customers - Being close to potential customers, such as jewelry stores and collectors, would make it easier for the brokerage firm to establish and maintain relationships with them.

- Premises layout - The layout of the premises should be conducive to showcasing and displaying gemstones, as well as providing a comfortable and secure environment for clients to view and handle the gemstones.

This list is obviously not exhaustive and will have to be adapted to the particularities of your project.

Once you’ve considered the factors above, it’s important to think about the budget that your startup has at its disposal. You’ll need to find a location that meets your business requirements but is affordable enough, especially short-term.

If you opt for renting instead of buying your premises, make sure to take into account the terms of the lease, including aspects such as the duration, rent increase, renewal, and so on.

The lease contractual terms vary greatly from country to country, so be sure to check the terms applicable to your situation and have your lease reviewed by your lawyer before signing.

Need inspiration for your business plan?

Avoid writer's block and draft your own business plan in no time by drawing inspiration from dozens of business plan templates.

Decide on a legal form for your gemstone brokerage firm

It's now time to think about the legal structure for your gemstone brokerage firm.

The legal form of a business simply means the legal structure it operates under. This structure outlines how the business is set up and defines its legal obligations and responsibilities.

What are the most common legal structures?

Naturally, the names and intricacies of business structures differ by country. However, they typically fit into two main categories:

- Individual businesses

- Companies

Individual businesses

Individual businesses are usually a good fit for self-employed individuals and freelancers who want limited administrative work. These types of entrepreneurs are commonly referred to as sole traders or sole proprietorships.

As mentioned above, the main benefit of being a sole trader is that minimal paperwork is required to launch and operate the business. Tax calculations are also relatively simple and annual accounts are not always required (and when they are, usually don't need to be audited) which saves a bit of time and money on bookkeeping and accounting fees.

Decision-making is also easy as the final decision is fully dependent on the sole trader (even if employees are hired).

However, being a sole trader also has drawbacks. The main disadvantage is that there is no separation between the individual running day-to-day operations and the business.

This means that if the business were to file for bankruptcy or legal disputes were to arise, the individual would be liable for any debts and their personal assets subsequently at risk. In essence, sole traders have unlimited liability.

This also means that profits earned by the business are usually taxed under the personal income tax category of the sole trader.

Another drawback is that sole traders might find it harder to finance their business. Debt (bank loan for example) is likely to be the only source of external financing given that the business doesn't have a share capital (effectively preventing equity investors from investing in their business).

Companies

Companies are more flexible and more robust than individual businesses. They are suitable for projects of all sizes and can be formed by one or more individuals, working on their own or with employees.

Unlike individual businesses, companies are recognised as distinct entities that have their own legal personality. Usually, there is also a limited liability which means that founders and investors cannot lose more than the capital they have invested into the business.

This means that there is a clear legal separation between the company and its owners (co-founders and investors), which protects the latter's personal assets in the event of legal disputes or bankruptcy.

Entrepreneurs using companies also gain the advantage of being able to attract equity investment by selling shares in the business.

As you can see companies offer better protection and more financing options, but this comes at a trade-off in terms of red-tape and complexity.

From a taxation perspective, companies are usually liable for corporation tax on their profits, and the income received by the owners running the business is taxed separately (like normal employees).

Normally, companies also have to produce annual accounts, which might have to be audited, and hold general assemblies, among other formalities.

How should I choose my gemstone brokerage firm's legal setup?

Choosing the right legal setup is often simple once you figure out things like how many partners you'll have, if you hire employees, and how much money you expect to make.

Remember, a great business idea can work well no matter which legal structure you pick. Tax laws change often, so you shouldn't rely too much on getting specific tax benefits from a certain structure when getting started.

You could start by looking at the legal structures most commonly utilised by your competitors. As your idea evolves and you're ready to officially register your business, it's a good idea to confirm your choice using inputs from a lawyer and an accountant.

Can I switch my gemstone brokerage firm's legal structure if I get it wrong?

Yes, you have the flexibility to change your legal setup later, which might include selling the existing one and adopting a new structure in certain situations. Keep in mind, though, that this restructuring comes with additional expenses, so making the right choice from the start is usually more cost-effective.

Can your business idea be profitable?

Just enter your data and let The Business Plan Shop crunch the numbers. We will tell if your business idea can generate profits and cash flows, and how much you need to get started.

Assess the startup costs for a gemstone brokerage firm

The next step in creating a gemstone brokerage firm involves thinking about the equipment and staff needed for the business to operate.

After figuring out what you need for your business, your financial plan will reveal how much money you'll need to start and how much you might make (check below for more details).

Because every venture is distinctive, providing a reliable one-size-fits-all budget for launching a gemstone brokerage firm without knowing the specifics of your project is not feasible.

Each project has its own particularities (size, concept, location), and only a forecast can show the exact amount required for the initial investment.

The first thing you'll need to consider is the equipment and investments you'll need to get your business up and running.

Startup costs and investments to launch your gemstone brokerage firm

For a gemstone brokerage firm, the initial working capital requirements (WCR) and investments could include the following elements:

- Gemstone Inventory: This includes purchasing raw gemstones from suppliers to add to your inventory. This is a crucial expenditure for a gemstone brokerage firm as it is the core product being sold to clients.

- Gemstone Testing Equipment: In order to accurately assess the quality and value of gemstones, you will need to invest in equipment such as microscopes, scales, and refractometers. These tools are essential for a gemstone brokerage firm to properly evaluate gemstones.

- Security Systems: As a gemstone brokerage firm, you will be dealing with high-value and precious items. It is important to invest in security systems such as alarm systems, cameras, and safes to protect your inventory from theft or damage.

- Office Furniture and Equipment: A comfortable and functional office space is necessary for conducting business and showcasing your gemstones. This can include desks, chairs, display cases, and computers. Investing in quality office furniture and equipment can improve efficiency and present a professional image to clients.

- Transportation: In order to transport gemstones to and from suppliers and clients, you may need to invest in a company vehicle or utilize shipping services. This is an important expense to consider in your expenditure forecast to ensure safe and timely delivery of gemstones.

Of course, you will need to adapt this list to your business specificities.

Staffing plan of a gemstone brokerage firm

In addition to equipment, you'll also need to consider the human resources required to run the gemstone brokerage firm on a day-to-day basis.

The number of recruitments you need to plan will depend mainly on the size of your company.

Once again, this list is only indicative and will need to be adjusted according to the specifics of your gemstone brokerage firm.

Other operating expenses for a gemstone brokerage firm

While you're thinking about the resources you'll need, it's also a good time to start listing the operating costs you'll need to anticipate for your business.

The main operating costs for a gemstone brokerage firm may include:

- Staff Costs: Salaries and benefits for employees such as brokers, administrators, and support staff.

- Accountancy Fees: Costs for hiring an accountant or accounting firm to manage financial records and prepare taxes.

- Insurance Costs: The cost of insuring gemstones, office space, and other assets against theft, damage, or loss.

- Software Licences: Fees for using software programs such as inventory management, accounting, and customer relationship management.

- Banking Fees: Charges for maintaining business bank accounts, wire transfers, and other financial transactions.

- Marketing Expenses: Costs for advertising, website development, and other promotional activities to attract new clients.

- Rent: The cost of leasing office space to conduct business operations.

- Travel Expenses: Costs for business travel, including airfare, accommodations, and meals.

- Legal Fees: Expenses for hiring a lawyer or law firm to handle legal matters related to the business.

- Office Supplies: The cost of purchasing office equipment, stationery, and other supplies necessary for day-to-day operations.

- Training and Development: Expenses for employee training, workshops, and conferences to enhance skills and knowledge.

- Telephone and Internet: Charges for phone and internet services used for business communications.

- Utilities: Costs for electricity, water, and other utilities necessary to run the office space.

- Professional Memberships: Fees for joining professional organizations related to the gemstone industry.

- Office Maintenance: Expenses for cleaning, repairs, and maintenance of the office space.

Like for the other examples included in this guide, this list will need to be tailored to your business but should be a good starting point for your budget.

How will I promote my gemstone brokerage firm's?

The next step to starting a gemstone brokerage firm is to think about strategies that will help you attract and retain clients.

Consider the following questions:

- How will you attract as many customers as possible?

- How will you build customer loyalty?

- Who will be responsible for advertising and promotion? What budget can be allocated to these activities?

- How many sales and how much revenue can that generate?

Once again, the resources required will depend on your ambitions and the size of your company. But you could potentially action the initiatives below.

Your gemstone brokerage firm's sales plan will also be affected by variations in consumer demand, like changes in activity during peak holiday seasons, and the dynamics within your competitive environment.

Can your business idea be profitable?

Just enter your data and let The Business Plan Shop crunch the numbers. We will tell if your business idea can generate profits and cash flows, and how much you need to get started.

Building your gemstone brokerage firm's financial forecast

The next step to opening a gemstone brokerage firm is to create your financial forecast.

What is a gemstone brokerage firm financial forecast?

A gemstone brokerage firm financial forecast is a forward-looking tool that projects the financial performance of your business over a specific period (usually 3 years for start-ups).

A forecast looks at your business finances in detail - from income to operating costs and investments - to evaluate its expected profitability and future cash flows.

Building a financial forecast enables you to determine the precise amount of initial financing required to start your gemstone brokerage firm.

There are many promising business ideas but very few are actually viable and making a financial forecast is the only way to ensure that your project holds up economically and financially.

Your financial forecast will also be part of your overall business plan (which we will detail in a later step), which is the document you will need to secure financing.

Financial forecasts are used to drive your gemstone brokerage firm and make key decisions, both in the pre and post-launch phases:

- Should we go ahead with the business or scrap the idea?

- Should we hire staff or use an external service provider?

- Which development project offers the best growth prospects?

- Etc.

Creating a financial forecast for starting a gemstone brokerage firm is an iterative process as you will need to refine your numbers as your business idea matures.

As your gemstone brokerage firm grows, your forecasts will become more accurate. You will also need to test different scenarios to ensure that your business model holds true even if economic conditions deteriorate (lower sales than expected, difficulties in recruiting, sudden cost increases or equipment failure problems, for example).

Once you’ve launched your business, it will also be important to regularly compare your accounting data to your financial projections in order to keep your forecast up-to-date and maintain visibility on future cash flows.

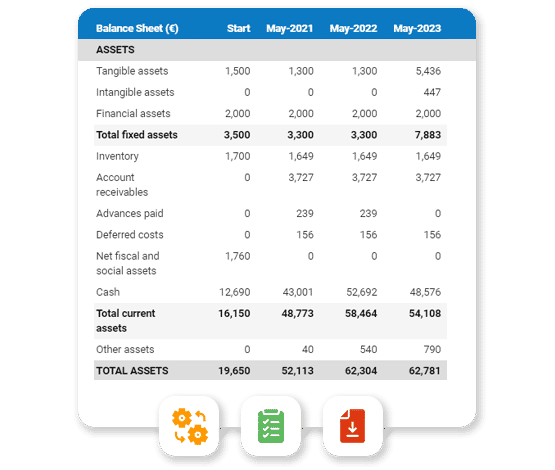

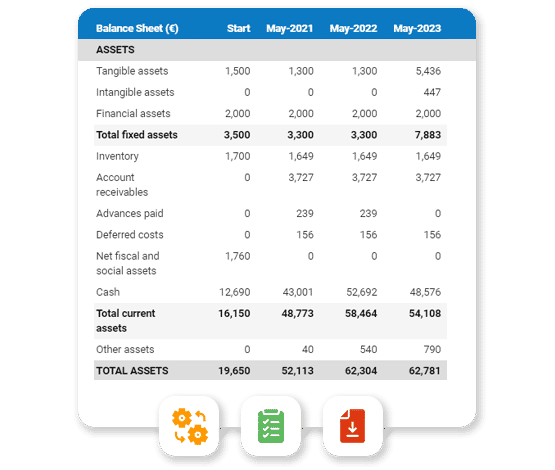

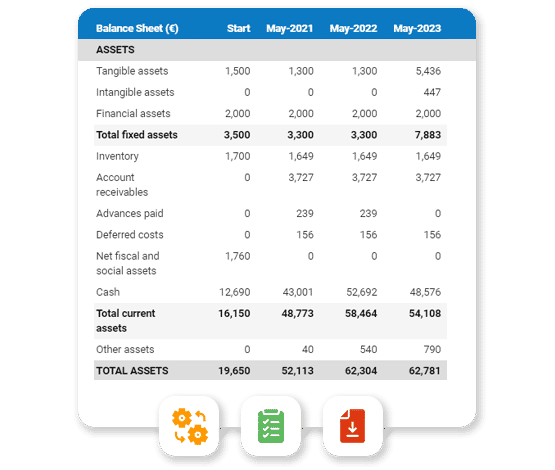

What does a financial projection look like?

The following financial tables will be used to present your gemstone brokerage firm's financial forecast.

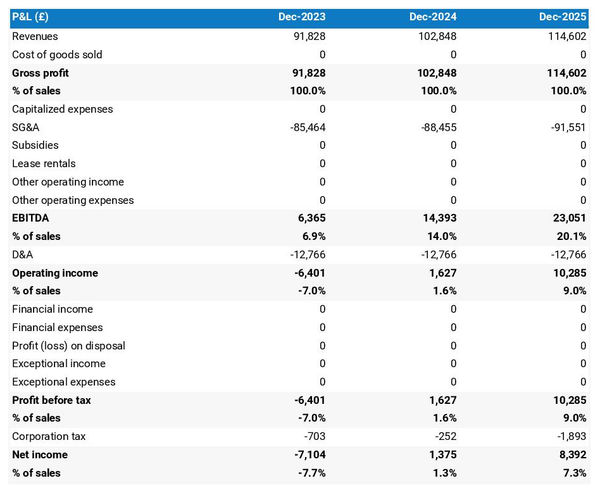

The projected P&L statement

Your gemstone brokerage firm's forecasted P&L statement will enable you to visualise your gemstone brokerage firm's expected growth and profitability over the next three to five years.

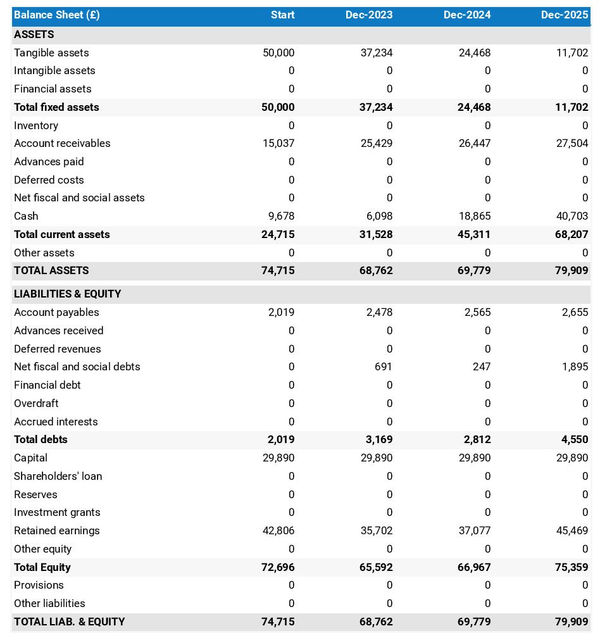

The projected balance sheet of your gemstone brokerage firm

The projected balance sheet gives an overview of your gemstone brokerage firm's financial structure at the end of the financial year.

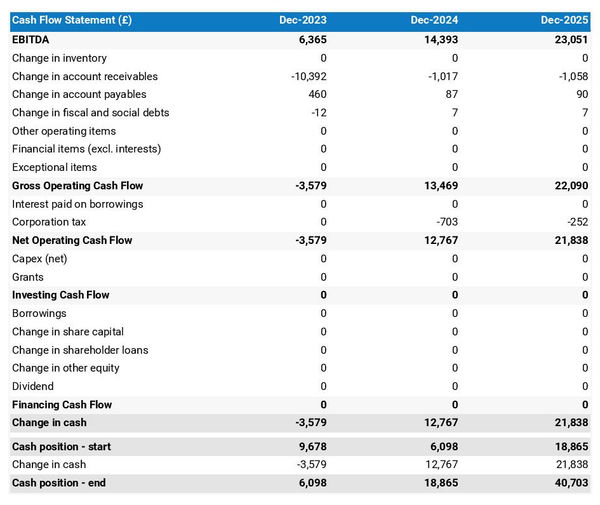

The cash flow projection

A cash flow forecast for a gemstone brokerage firm shows the projected inflows and outflows of cash over a specific period, providing insights into liquidity and financial health.

Which solution should you use to make a financial projection for your gemstone brokerage firm?

Using an online financial forecasting tool, such as the one we offer at The Business Plan Shop, is the simplest and safest solution for forecasting your gemstone brokerage firm.

There are several advantages to using specialised software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You have access to complete financial forecast templates

- You get a complete financial forecast ready to be sent to your bank or investors

- The software helps you identify and correct any inconsistencies in your figures

- You can create scenarios to stress-test your forecast's main assumptions to stress-test the robustness of your business model

- After you start trading, you can easily track your actual financial performance against your financial forecast, and recalibrate your forecast to maintain visibility on your future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you are interested in this type of solution, you can try our forecasting software for free by signing up here.

How do I choose a name and register my gemstone brokerage firm?

Now that your project of launching a gemstone brokerage firm is starting to take shape, it's time to look at the name of your business.

Finding the name itself is generally fairly easy. The difficulty lies in registering it.

To prevent this guide from being too long, we won't go into all the criteria you need to take into account when choosing a striking name for your gemstone brokerage firm. However, try to choose a name that is short and distinctive.

Once you have a name that you like, you need to check that it is available, because you cannot use a name that is identical or similar to that of a competitor: this type of parasitic behaviour is an act of unfair competition for which you risk being taken to court by your competitors.

To avoid any problems, you will need to check the availability of the name:

- Your country's company register

- With the trademark register

- With a domain name reservation company such as GoDaddy

- On an Internet search engine

If the desired name is available, you can start the registration process.

It is common to want to use the trading name as the name of the company, and to have a domain name and a registered trademark that also correspond to this name: Example ® (trading name protected by a registered trademark), Example LTD (legal name of the company), example.com (domain name used by the company).

The problem is that each of these names has to be registered with a different entity, and each entity has its own deadlines:

- Registering a domain name is immediate

- Registering a trademark usually takes at least 3 months (if your application is accepted)

- The time taken to register a new business depends on the country, but it's generally quite fast

How do I go about it?

Well, you have two choices:

- Complete all registrations at the same time and cross your fingers for a smooth process.

- Make sure to secure the domain names and trademarks. Once that's done, wait for confirmation of a successful trademark registration before moving on to register the company.

At The Business Plan Shop, we believe it's essential to prioritize securing your domain names and trademarks over the business name. This is because you have the flexibility to use a different trading name than your legal business name if needed.

Regardless, we suggest discussing this matter with your lawyer (see below in this guide) before making any decisions.

Need inspiration for your business plan?

Avoid writer's block and draft your own business plan in no time by drawing inspiration from dozens of business plan templates.

What corporate identity do I want for my gemstone brokerage firm?

The following step to start a gemstone brokerage firm is to define your company's visual identity.

Visual identity is part of the DNA of your gemstone brokerage firm: it makes you recognizable and recognized by your customers, and helps you stand out from the competition. It also helps convey your values, notably through the choice of colors that identify the company.

Creating your business's visual identity yourself is entirely possible: there are several online tools that let you generate color palettes, choose typography and even generate logos.

However, we advise you to delegate this task to a designer or a communications agency for a professional result.

Your corporate identity will include the following elements:

- Your business logo

- Your brand guidelines

- Your business cards

- Design and theme of your website

Logo

Your gemstone brokerage firm's logo serves as a quick identifier for your company. It will be featured on all your communication platforms (website, social networks, business cards, etc.) and official documents (invoices, contracts, etc.).

Beyond its appearance, your logo should be easy to use on any type of support and background (white, black, gray, colored, etc.). Ideally, it should be easy to use in a variety of colors.

Brand guidelines

One of the challenges when starting a gemstone brokerage firm is to ensure a consistent brand image wherever your company is visible.

This is the role of your company's brand guidelines, which defines the typography and colors used by your brand and thus acts as the protector of your brand image.

Typography refers to the fonts used (family and size). For example, Trebuchet in size 22 for your titles and Times New Roman in size 13 for your texts.

The colors chosen to represent your brand should typically be limited to five (or fewer):

- The main colour,

- A secondary colour (the accent),

- A dark background colour (blue or black),

- A grey background colour (to vary from white),

- Possibly another secondary colour.

Business cards

Classic but a must-have, your business cards will be at your side to help you easily communicate your contact details to your founders, customers, suppliers, recruitment candidates, etc.

In essence, they should feature your logo and adhere to the brand guidelines mentioned earlier.

Website theme

Likewise, the theme of your gemstone brokerage firm website will integrate your logo and follow the brand guidelines we talked about earlier.

This will also define the look and feel of all your site's graphic elements:

- Buttons

- Menus

- Forms

- Banners

- Etc.

Understanding the legal and regulatory steps involved in opening a gemstone brokerage firm

The next step in opening a gemstone brokerage firm is to take the necessary legal and regulatory steps.

We recommend that you be accompanied by a law firm for all of the steps outlined below.

Registering a trademark and protecting the intellectual property of your gemstone brokerage firm

The first step is to protect your company's intellectual property.

As mentioned earlier in this guide, you have the option to register a trademark. Your lawyer can assist you with a thorough search to ensure your chosen trademark is unique and doesn't conflict with existing ones and help select the classes (economic activities) and jurisdictions in which to register your trademark.

Your lawyer will also be able to advise you on other steps you could take to protect your company's other intellectual property assets.

Drafting the contractual documents for your gemstone brokerage firm

Your gemstone brokerage firm will rely on a set of contracts and legal documents for day-to-day operations.

Once again, we strongly recommend that you have these documents drawn up by a lawyer.

Your exact needs will depend on the country in which you are launching your gemstone brokerage firm and the size of the company you are planning.

However, you may wish to consider the following documents at a minimum:

- Employment contracts

- General terms and conditions of sale

- General terms and conditions of use for your website

- Privacy Policy for your website

- Cookie Policy for your website

- Invoices

- Etc.

Applying for licences and permits and registering for various taxes

The licenses and permits needed for your business will depend on the country where you are establishing it. Your lawyer can guide you on the regulations relevant to your activity.

Similarly, your chartered accountant will be able to help you register for taxes and take the necessary steps to comply with the tax authorities.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast and write a business plan to help convince investors that your business idea can be profitable.

How do I write a business plan for a gemstone brokerage firm?

Once you've completed all the above steps, you can start writing the business plan for your gemstone brokerage firm.

What is a gemstone brokerage firm's business plan?

The business plan is a document containing:

- The financial forecast (discussed earlier in this guide), highlighting the project's financing requirements and profitability potential,

- A written presentation, which presents your project in detail and provides the necessary context for the reader to assess the relevance and coherence of your forecast.

The business plan is particularly important: it will help you validate your business idea and ensure its coherence and financial viability.

But it's also the document you'll send to your bank and potential investors to present your plan to open a gemstone brokerage firm and make them want to support you.

So it's best to draw up a professional, reliable and error-free business plan.

How to write a business plan for my gemstone brokerage firm?

If you're not used to writing business plans, or if you want to save time, a good solution is to use an online business plan software for startups like the one we offer at The Business Plan Shop.

Using The Business Plan Shop to create a business plan for a gemstone brokerage firm has several advantages:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can access a library of dozens of complete startup business plan samples and templates for inspiration

- You get a professional business plan, formatted and ready to be sent to your bank or investors

- You can create scenarios to stress test your forecast's main assumptions

- You can easily track your actual financial performance against your financial forecast by importing accounting data

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

Interested? If so, you can try The Business Plan Shop for free by signing up here.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast and write a business plan to help convince investors that your business idea can be profitable.

Raise the financing needed to launch your gemstone brokerage firm

With your business plan in hand, you can tackle one of the final steps to open a gemstone brokerage firm business: the search for financing.

Raising the capital needed to launch your business will probably require a combination of equity and debt, which are the two types of financing available to companies.

Equity funding

Equity is the sum of money invested in a gemstone brokerage firm by both founders and investors.

Equity is a key factor in business start-ups. Should the project fail, the sums invested in equity are likely to be lost; these sums therefore enable the founders to send a strong signal to their commercial and financial partners as to their conviction in the project's chances of success.

In terms of return on investment, equity investors can either receive dividends from the company (provided it is profitable) or realize capital gains by selling their shares (provided a buyer is interested in the company).

Equity providers are therefore in a very risky position. They can lose everything in the event of bankruptcy, and will only see a return on their investment if the company is profitable or resold. On the other hand, they can generate a very high return if the project is a success.

Given their position, equity investors look for start-up projects with sufficient growth and profitability potential to offset their risk.

From a technical standpoint, equity includes:

- Share capital and premiums: which represent the amount invested by the shareholders. This capital is considered permanent as it is non-refundable. In return for their investment, shareholders receive shares that entitle them to information, decision-making power (voting in general assembly), and the potential to receive a portion of any dividends distributed by the company.

- Director loans: these are examples of non-permanent capital advanced to the company by the shareholders. This is a more flexible way of injecting some liquidity into your company as you can repay director loans at any time.

- Reserves: these represent the share of profits set aside to strengthen the company's equity. Allocating a percentage of your profits to the reserves can be mandatory in certain cases (legal or statutory requirement depending on the legal form of your company). Once allocated in reserves, these profits can no longer be distributed as dividends.

- Investment grants: which represent any non-refundable amounts received by the company to help it invest in long-term assets.

- Other equity: which includes the equity items which don't fit in the other categories. Mostly convertible or derivative instruments. For a small business, it is likely that you won't have any other equity items.

The main sources of equity are as follows:

- Contributions made by the owners.

- Private investors: business angels, friends and family.

- Crowdfunding: raising funds by involving a group of people through campaigns where they contribute money or make donations, often getting something in return for their support.

- Start-up aid, e.g. government loans to help founders build up their start-up capital.

Debt financing

Debt is the other way of financing companies. Unlike equity, debt offers lenders a limited, contractually guaranteed return on their investment.

Your gemstone brokerage firm undertakes to pay lenders' interest and repay the capital borrowed according to a pre-agreed schedule. Lenders are therefore making money whether or not your company makes a profit.

As a result, the only risk lenders take is that of your gemstone brokerage firm going bankrupt, so they're extremely conservative and will want to see prudent, hands-on management of the company's finances.

From the point of view of the company and all its stakeholders (workforce, customers, suppliers, etc.), the company's contractual obligation to repay lenders increases the risk for all. As a result, there is a certain caution towards companies which are too heavily indebted.

Businesses can borrow debt in two main ways:

- Against assets: this is the most common way of borrowing. The bank funds a percentage of the price of an asset (a vehicle or a building, for example) and takes the asset as collateral. If the business cannot repay the loan, the bank takes the asset and sells it to reduce losses.

- Against cash flows: the bank looks at how much profit and cash flow the business expects to make in the future. Based on these projections, it assigns a credit risk to the business and decides how much the business can borrow and under what terms (amount, interest rate, and duration of the loan).

It's difficult to borrow against future cash flows when you're starting a gemstone brokerage firm, because the business doesn't yet have historical data to reassure about the credibility of cash flow forecast.

Borrowing to finance a portion of equipment purchases is therefore often the only option available to founders. The assets that can be financed with this option must also be easy to resell, in the unfortunate event that the bank is forced to seize them, which could limit your options even further.

As far as possible sources of borrowing are concerned, the main ones here are banks and credit institutions. Bear in mind, however, that each institution is different, in terms of the risk it is prepared to accept, what it is willing to finance, and how the risk of your project will be perceived.

In some countries, it is also possible to borrow from private investors (directly or via crowdfunding platforms) or other companies, but not everywhere.

Key points about financing your gemstone brokerage firm

Multiple solutions are available to help you raise the initial financing you need to open your gemstone brokerage firm. A minimum amount of equity will be needed to give the project credibility, and bank financing can be sought to complete the financing.

Launching your gemstone brokerage firm and monitoring progress against your forecast

Once you’ve secured financing, you will finally be ready to launch your gemstone brokerage firm. Congratulations!

Celebrate the launch of your business and acknowledge the hard work that brought you here, but remember, this is where the real work begins.

As you know, 50% of business start-ups do not pass the five-year mark. Your priority will be to do everything to secure your business's future.

To do this, it is key to keep an eye on your business plan to ensure that you are on track to achieve your goals.

No one can predict the future with certainty, so it’s likely that your gemstone brokerage firm's financial performance will differ from what you predicted in your forecast.

This is why it is recommended to make several forecasts:

- A base case (most likely)

- An optimistic scenario

- And a pessimistic scenario to test the robustness of your financial model

If you follow this approach, your numbers will hopefully be better than your optimistic case and you can consider accelerating your expansion plans. That’s what we wish you anyway!

If, unfortunately, your figures are below your base case (or worse than your pessimistic case), you will need to quickly put in place corrective actions, or consider stopping the activity.

The key, in terms of decision-making, is to regularly compare your real accounting data to your gemstone brokerage firm's forecast to:

- Measure the discrepancies and promptly identify where the variances with your base case come from

- Adjust your financial forecast as the year progresses to maintain visibility on future cash flow and cash position

There is nothing worse than waiting for your accountant to prepare your year-end accounts, which can take several months after the end of your financial year (up to nine months in the UK for example), to realise that the performance over the past year was well below the your base case and that your gemstone brokerage firm will not have enough cash to keep running over the next twelve months.

This is why using a financial forecasting solution that integrates with accounting software and offers actuals vs. forecast tracking out of the box, like the financial dashboards we offer at The Business Plan Shop, greatly facilitates the task and significantly reduces the risk associated with starting a business.

Need inspiration for your business plan?

Avoid writer's block and draft your own business plan in no time by drawing inspiration from dozens of business plan templates.

Key takeaways

- To open a gemstone brokerage firm you need to go through each of the 15 steps we have outlined in this guide.

- The financial forecast is the tool that will enable you to check that your project can be profitable and to estimate the investment and initial financing requirements.

- The business plan is the document that your financial partners will ask you to produce when seeking finance.

- Once you have started trading, it will be essential to keep your financial forecasts up to date in order to maintain visibility of the future cash flow of your gemstone brokerage firm.

- Leveraging a financial planning and analysis platform that seamlessly integrates forecasts, business plans, and real-time performance monitoring — like The Business Plan Shop — simplifies the process and mitigates risks associated with launching a business.

We hope this practical guide has given you a better understanding of how to open a gemstone brokerage firm. Please do not hesitate to contact our team if you have any questions or if you would like to share your experience of setting up your own business.

Also on The Business Plan Shop

Do you know someone who is thinking about opening a gemstone brokerage firm? Share our guide with them!