How to open a food brokerage firm?

There's no doubt that starting a food brokerage firm requires a lot of work, but with expert planning, you'll be well on your way to creating a profitable business venture.

This guide will give you a low down on all of the major steps involved, from choosing a legal structure to creating a financial forecast and registering your business.

We will also walk you through the process of checking whether or not your idea can be viable given market conditions.

Let's embark on this exciting journey together!

What is the business model of a food brokerage firm?

Before thinking about starting a food brokerage firm, you'll need to have a solid understanding of its business model (how it generates profits) and how the business operates on a daily basis.

Doing so will help you decide whether or not this is the right business idea for you, given your skillset, personal savings, and lifestyle choices.

Looking at the business model in detail will also enable you to form an initial view of the potential for growth and profitability, and to check that it matches your level of ambition.

The easiest ways to acquire insights into how a food brokerage firm works are to:

- Speak with food brokerage firm owners

- Undertake work experience with a successful food brokerage firm

- Participate in a training course

Speak with food brokerage firm owners

Talking to seasoned entrepreneurs who have also set up a food brokerage firm will enable you to gain practical advice based on their experience and hindsight.

Learning from others' mistakes not only saves you time and money, but also enhances the likelihood of your venture becoming a financial success.

Undertake work experience with a successful food brokerage firm

Gaining hands-on experience in a food brokerage firm provides insights into the day-to-day operations, and challenges specific to the activity.

This firsthand knowledge is crucial for effective planning and management if you decide to start your own food brokerage firm.

You'll also realise if the working hours suit your lifestyle. For many entrepreneurs, this can be a "make or break" situation, especially if they have children to look after.

First-hand experience will not only ensure that this is the right business opportunity for you, but will also enable you to meet valuable contacts and gain a better understanding of customer expectations and key success factors which will likely prove advantageous when launching your own food brokerage firm.

Participate in a training course

Undertaking training within your chosen industry is another way to get a feel for how a food brokerage firm works before deciding to pursue a new venture.

Whichever approach you go for to gain insights before starting your food brokerage firm, make sure you familiarise yourself with:

- The expertise needed to run the business successfully (do you have the skills required?)

- How a week of running a food brokerage firm might look like (does this fit with your personal situation?)

- The potential turnover of your food brokerage firm and long-term growth prospects (does this match your ambition?)

- The likely course of action if you decide to sell the company or retire (it's never too early to consider your exit)

At the end of this stage, you should be able to decide whether opening a food brokerage firm is the right business idea for you given your current personal situation (skills, desires, money, family, etc.).

Can your business idea be profitable?

Just enter your data and let The Business Plan Shop crunch the numbers. We will tell if your business idea can generate profits and cash flows, and how much you need to get started.

What is the ideal founding team for my food brokerage firm?

The next step to opening your food brokerage firm, is to decide whether to assemble an ideal team or venture solo.

The failure rate for business start-ups is high: almost half don't make it past the five-year mark, and setting up a food brokerage firm is no exception.

Starting with a group of co-founders helps reduce this risk as each of you brings complementary skills and enables the financial risk to be spread on multiple shoulders.

However, managing a business with multiple partners comes with its own set of challenges. Disagreements among co-founders are quite prevalent, and they can pose risks to the business. That's why it's essential to carefully weigh all aspects before launching a business.

To help you think things through, we recommend that you ask yourself the following questions:

- Do you need more co-founders for this venture?

- Do you share the same vision and ambition as your potential partners for this project?

- What is your plan B?

Let's look at these issues in more detail.

Do you need more co-founders for this venture?

To answer this question you will need to consider the following:

- Are there any key skills missing for which you would rather have a business partner than recruit an employee?

- Do we have enough equity? Would the company benefit from more capital at the outset?

- Will the proposed number of founders make it easy to make decisions (an odd number of partners, or a majority partner, is generally recommended to avoid deadlock)?

In simple terms, co-founders bring skills, money, or both to the table. Having more partners is beneficial when there's a lack of either of these resources.

Do you share the same vision and ambition as your potential partners for this project?

One of the main sources of conflict between co-founders comes from a lack of alignment on the long-term vision.

To avoid any risk of disagreement, it is advisable to agree on ambitions from the outset and to provide an exit mechanism for one of the partners in the event of disagreement.

What is your plan B?

We hope your food brokerage firm takes off and thrives, but it's smart to have a "plan B" just in case things don't go as expected.

How you tackle potential failure can vary broadly depending on the type of co-founders (close friend, spouse, ex-colleague, etc.) and the personal circumstances of each of them.

For example, launching a family business with your spouse might seem exciting, but if it fails, you risk losing all of your household income at once, which might be stressful.

Likewise, starting a business with a friend might strain the friendship if things go wrong or if tough decisions need to be made.

Before diving in, make sure to thoroughly think about your choices. This way, you'll be ready for whatever might come your way when starting up.

Is there room for another food brokerage firm on the market?

The next step in starting a food brokerage firm is to undertake market research. Now, let's delve into what this entails.

The objectives of market research

The goal here is straightforward: evaluate the demand for your business and determine if there's an opportunity to be seized.

One of the key points of your market analysis will be to ensure that the market is not saturated by competing offers.

The market research to open your food brokerage firm will also help you to define a concept and market positioning likely to appeal to your target clientele.

Finally, your analysis will provide you with the data you need to assess the revenue potential of your future business.

Let's take a look at how to carry out your market research.

Evaluating key trends in the sector

Market research for a food brokerage firm usually begins with an analysis of the sector in order to develop a solid understanding of its key players, and recent trends.

Assessing the demand

After the sector analysis comes demand analysis. Demand for a food brokerage firm refers to customers likely to consume the products and services offered by your company or its competitors.

Looking at the demand will enable you to gain insights into the desires and needs expressed by your future customers and their observed purchasing habits.

To be relevant, your demand analysis must be targeted to the geographic area(s) served by your company.

Your demand analysis should highlight the following points:

- Who buys the type of products and services you sell?

- How many potential customers are there in the geographical area(s) targeted by your company?

- What are their needs and expectations?

- What are their purchasing habits?

- How much do they spend on average?

- What are the main customer segments and their characteristics?

- How to communicate and promote the company's offer to reach each segment?

Analyzing demand helps pinpoint customer segments your food brokerage firm could target and determines the products or services that will meet their expectations.

Assessing the supply

Once you have a clear vision of who your potential customers are and what they want, the next step is to look at your competitors.

Amongst other things, you’ll need to ask yourself:

- What brands are competing directly/indirectly against your food brokerage firm?

- How many competitors are there in the market?

- Where are they located in relation to your company's location?

- What will be the balance of power between you and your competitors?

- What types of services and products do they offer? At what price?

- Are they targeting the same customers as you?

- How do they promote themselves?

- Which concepts seem to appeal most to customers?

- Which competitors seem to be doing best?

The aim of your competitive analysis will be to identify who is likely to overshadow you, and to find a way to differentiate yourself (more on this see below).

Regulations

Market research is also an opportunity to look at the regulations and conditions required to do business.

Ask yourself the following questions:

- Do you need a special degree to open a food brokerage firm?

- Are there necessary licences or permits?

- What are the main laws applicable to your future business?

At this stage, your analysis of the regulations should be carried out at a high level, to familiarize yourself with any rules and procedures, and above all to ensure that you meet the necessary conditions for carrying out the activity before going any further.

You will have the opportunity to come back to the regulation afterwards with your lawyer when your project is at a more advanced stage.

Take stock of the lessons learned from your market analysis

Market research should give you a definitive idea of your business idea's chances of commercial success.

Ideally, the conclusion is that there is a market opportunity because one or more customer segments are currently underserved by the competition.

On the other hand, the conclusion may be that the market is already taken. In this case, don't panic: the first piece of good news is that you're not going to spend several years working hard on a project that has no chance of succeeding. The second is that there's no shortage of ideas out there: at The Business Plan Shop, we've identified over 1,300 business start-up ideas, so you're bound to find something that will work.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast and write a business plan to help convince investors that your business idea can be profitable.

Choosing the right concept and positioning for your food brokerage firm

Once your market research is completed, it's time to consider the type of food brokerage firm you want to open and define precisely your company's market positioning in order to capitalise on the opportunity you identified during your market research.

Market positioning refers to the place your product and service offering occupies in customers' minds and how they differ from competing products and services. Being perceived as the premium solution, for example.

There are four questions you need to consider:

- How will you compete with and differentiate yourself from competitors already on the market?

- Is it better to start or buy a food brokerage firm already in operation?

- How will you validate your concept and market positioning?

Let's look at each of these in a little more detail.

How will you compete with and differentiate yourself from competitors already on the market?

When you choose to start up a food brokerage firm, you are at a disadvantage compared to your rivals who have an established presence on the market.

Your competitors have a reputation, a loyal customer base and a solid team already in place, whereas you're starting from scratch...

Entering the market and taking market share from your competitors won't happen automatically, so it's important to carefully consider how you plan to establish your presence.

There are four questions to consider here:

- Can you avoid direct competition by targeting a customer segment that is currently poorly served by other players in the market?

- Can you offer something unique or complementary to what is already available on the market?

- How will you build a sustainable competitive advantage for your food brokerage firm?

- Do you have the resources to compete with well-established competitors on your own, or would it be wiser to explore alternative options?

Also, think about how your competitors will react to your arrival in their market.

Is it better to start or buy a food brokerage firm already in operation?

An alternative to opening a new business is to take over a food brokerage firm already trading.

Purchasing an existing food brokerage firm means you get a loyal customer base and an efficient team. It also avoids disrupting the equilibrium in the market by introducing a new player.

A takeover hugely reduces the risk of the business failing compared to starting a new business, whilst giving you the freedom to change the market positioning of the business taken over if you wish.

This makes buying an existing food brokerage firm a solid alternative to opening your own.

However, buying a business requires more capital compared to starting a food brokerage firm from scratch, as you will need to purchase the business from its current owner.

How will you validate your concept and market positioning?

Regardless of how you choose to establish your business, it's crucial to make sure that the way you position your company aligns with the expectations of your target market.

To achieve this, you'll have to meet with your potential customers to showcase your products or services and get their feedback.

Deciding where to base your food brokerage firm

The next step to opening a food brokerage firm is deciding where you want to set up your business.

Choosing the right location for your business is like finding the perfect stage for a play. Without it, your business may lack the spotlight it deserves.

Whilst there is no “perfect” location for your food brokerage firm, one that meets as many of the following factors as possible could be ideal:

- Visibility and foot traffic: As a food brokerage firm, it is important to be located in an area with high visibility and foot traffic to attract potential customers and showcase products.

- Parking space, road and public transport accessibility: Having ample parking space and easy access to roads and public transportation is crucial for transporting goods and conducting business efficiently.

- Proximity to target customers: Being close to the target market, such as grocery stores and restaurants, will make it easier to establish and maintain relationships with clients.

- Competitor presence: Researching the competition in the area can help determine if there is a demand for a food brokerage firm and how to differentiate from competitors.

This list is obviously not exhaustive and will have to be adapted to the particularities of your project.

Once you’ve considered the factors above, it’s important to think about the budget that your startup has at its disposal. You’ll need to find a location that meets your business requirements but is affordable enough, especially short-term.

If you opt for renting instead of buying your premises, make sure to take into account the terms of the lease, including aspects such as the duration, rent increase, renewal, and so on.

The lease contractual terms vary greatly from country to country, so be sure to check the terms applicable to your situation and have your lease reviewed by your lawyer before signing.

Need inspiration for your business plan?

Avoid writer's block and draft your own business plan in no time by drawing inspiration from dozens of business plan templates.

Choosing your food brokerage firm's legal form

The next step to open a food brokerage firm is to choose the legal form of your business.

The legal form of a business simply means the legal structure it operates under. This structure outlines how the business is set up and defines its legal obligations and responsibilities.

Why is your food brokerage firm's legal form important?

Choosing the legal form for your food brokerage firm is an important decision because this will affect your tax obligations, your personal exposure to risk, how decisions are made within the business, the sources of financing available to you, and the amount of paperwork and legal formalities, amongst other things.

The way you set up your business legally will impact your taxes and social contributions, both at a personal level (how much your income is taxed) and at the business level (how much the business's profits are taxed).

Your personal exposure to risk as a business owner also varies based on the legal form of your business. Certain legal forms have a legal personality (also called corporate personality), which means that the business obtains a legal entity which is separate from the owners and the people running it. To put it simply, if something goes wrong with a customer or competitor, for example, with a corporate personality the business gets sued, whereas without it is the entrepreneur personally.

Similarly, some legal forms benefit from limited liability. With a limited liability the maximum you can lose if the business fails is what you invested. Your personal assets are not at risk. However, not all structures protect you in such a way, some structures may expose your personal assets (for example, your creditors might try to go after your house if the business incurs debts and then goes under without being able to repay what it owed).

How decisions are made within the business is also influenced by the legal form of your food brokerage firm, and so is the amount of paperwork and legal formalities: do you need to hold general assemblies, to produce annual accounts, to get the accounts audited, etc.

The legal form also influences what sources of financing are available to you. Raising capital from investors requires having a company set up, and they will expect limited liability and corporate personality.

What are the most common legal structures?

It's important to note that the actual names of legal structures for businesses vary from country to country.

But they usually fall within two main types of structures:

- Individual businesses

- Companies

Individual businesses

Individual businesses, such as sole traders or sole proprietorships, are legal structures with basic administrative requirements.

They primarily serve self-employed individuals and freelancers rather than businesses with employees.

The main downside of being a sole trader is that there's usually no legal separation between the business and the person running it. Everything the person owns personally is tied up with the business, which can be risky.

This means that if there are problems or the business goes bankrupt, the entrepreneur's personal assets could be taken by creditors. So, there's a risk of personal liability in case of disputes or financial issues.

It is also not possible to raise equity from investors with these structures as there is no share capital.

Despite the downsides, being a sole proprietorship has some advantages. There is usually very little paperwork to get started, simpler tax calculations and accounting formalities.

Companies

Companies are all rounders which can be set up by one or more individuals, working on their own or with many employees.

They are recognized as a distinct entity with their own legal personality, and the liability is usually limited to the amount invested by the owners (co-founders and investors). This means that you cannot lose more than you have invested in the business.

This separation ensures that in legal disputes or bankruptcy, the company bears primary responsibility, protecting the personal assets of the founder(s) and potential investor(s).

How should I choose my food brokerage firm's legal structure?

Deciding on the legal structure is usually quite straightforward once you know how many co-founders you'll have, whether you'll have employees, and the expected revenues for the business.

A good business idea will be viable whatever the legal form you choose. How businesses are taxed changes every year, therefore one cannot rely on specific tax benefits tied to a particular structure when deciding to go into business.

One easy way to proceed is to take note of the legal structures used by your top five competitors, and assume you're going with the most commonly chosen option. Once your idea is mature and you're prepared to formally register the business, you can validate this assumption with a lawyer and an accountant.

Can I switch my food brokerage firm's legal structure if I get it wrong?

You can switch your legal setup later on, even if it involves selling the old one to a new entity in some cases. However, this comes with extra costs, so it's better to make the right choice from the beginning if you can.

Can your business idea be profitable?

Just enter your data and let The Business Plan Shop crunch the numbers. We will tell if your business idea can generate profits and cash flows, and how much you need to get started.

Assess the startup costs for a food brokerage firm

The next step in creating a food brokerage firm involves thinking about the equipment and staff needed for the business to operate.

After figuring out what you need for your business, your financial plan will reveal how much money you'll need to start and how much you might make (check below for more details).

Because every venture is distinctive, providing a reliable one-size-fits-all budget for launching a food brokerage firm without knowing the specifics of your project is not feasible.

Each project has its own particularities (size, concept, location), and only a forecast can show the exact amount required for the initial investment.

The first thing you'll need to consider is the equipment and investments you'll need to get your business up and running.

Startup costs and investments to launch your food brokerage firm

For a food brokerage firm, the initial working capital requirements (WCR) and investments could include the following elements:

- Warehouse Space: As a food brokerage firm, you will need adequate warehouse space to store and distribute the products that you represent. This could include rent, utilities, and maintenance costs.

- Delivery Vehicles: You will likely need delivery vehicles to transport products from your warehouse to your clients. These may include trucks, vans, or other vehicles with refrigeration capabilities.

- Office Equipment: In order to effectively run your food brokerage firm, you will need essential office equipment such as computers, printers, and furniture. These items may require upfront investment but will be necessary for your day-to-day operations.

- Software and Technology: With the increasing use of technology in the food industry, investing in software and technology will be crucial for your food brokerage firm. This may include inventory management systems, customer relationship management (CRM) software, and other tools to help you streamline your processes and improve efficiency.

- Refrigeration Equipment: Depending on the types of products you represent, you may need to invest in refrigeration equipment to store and transport perishable goods. This could include walk-in coolers, refrigerated trucks, or other cooling systems.

Of course, you will need to adapt this list to your business specificities.

Staffing plan of a food brokerage firm

In addition to equipment, you'll also need to consider the human resources required to run the food brokerage firm on a day-to-day basis.

The number of recruitments you need to plan will depend mainly on the size of your company.

Once again, this list is only indicative and will need to be adjusted according to the specifics of your food brokerage firm.

Other operating expenses for a food brokerage firm

While you're thinking about the resources you'll need, it's also a good time to start listing the operating costs you'll need to anticipate for your business.

The main operating costs for a food brokerage firm may include:

- Staff costs: This includes salaries, benefits, and any other expenses related to your employees. As a food brokerage firm, you will need to hire sales representatives, customer service agents, and administrative staff to run your business effectively.

- Accountancy fees: You will need to hire an accountant to keep track of your financial records, prepare tax filings, and provide financial advice. These fees may include bookkeeping, tax preparation, and other accounting services.

- Insurance costs: It is important to have insurance coverage to protect your business from any potential risks. This may include general liability insurance, professional liability insurance, and property insurance.

- Software licences: As a food brokerage firm, you will need to use various software programs to manage your operations, such as inventory management software, sales tracking software, and accounting software. These programs may require annual or monthly licence fees.

- Banking fees: You will need to maintain a business bank account to manage your finances. This may include fees for maintaining the account, wire transfers, and other banking services.

- Marketing expenses: To attract clients and promote your services, you will need to invest in marketing activities. This may include print and digital advertising, trade show expenses, and promotional materials.

- Office rent: You will need to rent office space to run your business. This may include monthly rent, utilities, and maintenance fees.

- Travel expenses: As a food brokerage firm, you may need to travel to meet with clients or attend trade shows. This may include airfare, hotel accommodations, and other travel-related expenses.

- Professional development: It is important to continuously learn and improve your skills as a food broker. This may include attending conferences, seminars, and other training programs.

- Legal fees: You may need to consult with a lawyer for legal advice or to draft contracts for your business. This may include fees for consultations, contract review, and other legal services.

- Office supplies: To run your business smoothly, you will need to purchase office supplies such as stationery, printer ink, and other necessary items.

- Telephone and internet expenses: You will need to have a reliable phone and internet connection to communicate with clients and run your business. This may include monthly service fees and equipment costs.

- Training and onboarding: When you hire new employees, you will need to provide them with training and onboarding. This may include training materials, workshops, and other resources.

- Office equipment: You may need to purchase or lease office equipment such as computers, printers, and furniture to run your business.

- Utilities: You will need to pay for utilities such as electricity, water, and gas to operate your office space.

Like for the other examples included in this guide, this list will need to be tailored to your business but should be a good starting point for your budget.

Create a sales & marketing plan for your food brokerage firm

The next step to launching your food brokerage firm is to think about the actions you need to take to promote your products and services and build customer loyalty.

Here, you'll be looking at the following issues:

- What is the best method to attract as many new customers as possible?

- How to build customer loyalty and spread word of mouth?

- What human and financial resources will be required to implement the planned actions?

- What level of sales can I expect to generate in return?

The precise sales and marketing levers to activate will depend on the size of your food brokerage firm. But you could potentially leverage some of the initiatives below.

Besides your sales and marketing plan, your sales forecast will be affected by seasonal patterns related to the nature of your business, such as fluctuations during the holiday season, and your competitive landscape.

Can your business idea be profitable?

Just enter your data and let The Business Plan Shop crunch the numbers. We will tell if your business idea can generate profits and cash flows, and how much you need to get started.

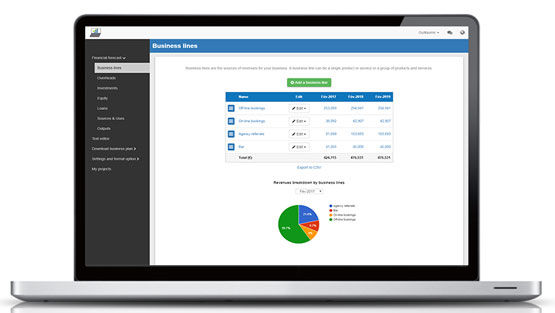

Build your food brokerage firm's financial forecast

The next step to start your food brokerage firm: putting your financial projections together.

What is the financial forecast for a food brokerage firm?

A forecast is a quantified decision-making document that shows the initial investment required to open a food brokerage firm and the company's potential profitability and cash flow generation over the next 3 to 5 years.

As you think about your food brokerage firm idea, the main role of financial projections will be to help you decide whether it makes sense to create the company.

Building a financial forecast helps determine the amount of initial financing required to start your food brokerage firm.

In fact, creating financial projections is the only way to assess the amount of initial financing you'll need to open your food brokerage firm, and to make sure your project makes economic and financial sense.

Keep in mind that very few business ideas are financially viable. At The Business Plan Shop, we've seen nearly a million business start-up ideas, and we estimate that less than one in four is economically viable.

Your forecast will therefore require your full attention and constant revision, as your project matures. It's also a good idea to simulate different scenarios to anticipate several possibilities (what happens if your sales take longer than expected to ramp up, for example), so you're ready for all eventualities.

When seeking financing, your forecast will be incorporated into your business plan, which is the document you will use to present your business idea to financial partners. We'll come back to the business plan in more detail later in this guide.

Creating and updating your food brokerage firm's forecast is an ongoing process. Indeed, having up-to-date financial projections is the only way to maintain visibility over your company's future cash flow and cash position.

Forecasting is, therefore, the financial management tool that will be with you throughout the life of your company. Once you've started trading, you'll need to regularly compare the difference between your actual accounts and your forecasts, and then adjust them to maintain visibility over your future cash flows.

What does a financial projection look like?

The following financial tables will be used to present your food brokerage firm's financial forecast.

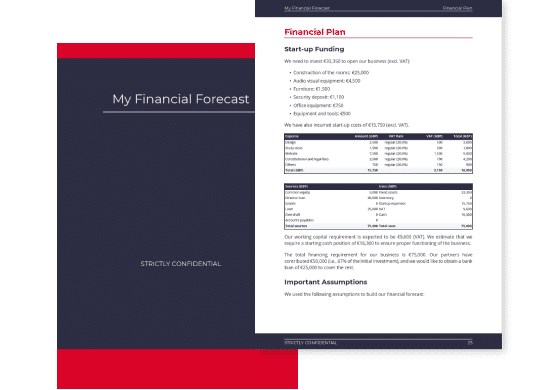

The projected P&L statement

Your food brokerage firm's forecasted P&L statement will enable you to visualise your food brokerage firm's expected growth and profitability over the next three to five years.

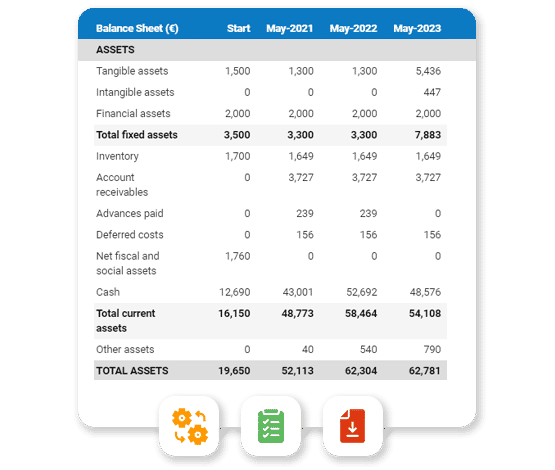

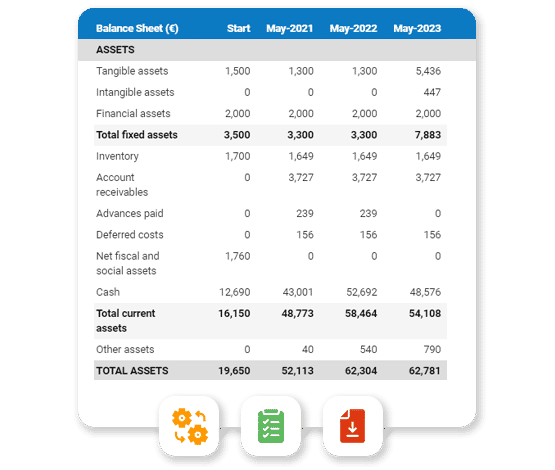

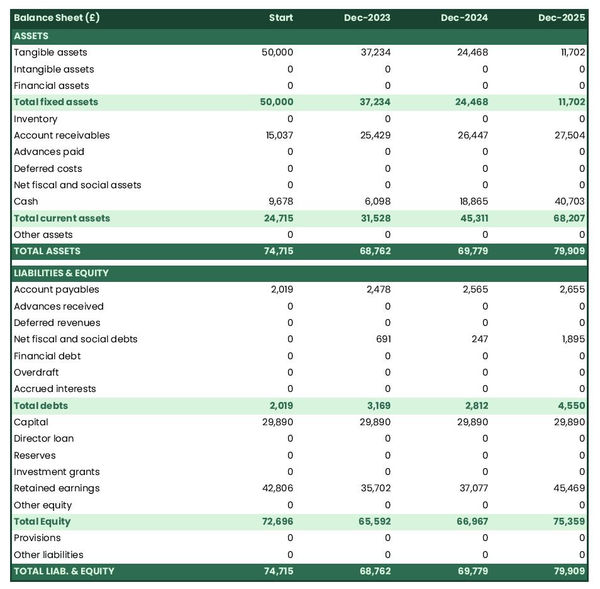

The projected balance sheet of your food brokerage firm

The projected balance sheet gives an overview of your food brokerage firm's financial structure at the end of the financial year.

The cash flow projection

A cash flow forecast for a food brokerage firm shows the projected inflows and outflows of cash over a specific period, providing insights into liquidity and financial health.

Which solution should you use to make a financial forecast for your food brokerage firm?

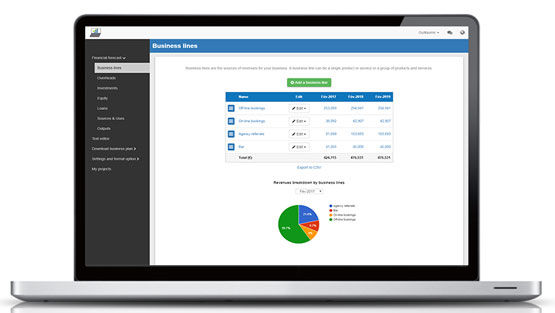

The easiest and safest way to create your food brokerage firm forecasts is to use an online financial forecasting software, like the one we offer at The Business Plan Shop.

There are several advantages to using professional software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You have access to complete financial forecast templates

- You get a complete financial forecast ready to be sent to your bank or investors

- The software helps you identify and correct any inconsistencies in your figures

- You can create scenarios to stress-test your forecast's main assumptions to stress-test the robustness of your business model

- After you start trading, you can easily track your actual financial performance against your financial forecast, and recalibrate your forecast to maintain visibility on your future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you are interested in this type of solution, you can try our forecasting software for free by signing up here.

Choose a name and register your food brokerage firm

The next phase in launching your food brokerage firm involves selecting a name for your company.

This stage is trickier than it seems. Finding the name itself is quite fun; the difficulty lies in finding one that is available and being the first to reserve it.

You cannot take a name that is similar to a name already used by a competitor or protected by a registered trademark without inevitably risking legal action.

So you need to find a name that is available, and be able to register it before someone else can.

In addition, you will probably want to use the same name for:

- Your company’s legal name - Example LTD

- Your business trading name - Example

- The trademark - Example ®

- Your company’s domain name - Example.com

The problem is that the procedures for registering these different names are carried out in different places, each with their own deadlines:

- Registering a domain name takes only a few minutes

- Registering a new trademark takes at least 12 weeks (if your application is accepted)

- The time taken to register a new business depends on the country, but it's generally fast

You will therefore be faced with the choice of: either registering everything at once and hoping that your name will be accepted everywhere, or proceeding step by step in order to minimise costs, but taking the risk that someone else will register one of the names you wanted in the meantime.

Our advice is to discuss strategy with your legal counsel (see further down in this guide) and prioritise your domain names and registered trademarks. You'll always have the option of using a trade name that's different from your company's legal name, and that's not a big deal.

To check that the name you want is not already in use, you should consult:

- Your country's business register

- The relevant trademark registers depending on which countries you want to register your trade mark in

- A domain name reservation company such as GoDaddy

- An Internet search engine

In this area too, your legal counsel will be able to help with the research and formalities.

Need inspiration for your business plan?

Avoid writer's block and draft your own business plan in no time by drawing inspiration from dozens of business plan templates.

Develop your food brokerage firm's corporate identity

The next step to launching a food brokerage firm: defining your company's visual identity.

Your corporate identity defines how your company's values are communicated visually. It makes you unique and allows you to stand out visually from your competitors and be recognized by your customers.

Defining your corporate identity can easily be done by you and your co-founders, using the many free tools available to generate color palettes, logos and other graphic elements. Nevertheless, this task is often best entrusted to a designer or agency to achieve a professional result.

Your food brokerage firm's visual identity will include the following elements:

- Logo

- Brand guidelines

- Business cards

- Website theme

Logo

The goal is to have stakeholders identify your business logo quickly and relate to it. Your logo will be used for media purposes (website, social networks, business cards, etc.) and legal documents (invoices, contracts, etc.).

The design of your logo must be emblematic, but it's also important that it can be seen on any type of support. To achieve this, it should be easily available in a range of colors, so that it stands out on both light and dark backgrounds.

Brand guidelines

The brand guidelines of your food brokerage firm act as a safeguard to ensure that your image is consistent whatever the medium used.

Brand guidelines lay out the details like the typography and colors to use to represent your company.

Typography refers to the fonts used (family and size). For example, Arial in size 26 for your titles and Tahoma in size 15 for your texts.

When it comes to the colors representing your brand, it's generally a good idea to stick to five or fewer:

- The main colour,

- A secondary colour (the accent),

- A dark background colour (blue or black),

- A grey background colour (to vary from white),

- Possibly another secondary colour.

Business cards

A rare paper medium that continues to survive digitalization, business cards are still a must-have for communicating your food brokerage firm contact details to your customers, suppliers and other partners.

In principle, they will include your logo and the brand guidelines we mentioned above.

Website theme

Likewise, the theme of your food brokerage firm website will include your logo and follow the brand guidelines we discussed earlier.

This will also define the look and feel of the main visual elements on your website:

- Buttons

- Menus

- Forms

- Banners

- Etc.

Understanding the legal and regulatory steps involved in opening a food brokerage firm

The next step in opening a food brokerage firm is to take the necessary legal and regulatory steps.

We recommend that you be accompanied by a law firm for all of the steps outlined below.

Registering a trademark and protecting the intellectual property of your food brokerage firm

The first step is to protect your company's intellectual property.

As mentioned earlier in this guide, you have the option to register a trademark. Your lawyer can assist you with a thorough search to ensure your chosen trademark is unique and doesn't conflict with existing ones and help select the classes (economic activities) and jurisdictions in which to register your trademark.

Your lawyer will also be able to advise you on other steps you could take to protect your company's other intellectual property assets.

Drafting the contractual documents for your food brokerage firm

Your food brokerage firm will rely on a set of contracts and legal documents for day-to-day operations.

Once again, we strongly recommend that you have these documents drawn up by a lawyer.

Your exact needs will depend on the country in which you are launching your food brokerage firm and the size of the company you are planning.

However, you may wish to consider the following documents at a minimum:

- Employment contracts

- General terms and conditions of sale

- General terms and conditions of use for your website

- Privacy Policy for your website

- Cookie Policy for your website

- Invoices

- Etc.

Applying for licences and permits and registering for various taxes

The licenses and permits needed for your business will depend on the country where you are establishing it. Your lawyer can guide you on the regulations relevant to your activity.

Similarly, your chartered accountant will be able to help you register for taxes and take the necessary steps to comply with the tax authorities.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast and write a business plan to help convince investors that your business idea can be profitable.

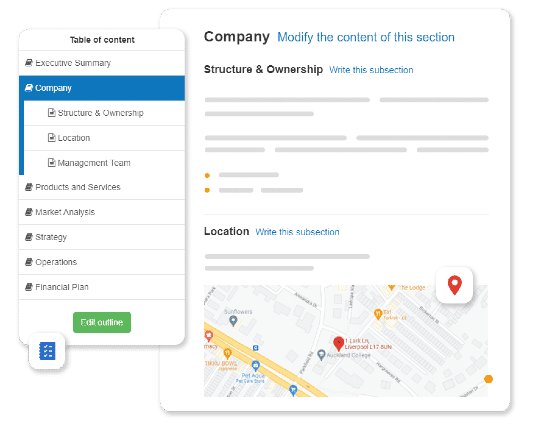

Writing a business plan for your food brokerage firm

The next step in opening a food brokerage firm is to draw up your business plan.

What is a food brokerage firm's business plan?

A business plan serves as a comprehensive roadmap outlining the objectives, strategies, and key components of your venture.

There are two essential parts to a business plan:

- A numerical part, the financial forecast we mentioned earlier in this guide, which highlights the amount of initial financing needed to launch the business and its potential profitability over the next 3 to 5 years,

- A written part, which presents in detail the project of creating a food brokerage firm and provides the necessary context to enable the reader of the business plan to judge the relevance and coherence of the figures included in the forecast.

Your business plan helps guide decision-making by showcasing your vision and financial potential in a coherent manner.

Your business plan will also be essential when you're looking for financing, as your financial partners will ask you for it when deciding whether or not to finance your project to open a food brokerage firm. So it's best to produce a professional, reliable, and error-free business plan.

In essence, your business plan is the blueprint to turn your idea into a successful reality.

What tool should you use to create your food brokerage firm business plan?

If you want to write a convincing business plan quickly and efficiently, a good solution is to use an online business plan software for business start-ups like the one we offer at The Business Plan Shop.

Using The Business Plan Shop to create a business plan for a food brokerage firm has several advantages :

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can access a library of dozens of complete startup business plan samples and templates for inspiration

- You get a professional business plan, formatted and ready to be sent to your bank or investors

- You can create scenarios to stress test your forecast's main assumptions

- You can easily track your actual financial performance against your financial forecast by importing accounting data

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you're interested in using our solution, you can try The Business Plan Shop for free by signing up here.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast and write a business plan to help convince investors that your business idea can be profitable.

How to raise finance for my food brokerage firm?

Once your business plan has been drafted, you’ll need to think about how you might secure the financing necessary to open your food brokerage firm.

The amount of initial financing required will obviously depend on the size of your food brokerage firm and the country in which you wish to set up.

Businesses have access to two main categories of financing: equity and debt. Let's take a closer look at how they work and what sources are available.

Equity funding

At a high level, the equity of your food brokerage firm will consist of the money that founders and potential investors will invest to launch the company.

Equity is indispensable as it provides the company with a source of long-term (often permanent) financing and demonstrates the founders' conviction in the company's chances of success, since their investments would be lost in the event of bankruptcy.

Equity investors can generate a return on their investment through dividends (which can only be paid out if the company is profitable) or capital gains on the resale of their shares (if the company is attractive enough to attract a buyer).

As you can see, the equity investors' position is extremely risky, since their capital is at risk and can be lost in the event of bankruptcy, and the company must be profitable or resellable before they can hope to generate a return on their investment.

On the other hand, the return on investment that equity investors can expect to generate by investing in a food brokerage firm can be very substantial if the company is successful.

This is why equity investors look for start-up ideas with very high growth or profitability potential, in order to offset their risk with a high potential return on investment.

In technical terms, equity includes:

- Share capital and premiums: which represent the amount invested by the shareholders. This capital is considered permanent as it is non-refundable. In return for their investment, shareholders receive shares that entitle them to information, decision-making power (voting in general assembly), and the potential to receive a portion of any dividends distributed by the company.

- Director loans: these are examples of non-permanent capital advanced to the company by the shareholders. This is a more flexible way of injecting some liquidity into your company than doing so as you can repay director loans at any time.

- Reserves: these represent the share of profits set aside to strengthen the company's equity. Allocating a percentage of your profits to the reserves can be mandatory in certain cases (legal or statutory requirement depending on the legal form of your company). Once allocated in reserves, these profits can no longer be distributed as dividends.

- Investment grants: these represent any non-refundable amounts received by the company to help it invest in long-term assets.

- Other equity: which includes the equity items which don't fit in the other categories. Mostly convertible or derivative instruments. For a small business, it is likely that you won't have any other equity items.

The main sources of equity are as follows:

- Money put into the business from the founders' personal savings.

- Money invested by private individuals, which can include business angels, friends, and family members.

- Funds raised through crowdfunding, which can take the form of either equity or donations (often in exchange for a reward).

- Government support to start-ups, for example, loans on favourable terms to help founders build up their start-up capital.

Debt funding

The other way to finance your food brokerage firm is to borrow. From a financial point of view, the risk/return profile of debt is the opposite of that of equity: lenders' return on investment is guaranteed, but limited.

When it borrows, your company makes a contractual commitment to pay the lenders by interest, and to repay the capital borrowed according to a pre-agreed schedule.

As you can see, the lenders' return on investment is independent of whether or not the company is profitable. In fact, the only risk taken by lenders is the risk of the company going bankrupt.

To avoid this risk, lenders are very cautious, only agreeing to finance when they are convinced that the borrowing company will be able to repay them without problems.

From the point of view of the company and its stakeholders (workforce, customers, suppliers, etc.), debt increases the risk of the venture, since the company is committed to repaying the capital whether or not it is profitable. So there's a certain distrust towards heavily indebted companies.

Companies borrow in two ways:

- Against their assets: this is the most common way of borrowing. The bank finances a percentage of the price of an asset (a vehicle or a building, for example) and takes the asset as collateral. If the company cannot repay, the bank seizes the asset and sells it to limit its losses.

- Against their future cash flows: the bank reviews the company's financial forecast to estimate how much the company can comfortably borrow and repay, and what terms (amount, interest rate, term, etc.) the bank is prepared to offer given the credit risk posed by the company.

When creating a food brokerage firm, the first option is often the only one available, as lenders are often reluctant to lend on the basis of future cash flows to a structure that has no track record.

The type of assets that can be financed using the first method is also limited. Lenders will want to be sure that they can dispose of foreclosed assets if needed, so they need to be assets that have an established second-hand market.

That being said, terms and conditions also depend on the lender: some banks are prepared to finance riskier projects, and not all have the same view of your company's credit risk. It also depends on the collateral you can offer to reduce risk, and on your relationship with the bank.

In terms of possible sources of borrowing, the main sources here are banks and credit institutions.

In some countries, it's also possible to borrow from private investors (directly or via crowdlending platforms) or other companies, but not everywhere.

Takeaways on how to finance a food brokerage firm

Multiple options are available to help you raise the initial financing you need to launch your food brokerage firm.

There are two types of financing available to companies. To open a food brokerage firm, an equity investment will be required and may be supplemented by bank financing.

Track your actuals against your forecast

You've reached the end of the road and are ready to launch your food brokerage firm.

Congratulations and welcome to the fantastic world of entrepreneurship! Celebrate the work you've done so far, and get back to work quickly, because this is where the real work begins.

Your first priority will be to do everything you can to make your business sustainable (and thus avoid being one of the 50% of start-ups that fail within five years of launching).

Your business plan will be your best ally to ensure that you're on track to achieve your objectives, or to help rectify the situation if necessary.

The key to financial management is to regularly compare your actual accounting data with your food brokerage firm forecasts, in order to be able to :

- Quantify the gaps between what you planned and what you achieved

- Adjust your financial forecasts as the year progresses to maintain visibility over your future cash flow

No one can predict the future with certainty, but by closely monitoring the variances between actuals and forecasts, regularly adjusting your forecasts and simulating several scenarios, you can prepare your food brokerage firm for the worst while hoping for the best.

It's the only way to keep an eye on your cash flow and actively manage the development of your food brokerage firm, ultimately reducing the risk to your company.

There's nothing worse than waiting for your company's annual accounts to close, which can be many months after the end of your financial year (up to nine months in the UK for example), only to realize that you've fallen far short of your forecasts for the past year, and that your food brokerage firm urgently needs a cash injection to keep going.

That's why it's strongly recommended to use a financial planning and analysis solution that integrates forecasting, scenario analysis, and actuals vs. forecast tracking, like we do at The Business Plan Shop with our financial dashboards.

Need inspiration for your business plan?

Avoid writer's block and draft your own business plan in no time by drawing inspiration from dozens of business plan templates.

Key takeaways

- There are 15 key steps to opening a food brokerage firm.

- Your financial forecast will enable you to accurately assess your initial financing requirements and the potential profitability of your project.

- Your business plan will give your financial partners the context they need to be able to judge the consistency and relevance of your forecast before deciding whether or not to finance the creation of your food brokerage firm.

- Post-launch, it's essential to have an up-to-date forecast to maintain visibility of your business's future cash flows.

- Using a financial planning and analysis platform that integrates forecasts, business plans and actual performance monitoring, such as The Business Plan Shop, makes the process easier and reduces the risks involved in starting a business.

We hope this guide has helped you understand how to open a food brokerage firm. Please don't hesitate to contact us if you have any questions or want to share your experience as an entrepreneur.

Also on The Business Plan Shop

Know someone who wants to start a food brokerage firm? Share this guide with them!