How can I edit my equity?

This article explains how to enter equity in The Business Plan Shop's our financial forecasting software.

This data enables our software to build your financial statements (balance sheet, P&L, cash flow statement), which can then be downloaded along with your business plan.

It’s fast and easy to do.

How can I add or edit equity in The Business Plan Shopour software?

Firstly, follow this link to access the equity module. Once you are on the module, click on the edit button.

How does the edit equity module work?

The module contains tabs that enable you to enter the financial data required to model the equity amount.

Common equity tab

The Common equity tab allows you to enter the amount that has been invested into the business by shareholders (nominal and share premium).

You can also detail any capital that has been raised during a financial year. Note that if you use the annual summary section to do so, the software will assume the fundraise happened in the first month of the financial year.

Shareholders loan tab

The shareholders loan tab allows you to enter the amount that has been loaned to the business by shareholders.

Note that you can enter the amount monthly or annually. If you use the annual summary section to detail any changes in the shareholder’s loan, the software will automatically allocate those changes to the first month.

Retained earnings tab

Retained earnings are accumulated profits (or losses).

They can either be distributed to shareholders in the form of dividends, added to the overall reserves (these cannot be distributed) or kept in the retained earnings account until the shareholders decide what to do with them.

Note that the software automatically checks if the total retained earnings are positive or not when validating inputs. It needs to be positive in order to pay dividends or if you want to add them to reserves.

The retained earnings tab allows you to enter the amount of dividends or reserves.

Note that you can enter the amount monthly or annually. If you use the annual summary section for dividends or reserves, by default the software will allocate the amount to the final month of that financial year.

Reserves tab

The Reserves Tab allows you to view the amount that has been put in reserves.

If you are doing a business plan for an existing business, you can also enter the value of the reserves at the beginning of the plan.

Other equity tab

The other equity tab is unlikely to be applicable to small businesses. It lets you enter any equity items that your business holds that don’t fit into any of the other categories such as convertibles or derivative instruments.

How does the edit equity module impact my financial forecast?

The Business Plan Shop's Our software will use your equity amount data to create your forecasted financial statements (P&L, balance sheet and cash flow statement).

These statements also form part of the financial plan section of your business plan.

As soon as you save a new equity amount, the software will automatically recalculate everything to ensure that your financial forecast is up to date. It’s fast and simple, meaning that your plan will always be ready to export.

When building your forecasted financial statements:

- We’ll use the amount entered to build your balance sheet equity

- We’ll also use this data to build the financing cash flow in your cash flow forecast.

Frequently Asked Questions

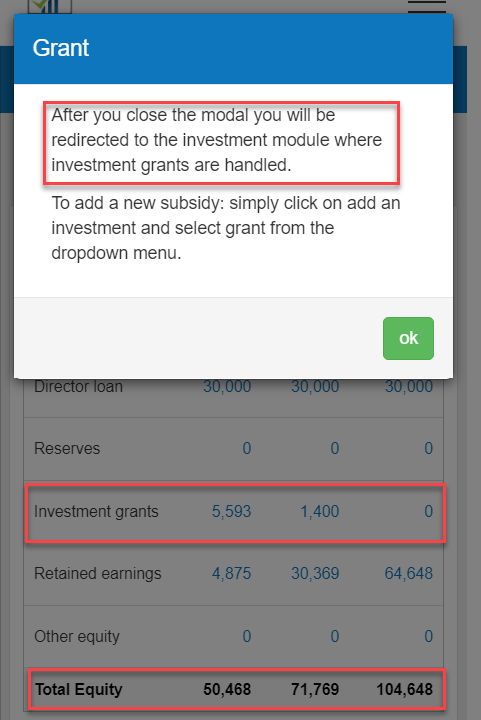

No, you cannot add investment grants to this module.

While its true that investment grants are visible in the equity module, these are only there as a perspective. Clicking on them will redirect you to the investments module.

Go further with The Business Plan Shop

Was this page helpful?