How do I edit my sources and uses?

This article explains how to enter your sources and uses in The Business Plan Shop’s financial forecasting software.

This data enables our software to build your financial statements (balance sheet, P&L, cash flow statement), which can then be downloaded along with your business plan.

It’s fast and easy to do.

How can I add or edit sources and uses in The Business Plan Shop?

Firstly, follow this link to access the sources and uses module. Once you are on the module, click the edit button.

How does the edit sources and uses module work?

Start Up Expenses

The start up expenses tab allows you to enter the name and the amount for the cost. This section is used to detail any expenses incurred prior to the operation contemplated in this business plan (refinancing, buyout, expansion plan, etc.).

For existing businesses, the software assumes that these are already included in the opening working capital and retained earnings.

Cash And Other Balance Sheet Items

The Cash And Other Balance Sheet Items Tab allows existing businesses to enter their opening working capital and other balance sheet items. This tab is hidden for start-up plans.

Opening Balance Sheet

The opening balance sheet tab displays a snapshot of your balance sheet on day one of the business plan. It uses the opening balance of each financial item that you have listed on your plan.

Note that any investments or loans will not be included in this snapshot unless their date is set to “the beginning of the plan.”

Comments & notes tab

The comments & notes tab lets you write down your hypothesis, notes or comments.

Notes are private and only visible to you, whilst comments can be seen by other users you invited to collaborate with you on your plan.

How does the edit sources and uses module impact my financial forecast?

The Business Plan Shop’s software will use your sources and uses to create the opening balance sheet of your forecasted financial statements.

If you are on a startup plan, we will also use your start-up expenses to build the opening value of your retained earnings and carry back these losses when computing your corporation tax.

If you are on an existing business plan, we will also use the schedules to allocate the cash movements linked to your opening balance sheet in your first year cash flow statement, and potential deferred costs or revenues in your P&L.

What advice can you give me before I begin editing my sources and uses?

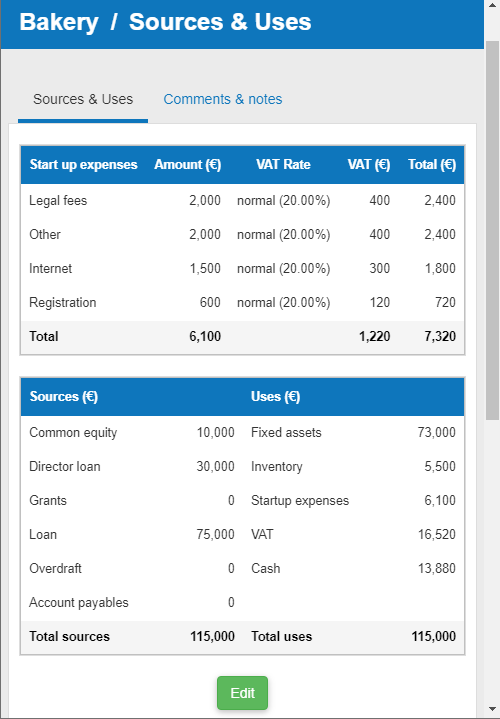

The sources and uses table shows a breakdown of your company's financing at day 1.

The sources columns shows which sources of finance are being used and the uses column how they are being used. Here you need to make sure that your cash position is positive.

Frequently Asked Questions

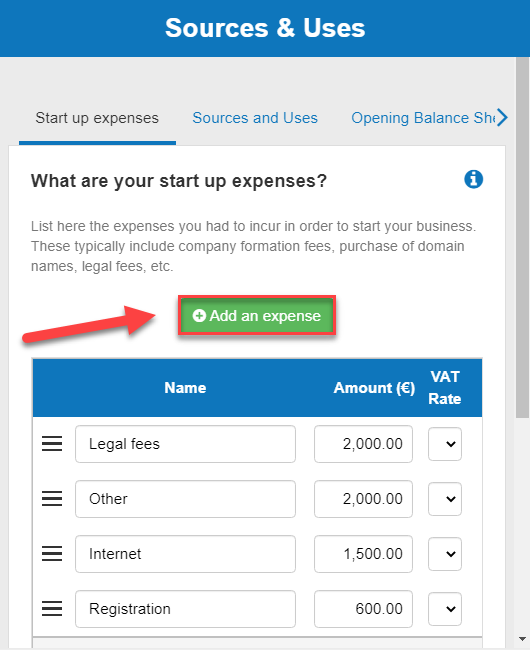

- Firstly, click on the "startup expenses" tab

- Then, click on the "add an expense" button above the table

![adding a new startup expense to the business plan shop's software]()

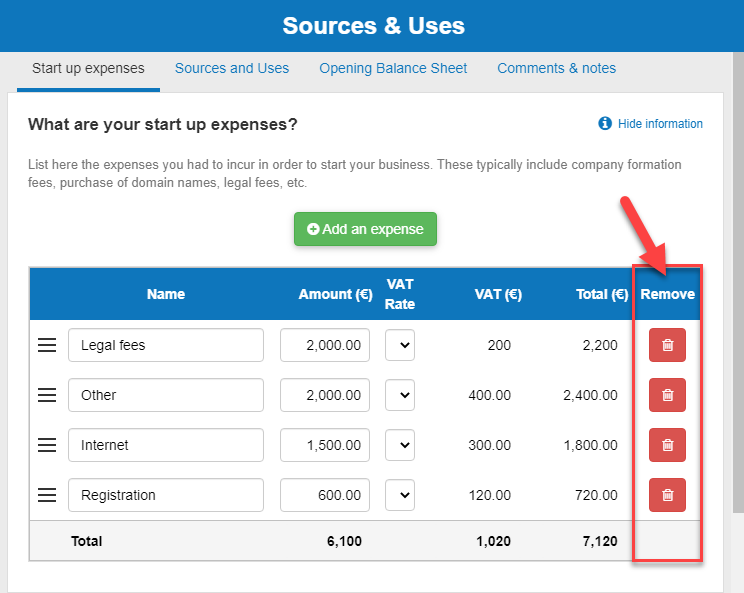

- Firstly, click on the "startup expenses" tab

- Then, click on the "remove" button in the table

![deleting a startup expense that is unnecessary]()

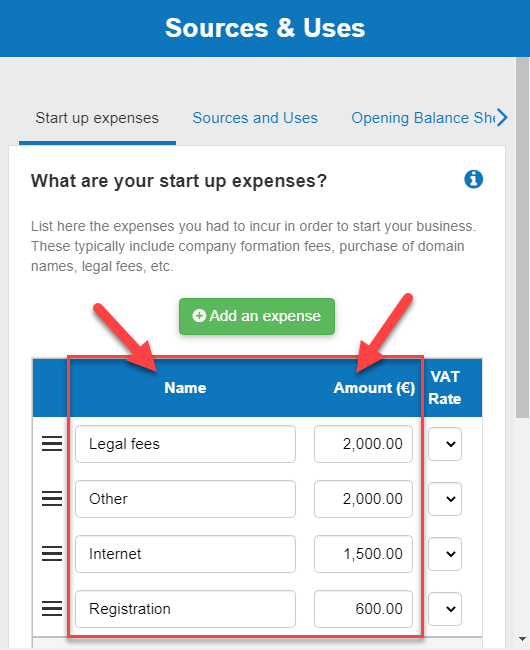

- Firstly, click on the "startup expenses" tab

- There will be headings called "name" and "amount" in the table

![editing the name and amount of a startup expense in the table]()

Go further with The Business Plan Shop

Was this page helpful?