How to write a business plan for a NEMT company?

Creating a business plan for a NEMT company is an essential process for any entrepreneur. It serves as a roadmap that outlines the necessary steps to be taken to start or grow the business, the resources required, and the anticipated financial outcomes. It should be crafted with method and confidence.

This guide is designed to provide you with the tools and knowledge necessary for creating a NEMT company business plan, covering why it is so important both when starting up and running an established business, what should be included in your plan, how it should be structured, what tools should be used to save time and avoid errors, and other helpful tips.

We have a lot to cover, so let's get to it!

Why write a business plan for a NEMT company?

Being clear on the scope and goals of the document will make it easier to understand its structure and content. So before diving into the actual content of the plan, let's have a quick look at the main reasons why you would want to write a NEMT company business plan in the first place.

To have a clear roadmap to grow the business

Small businesses rarely experience a constant and predictable environment. Economic cycles go up and down, while the business landscape is mutating constantly with new regulations, technologies, competitors, and consumer behaviours emerging when we least expect it.

In this dynamic context, it's essential to have a clear roadmap for your NEMT company. Otherwise, you are navigating in the dark which is dangerous given that - as a business owner - your capital is at risk.

That's why crafting a well-thought-out business plan is crucial to ensure the long-term success and sustainability of your venture.

To create an effective business plan, you'll need to take a step-by-step approach. First, you'll have to assess your current position (if you're already in business), and then identify where you'd like your NEMT company to be in the next three to five years.

Once you have a clear destination for your NEMT company, you'll focus on three key areas:

- Resources: you'll determine the human, equipment, and capital resources needed to reach your goals successfully.

- Speed: you'll establish the optimal pace at which your business needs to grow if it is to meet its objectives within the desired timeframe.

- Risks: you'll identify and address potential risks you might encounter along the way.

By going through this process regularly, you'll be able to make informed decisions about resource allocation, paving the way for the long-term success of your business.

To anticipate future cash flows

Regularly comparing your actual financial performance to the projections in the financial forecast of your NEMT company's business plan gives you the ability to monitor your business's financial health and make necessary adjustments as needed.

This practice allows you to detect potential financial issues, such as unexpected cash shortfalls before they escalate into major problems. Giving you time to find additional financing or put in place corrective measures.

Additionally, it helps you identify growth opportunities, like excess cash flow that could be allocated to launch new products and services or expand into new markets.

Staying on track with these regular comparisons enables you to make well-informed decisions about the amount of financing your business might require, or the excess cash flow you can expect to generate from your main business activities.

To secure financing

Whether you are a startup or an existing business, writing a detailed NEMT company business plan is essential when seeking financing from banks or investors.

This makes sense given what we've just seen: financiers want to ensure you have a clear roadmap and visibility on your future cash flows.

Banks will use the information included in the plan to assess your borrowing capacity (how much debt your business can support) and your ability to repay the loan before deciding whether they will extend credit to your business and on what terms.

Similarly, investors will review your plan carefully to assess if their investment can generate an attractive return on investment.

To do so, they will be looking for evidence that your NEMT company has the potential for healthy growth, profitability, and cash flow generation over time.

Now that you understand why it is important to create a business plan for a NEMT company, let's take a look at what information is needed to create one.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Information needed to create a business plan for a NEMT company

Drafting a NEMT company business plan requires research so that you can project sales, investments and cost accurately in your financial forecast, and convince the reader that there is a viable commercial opportunity to be seized.

Below, we'll focus on three critical pieces of information you should gather before starting to write your plan.

Carrying out market research for a NEMT company

Before you begin writing your business plan for a NEMT company, conducting market research is a critical step in ensuring precise and realistic financial projections.

Market research grants you valuable insights into your target customer base, competitors, pricing strategies, and other crucial factors that can impact the success of your business.

In the course of this research, you may stumble upon trends that could impact your NEMT company.

Your market research might reveal that the demand for NEMT services may be growing in certain areas, and that your company could benefit from expanding into those areas. Additionally, it could reveal that elderly and disabled populations may be increasingly reliant on NEMT services, indicating a potential opportunity to specialize in those markets.

Such market trends play a pivotal role in revenue forecasting, as they provide essential data regarding potential customers' spending habits and preferences.

By integrating these findings into your financial projections, you can provide investors with more accurate information, enabling them to make well-informed decisions about investing in your NEMT company.

Developing the marketing plan for a NEMT company

Before delving into your NEMT company business plan, it's imperative to budget for sales and marketing expenses.

To achieve this, a comprehensive sales and marketing plan is essential. This plan should provide an accurate projection of the necessary actions to acquire and retain customers.

Additionally, it will outline the required workforce to carry out these initiatives and the corresponding budget for promotions, advertising, and other marketing endeavours.

By budgeting accordingly, you can ensure that the right resources are allocated to these vital activities, aligning them with the sales and growth objectives outlined in your business plan.

The staffing and equipment needs of a NEMT company

As you embark on starting or expanding your NEMT company, having a clear plan for recruitment and capital expenditures (investment in equipment and real estate) is essential for ensuring your business's success.

Both the recruitment and investment plans must align with the timing and level of growth projected in your forecast, and they require appropriate funding.

One possible staffing cost that a NEMT company might incur is the cost of hiring a fleet of drivers. Additionally, the company could incur costs for recruiting, interviewing, and onboarding staff. Another possible cost is the cost of purchasing or leasing the necessary vehicles and equipment for the business, such as wheelchair-accessible vans, navigation systems, and other necessary medical equipment. The company could also incur costs for vehicle maintenance and fuel. Finally, the company could incur costs for office supplies and administrative staff.

To create a realistic financial forecast, you also need to consider other operating expenses associated with the day-to-day running of your business, such as insurance and bookkeeping.

With all the necessary information at hand, you are ready to begin crafting your business plan and developing your financial forecast.

What goes into your NEMT company's financial forecast?

The financial forecast of your NEMT company's business plan will enable you to assess the growth, profitability, funding requirements, and cash generation potential of your business in the coming years.

The four key outputs of a financial forecast for a NEMT company are:

- The profit and loss (P&L) statement,

- The projected balance sheet,

- The cash flow forecast,

- And the sources and uses table.

Let's look at each of these in a bit more detail.

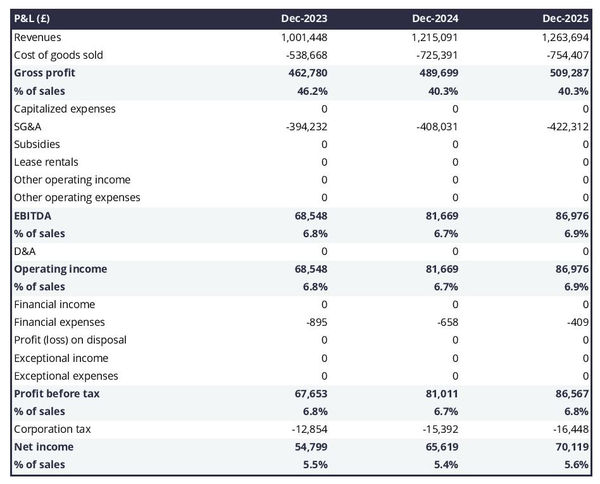

The projected P&L statement

The projected P&L statement for a NEMT company shows how much revenue and profits your business is expected to generate in the future.

Ideally, your NEMT company's P&L statement should show:

- Healthy growth - above inflation level

- Improving or stable profit margins

- Positive net profit

Expectations will vary based on the stage of your business. A startup will be expected to grow faster than an established NEMT company. And similarly, an established company should showcase a higher level of profitability than a new venture.

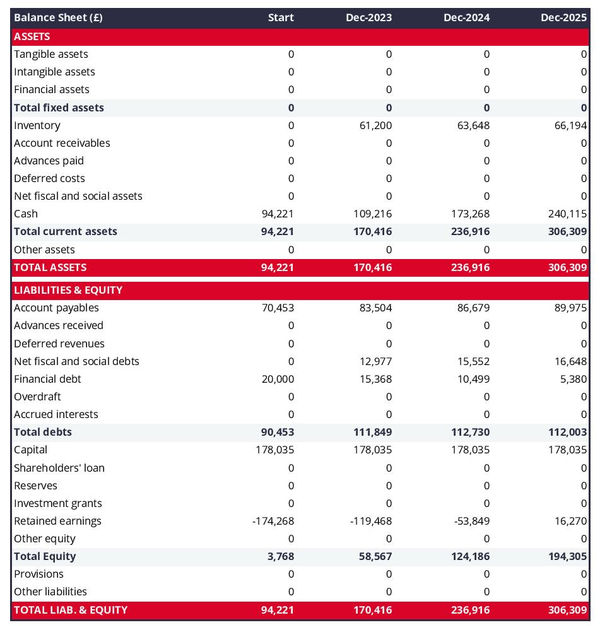

The forecasted balance sheet of your NEMT company

The projected balance sheet of your NEMT company will enable the reader of your business plan to assess the overall financial health of your business.

It shows three elements: assets, liabilities and equity:

- Assets: are productive resources owned by the business, such as equipment, cash, and accounts receivable (money owed by clients).

- Liabilities: are debts owed to creditors, lenders, and other entities, such as accounts payable (money owed to suppliers).

- Equity: includes the sums invested by the shareholders or business owners and the profits and losses accumulated by the business to date (which are called retained earnings). It is a proxy for the value of the owner's stake in the business.

Analysing your NEMT company projected balance sheet provides an understanding of your NEMT company's working capital structure, investment and financing policies.

In particular, the readers of your plan can compare the level of financial debt on the balance sheet to the equity value to measure the level of financial risk (equity doesn't need to be reimbursed, while financial debt must be repaid, making it riskier).

They can also use your balance sheet to assess your NEMT company's liquidity and solvency:

- A liquidity analysis: focuses on whether or not your business has sufficient cash and short-term assets to cover its liabilities due in the next 12 months.

- A solvency analysis: takes and longer view to assess whether or not your business has the capacity to repay its debts over the medium-term.

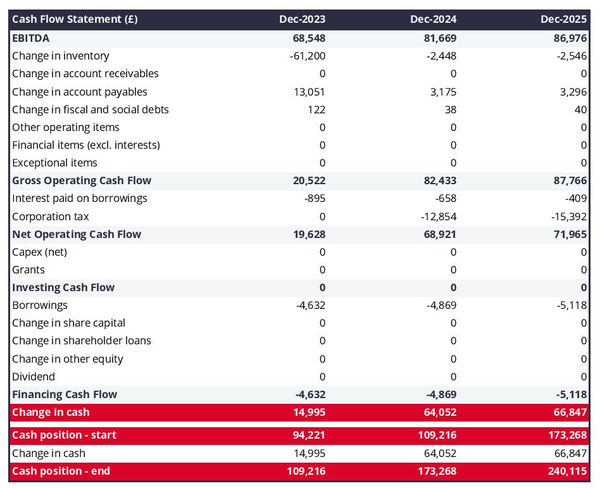

The cash flow forecast

A projected cash flow statement for a NEMT company is used to show how much cash the business is generating or consuming.

The cash flow forecast is usually organized by nature to show three key metrics:

- The operating cash flow: do the core business activities generate or consume cash?

- The investing cash flow: how much is the business investing in long-term assets (this is usually compared to the level of fixed assets on the balance sheet to assess whether the business is regularly maintaining and renewing its equipment)?

- The financing cash flow: is the business raising new financing or repaying financiers (debt repayment, dividends)?

As we discussed earlier, cash is king and keeping an eye on future cash flows an imperative for running a successful business. Therefore, you can expect the reader of your NEMT company business plan to pay close attention to your cash flow forecast.

Also, note that it is customary to provide both yearly and monthly cash flow forecasts in a business plan - so that the reader can analyze seasonal variation and ensure the NEMT company is appropriately funded.

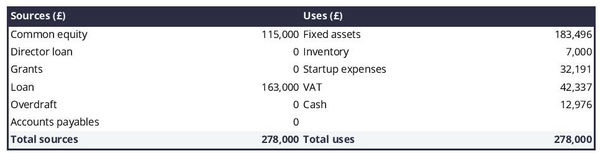

The initial financing plan

The initial financing plan - also called a sources and uses table - is an important tool when starting a NEMT company.

It shows where the money needed to set up the business will come from (sources) and how it will be allocated (uses).

Having this table helps understand what costs are involved in setting up the NEMT company, how the risks are distributed between the shareholders and the lenders, and what will be the starting cash position (which needs to be sufficient to sustain operations until the business breaks even).

Now that the financial forecast of a NEMT company business plan is understood, let's focus on what goes into the written part of the plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The written part of a NEMT company business plan

The written part of a NEMT company business plan is composed of 7 main sections:

- The executive summary

- The presentation of the company

- The products and services

- The market analysis

- The strategy

- The operations

- The financial plan

Throughout these sections, you will seek to provide the reader with the details and context needed for them to form a view on whether or not your business plan is achievable and your forecast a realistic possibility.

Let's go through the content of each section in more detail!

1. The executive summary

The executive summary, the first section of your NEMT company's business plan, serves as an inviting snapshot of your entire plan, leaving readers eager to know more about your business.

To compose an effective executive summary, start with a concise introduction of your business, covering its name, concept, location, history, and unique aspects. Share insights about the services or products you intend to offer and your target customer base.

Subsequently, provide an overview of your NEMT company's addressable market, highlighting current trends and potential growth opportunities.

Then, present a summary of critical financial figures, such as projected revenues, profits, and cash flows.

You should then include a summary of your key financial figures such as projected revenues, profits, and cash flows.

Lastly, address any funding needs in the "ask" section of your executive summary.

2. The presentation of the company

In your NEMT company business plan, the second section should focus on the structure and ownership, location, and management team of your company.

In the structure and ownership part, you'll provide an overview of the business's legal structure, details about the owners, and their respective investments and ownership shares. This clarity is crucial, especially if you're seeking financing, as it helps the reader understand which legal entity will receive the funds and who controls the business.

Moving on to the location part, you'll offer an overview of the company's premises and their surroundings. Explain why this particular location is of interest, highlighting factors like catchment area, accessibility, and nearby amenities.

When describing the location of your NEMT company, you may want to emphasize the potential advantages of the area. You could mention its proximity to major transportation routes, such as highways, airports, and railroads, which could help reduce travel time for your passengers. You might also mention the potential for high demand for your services in the surrounding area, as well as the potential for growth in the future. Additionally, you could talk about the area's potential for accessibility, which could make it easier for your passengers to get to their destinations quickly and safely.

Finally, you should introduce your management team. Describe each member's role, background, and experience.

Don't forget to emphasize any past successes achieved by the management team and how long they've been working together. Demonstrating their track record and teamwork will help potential lenders or investors gain confidence in their leadership and ability to execute the business plan.

3. The products and services section

The products and services section of your NEMT company business plan should include a detailed description of what your company sells to its customers.

For example, your NEMT company might offer wheelchair-accessible and non-wheelchair accessible transportation, door-to-door pick-up and drop-off services, and medical courier services. These products and services provide convenience and flexibility to customers who need to travel in order to receive medical care or to have medical supplies delivered to them safely and quickly.

The reader will want to understand what makes your NEMT company unique from other businesses in this competitive market.

When drafting this section, you should be precise about the categories of products or services you sell, the clients you are targeting and the channels that you are targeting them through.

4. The market analysis

When outlining your market analysis in the NEMT company business plan, it's essential to include comprehensive details about customers' demographics and segmentation, target market, competition, barriers to entry, and relevant regulations.

The primary aim of this section is to give the reader an understanding of the market size and appeal while demonstrating your expertise in the industry.

To begin, delve into the demographics and segmentation subsection, providing an overview of the addressable market for your NEMT company, key marketplace trends, and introducing various customer segments and their preferences in terms of purchasing habits and budgets.

Next, shift your focus to the target market subsection, where you can zoom in on the specific customer segments your NEMT company targets. Explain how your products and services are tailored to meet the unique needs of these customers.

For example, your target market might include elderly individuals who need assistance getting to their medical appointments. This segment of people may be unable to drive or have difficulty accessing public transportation. They might also have limited physical mobility and need assistance with door-to-door transportation.

In the competition subsection, introduce your main competitors and explain what sets your NEMT company apart from them.

Finally, round off your market analysis by providing an overview of the main regulations that apply to your NEMT company.

5. The strategy section

When writing the strategy section of a business plan for your NEMT company, it is essential to include information about your competitive edge, pricing strategy, sales & marketing plan, milestones, and risks and mitigants.

The competitive edge subsection should explain what sets your company apart from its competitors. This part is especially key if you are writing the business plan of a startup, as you have to make a name for yourself in the marketplace against established players.

The pricing strategy subsection should demonstrate how you intend to remain profitable while still offering competitive prices to your customers.

The sales & marketing plan should outline how you intend to reach out and acquire new customers, as well as retain existing ones with loyalty programs or special offers.

The milestones subsection should outline what your company has achieved to date, and its main objectives for the years to come - along with dates so that everyone involved has clear expectations of when progress can be expected.

The risks and mitigants subsection should list the main risks that jeopardize the execution of your plan and explain what measures you have taken to minimize these. This is essential in order for investors or lenders to feel secure in investing in your venture.

Your NEMT company could face the risk of not being able to provide enough drivers to meet the demand for rides. If you do not have enough staff or vehicles available, you may not be able to meet the needs of your customers. Another risk your NEMT company could face is the possibility of not having the necessary funding to cover operational costs. If you do not have sufficient financial resources, you may not be able to pay for repairs, replacements, and other necessary expenses.

6. The operations section

The operations of your NEMT company must be presented in detail in your business plan.

The first thing you should cover in this section is your staffing team, the main roles, and the overall recruitment plan to support the growth expected in your business plan. You should also outline the qualifications and experience necessary to fulfil each role, and how you intend to recruit (using job boards, referrals, or headhunters).

You should then state the operating hours of your NEMT company - so that the reader can check the adequacy of your staffing levels - and any plans for varying opening times during peak season. Additionally, the plan should include details on how you will handle customer queries outside of normal operating hours.

The next part of this section should focus on the key assets and IP required to operate your business. If you depend on any licenses or trademarks, physical structures (equipment or property) or lease agreements, these should all go in there.

You might have a fleet of vehicles that could be considered a key asset. This would include any buses, vans, or other vehicles used to transport passengers. Additionally, you could have proprietary software that supports the daily operations of the business. This could be a key intellectual property of the company. It might contain confidential business information, such as customer records, routes, schedules, and other data.

Finally, you should include a list of suppliers that you plan to work with and a breakdown of their services and main commercial terms (price, payment terms, contract duration, etc.). Investors are always keen to know if there is a particular reason why you have chosen to work with a specific supplier (higher-quality products or past relationships for example).

7. The presentation of the financial plan

The financial plan section is where we will include the financial forecast we discussed earlier in this guide.

Now that you have a clear idea of what goes into a NEMT company business plan, let's look at some of the tools you can use to create yours efficiently.

What tool should I use to write my NEMT company's business plan?

There are two main ways of creating your NEMT company business plan:

- Using specialized business planning software,

- Hiring a business plan writer.

Using an online business plan software for your NEMT company's business plan

Using online business planning software is the most efficient and modern way to create a NEMT company business plan.

There are several advantages to using specialized software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can access a library of dozens of complete business plan samples and templates for inspiration

- You get a professional business plan, formatted and ready to be sent to your bank or investors

- You can easily track your actual financial performance against your financial forecast

- You can create scenarios to stress test your forecast's main assumptions

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you're interested in using this type of solution, you can try The Business Plan Shop for free by signing up here.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Hiring a business plan writer to write your NEMT company's business plan

Outsourcing your NEMT company business plan to a business plan writer can also be a viable option.

Business plan writers are experienced in writing business plans and adept at creating financial forecasts without errors. Furthermore, hiring a consultant can save you time and allow you to focus on the day-to-day operations of your business.

However, hiring business plan writers is expensive as you are paying for the software used by the consultant, plus their time, and their profit margin of course.

From experience, you need to budget at least £1.5k ($2.0k) excluding tax for a complete business plan, more if you need to make changes after the initial version (which happens frequently after the initial meetings with lenders or investors).

You also need to be careful when seeking investment. Investors want their money to be used to grow the business, not spent on consulting fees. Therefore, the amount you spend on business plan writing services (and other consulting services such as legal services) needs to be negligible relative to the amount raised.

The other drawback is that you usually don't own the business plan itself: you just get the output, while the actual document is saved in the consultant's business plan software - which makes it difficult to maintain the document up to date without hiring the consultant on a retainer.

For these reasons, outsourcing the NEMT company business plan to a business plan writer should be considered carefully, weighing both the advantages and disadvantages of hiring outside help.

Ultimately, it may be the right decision for some businesses, while others may find it beneficial to write their business plan using online software.

Why not create your NEMT company's business plan using Word or Excel?

Using Microsoft Excel and Word (or their Google, Apple, or open-source equivalents) to write a NEMT company business plan is not advisable. Allow me to explain the reasons.

Firstly, creating an accurate and error-free financial forecast on Excel or any spreadsheet demands technical expertise in accounting principles and financial modelling. Without a degree in finance and accounting and significant financial modelling experience, it's unlikely that the reader will fully trust your numbers.

Secondly, relying on spreadsheets is inefficient. While it may have been the go-to option in the past, technology has evolved, and software now performs such tasks much faster and more accurately.

The second reason is that it is inefficient. Building forecasts on spreadsheets was the only option in the early 2000s, nowadays technology has advanced and software can do it much faster and much more accurately.

And with the rise of AI, software is also becoming smarter at helping us detect mistakes in our forecasts and helping us analyse the numbers to make better decisions.

Moreover, software offers ease in comparing actuals versus forecasts and maintaining up-to-date forecasts for clear visibility on future cash flows, as we discussed earlier in this guide. Such tasks are cumbersome when using spreadsheets.

Now, let's address the written part of your NEMT company business plan. While it may be less prone to errors, using software can significantly boost productivity. Word processors lack instructions and examples for each section of your business plan. They also won't automatically update your numbers when changes occur in your forecast, and they lack automated formatting capabilities.

In summary, while some entrepreneurs may consider Word or Excel for their business plan, it's far from the best or most efficient solution when compared to specialized software.

Takeaways

- A business plan has 2 complementary parts: a financial forecast showcasing the expected growth, profits and cash flows of the business; and a written part which provides the context needed to judge if the forecast is realistic and relevant.

- Having an up-to-date business plan is the only way to keep visibility on your NEMT company's future cash flows.

- Using business plan software is the modern way of writing and maintaining business plans.

We hope that this practical guide gave you insights on how to write the business plan for your NEMT company. Do not hesitate to get in touch with our team if you still have questions.

Also on The Business Plan Shop

- In-depth business plan structure

- Business plan pricing strategy template

- What is a business plan?

- Key steps to write a business plan?

- Free business plan template

Know someone who owns or wants to start a NEMT company? Share this article with them!