What is the P&L (Profit & Loss)?

Definition of P&L

The income statement is a table listing all the company's income and expenses to deduct the result for a given fiscal year.

The income statement is part of the company's financial statements, together with the balance sheet, cash flow statement and notes.

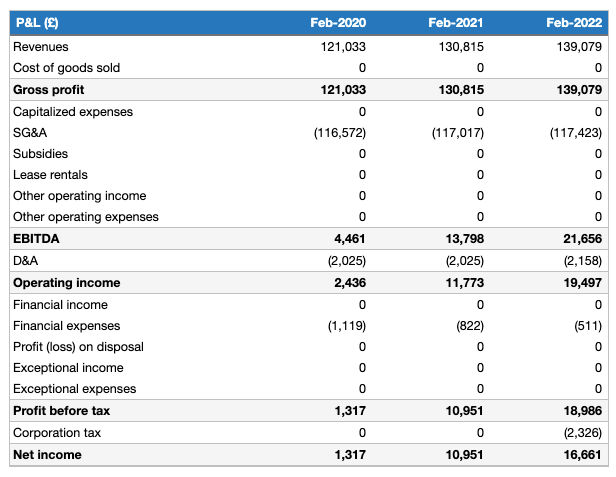

Example of a projected income statement

Here is an example of a projected income statement from our business plan creation application.

Profit and Loss Analysis

The income statement focuses on the past or future profitability of the company.

The analysis of the profit and loss account focuses on 3 main factors:

- the company's growth

- the cost structure

- profitability

Growth

Ideally the company should be able to grow its turnover and profit.

The analysis of revenue growth helps to determine whether the company is able both to gain customers and to pass on cost increases to its customers.

For example, growth below inflation is a negative signal to banks and investors, as it suggests that the company is mature and that its profitability will gradually decline.

Cost structure

An analysis of the profit and loss account over several years generally provides a good view of the cost structure.

The financial analyst will seek to identify the breakdown of costs between fixed and variable costs in order to estimate the company's operational risk.

He or she will also analyse the distribution of expenses between the various items and the evolution of each item in order to form an opinion on the proper management of the company.

Profitability

The difference between income and expenses shows a profit or loss in the income statement.

The analysis of a company's profitability is carried out at several levels:

- at the operational level

- at the global level

- in a dynamic way

At the operational level the key is to have a positive and increasing EBITDA. If the EBITDA is negative then the company is selling at a loss and is heading for disaster. If EBITDA is negative, then the company's profitability deteriorates, affecting its ability to invest and meet its financial obligations.

At the global level, the focus is on the company's net result. If this is positive, then there is a good chance that the company's profitability will be sufficient to enable it to maintain its productive equipment and meet its financial commitments.

The analysis is carried out dynamically using ratios in order to analyse the trend over several years.

Was this page helpful?