What is the difference between bullet, amortisation and constant annuity loans?

The constant annuity loan

The constant annuity loan is the most common type of loan. Its principle is very simple: you pay a fixed amount at each period (the annuity), and this amount is divided between the payment of interest and repayment of the principal.

As you repay the loan, the portion of the annuity allocated to interest payments decreased in favour of principal repayments.

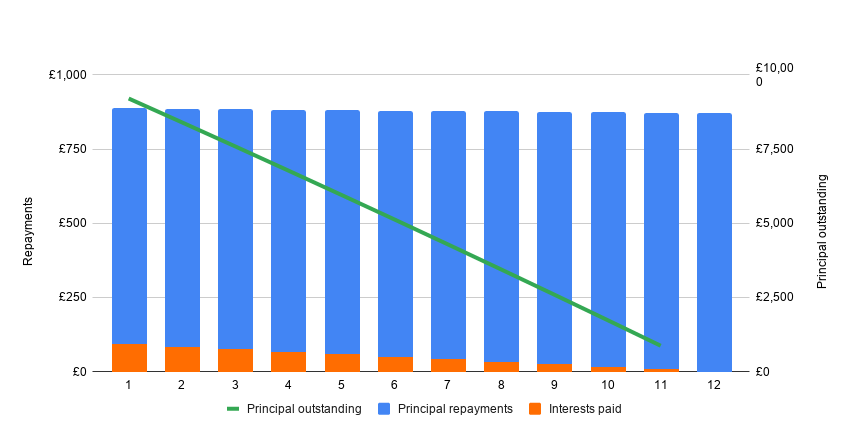

Here is an example for a loan of £10,000 over 12 months with a monthly interest rate of 10%:

The constant amortisation loan

The principle of the constant amortisation loan is quite simple: you repay a fixed capital amount at each period and pay in addition the interest on the calculated outstanding capital.

As the repayments are made, the amount of the annuity decreases as the principal is repaid (less interest to be paid).

Here is an example for a loan of £10,000 over 12 months with a monthly interest rate of 10%:

Bullet loan

The operation of the bullet loan is very simple: you only pay the interest and repay the entire principal at the end of the borrowing period.

This type of loan is more expensive than other types of loans because, since you do not repay the principal, you have to pay interest on the full amount borrowed each period.

It is also riskier because it requires the company to have a sufficient cash reserve to be able to repay the capital in full at the end. In practice, this type of loan is generally reserved for companies of a certain size, or requires serious guarantees to be given to the bank.

Here is an example for a loan of £10,000 over 12 months with a monthly interest rate of 10%:

Was this page helpful?