What is a balance sheet?

Definition of the balance sheet

The balance sheet presents the assets and liabilities of the company at the end of a financial year. On the assets side, the assets listed belong to (or are owed to) the company, and on the liabilities side are listed the items owed to creditors (State, suppliers, employees) as well as capital contributors (shareholders, banks).

The balance sheet is part of the company's financial statements, together with the income statement, and the cash flow statement.

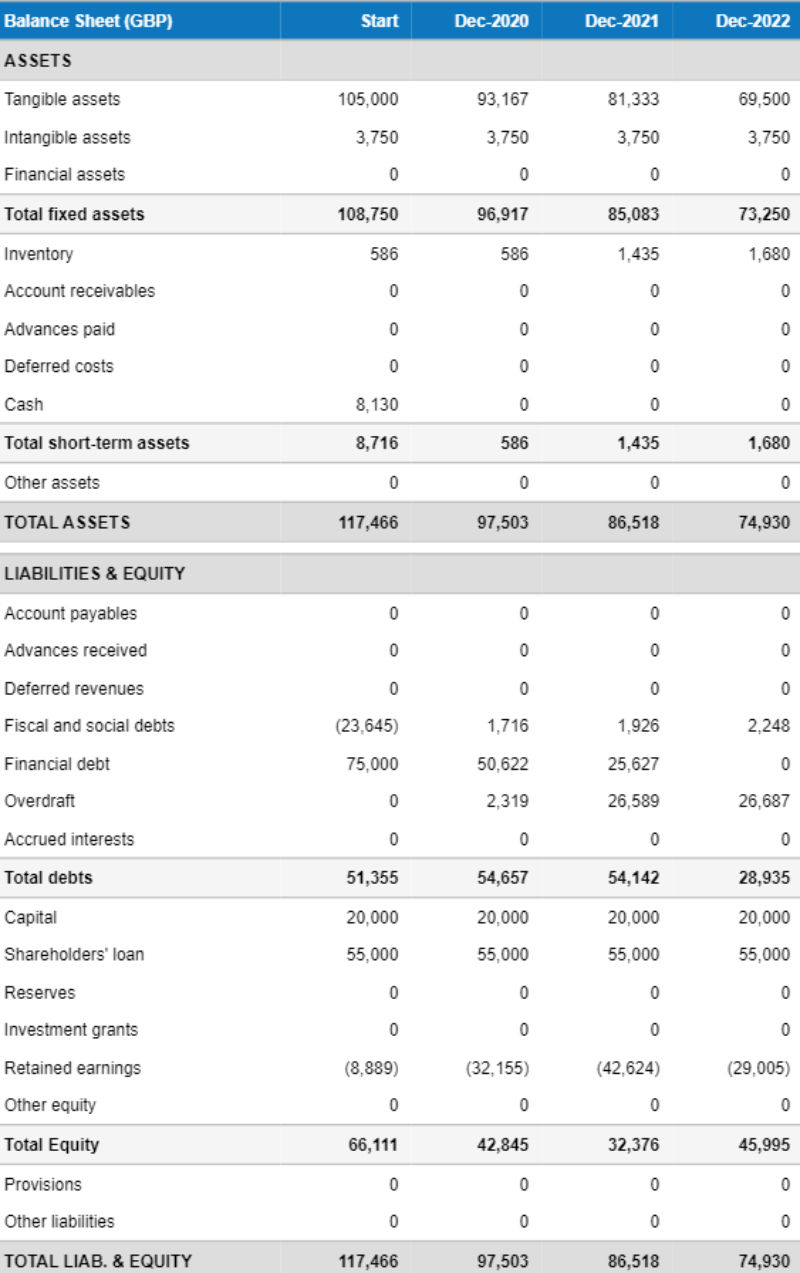

Example of balance sheet

Here is an example of a balance sheet from our business planning app.

Balance sheet analysis

The balance sheet provides a quick overview of the following elements:

- the company's cash position

- the amount of its debts

- the degree of capital intensity (weight of investments in fixed assets)

- the book value of the shareholders' equity, which is understood here as opposed to the real value (financial or market value), which depends on the company's potential for future profitability, which the balance sheet does not allow to be assessed

The analysis of the balance sheet is generally carried out in parallel with that of the other financial statements. Indeed, the balance sheet presents a static view of the company at the end of the financial year and is therefore of limited interest in itself.

Moreover, in order to be analysed in a relevant manner, the balance sheet must also be restated to show a so-called financial balance sheet (elimination of non-book values, adjustments to better reflect the financial situation of the company).

The analysis of the balance sheet focuses on the following elements:

- financial policy

- investment policy

- Working capital and return on assets

Financial policy

From a purely financial point of view, shareholders and lenders finance the investments and working capital of the company in order to generate a return.

The analysis of financial policy focuses on the distribution of risk between the different providers of capital (lenders and shareholders), the ability of the company to service its debts, and the distribution of cash flows between lenders, shareholders, and reinvestment.

Here are some examples of ratios to measure these elements:

- Financial leverage: net debt/equity

- Net debt/EBITDA: gives an indication of the number of years it would take to repay the company's debts if 100% of the EBITDA (used as a proxy for operating cash flow) was used to deleverage

- Quick ratio: (cash + marketable securities + trade receivables) / debts due in less than one year, measures the company's ability to meet its short term operational and financial commitments

- Coverage ratio: cash flow available for debt service / (repayment + interest), measures the company's room to manoeuvre to meet its annual financial obligations without defaulting

- EBITDA / Financial expenses: measures the company's ability to continue to pay interest in the event of default (debt restructuring)

Investment policy

The idea here is to assess the level of investment needed to maintain the productive assets of the company. Here are some examples of ratios to measure these elements:

- Depreciation / Gross Tangible Assets: gives an idea of the rate of wear and tear of the productive equipment

- Investments / Depreciation: a ratio of less than 1 indicates an ageing of the productive assets, a ratio of more than 1 indicates an expansion of the productive apparatus.

Working capital and return on assets

The idea here is to assess the efficiency with which the company uses its assets to generate sales and to measure the impact of working capital on the business. Here are some examples of ratios to measure these elements:

- Turnover / fixed assets: measures the return on productive assets (£x generated for £1 invested)

- Turnover / total assets: measures the return on assets (£x generated for £1 invested)

- Working capital ratios mentioned in this article

Was this page helpful?