How can I enter employee expenses?

This article explains how to enter employee costs in The Business Plan Shop's financial forecasting software.

This data enables our software to build your forecasted financial statements (balance sheet, P&L, cash flow statement), which can then be downloaded along with your business plan.

It’s fast and easy to do.

How can I add or edit employee costs in The Business Plan Shop's software?

Firstly, follow this link to access the overheads module.

Once you are on the module, you can either click the add button at the top of the list to add a new employee cost or edit an existing one.

If you are on desktop, to edit an existing employee cost:

- Hover your mouse over the row containing the cost in the list

- Click the edit button that appears

If you are on mobile, to edit an existing employee cost:

- Click on the settings icon at the end of the row containing the cost in the list

- Click on the edit button that appears

How does the edit employee overheads module work?

The module contains tabs that enable you to enter the financial data required to model the employee cost

Settings tab

The settings tab allows you to enter the name and amount for the cost of employees.

Computations are based on a full-time equivalent (FTE) basis. 1 FTE = 1 employee working full time, 1.5 FTE = 1 employee working full time + 1 employee working half time.

Note that by default, the software will apply social contributions rates to work out the net salary and total employer cost.

Payment terms tab

You can set a global parameter in the options and then override it at the employee level if you want to use different payment terms.

Overriding the payment terms only impacts the payment of social contributions (employees are still paid in the current month).

Note that the percentage must total 100 for each financial year that data is entered for or the software will allocate the remaining percentage automatically.

Comments & notes tab

The comments & notes tab lets you write down your hypothesis, notes or comments.

Notes are private and only visible to you, whilst comments can be seen by other users you invited to collaborate with you on your plan.

How does the edit employee overheads module impact my financial forecast?

The Business Plan Shop's software will use your employee cost data to create your forecasted financial statements (P&L, balance sheet and cash flow statement).

These statements also form part of the financial plan section of your business plan.

As soon as you save your changes, the software will automatically recalculate everything to ensure that your financial forecast is up to date. It’s fast and simple, meaning that your plan will always be ready to export.

When building your forecasted financial statements:

- We’ll use the amount entered to build the SG&A section in your P&L.

- We will then use your payment terms settings to build your balance sheet’s liabilities (amount owed to employees and social contributions owed to the government)

- We’ll then combine all this data to build your cash flow forecast.

Frequently Asked Questions

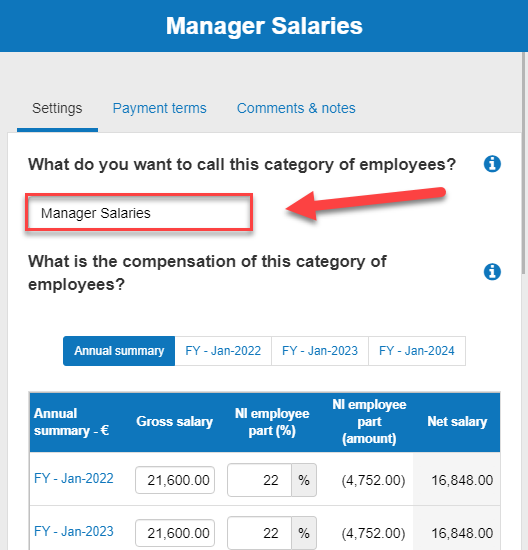

- Firstly, click on the settings tab at the top of this page

- Next, you’ll see a text box with the heading “What do you want to call this category of employees?

![entering manager salaries as the expense name]()

- Enter your chosen name into the text box given (In this example, we’ve chosen manager salaries as the employee expenses).

- Finally, press the “save and close” button.

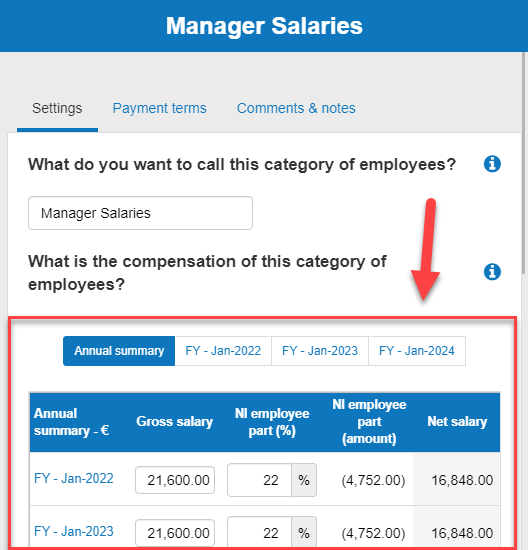

- Firstly, click on the "settings tab" at the top of the page:

- Next, you’ll see a table with the heading "What is the compensation of this category of employees?"

![entering annual data for manager salary expenses]()

- You can enter either annual or monthly data into the table. (In this example, we’ve chosen manager salaries as the employee expenses).

How can I enter annual data?

You can enter annual data by clicking on the annual summary, you will a input field for each of the financial years (FY) in your forecast:

You can also enter annual data by filling the “total for the year” field in the monthly view of each financial year.

Use the navigation at the top of the table to toggle between the annual summary and the monthly view of each financial year.

Press the “save and close” button when you are done:

How can I enter monthly data?

Use the navigation at the top of the table to select the monthly view of the financial year for which you wish to enter data.

Then enter the amount for each month and press the “save and close” button when you are done:

Notes:

Mensualisation

By default when you enter an annual figure, our software will allocate one-twelfth of the total cost to each of the 12 months.

For example, if you enter £48,000 in the “total for the year” for Year 1, the software will allocate £4,000 to each of the 12 months leading up to that period.

Using monthly data is useful if you anticipate a material change in the level of costs at a specific date (planned yearly pay review for example). And to get a more precise cash flow forecast.

Financial years

In The Business Plan Shop, the financial year always includes 12 months and is defined using the start date entered when creating the forecast (if needed you can change that value in the options).

For example:

- If your forecast starts in January: your financial year will run from January to December.

- If your forecast starts in March: your financial year will run from March to April.

Financial years are formatted using the last month in the period. For example a financial year running from January to December 2022 will be displayed as FY - Dec 22.

It is therefore possible that your forecast’s financial year will be different from your accounting financial year.

That’s OK, using 12 full months for each financial year is a best practice when forecasting as it makes the data between years comparable (which wouldn’t be the case if one year had 3 months and the others 12).

Investors and lenders would rather get an accurate projection using the most up to date information than dates matching your accounting or fiscal year end.

If there are tax implications, for example if your corporation tax bill is based on a different fiscal year end, you can use a custom tax model in the options where you can use a fiscal year end that is different from the financial year end used for forecasting.

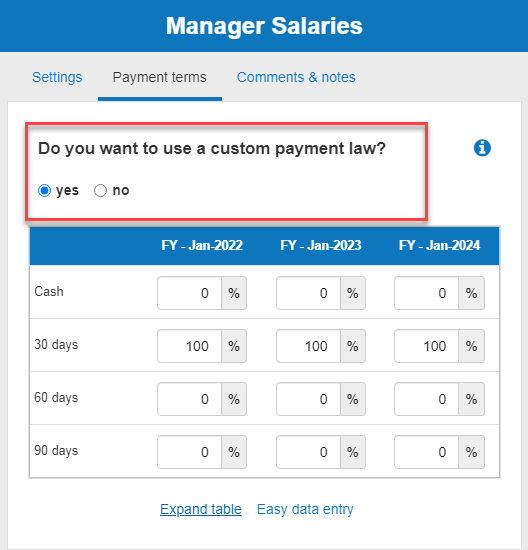

- Firstly, click on the “payment terms” tab at the top of this page

- Next, you’ll see a table with the heading “Do you want to use a custom payment law?”

![the payment terms agreed with employees in terms of cash and credit]()

- You can enter payment terms in this table. This will override the global settings set in the options

- Then press the “save & close” button once you are done

How does our payment table work?

You can forecast the impact of your commercial terms on your cash flow using payment laws.

The table uses the following terms:

- Cash: paid when after each payroll run (no payment terms).

- XX days: paid in credit. For example “90 days” means paying your social contributions 90 days after the payroll date.

By default the table shows up to 90 days in credit but this can be increased to 360 days by clicking the “expand table” button below the table

You can enter payment terms by typing percentages into the allocated text boxes. For example, if you always pay when you receive the invoice, enter 100% into the text box labelled “cash” (cash means upfront in this context, it’s not the payment method)

Multiple payment terms can be used simultaneously. For example, if you pay for half of your social contributions upfront and the other half in 30 days after the payroll date, you should enter 50% into the cash box and 50% into the “30 days” box.

For any financial year the total percentage must equal 100%. If it does not, the software will automatically allocate the remaining percentage to reach 100%. When doing so the software tries to preserve your inputs, so it is possible that the remainder gets allocated in a part of the table not visible on the screen (for example the “360 days” credit field which is only visible when you expand the table)

The table enables you to enter different payment terms for each financial year in your forecast (for a definition of financial years please refer to the: “How can I enter the cost amount?” question of this FAQ)

If your payment terms remain constant throughout your forecast, you can use the “Easy data entry” link below the table to copy the value of the first year across to the other years.

Classifying your employee expenses by segment allows you to group expenses in your forecasted financial statements.

This means that you can breakdown and adjust the level of details when you export your business plan.

To classify your employee expenses by segment:

- Firstly, click on the settings tab at the top of this page

- Next, scroll down to the bottom of the page and click on “show advanced parameters”

- You’ll see a text box with the heading “does this element belong to a segment?

Enter your chosen segment name into the text box given

- I fyou don't want to use a segment leave the field empty or on “Global”

Finally, press the “save and close” button

Go further with The Business Plan Shop

Was this page helpful?